Adele

HISTORY PAPER 2 GRADE 12 QUESTIONS - NSC PAST PAPERS AND MEMOS FEBRUARY/MARCH 2017

HISTORY

PAPER 2

GRADE 12

NSC PAST PAPERS AND MEMOS

FEBRUARY/MARCH 2017

QUESTIONS

INSTRUCTIONS AND INFORMATION

- This question paper consists of SECTION A and SECTION B based on the prescribed content framework in the CAPS document.

SECTION A: SOURCE-BASED QUESTIONS

QUESTION 1: CIVIL RESISTANCE, 1970s TO 1980s: SOUTH AFRICA

QUESTION 2: THE COMING OF DEMOCRACY TO SOUTH AFRICA AND COMING TO TERMS WITH THE PAST

QUESTION 3: THE END OF THE COLD WAR AND A NEW WORLD ORDER, 1989 TO THE PRESENT

SECTION B: ESSAY QUESTIONS

QUESTION 4: CIVIL RESISTANCE, 1970s TO 1980s: SOUTH AFRICA: THE CRISIS OF APARTHEID IN THE 1980s

QUESTION 5: THE COMING OF DEMOCRACY TO SOUTH AFRICA AND COMING TO TERMS WITH THE PAST

QUESTION 6: THE END OF THE COLD WAR AND A NEW WORLD ORDER: THE EVENTS OF 1989 - SECTION A consists of THREE source-based questions. Source material that is required to answer these questions may be found in the ADDENDUM.

- SECTION B consists of THREE essay questions.

- Answer THREE questions as follows:

4.1 At least ONE must be a source-based question and at least ONE must be an essay question.

4.2 The THIRD question may be either a source-based question or an essay question. - You are advised to spend at least ONE hour per question.

- When answering questions, you should apply your knowledge, skills and insight.

- You will be disadvantaged by merely rewriting the sources as answers.

- Number the answers correctly according to the numbering system used in this question paper.

- Write neatly and legibly.

SECTION A: SOURCE-BASED QUESTIONS

Answer at least ONE question, but not more than TWO questions, in this section. Source material to be used to answer these questions may be found in the ADDENDUM.

QUESTION 1: HOW DID THE STUDENTS FROM SOWETO CHALLENGE THE APARTHEID REGIME IN THE 1970s?

Study Sources 1A, 1B, 1C and 1D and answer the questions that follow.

1.1 Refer to Source 1A.

1.1.1 What, according to Desmond Tutu, was the purpose of grand apartheid? (2 x 1) (2)

1.1.2 Why did the apartheid government decide to arrest political activists in the 1960s? (1 x 2) (2)

1.1.3 Quote any FOUR pieces of evidence from the source which describe how black South Africans lived in the townships. (4 x 1) (4)

1.2 Read Source 1B.

1.2.1 What, according to the source, was Tsietsi Mashinini's ultimate goal? (1 x 1) (1)

1.2.2 How did Tiro describe Mashinini as a student? (2 x 1) (2)

1.2.3 What do you understand by the term Black Consciousness? (1 x 2) (2)

1.2.4 Comment on why you think the Soweto Uprising of 1976 turned Mashinini into a national and international hero. (2 x 2) (4)

1.3 Study Source 1C.

1.3.1 Identify the first school in the source that embarked on protest action on 16 June 1976. (1 x 1) (1)

1.3.2 How, according to the source, did the police respond to the marchers on Vilakazi Street? (2 x 1) (2)

1.3.3 Why do you think the police decided to use live ammunition (bullets) on the students? (1 x 2) (2)

1.3.4 Comment on the role that women played during the Soweto Uprising of 1976. (2 x 2) (4)

1.3.5 Explain to what extent you would consider the information in this source reliable when studying how the Soweto Uprising unfolded on 16 June 1976. (2 x 2) (4)

1.4 Compare Sources 1B and 1C. Explain in what ways the information in both sources support each other regarding the impact that the youth of Soweto had on the Soweto Uprising. (2 x 2) (4)

1.5 Use Source 1D.

1.5.1 Explain the messages that are conveyed by the photograph. (2 x 2) (4)

1.5.2 Comment on the effectiveness of the words 'UP IN ARMS 1976' that were used as a title for this photograph in the context of the Soweto Uprising. (2 x 2) (4)

1.6 Using the information in the relevant sources and your own knowledge, write a paragraph of about EIGHT lines (about 80 words) explaining how the students from Soweto challenged the apartheid regime in the 1970s. (8)

[50]

QUESTION 2: WAS THE TRUTH AND RECONCILIATION COMMISSION (TRC) SUCCESSFUL IN RECONCILING SOUTH AFRICA WITH ITS DIVIDED PAST?

Study Sources 2A, 2B, 2C and 2D and answer the questions that follow.

2.1 Refer to Source 2A.

2.1.1 Why, according to the source, was the TRC established? (1 x 1) (1)

2.1.2 Define the following terms in the context of the TRC:

- Amnesty (1 x 2) (2)

- Reconciliation (1 x 2) (2)

2.1.3 Explain why you think the author of the source claimed that most cases were only scantily addressed. (2 x 2) (4)

2.1.4 Using the information in the source and your own knowledge, explain why the following applied for amnesty:

- Vlakplaas operatives (1 x 2) (2)

- ANC operatives (1 x 2) (2)

2.2 Read Source 2B.

2.2.1 Who, according to the source, did the National Party blame for the widespread human rights violations? (1 x 1) (1)

2.2.2 Why do you think the PAC's contribution at the TRC hearings was regarded as controversial? (2 x 2) (4)

2.2.3 How, according to the information in the source, did the IFP respond to the TRC hearings? (1 x 2) (2)

2.2.4 Comment on the usefulness of the information in this source to a historian researching how political parties responded to the TRC hearings. (2 x 2) (4)

2.3 Consult Source 2C.

2.3.1 Explain the messages portrayed in this cartoon. Use the visual clues in the source to support your answer. (2 x 2) (4)

2.3.2 Identify any FOUR 'dirty tricks' in the source that the National Party committed during the 1980s. (4 x 1) (4)

2.4 Compare Sources 2B and 2C. Comment on how the information in these sources differs regarding the role that the National Party played in committing political crimes against humanity. (2 x 2) (4)

2.5 Study Source 2D.

2.5.1 Identify the TWO human rights abuses in the source that the ANC was responsible for. (2 x 1) (2)

2.5.2 Comment on why both the ANC and the IFP decided to challenge the final draft of the TRC's report. (2 x 2) (4)

2.6 Using the information in the relevant sources and your own knowledge, write a paragraph of about EIGHT lines (about 80 words) explaining whether the TRC was successful in reconciling South Africa with its divided past. (8)

[50]

QUESTION 3: HOW DID THE IMPLEMENTATION OF STRUCTURAL ADJUSTMENT POLICIES (SAPs) AFFECT THE ECONOMIES OF DEVELOPING COUNTRIES?

Study Sources 3A, 3B, 3C and 3D and answer the questions that follow.

3.1 Refer to Source 3A.

3.1.1 Name any THREE of the most developed countries in the world according to the source. (3 x 1) (3)

3.1.2 What, according to the source, was the purpose of structural adjustment policies in the context of globalisation? (1 x 2) (2)

3.1.3 Why, according to the source, were African countries forced to implement IMF-inspired policies? (1 x 2) (2)

3.1.4 Explain why Arnold claimed that the conditions which the IMF imposed on developing countries were harsh. (2 x 2) (4)

3.2 Study Source 3B.

3.2.1 Why, according to Ismi, was the 1980s referred to as the 'lost decade'? (1 x 2) (2)

3.2.2 Using the information in the source and your own knowledge, explain how the repayment of debts to Western banks affected the economies of African countries. (2 x 2) (4)

3.2.3 What evidence in the source suggests that Africa's debt between 1980 and 1990 had increased? (1 x 2) (2)

3.2.4 Comment on whether you would consider the information in this source useful when researching the impact that structural adjustment policies had on African countries. (2 x 2) (4)

3.3 Consult Source 3C

3.3.1 Explain how the cartoonist portrays the International Monetary Fund's structural adjustment policies. Use the visual clues in the cartoon to support your answer. (2 x 2) (4)

3.3.2 Comment on the caption in the source, 'SPOT THE DIFFERENCE', in the context of the implementation of structural adjustment policies in developing countries. (2 x 2) (4)

3.4 Compare Sources 3B and 3C. Explain how the cartoonist's interpretation of events supports Ismi's views regarding the effects that structural adjustment policies had on developing countries. (2 x 2) (4)

3.5 Read Source 3D.

3.5.1 Explain to what extent structural adjustment policies were able to assist the economies of developing countries. (2 x 2) (4)

3.5.2 Name any THREE factors that have contributed to the reduction of domestic markets in developing countries. (3 x 1) (3)

3.6 Using the information in the relevant sources and your own knowledge, write a paragraph of about EIGHT lines (about 80 words) explaining how the implementation of structural adjustment policies affected developing countries. (8)

[50]

SECTION B: ESSAY QUESTIONS

Answer at least ONE question, but not more than TWO questions, in this section. Your essay should be about THREE pages long.

QUESTION 4: CIVIL RESISTANCE, 1970s TO 1980s: SOUTH AFRICA: THE CRISIS OF APARTHEID IN THE 1980s

The various internal resistance organisations in South Africa were successful in challenging PW Botha's apartheid regime in the 1980s.

Do you agree with this statement? Use relevant examples to support your line of argument.

[50]

QUESTION 5: THE COMING OF DEMOCRACY TO SOUTH AFRICA AND COMING TO TERMS WITH THE PAST

The violence that began in South Africa in the early 1990s was specifically aimed at derailing the process of negotiations among various political organisations.

Critically discuss this statement in the context of the process of negotiations that occurred in South Africa between 1990 and 1994.

[50]

QUESTION 6: THE END OF THE COLD WAR AND A NEW WORLD ORDER: THE EVENTS OF 1989

Explain to what extent the disintegration of the Soviet Union in 1989 contributed to the political changes that occurred in South Africa. Support your line of argument with relevant evidence.

[50]

TOTAL: 150

HISTORY PAPER 1 GRADE 12 QUESTIONS - NSC PAST PAPERS AND MEMOS FEBRUARY/MARCH 2017

HISTORY

PAPER 1

GRADE 12

NSC PAST PAPERS AND MEMOS

FEBRUARY/MARCH 2017

QUESTIONS

INSTRUCTIONS AND INFORMATION

- This question paper consists of SECTION A and SECTION B based on the prescribed content framework in the CAPS document.

SECTION A: SOURCE-BASED QUESTIONS

QUESTION 1: THE COLD WAR: THE ORIGINS OF THE COLD WAR

QUESTION 2: INDEPENDENT AFRICA: CASE STUDY – ANGOLA

QUESTION 3: CIVIL SOCIETY PROTESTS FROM THE 1950s TO THE 1970s: CIVIL RIGHTS MOVEMENT

SECTION B: ESSAY QUESTIONS

QUESTION 4: EXTENSION OF THE COLD WAR: CASE STUDY – VIETNAM

QUESTION 5: INDEPENDENT AFRICA: COMPARATIVE CASE STUDY – THE CONGO AND TANZANIA

QUESTION 6: CIVIL SOCIETY PROTESTS FROM THE 1950s TO THE 1970s: BLACK POWER MOVEMENT - SECTION A consists of THREE source-based questions. Source material that is required to answer these questions will be found in the ADDENDUM.

- SECTION B consists of THREE essay questions.

- Answer THREE questions as follows:

4.1 At least ONE must be a source-based question and at least ONE must be an essay question.

4.2 The THIRD question may be either a source-based question or an essay question. - You are advised to spend at least ONE hour per question.

- When answering questions, you should apply your knowledge, skills and insight.

- You will be disadvantaged by merely rewriting the sources as answers.

- Number the answers correctly according to the numbering system used in this question paper.

- Write clearly and legibly.

SECTION A: SOURCE-BASED QUESTIONS

Answer at least ONE question, but not more than TWO questions, in this section. Source material that is required to answer these questions may be found in the ADDENDUM.

QUESTION 1: HOW DID THE UNITED STATES OF AMERICA AND THE SOVIET UNION RESPOND TO THE ECONOMIC CRISIS IN EUROPE AFTER 1945?

Study Sources 1A, 1B, 1C and 1D and answer the questions that follow.

1.1 Refer to Source 1A.

1.1.1 Define the term containment in the context of the Cold War in Europe after 1945. (1 x 2) (2)

1.1.2 Why, according to the source, was the Marshall Plan introduced in Europe? Give TWO reasons. (2 x 1) (2)

1.1.3 How, according to the source, did Stalin respond to America's aid plan to Europe? (2 x 1) (2)

1.1.4 Explain how the Marshall Plan was implemented in Europe. (2 x 2) (4)

1.1.5 Why, according to the information in the source, was the COMECON formed? (1 x 2) (2)

1.2 Use Source 1B.

1.2.1 Quote TWO pieces of evidence from the source that suggest that Bellows believed that the Marshall Plan was a 'great and original initiative'. (2 x 1) (2)

1.2.2 Comment on why you think the United States of America did not want to fall within the Soviet Union's sphere of influence. (2 x 2) (4)

1.2.3 State TWO ways in which the counterpart fund was used to rebuild damaged infrastructure in Europe. (2 x 1) (2)

1.3 Study Source 1C.

1.3.1 How, according to Vyshinsky, did the United States of America violate the principles of the United Nations Charter? (1 x 2) (2)

1.3.2 Explain why Vyshinsky claimed that the Marshall Plan was used as an 'instrument of political pressure' on European countries. (2 x 2) (4)

1.3.3. Explain to what extent a historian researching the Marshall Plan would find the information in this source useful. (2 x 2) (4)

1.4 Compare Sources 1B and 1C. Explain how the information in these sources differs regarding the effect that the Marshall Plan had on relations between European countries and the USA. (2 x 2) (4)

1.5 Consult Source 1D.

1.5.1 Explain the messages portrayed in the cartoon. Use the visual clues in the source to support your answer. (2 x 2) (4)

1.5.2 Comment on the title of the cartoon, 'IT'S THE SAME THING WITHOUT MECHANICAL PROBLEMS', in the context of the 'Marshal Stalin Plan'. (2 x 2) (4)

1.6 Using the information in the relevant sources and your own knowledge, write a paragraph of about eight lines (about 80 words), explaining how the United States of America and the Soviet Union responded to the economic crisis in Europe after 1945. (8)

[50]

QUESTION 2: WHAT WERE THE CAUSES AND CONSEQUENCES OF CUBA'S INVOLVEMENT IN THE BATTLE OF CUITO CUANAVALE BETWEEN 1987 AND 1988?

Study Sources 2A, 2B, 2C and 2D and answer the questions that follow.

2.1 Refer to Source 2A.

2.1.1 What, according to the source, was the outcome of Operation Modular? (1 x 2) (2)

2.1.2 Select TWO pieces of evidence in the source which suggest that South Africa intended to continue fighting in Angola after the battle at the Lomba River. (2 x 1) (2)

2.1.3 Explain the significance of the statement, 'Pretoria (South African government) was now openly leading the war in Angola', in the context of the Battle of Cuito Cuanavale. (1 x 2) (2)

2.1.4 Using the information in the source and your own knowledge, comment on why Jose Eduardo Dos Santos requested military assistance from Fidel Castro. (2 x 2) (4)

2.2 Use Source 2B.

2.2.1 Why, according to the information in the source, was the Angolan army (FAPLA) 'close to being surrounded and annihilated (destroyed)' in 1987? Give TWO reasons. (2 x 1) (2)

2.2.2 List THREE ways in the source that show how the Cuban troops prevented the advance of the SADF into Cuito Cuanavale. (3 x 1) (3)

2.2.3 Why do you think Raúl Castro emphasised the role that President Fidel Castro played in the Battle of Cuito Cuanavale? (1 x 2) (2)

2.2.4 Explain what you think was implied by the phrase, 'Cuito (Cuanavale) held out'. (2 x 2) (4)

2.3 Study Sources 2A and 2B. Explain how the evidence in Source 2B supports the information in Source 2A regarding Cuba's involvement in the Battle of Cuito Cuanavale.

(2 x 2) (4)

2.4 Consult Source 2C.

2.4.1 Explain the messages that are conveyed by this photograph. Support your answer by using the visual clues in the source. (2 x 2) (4)

2.4.2 Comment on the significance of this memorial for the people of Angola in the context of the outcome of the Battle of Cuito Cuanavale. (2 x 2) (4)

2.5 Read Source 2D.

2.5.1 What do you understand by the term sovereignty in the context of African history? (1 x 2) (2)

2.5.2 List any THREE ways in which the Battle of Cuito Cuanavale assisted to free African countries from the 'scourge of apartheid'. (3 x 1) (3)

2.5.3 Comment on the usefulness of the information in this source to a historian researching the consequences of Cuba's involvement in the Battle of Cuito Cuanavale. (2 x 2) (4)

2.6 Using the information in the relevant sources and your own knowledge, write a paragraph of about EIGHT lines (about 80 words), explaining the causes and consequences of Cuba's involvement in the Battle of Cuito Cuanavale between 1987 and 1988. (8)

[50]

QUESTION 3: WHAT IMPACT DID THE CLOSURE OF HIGH SCHOOLS HAVE ON THE COMMUNITY OF LITTLE ROCK, ARKANSAS, IN 1958?

Study Sources 3A, 3B, 3C and 3D and answer the questions that follow.

3.1 Refer to Source 3A.

3.1.1 How, according to Governor Faubus, would the closure of high schools in Little Rock affect the following people:

- Parents (1 x 1) (1)

- Students (1 x 1) (1)

3.1.2 Why, according to the source, did Governor Faubus decide to sign the bills of the Extraordinary Session of the General Assembly? (2 x 1) (2)

3.1.3 Explain the term integration in the context of the closure of schools in Little Rock. (1 x 2) (2)

3.1.4 Comment on what Governor Faubus implied when he said that school integration would lead to a 'catastrophe'. (2 x 2) (4)

3.1.5 Give TWO pieces of evidence in the source that suggest that the federal government had limited control over the state government. (2 x 1) (2)

3.1.6 Explain why a historian researching the reasons for the closure of all high schools in Little Rock, Arkansas, in 1958 would find the information in this source useful. (2 x 2) (4)

3.2 Use Source 3B.

3.2.1 According to the source, how many of the following learners were displaced as a result of Faubus' actions:

- White learners (1 x 1) (1)

- Black learners (1 x 1) (1)

3.2.2 Comment on why you think the NAACP was against the opening of private schools for displaced black learners. (2 x 2) (4)

3.3 Consult Source 3C.

3.3.1 Explain the intention of this photograph in the context of the closure of schools by Governor Faubus. (2 x 2) (4)

3.3.2 Comment on whether the activity depicted in the photograph supported the claim that 1958 to 1959 was regarded as the Lost Year for learners in Little Rock. (2 x 2) (4)

3.4 Study Sources 3B and 3C. Explain how the evidence in Source 3C supports the information in Source 3B regarding Faubus' decision to close all high schools in Little Rock in 1958. (2 x 2) (4)

3.5 Read Source 3D.

3.5.1 Give TWO reasons in the source for the formation of the Women's Emergency Committee (WEC) in 1958. (2 x 1) (2)

3.5.2 Why, according to the information in the source, did the WEC, the group Stop This Outrageous Purge (STOP) and other community based organisations call for a special election? (1 x 2) (2)

3.5.3 Comment on what the author implied by the statement: '1959 brought to a close an important chapter in the history of public education in Little Rock.' (2 x 2) (4)

3.6 Using the information in the relevant sources and your own knowledge, write a paragraph of about EIGHT lines (about 80 words), explaining the impact that the closure of high schools had on the community of Little Rock, Arkansas, in 1958. (8)

[50]

SECTION B: ESSAY QUESTIONS

Answer at least ONE question, but not more than TWO questions, in this section. Your essay should be about THREE pages long.

QUESTION 4: EXTENSION OF THE COLD WAR: CASE STUDY – VIETNAM

The United States of America lost the war in Vietnam because of intense opposition to the war within the country, rather than because of military failure on the battlefields of Vietnam between 1963 and 1973.

Evaluate the accuracy of this statement. Use relevant historical evidence to support your line of argument.

[50]

QUESTION 5: INDEPENDENT AFRICA: COMPARATIVE CASE STUDY – THE CONGO AND TANZANIA

Mobuto Seso Seko (the Congo) and Julius Nyerere (Tanzania) both attempted to 'Africanise' their economies after attaining independence. However, these policies were a total failure in both countries.

Critically discuss this statement with reference to the aims, implementation and effects of Mobutu and Nyerere's economic policies in their respective countries from 1960.

[50]

QUESTION 6: CIVIL SOCIETY PROTESTS FROM THE 1950s TO THE 1970s: BLACK POWER MOVEMENT

Explain to what extent you agree that the ideas and actions of Malcolm X, Stokely Carmichael and the Black Panther Party gave African Americans a new sense of identity in the United States of America during the 1960s.

Use relevant evidence to support your line of argument.

[50]

TOTAL: 150

RELIGIOUS STUDIES PAPER 2 GRADE 12 MEMORANDUM - NSC PAST PAPERS AND MEMOS FEBRUARY/MARCH 2017

RELIGIOUS STUDIES

PAPER 2

GRADE 12

NSC PAST PAPERS AND MEMOS

FEBRUARY/MARCH 2017

MEMORANDUM

NOTE: If a candidate has answered more than THREE questions, only the first three must be marked. The extra questions should be struck off, with EQ written across the answers.

QUESTION 1

1.1

- The Eastern Cape leaders believe that the Islamic Religion is contrary to their culture./The marriage would bring about a clash of cultures.

- They believe that the new wife to Inkosi would negatively influence their chief against their cultural practices.

- They regard the Inkosi as the custodian of their culture and tradition./ He is a chief, and must uphold traditional values

- They are also afraid that the marriage based on different religious backgrounds would divide their tribe.

- According to African culture, the wife of the Inkosi is regarded as the mother of the nation.

- She is therefore expected to play a leading role in the cultural functions of their nation. (10)

1.2

- The Constitution of the Republic of South Africa guarantees all individuals their human rights.

- Every individual is entitled to freedom of choice. and conscience

- Even though I am a traditional leader, the same rights apply to me.

- I have a right to choose whom to marry, irrespective of culture or religion.

- I have a right to enter into a marriage and have a family of my choice.

- I have freedom from state or personal interference in my right to make choices.

- I have the right to participate in the cultural life of my community with my wife, irrespective of religious affiliation and cultural background.

- I have the right not to be discriminated against even after marrying a woman from a different culture or religion.

- I acknowledge that I am the custodian of my African culture and customs. ∙ According to the African culture, the Inkosi has to be considerate of his subjects' interests and needs before his own.

- I do not see any difficulty in upholding these obligations, just because I am married to a Muslim woman.

- This marriage will unite our people with another faith.

NOTE: Other relevant responses must be accepted. (16)

1.3 EXAMPLE 1: TAOISM

- The Tao-te Ching has little to say about the community, but a lot about how individuals should direct their lives.

- Tao does not have a plan, and Tao is massively powerful.

- The earth and the people are just a tiny speck in the midst of the Tao.

- The Tao has given life no purpose or plan.

- To the Taoist, it is common sense that you should live in harmony with the Tao.

- If you live in harmony with the Tao, you will then discover that life is its own reward.

- The Tao only crushes you when you try to stop the path it is following.

- The individual must be flexible in order to live in harmony with the Tao.

- In Taoism there is more emphasis on individual action than that of the community.

- The Taoists believe that the community develops from the individuals.

- If the individual is in line with the Tao, the whole community will live harmoniously.

EXAMPLE 2: CHRISTIANITY

- According to the Christian faith, God created humanity.

- God realised that Adam needed the company of another human being. That person had to be of the opposite sex and the result was that God created Eve.

- In the Christian view, no person should dominate or exploit another person.

- Jesus said to His disciples, 'You know that the rulers of the Gentiles lord it over them and their great men exercise authority over them. It shall not be so among you.'

- Jesus also said, '… whoever would be great among you must be your servant.'

- Individuals have to look after one another and also protect one other.

- Humans should be a community in the same way that the Three Persons of the Holy Trinity are a community.

- Humanity should have a relationship of mutual respect and love.

- The Three Persons of the Holy Trinity communicate and consult among each other, so should the community.

- In Christianity individual rights are not above that of the community. There is always consideration of other people's rights and needs. (20)

[50]

QUESTION 2

2.1

2.1.1 EXAMPLE 1: ISLAM

Sunni Islam

- Sunnis believe that the faithful, rather than the descendants of the Prophet, should elect their leaders.

- Sunni refers to the followers of the sunnah (example) of the Prophet Muhammad.

- All the companions of the Prophet are believed to be given equal respect in Islamic jurisprudence.

- Sunnis do not believe in the Mutta (temporary marriage).

Shi'a Islam

- They believe that the caliphate (successor to Prophet Muhammad) should be from among his descendants.

- They believe that caliphs are divinely appointed imams.

- They also believe that caliphs have supernatural knowledge and authority to lead the faithful.

- They share a collective guilt for not coming to the aid of Husain when he was martyred.

- They believe in Mutta (temporary marriage).

EXAMPLE 2: CHRISTIANITY

The Catholic Church

- It considers itself to be the original Christian church.

- The Catholic Church believes in the orders of priests, monks and nuns who devote their lives completely to God.

- They take the vows of celibacy as they believe that they are married to the Church.

- They believe that the supreme authority of the Church rests with the Pope.

- The Pope is considered to be the successor of St. Peter, who is believed to be the leader of Jesus' twelve apostles.

- The Church teaches that God is made of three separate, yet equal, parts, namely the Father, the Son and the Holy Spirit. This is known as the Holy Trinity.

The Eastern Orthodox Church

- The Trinity and the Holy Spirit are understood in a different way than the views of the Catholic Church.

- The Eastern Orthodox Church believes that the Holy Spirit comes from God the Father only.

- The Eastern Orthodox Church disagrees with adding the Son because they believe that this makes the Father and the Son superior to the Holy Spirit.

Protestantism

- Protestant churches do not believe that salvation is something that has to be earned through rituals and practices.

- Protestants believe that salvation is attained through faith in Jesus.

- Protestant churches believe that the teachings of the Bible have more authority than any church leader. (18)

2.1.2 EXAMPLE 1: ISLAM

Sunni Islam

- There are no clergy in Sunni Islam.

- Any Muslim can serve on the community boards.

- Governance is localised and community based.

- Scholars of Islam and community members serve on the governing boards of mosques, madrassas and schools.

- In governance the sunnah (practices) of the Prophet is observed.

- A shura (consultative) council is appointed, and this in turn appoints a chairman (ameer).

Shi'a Islam

- They believe that only the descendants of the Prophet have a divine right to lead the Muslims.

- They reserve the title 'imam' for certain past leaders who are believed to have been chosen by God.

- Governance is in the hands of mullahs.

- The mullahs also have considerable political influence.

EXAMPLE 2: CHRISTIANITY

The Catholic Church

- Political control is traditionally seen to be the Vatican in Rome.

- The head of the Catholic Church is the Pope.

- The first Pope is said to be St. Peter.

- All Catholic churches are governed by the Vatican.

- The parish is an area or district with a particular church and priest.

The Eastern Orthodox Church

- Political control was traditionally in Constantinople (Istanbul).

- The church structure comprises priests and bishops.

- There is no single leader.

- Authority within the church is in the hands of the group of bishops.

- A diocese is a group of parishes under the leadership of a bishop.

Protestantism

- The churches are ruled by ordained ministers and bishops or elected leaders.

- The overall rule is by higher authority, such as a synod or general assembly, chaired by the presiding bishop.

- In Protestant churches, each church is independent.

- The churches are not responsible to any higher authority than the congregation. (18)

2.2 NOTE: The role of humans as 'custodians' in Abrahamic faiths should be awarded a max of six marks for suitable examples .e.g.

They must care for the animals and plants.√√

They must care for the environment√√, etc

EXAMPLE 1: HINDUISM

- A young person in the world has a responsibility to ensure that his/her time and energy are used effectively to attain secular and spiritual knowledge.

- In doing that a good teacher is indispensable and this is the first stage of personal development.

- In the second stage of human life it is expected of a grown-up person to get married.

- He must look after his family and ensure that he works productively and is economically stable for the welfare of the society.

- The next stage is semi-retirement. Its purpose is to encourage the person to motivate other people to remain detached from worldly matters/things.

- The semi-retired should focus on studying scriptures, meditating and other spiritual endeavours.

- The final stage for Hindus is to renounce the world and concentrate on the spiritual quest.

EXAMPLE 2: BUDDHISM

- Buddhism sees being born as human as rare and very precious, since one can be born as so many other types of beings.

- The primary responsibility of every human is to become enlightened and to share the way to this enlightenment with others.

- Everything else is secondary to enlightenment and, in any case, impermanent.

- Historically Buddhism has not been good at practical efforts to fight poverty, discrimination, etc.

- Buddhism is not enough to eliminate sufferings in some distant future; we should reduce it here and now.

- Engaged Buddhists have been very active in the field of nuclear disarmament, anti-war efforts and ecologically actions.

- To be truly effective a Buddhist needs to develop not only the wisdom to see the true nature of reality, but also the compassion to share this wisdom with others. (14)

[50]

QUESTION 3

3.1

3.1.1 Inspiration:

- Inspiration is an important normative source in many religions.

- It is the true origin of all religions.

- Inspiration refers to the power or force of an extraordinary being taking over a chosen being.

- The founding figures of many religions were inspired by a higher power or wisdom.

- Such people felt that they received 'revelation' from an extraordinary being.

- In the African Traditional Religion the mediums or diviners receive inspiration while they are in a trance.

- Inspiration is a powerful motivation for the followers of a religion.

- There are several types of inspiration, namely:

- Divine inspiration, which is direct and immediate and inspired the founders of religions

- Contemporary inspiration, which is on-going and serves to unite worshippers with their Creator

- Mediums and diviners in the ATR communicate with the spiritual realm through inspiration. (10)

3.1.2 Oral tradition:

- In all religions oral tradition serves as an effective way of passing the original message from one generation to another.

- Some religions place more emphasis on oral tradition than on their sacred texts.

- Oral tradition still plays an important role in some religions, e.g. the African Traditional Religion.

- Oral tradition still runs parallel to written texts.

- Oral tradition provides more clarity than written texts, owing to the narrative style.

- The chain of narrators is also important, as it leads to the original source.

- Oral tradition reflects local dialect and culture. It is therefore more easily understood in each culture.

- Rituals in many religions include oral traditions. (10)

3.2 Similarities:

- A religious teaching is a set of broad beliefs regarding the fundamental questions of human existence.

- Both Abrahamic and Eastern religions use teachings to guide the followers towards right living.

- All religious teachings tend to emphasise clear, rational, systematic thinking.

- In both Abrahamic and Eastern religions, teachings are a vehicle to convey religious dogma.

Differences:

- Teachings in the Abrahamic faiths come from the scriptures which are believed to be the word of God.

- Therefore, there is more emphasis on correct teachings.

- In the Abrahamic religions people who deviate from the correct teachings may have to suffer certain social consequences, e.g. excommunication.

- In the Abrahamic faiths there is little room for variation as far as the teachings of the religions are concerned.

- In Abrahamic religions, sacred text is treated as 'canonical' –prescriptive. ∙ In Eastern religions, the interpretation is more flexible.

- Teachings in the Eastern religions come from scriptures written by rishis, sages etc. Some are claimed to be divinely inspired.

- In the Eastern religions it is more important to do the correct thing and to behave in the correct way than to follow the teachings.

- In the Eastern religions acceptance of a certain teaching may even be seen as a hindrance on the way to salvation.

- In the Eastern religions attachment to the teachings is just as bad as the attachment to money, because it leads to suffering and interpersonal strife. (14)

3.3 Grammar and historical context:

- Meaning one must use rules of grammar and historical facts to interpret the sacred texts.

Clearest meaning:

- One should take the literal meaning of the text.

Plan, purpose and context:

- Meaning a piece of writing should be viewed as a whole. What is the writing plan or structure? What was the author's purpose in writing the text? What is the context of the passage being studied?

Meaning of words:

- The meaning of words change over time and in different places. Find out the original meaning of the words as used in the normative source.

Figurative meaning:

- Figurative and non-literal meaning must be taken into account.

Other sacred texts:

- Sacred texts themselves may be used to interpret other sacred texts. (16)

[50]

QUESTION 4

4.1

- According to the Big Bang theory, it is not known what existed before the Big Bang.

- The theory states that there was an enormous explosion in space and, within a second, the universe appeared and expanded to an enormous size.

- The Big Bang happened about 13,7 billion years ago.

- The Big Bang theory states that the process of creation took a split second.

- Small temperature differences in the initial explosion resulted in the formation of matter and energy.

- The matter condensed and formed the stars and galaxies.

- Scientists believe that the universe is still expanding.

- It is not known whether or how the universe will end. (14)

4.2

- It is mainly the Abrahamic religions that are against the theory of evolution because it is against their fundamental teachings about the creation of humans and their status in the universe.

- Evolution does not recognise the existence of a Creator.

- Nor does it put human beings at the centre of creation.

- According to evolution, a human being is simply another organism.

- This is contrary to the teachings of the Abrahamic religions, as well as the African Traditional Religion.

- The Abrahamic religions teach that human beings are created in the image of God, which places human beings above all creation.

- According to evolution, humans are part of the process of life, coming into being and passing away.

- This is against religious teachings which teach that human beings are immortal, and that they possess a spiritual part (soul).

- Religions teach that everything was created by God and each creation was perfect.

- This implies that human beings were created perfectly and they did not evolve from primates.

- They further argue that the evolution of a new species had never been recorded.

- The fact that species adapt to changing environments is part of the grand design of God.

- This lesser scale of evolution, therefore, does not deny the existence of God. (20)

4.3

- Many Buddhists argue that the theory of evolution and Buddhism are in agreement.

- Since Buddhists believe in the impermanence of everything, even gods are impermanent. Even Buddhas do not live forever.

- Buddhism does not have an account for creation.

- Buddhists do not mind what scientists say about how the universe and people came into being.

- They do, however, attach special significance to human existence.

- Buddhists believe that all life involves constant transformation and evolution.

- Buddhists believed in evolution long before Western scientists did.

- Buddhists believe in the continuity of all living beings.

- Therefore, they have no problem with the idea that human beings may have evolved from more primitive primate forms. (14)

[50]

QUESTION 5

5.1

- 'Secular' refers to 'non-religious'.

- Humanism developed from a group of philosophers that believe human beings can develop ethics and morality independently of supernatural being.

- Secular humanism is a branch of humanism that rejects religious beliefs. ∙ It also rejects the existence of a supernatural being.

- It is often associated with scientists and academics.

- Secular humanism generally leads to atheism.

- Secular humanism originated as a liberal view of human rights.

- It was not anti-religion, but emphasised that people's emotional and spiritual needs can be filled without religion. (10)

5.2

- In the 15th century Martin Luther set in motion certain changes that led to the splintering of Christianity.

- This led to decades of religious wars in Europe.

- Various Christian groups fought for dominance.

- At the time the church was very influential, both politically and socially. ∙ Most countries were not democratic, as they were ruled by emperors, kings, queens or nobility.

- These rulers used the church to establish their power.

- In return religious leaders also influenced rulers to promote their interpretation of beliefs.

- All the warring parties eventually fought themselves to a standstill.

- People started to seek for a state where there would be religious tolerance.

- The intellectuals came to the conclusion that religion was divisive, rather than uniting.

- A government which was based purely on reasoning and on an understanding of human nature was then the solution.

- Thus government and morality were divorced from religion and secular humanism came into being.

- At the same time freedom from the shackles of religion (free inquiry) gave rise to a number of scientific discoveries.

- These further eroded the influence of religion and gave people an alternative world view – secularism. (20)

5.3 EXAMPLE: ATHEISM

Agree:

- I am convinced that atheism is truthful.

- Atheism rejects the belief that divine or supernatural power exists.

- There is no way one can prove the existence of a supernatural being or power.

- Atheists state that if there had been a loving God or gods, there would not be so much suffering in the world.

- There are different degrees of atheism.

- The soft or neutral atheists do not actively reject the existence of a supernatural being.

- It is better to keep quiet and neither rejects nor accepts the existence of the supernatural being, because those who follow religion have the right to do so.

- The strong (positive) atheists believe that there is evidence to support their atheistic views and such evidence is convincing enough to accept this world view.

- Belief in the supernatural realm is unscientific.

- Explanations for the world and creation are to be found in science.

- Evil and suffering in the world refute a God who is all powerful, all loving and all knowing.

- Atheists often turn to science to explain the nature of the universe rather than relying on faith.

Disagree:

- I am not convinced that atheism is truthful.

- God or a supernatural being exists.

- The proof that God or a supernatural being exists is the order in which the creation is organised.

- The order shows that there is a master plan.

- If there had not been a loving God or gods, who would have intervened to protect us from the suffering that we are facing every day.

- There are different degrees of atheism, which means that there is no certainty about the beliefs in atheism.

- The soft or neutral atheists do not actively reject the existence of a supernatural being.

- The strong (positive) atheists believe that there is evidence to support their atheistic views and such evidence is convincing enough to accept this world view.

- Atheists often turn to science to explain the nature of the universe rather than relying on faith.

- There is no evidence in human history of the development of new species.

- There is no evidence of one species having developed from another species.

- In African religion the diviners are good examples of the existence of supernatural power.

- Healing by the power of God is a good demonstration of the existence of God or divine powers.

- The fact that the level of oxygen in the atmosphere is 21% places the earth in a better position to sustain life which is evidence of the existence of a master designer.

NOTE: Any other relevant facts must be credited.

(20)

[50]

TOTAL: 150

RELIGIOUS STUDIES PAPER 1 GRADE 12 MEMORANDUM - NSC PAST PAPERS AND MEMOS FEBRUARY/MARCH 2017

RELIGIOUS STUDIES

PAPER 1

GRADE 12

NSC PAST PAPERS AND MEMOS

FEBRUARY/MARCH 2017

MEMORANDUM

SECTION A (COMPULSORY)

QUESTION 1

1.1

1.1.1 B (1)

1.1.2 B (1)

1.1.3 C (1)

1.1.4 D (1)

1.1.5 D (1)

1.1.6 A (1)

1.1.7 C (1)

1.1.8 D (1)

1.1.9 B (1)

1.1.10 C (1)

1.2

1.2.1 Iran (1)

1.2.2 Three baskets(of wisdom) (1)

1.2.3 Martin Luther (1)

1.2.4 Yin and Yang (1)

1.2.5 Halakhah (1)

1.3

1.3.1 Tanach – is a sacred book for Judaism. (2)

1.3.2 Abu Bakr – was the father in-law of Prophet Muhammad. He was the successor to Muhammad/the first caliph. (2)

1.3.3 Nirvana – a state of perfect happiness and peace in Buddhism. (2)

1.3.4 Sanskrit – an ancient language of the Far East. (2)

1.3.5 Jesus – the founder of Christianity. (2)

1.4

1.4.1 The most well-known Bodhisattva is Dalai Lama. (2)

1.4.2 The Shi'a holy shrine of Karbala is in Iraq. (2)

1.4.3 The longest epic in Hinduism is the Mahabharata. (2)

1.4.4 The tangible expression of the oral Torah is Talmud. (2)

1.4.5 The highest goal of Buddhist practice is Nirvana. (2)

1.5

1.5.1 E (1)

1.5.2 D (1)

1.5.3 F (1)

1.5.4 B (1)

1.5.5 A (1)

1.6

1.6.1

- Zen is a branch of Mahayana Buddhism which emphasises meditation.

- Zen practitioners meditate in order to attain enlightenment.

- Zen Buddhism believes that there is a line of authority that goes down to Buddha. (2)

1.6.2

- A principle, tenant or system as laid down by a collective religious authority.

- Comes from the Greek word 'dogma' which originally meant 'appearance' or 'opinion'.

- Refers to any set of beliefs that is taken to be absolutely true and fixed. (2)

1.6.3

- The founder of the Bahá'i' faith

- He was a Persian nobleman and a prophet. (2)

1.6.4

- The attribution of human qualities to the divine.

- When something non-human is spoken of as if it was human.

- Example: When God is spoken of as having a 'voice'. (2)

1.6.5

- The re-birth of a soul in a new body.

- The Hindu/Buddhist belief that beings are born into a next life over and over again. (2)

TOTAL SECTION A: 50

SECTION B

- NOTE: In this section, each fact (identified by a bullet) counts TWO marks. If a candidate has answered more than two questions, only the first two must be marked. The extra questions should be struck off, with EQ written across the answers.

QUESTION 2

2.1

2.1.1

- All are created by Allah.

- We are therefore all part of the family, no matter what we believe, and we should treat each other as brothers and sisters.

- Humanity is seen as having a common father – Adam.

- This is the foundation of humanity in Islam.

- People are born into tribes and race groups, so that they may recognise each other, not that they may despise each other.

- 'There is no compulsion in Islam.'

- Islam rejects conversion by force or by compulsion.

- Islamic tolerance extends to all sincere believers in all religions. As long as people are truthful, patient, humble, and practise chastity, charity, kindness, and justice Allah will be forgiving and rewarding.

- When there are differences, people should interact on a basis of mutual respect and goodwill.

- The Buddhist ethic is to do no harm to living creatures, including humans.

- Buddhism does not use war to spread their message.

- Buddhism uses the power of logic and examples to show people that they can live socially harmonious lives in which they are at peace with themselves.

- There should be tolerance and acceptance of people just as they are: this is fundamental to Buddhism.

- Thou shalt not kill.

- This Biblical commandment sanctifies human life.

- It is not permissible to kill another human being, except in self defence.

- It also refers to the protection of the unborn child, as observed in Catholicism. (18)

2.1.2

- Respect is the appreciation of another person's beliefs and practices.

- Tolerance means to understand and respect the other person's beliefs and practices, even though you don't agree with them. (4)

2.1.3

- In Western culture everyone should have only one religion.

- Religious tolerance means allowing people to convert from one religion to another.

- In Eastern culture religious tolerance means that a person may subscribe to multiple religions at the same time.

- People are not forced to convert. (8)

2.2

2.2.1

- It refers to features that are common in different religions.

- In Christianity and African Traditional Religion, they both recognise the existence of a supernatural being. (4)

2.2.2

- Religious identity is a form of self-identification.

- It refers to a certain individuality that distinguishes a particular religion from other religions.

- Example: Many Muslims believe that their identity as Muslims form an essential part of their 'being' and is exclusive to them. (4)

2.2.3

- A foreign government imposes their ruling upon the people of another country.

- When the foreign government imposes their culture, religion and education on another country.

- Example: Religions have basic, non-negotiable teachings, (dogma), which foster unity within a religion/each religion has a unique dress code, e.g. Muslim women wear the hijab. (4)

2.2.4

- Different religions are able to co-exist quit peacefully irrespective of their differences.

- Different religions actively co-operate to achieve certain particular aims in society.

- Example: The teachings of Islam and Judaism concerning God are 'one', in the sense that there are no serious differences between these religions on that topic. (4)

2.2.5

- It means that when you compare a religion to other religions, only religion A has these or those features.

- Uniqueness in a particular religion can be an expression of how adherents themselves see their own religion.

- Example: The unique feature of the African Traditional Religion is the veneration of the ancestors. (4)

[50]

QUESTION 3

3.1

3.1.1 YES:

- Coverage differs both in terms of time and quality of coverage.

- More time is given for majority religions, like Christianity, while smaller religions get no coverage.

- Minority religions are excluded from mainstream media, e.g. Jain, Tao.

- Some religions are selectively represented, e.g. Islam is shown as a violent religion, with protests and terrorist attacks getting maximum coverage.

- Buddhism is shown as a religion of peace; the Dalai Lama gets positive coverage, as do Buddhist monks.

- Religions are heavily stereotyped, some positively, others negatively.

- Minority religions get positive coverage.

- Christianity gets the most coverage.

- International visits by the Pope get full coverage, whereas other religious leaders are hardly mentioned.

- The media also remains silent on (or downplays) some religious issues.

- The ethnic cleansing of Myanmar's Rohigya Muslims by Buddhists is rarely mentioned.

- The rise of Hindu fundamentalism in India is largely ignored, while fundamentalism in Christianity and Islam are always emphasised.

NO:

- The public broadcaster gives equal coverage to all major religions.

- The morning prayer on TV is presented by various religions in rotation.

- There are dedicated TV channels for each religion, according to community needs.

- Islam Channel and Rhema church are two such examples.

- Radio channels too, cater for a variety of religions.

- Hindvani, Radio Pulpit, Radio Highway and Radio Al Ansaar are some examples.

- The Internet has no limit on the establishment of websites dedicated to any religion.

- Sites for each religion will depend directly on interest shown by its followers (frequency of visits/number of “hits”) (12)

3.1.2

- There are political reasons.

- Religion is a highly contentious political issue. The public have very strong attitudes towards religion, and media bias can influence such a sentiment.

- The media thrives on sensationalism, as this sells papers/advertising space.

- They will therefore use biased coverage to elicit responses.

- The media coverage may be biased owing to ignorance about religious matters. (8)

3.1.3 POSITIVE:

- It is easier to find information on religious matters, teachings and rulings.

- It allows easy access to religious material, such as sermons, seminars and meetings.

- Like-minded people can easily share and clarify ideas about religion.

- Religion has always focused on community interaction and the Internet is a medium that allows easy access for religious communities.

- People have access to podcasts at any time, unlike attending religious functions at fixed times.

NEGATIVE:

- However, anytime access to religious material means that attendance of religious gatherings may be adversely affected.

- In addition, there is no moderation of religious comments on social media. Any person, religious or ignorant about religion, can post comments. These comments may be true or untrue.

- These may be untrue, and negatively influence gullible people.

- Owing to anonymity on the Internet, a person can post hate speech, and incite religious hatred, without being arrested.

NOTE: Other relevant responses must be credited. (14)

3.2

3.2.1

- The mosque and cathedral are in close proximity to each other. This facilitates cultural and religious interaction.

- It is a historical landmark.

- It houses the Denis Hurley Centre.

- The archbishop has served at the cathedral for many years. (4)

3.2.2

- World Religions in Concert (2)

3.2.3

- To encourage unity, tolerance and respect amongst different religions through a multifaith concert.

- To celebrate the official opening of the Denis Hurley Centre

- To give opportunity to different religions to demonstrate their talents and gifts.

- To entertain the audience.

- To demonstrate the diversity of religions. (6)

3.2.4

- The report is fair because it shows the unity of different religions celebrating one common goal.

- The report shows that there is harmony and co-operation amongst religions.

- The report motivates and makes people aware of the unity that is amongst the religions.

- The report promotes respect of all religions by stating/ mentioning the activities performed by different religions (4)

[50]

QUESTION 4

4.1 YES:

- The article shows the attempt by one religion to dominate others.

- This period was characterised by the Crusades, when Christians waged wars against Muslims and Jews.

- The Crusades were Christian military expeditions, specifically intended to re-take Holy Lands.

- These holy wars were sanctioned by the Church.

- Furthermore, Christians were not attacked.

- This was also the period of the Spanish Inquisition.

- This was a religious court intended to force conversion to Christianity.

- It is therefore clear that the conflict was mainly religious.

NO:

- Although Christians mounted military attacks against Muslims and Jews, this was not primarily a religious conflict.

- It was about political and economic control.

- The goal of the Christians was not to forcibly convert people to Christianity.

- This is illustrated by the fact that Muslims did not leave the Christian dominated areas.

- Jews also continued to live among the other religions.

- This indicates that harmonious interaction between people of the three religions continued. (12)

4.2

4.2.1 Causes of the conflict

EXAMPLE 1: ISRAEL-PALESTINE CONFLICT

- After World War II Britain issued the Balfour Declaration.

- This made Palestine a British Protectorate.

- Palestinians were never consulted on the matter.

- In terms of the Balfour Declaration, sections of Palestinian land were set aside for Jews from Europe to settle.

- Jews initially bought land from Palestinians, but later forced them off their lands.

- In 1948 Jews declared their independence from Palestine and named their land Israel.

- Jews emigrated en masse from Europe and Muslim countries to the new Jewish state.

- Muslims were forced to flee the land Jews called Israel.

- The settlers soon invaded land belonging to Palestinians, and the latter became refugees.

- Today Jews still continue to build settlements in confiscated Palestinian land.

EXAMPLE 2: CONFLICT IN NORTHERN IRELAND

- The conflict in this country is intra-religious./Sectarian

- The conflict is between the Catholics and Protestants.

- These two groups belong to the Christian religion.

- Northern Ireland is constitutionally part of the United Kingdom.

- Its population is religiously split between Protestants and Catholics.

- For decades some Catholics in Northern Ireland have fought for independence from the United Kingdom.

- Northern Ireland has also been fighting for union with the Republic of Ireland.

- The Protestants have been resisting.

- The result has been a long and sporadic civil war. (10)

4.2.2 The extent to which religion is involved in the conflict

EXAMPLE 1: ISRAEL-PALESTINE CONFLICT

- It is only some Jews who claim the land as a 'God-given right'.

- Orthodox Jews reject the concept of a Jewish homeland.

- In this case, Jews use religion to both justify and reject the existence of a Jewish homeland.

- This leads to low-level intra-religious conflict among the Jews.

- However, the Palestine-Israel conflict is not religious: it is about land and human rights.

EXAMPLE 2: CONFLICT IN NORTHERN IRELAND

- Northern Ireland is constitutionally part of the United Kingdom, which is largely Protestant.

- Northern Ireland's population is religiously split between Protestants and Catholics, with Catholics in the majority.

- For decades some Catholics in Northern Ireland have fought for independence from the Protestant United Kingdom.

- Northern Ireland has also been fighting for union with the Republic of Ireland.

- The Protestants in both Ireland and United Kingdom have been resisting a break-away by Catholics.

- The result is a long and violent intra-religious civil war.

- The RIRA (Real Irish Republican Army) is continuing the fight for independence, albeit on a smaller scale. (10)

4.2.3 What religions can do to resolve the conflict

EXAMPLE 1: ISRAEL-PALESTINE CONFLICT

- Each of the Abrahamic religions should develop understanding and respect of the other.

- This will lead to tolerance, so that religion may not be used as an excuse to oppress one another.

- They should foster interreligious partnerships among the various communities, as they are divided along religious lines.

- They should have joint prayer meetings at sites holy to each religion.

- Religion should never be used to abuse the human rights of people from other religions.

EXAMPLE 2: CONFLICT IN NORTHERN IRELAND

- This is an intra-religious conflict.

- The Catholics and the Protestant should recognise the reality that they belong to one religion.

- The two religions should also form an organisation for peace.

- The organisation should be inclusive of these two branches of religion.

- The Catholics and the Protestants should use their common teachings and beliefs to find a solution.

- The two religious branches should establish a task team to enhance peaceful negotiations with the politicians. (8)

4.3 EXAMPLE 1:

- In 2000 Pope John Paul II spoke of the need to bring peace to the Middle East.

- He was the first pontiff to speak publicly of a political situation from a religious perspective.

- To symbolise his acceptance of other faiths, he visited the Western Wall in the Jewish quarter of Jerusalem.

- He acknowledged that the Holy land is equally sacred to Muslims, Jews and Christians.

- In another symbolic act of interreligious harmony, Pope John Paul II issued an unprecedented apology for the past sins of the Catholic Church.

- This included the unjustified violence of the Crusades and the Inquisition.

EXAMPLE 2:

- King Goodwill Zwelithini is both a Zulu king and a traditional religious leader.

- While he is a member of the Anglican Church, he also presides over African Traditional Religious rituals. He illustrates that both religions are complementary.

- He has officially represented the Zulu nation at religious gatherings of various Christian denominations.

- An example is his visits to the Sheme Church.

- Another example is his May 2016 visit to the Juma Masjid (mosque) in Durban, where he emphasised respect and tolerance for all faiths. (10)

[50]

QUESTION 5

5.1

5.1.1

- A belief is what adherents of a religion hold to be true.

- They are uniting elements of a religion.

- They are closely connected to religious rituals.

- Example: In Christianity, the Eucharist commemorates the death and resurrection of Jesus Christ. (6)

5.1.2

- An ideology refers to the prevailing worldview that gives meaning to a person's existence.

- An ideology is the broadest category used to describe the beliefs of an individual.

- Ideologies are always contested.

- Example: Religious ideologies include world religions, such as Buddhism and African Traditional Religion.

- Secular ideologies include Communism and Materialism. (6)

5.2

- The Tao-te–Ching was written in a night by its legendary founder Lao-tzu.

- He was born with white hair.

- He spent eight or 80 years in his mother's womb.

- According to Tao it is impossible to describe divinity completely.

- The working of the universe is divine.

- All things come from being and being comes from non-being.

- According to the Taoist, everything in creation consists of two kinds of forces, the yang and the yin. (10)

5.3

- The World Conference of Religions for Peace has been involved in mediating talks and agreements between groups at war with each other.

- It helps with reconciliation in communities that are in conflict with each other because of ethnic and political differences.

- It organises a worldwide network of religious women's organisations and has a programme to help children in Africa who are affected by Aids.

It is committed to issues such as:- Conflict and reconciliation

- Disarmament and security

- Development and ecology

- Human rights and responsibilities

- Peace and education (10)

5.4

- There was unity amongst different religions and denominations because they had one common goal, namely to eradicate apartheid.

- The South African Council of Churches was formed in 1968, so that Christians could oppose the National Party's racist interpretations of the Bible.

- The Call of Islam was formed in 1984.

- Jews for Justice was formed in 1985.

- Such organisations united people of faith against Apartheid.

- The South African branch of the World Conference of Religions for Peace (WCPR), led by people like Frank Chikane and Desmond Tutu, played a significant role in the 1980s and 1990s.

- Religious organisations had an obligation to uphold the moral responsibility in guiding communities and encouraging them to vote in the elections.

- It also held briefings on major national and international issues.

- Together with the Health Education and Aids Research Division at the University of KwaZulu-Natal, it has formed an HIV and Aids Interreligious Forum. (12)

5.5

- The Programme for Christian – Muslim relations in Africa (PROCMURA)

- The Inter – Faith Action for Peace in Africa (IFAPA)

- The African Council of Religious Leaders (ACRL) (6)

[50]

TOTAL SECTION B: 100

GRAND TOTAL: 150

RELIGIOUS STUDIES PAPER 2 GRADE 12 QUESTIONS - NSC PAST PAPERS AND MEMOS FEBRUARY/MARCH 2017

RELIGIOUS STUDIES

PAPER 2

GRADE 12

NSC PAST PAPERS AND MEMOS

FEBRUARY/MARCH 2017

QUESTIONS

INSTRUCTIONS AND INFORMATION

- This question paper consists of FIVE questions.

- Answer any THREE questions.

- Read ALL the questions carefully.

- Number the answers correctly according to the numbering system used in this question paper.

- The length of your answers must be in accordance with the marks allocated to each question.

- Write neatly and legibly.

QUESTION 1

Read the extracts below and answer the questions that follow.

All religions aim to balance the rights of the individual and the rights of the community. It is when this balance is upset that all types of social challenges arise. |

This need for balance is illustrated in the media article below.

Eastern Cape leaders want answers from Nelson Mandela's grandson, Inkosi Zwelivelile 'Mandla' Mandela, about why he reportedly converted to Islam when he married a Muslim woman. [Source: www.Timeslive.co.za/Local2016/02] |

1.1 Give reasons why Eastern Cape leaders are not happy about the marriage between Inkosi 'Mandla' Mandela and the Muslim woman. (10)

1.2 What do you think the Inkosi would say to justify his interreligious marriage? (20)

1.3 Choose any ONE religion and discuss its teachings about the rights of the individual and the rights of the community. (20)

[50]

QUESTION 2

Read the extract below and answer the questions that follow.

It is true that in most religions, different interpretations of beliefs exist. This leads to major differences that sometimes culminate in the formation of strands or branches and other divisions, for example different denominations in Christianity. [Adapted from Shuters Top Class Religion Studies Grade 12] |

2.1 Choose ONE religion and discuss the internal differences under the following headings:

2.1.1 Internal differences concerning beliefs (18)

2.1.2 Internal differences concerning governance (18)

2.2 With reference to the central teachings of any ONE religion, discuss the place and responsibility of humanity in the world. (14)

[50]

QUESTION 3

3.1 Discuss the importance of the following in the context of religion:

3.1.1 Inspiration (10)

3.1.2 Oral tradition (10)

3.2 Compare the role played by religious teachings in the Abrahamic religions with the role played by religious teachings in the Eastern religions. (14)

3.3 State FOUR hermeneutical principles and explain EACH of them. (16)

[50]

QUESTION 4

Study the extract below and answer the questions that follow.

Scientists refer to the attempt to understand the evolution of the universe as 'cosmology'. Currently the most popular scientific theory of the universe is the so-called Big Bang theory. [Adapted from Shuters Top Class Religion Studies Grade 12] |

4.1 Write SEVEN facts about the Big Bang theory. (14)

4.2 Explain why some religions have rejected Darwin's theory of evolution. (22)

4.3 Discuss the views of Buddhism on the theory of evolution. (14)

[50]

QUESTION 5

Read the extract below and answer the questions that follow.

When people become actively secular, they find that they need to put forward a theory of their own, sometimes to replace religion. [Adapted from Religion Studies Grade 12, Steyn] |

5.1 Explain the term secular humanism with reference to the statement above. (10)

5.2 Discuss the historical origin of Western secular humanism. (20)

5.3 Describe any ONE secular world view and state whether you agree or disagree with its teachings. Give reasons for your answer. (20)

[50]

TOTAL: 150

RELIGIOUS STUDIES PAPER 1 GRADE 12 QUESTIONS - NSC PAST PAPERS AND MEMOS FEBRUARY/MARCH 2017

RELIGIOUS STUDIES

PAPER 1

GRADE 12

NSC PAST PAPERS AND MEMOS

FEBRUARY/MARCH 2017

QUESTIONS

INSTRUCTIONS AND INFORMATION

- This question paper consists of SECTION A and SECTION B.

- SECTION A: COMPULSORY

SECTION B: Answer any TWO questions in this section. - Read ALL the questions carefully.

- Number the answers correctly according to the numbering system used in this question paper.

- Write neatly and legibly.

SECTION A (COMPULSORY)

QUESTION 1

1.1 Various options are provided as possible answers to the following questions. Write down the question number (1.1.1–1.1.10), choose the answer and make a cross (X) over the letter (A–D) of your choice in the ANSWER BOOK.

EXAMPLE:

1.1.11 ![]()

1.1.1 To establish communication with ancestors, worshippers of the African Traditional Religion must engage in …

- stories.

- rituals.

- miracles.

- ubuntu. (1)

1.1.2 The Tao is …

- the universe.

- the path of the universe.

- oscillation.

- All the above-mentioned (1)

1.1.3 The mystical dimension of Islam is often called …

- a trance.

- Shi'ism.

- Sufism.

- Zakaat/Zakat. (1)

1.1.4 The founder of Taoism was …

- Tao-te Ching.

- Buddha.

- Chuang-Tzu.

- Lao-tzu. (1)

1.1.5 The collection of teachings of the Prophet Muhammad is called the …

- Qur'an.

- Vedas.

- Tripitaka.

- Hadith. (1)

1.1.6 A ritual based on Jesus' last meal is …

- the Eucharist.

- Christmas.

- Easter.

- the Passover. (1)

1.1.7 … is a world view based solely on human reasoning.

- Socialism

- Natural Sciences

- Secularism

- Enlightenment (1)

1.1.8 Zen Buddhism originated …

- in Iran.

- from Theravada Buddhism.

- from Hinduism.

- from Mahayana Buddhism. (1)

1.1.9 Catholics attend church services called the …

- hajj.

- Mass.

- Holy Communion.

- Mitzvot. (1)

1.1.10 A teaching not common to Judaism:

- Giving charity

- Belief in the afterlife

- Belief in the ancestors

- The Sabbath (1)

1.2 Complete the following sentences by filling in the missing word(s). Write only the word(s) next to the question number (1.2.1–1.2.5) in the ANSWER BOOK.

1.2.1 The Bahá'i faith originated in the country presently called … (1)

1.2.2 In Buddhism Tripitaka means … (1)

1.2.3 The German priest whose teachings led to Protestantism was … (1)

1.2.4 The two opposing forces in Taoism are called … (1)

1.2.5 Jews observe Divine Law called the … (1)

1.3 Choose the word in each list below that does NOT match the rest. Write down the word and a reason next to the question number (1.3.1–1.3.5) in the ANSWER BOOK.

1.3.1 Ancestors; Clan; Ilimo; Tanach (2)

1.3.2 Bahá'u'lláh; Haifa; Kitáb-i-Aqdas; Abu Bakr (2)

1.3.3 Brahma; Vishnu; Nirvana; Shiva (2)

1.3.4 Theravada; Pali Canon; Sanskrit, Mahayana (2)

1.3.5 Matthew; Mark; Jesus; John (2)

1.4. Each of the statements below is FALSE. Change ONE term/concept in each statement to make it TRUE. Write down the TRUE statement next to the question number (1.4.1–1.4.5) in the ANSWER BOOK.

EXAMPLE: Apples and grapes are vegetables.

ANSWER: 1.4.6 Apples and grapes are fruit.

1.4.1 The most well-known Bodhisattva is Chuang-Tzu. (2)

1.4.2 The Shi'a holy shrine of Karbala is in Saudi Arabia. (2)

1.4.3 The longest epic in Hinduism is the Vedas. (2)

1.4.4 The tangible expression of the oral Torah is Nervim. (2)

1.4.5 The highest goal of Buddhist practice is Darma. (2)

1.5 Choose a description from COLUMN B that matches the term in COLUMN A. Write only the letter (A–G) next to the question number (1.5.1–1.5.5) in the ANSWER BOOK.

COLUMN A | COLUMN B |

1.5.1 Karma | A headquarters of the Bahá'i faith |

(5 x 1) (5)

1.6 In the context of religion, write TWO facts about EACH of the following terms:

1.6.1 Zen (2)

1.6.2 Dogma (2)

1.6.3 Bahá'u'lláh (2)

1.6.4 Anthropomorphism (2)

1.6.5 Reincarnation (2)

TOTAL SECTION A: 50

SECTION B

Answer any TWO questions in this section.

QUESTION 2

2.1 Read the extract below and answer the questions that follow.

According to the Bill of Rights in the South African Constitution 'everyone has the right to freedom of conscience, religion, thought, belief and opinion'. |

2.1.1 What role did religions play in the development of the Human Rights Charter? Give examples to illustrate the answer. (18)

2.1.2 Discuss the difference between respect and tolerance. (4)

2.1.3 How is religious tolerance different in Western and Eastern cultures? (8)

2.2 Explain the terms below in a religious context and give ONE example of each:

2.2.1 Similarity (4)

2.2.2 Identity (4)

2.2.3 Colonialism (4)

2.2.4 Unity (4)

2.2.5 Uniqueness (4)

[50]

QUESTION 3

3.1 Read the article below and answer the questions that follow.

MEDIA PORTRAYALS OF RELIGION IN SOUTH AFRICA South Africa is a culturally diverse country that is home to many different religions. These religions are not always equally represented in the media, where portrayals of religion are often negatively stereotyped and disempowering. These stereotypes exist for a variety of reasons, from political to financial. Religious stereotypes can be found throughout a wide variety of media, including television, movies and video games. [Adapted from http://mediasmarts.ca. Accessed on 16 June 2016.] |

3.1.1 Do you agree that 'religions are not always equally represented in the media' in South Africa? Give reasons and use suitable examples to illustrate your answer. (12)

3.1.2 Discuss possible factors that may cause the media to be biased against reporting religious issues. (8)

3.1.3 Discuss the positive and negative effects of the Internet on religion. (14)

3.2 Read the newspaper article below and answer the questions that follow.

DURBAN'S CALL TO DEVOTION On Monday night the Muslim call to prayer from the Juma Mosque was transmitted a mere 200 metres to the 112-year-old Emmanuel Cathedral in the Durban city centre. This occurrence opened a multifaith concert held to celebrate the official opening of the Denis Hurley Centre, on the day that would have marked the Catholic archbishop's 100th birthday. [Adapted from The Times, November 2015] |

3.2.1 Give TWO reasons why this particular cathedral was chosen for the event. (4)

3.2.2 What was this multifaith event called? (2)

3.2.3 What, do you think, were the goals of the function? (6)

3.2.4 Do you think the report is fair and unbiased? Give TWO reasons for your answer. (4)

QUESTION 4

Study the extract below and answer the questions that follow.

The three Abrahamic faiths lived side by side in Portugal-Spain during the 782 years of Muslim-Christian rivalry on its soil. This was despite Christians waging a military struggle to exert sole control. For generations Muslims continued to reside in areas the Christians retook … and Jews flourished on both sides of the divide. [Adapted from Top Class Religion Studies, Grade 12] |

4.1 Do you think the article above refers to a religious conflict? Give reasons to support your views. (12)

4.2 Identify ONE area of recent conflict, anywhere in the world, and discuss:

4.2.1 The causes of the conflict (10)

4.2.2 The extent to which religion is involved in the conflict (10)

4.2.3 What religions can do to resolve the conflict (8)

4.3 Discuss ONE religious leader who has worked to bring about interreligious harmony. (10)

[50]

QUESTION 5

5.1 Use a suitable example to explain EACH of the following terms in the context of religion:

5.1.1 Belief (6)

5.1.2 Ideology (6)

5.2 Discuss any FIVE unique features of Taoism. (10)

5.3 The World Conference of Religions for Peace is one organisation promoting interreligious dialogue globally. Discuss FIVE functions of this organisation in detail. (10)

5.4 What role did interreligious co-operation play in South Africa prior to the democratic election in 1994? (12)

5.5 Name THREE African organisations that develop cordial relationships between different religions. (6)

[50]

TOTAL SECTION B: 100

GRAND TOTAL: 150

PHYSICAL SCIENCES SCHOOL BASED ASSESSMENT EXEMPLARS - CAPS GRADE 12 LEARNER'S GUIDE

PHYSICAL SCIENCES

SCHOOL BASED ASSESSMENT EXEMPLARS - CAPS

GRADE 12

LEARNER'S GUIDE

| TABLE OF CONTENT | |||

| CONTENT | PAGE | ||

| 1 | Introduction | 3 | |

| 2 | Objectives | 3 | |

| 3 | Assessment Tasks for Grade 12 Practical Work | 3 | |

| 4 | Exemplars of Practical Work as Formal Assessment Tasks | 4 | |

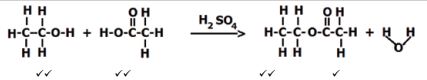

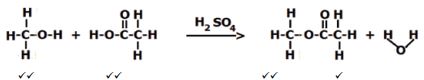

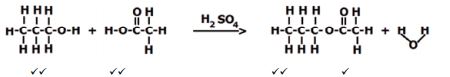

| 4.1 | Term 1: Preparation of esters and smell identification | 4 | |

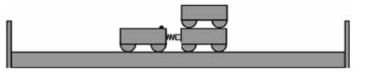

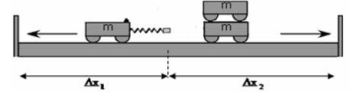

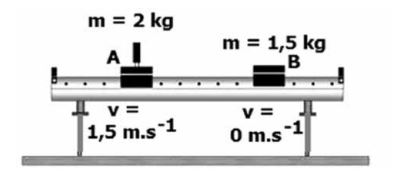

| 4.2 | Term 2: Conservation of linear momentum | 9 | |

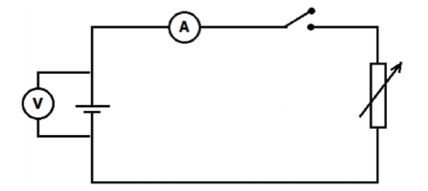

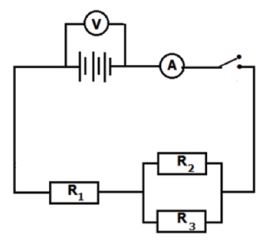

| 4.3 | Term 3: Electricity and magnetism | ||

| Part 1: Determine the internal resistance of a battery. | 14 | ||

Part 2: Set up a series-parallel network with known resistor. | 16 | ||

1. INTRODUCTION

Assessment of a learner’s progress in Grade 12 Physical Sciences consists of two components:

- A school-based programme of assessment consisting of six tasks, which makes up 25% (mark out of 100) of the total mark for Physical Sciences. Three of the six tasks comprise prescribed experiments.

- An external examination (out of 300 marks), which makes up the remaining 75%.

2. OBJECTIVES

Physical Sciences investigate physical and chemical phenomena. This is done through scientific enquiry and the application of scientific models, theories and laws in order to explain and predict events in the physical environment.

Practical work in Physical Sciences must be integrated with the theory to strengthen the concepts being taught. These may take the form of simple practical demonstrations or even an experiment or practical investigation.

As from 2014 THREE prescribed experiments will be done per year as practical activities for formal assessment:

- One Chemistry Practical during Term 1

- A Physics or a Chemistry Practical during Term 2

- A Physics Practical during Term 3.

This learner guide will provide support to the learner and teacher in performing these practical activities.

3. ASSESSMENT TASKS FOR GRADE 12 PRACTICAL WORK

The table below lists the prescribed formal assessment activities for practical work and the weighting for the annual SBA.

TERM | PRESCRIBED PRACTICAL ACTIVITIES FOR FORMAL ASSESSMENT | WEIGHTING |