Adele

AGRICULTURAL MANAGEMENT PRACTICES GRADE 12 MEMORANDUM - AMENDED SENIOR CERTIFICATE EXAMS PAST PAPERS AND MEMOS MAY/JUNE 2018

AGRICULTURAL MANAGEMENT PRACTICES

GRADE 12

AMENDED SCE PAST PAPERS AND MEMOS

MAY/JUNE 2018

MEMORANDUM

SECTION A

QUESTION 1

1.1 Multiple choice

1.1.1 C ✔✔

1.1.2 D ✔✔

1.1.3 B ✔✔

1.1.4 C ✔✔

1.1.5 A ✔✔

1.1.6 B ✔✔

1.1.7 D ✔✔

1.1.8 D ✔✔

1.1.9 B ✔✔

1.1.10 C ✔✔ (10 x 2) (20)

1.2 Matching items

1.2.1 G ✔✔

1.2.2 D ✔✔

1.2.3 L ✔✔

1.2.4 K ✔✔

1.2.5 C ✔✔

1.2.6 J ✔✔

1.2.7 A ✔✔

1.2.8 E ✔✔

1.2.9 H ✔✔

1.2.10 F ✔✔ (10 x 2) (20)

1.3 Underlined words

1.3.1 Soil data ✔

1.3.2 GPS ✔

1.3.3 Weakness ✔

1.3.4 Administrative ✔

1.3.5 Planning ✔

1.3.6 Partial ✔

1.3.7 Foreman ✔

1.3.8 Mechanisation ✔

1.3.9 Growth ✔

1.3.10 Current ✔ (10 x 1) (10)

TOTAL SECTION A: 50

SECTION B

QUESTION 2: PHYSICAL AND FINANCIAL PLANNING

2.1 Mechanisation

2.1.1 FOUR factors for introducing machinery

- Cost of equipment ✔

- Efficiency of equipment ✔

- Quality of the equipment ✔

- Time saving ✔

- Maintenance costs ✔

- Social factors ✔ (Any 4) (4)

2.1.2 FOUR reasons for preferring the use of machinery

- It simplifies supervision ✔

- Increases labour efficiency ✔

- Eliminate fatigue ✔

- Reduces the need for manual labour/decreases the number of workers ✔

- Less expensive over a longer period ✔

- Can cultivate larger areas ✔

- Quicker to complete the work ✔

- Not mostly dependant on weather conditions ✔ (Any 4) (4)

2.2 Deduction between correction method and soil characteristic

| CORRECTION METHOD | SOIL CHARACTERISTIC |

| Breaking impermeable layers | Soil depth ✔ |

| Vegetation strips | Soil slope ✔ |

| Opening water ways | Soil drainage ✔ |

| Apply gypsum | Soil reaction /soil pH ✔ (4) |

2.3 THREE factors influencing land use for grazing livestock

- Palatability of the veld ✔

- Topography ✔

- Type of vegetation ✔

- Ability of soil to erode ✔

- Production status of the soil ✔

- Availability of water resources ✔ (Any 3) (3)

2.4 Type of capital and finance period

2.4.1 Monthly veterinarian account

- Working/floating capital ✔

- Short term credit ✔ (2)

2.4.2 Production loan

- Floating/working capital ✔

- Short term credit ✔ (2)

2.4.3 Mortgage for land

- Fixed capital ✔

- Long term credit ✔ (2)

2.4.4 Equipment

- Movable capital ✔

- Medium term credit ✔ (2

2.5 Budget

2.5.1 TWO most important elements of a farm business budget

- Estimated/expected/probable income ✔

- Estimated/expected/probable cost ✔

- Distribution of funds over the period of the budget ✔ (Any 2) (2)

2.5.2 Budget for the farm enterprise of your choice

- Heading:

- Type of budget for the enterprise (e.g. crop or animal) ✔

- Indicate timeframe (period) ✔ (2)

- Content:

- Each listed item and number ✔ x 4 (4)

- Unit price and total price ✔ x 4 (4)

2.6 Soil analysis

2.6.1 TWO methods to increase field water capacity

- Add organic matter/compost/plant rests/organic fertiliser to soil ✔

- Minimum tillage/no tillage ✔

- Soil cover ✔ (Any 2) (2)

2.6.2 FOUR ways to improve soil reaction

- Adding dolomite agricultural lime ✔

- It contain calcium ✔

- Increase the magnesium level in the soil ✔

- To increase the pH level to 7 ✔ (4)

2.7 Discussion of the negative effect of excess use of herbicides

- It causes environmental pollution ✔

- Excess herbicides are washed away through irrigation, rain and ground water movement to rivers and underground water ✔

- It enters the food chain ✔

- Pesticides are absorbed into plants and people and animals health can be affected if they eat these plants too soon after application ✔

- Kills micro-organism / beneficial organisms ✔

- Many soil microbes are killed by excess herbicides that will affect the health of the soil and would lead to soil degradation ✔ (6)

2.8 Farming practice for continuously planting the same crop

- Monoculture/monocropping ✔

- Depleting nutrients - Same crop continuously using same soil nutrients ✔

- Insects can build up resistance to pesticides ✔ (3) [50]

QUESTION 3: ENTREPRENEURSHIP, RECORDING, MARKETING, BUSINESS PLANNING AND ORGANISED AGRICULTURE

3.1 Source document

3.1.1 Invoice ✔ (1)

3.1.2 Deposit slip ✔ (1)

3.1.3 Receipt ✔ (1)

3.1.4 Cash slip/till slip ✔ (1)

3.2 Labour records

3.2.1 Conditions of service

- Working hours per week

- Stipulate the normal working hours for a worker ✔

- In a 5 day (40 hour) or 6 day (45 hour) per week ✔

- Stipulate the maximum overtime per week ✔ (Any 2) (2)

- Overtime

- Limitations on overtime for a 5 day or 6 day week ✔

- Payment for overtime on normal working days is 1,5 times the daily salary ✔

- Payment on Sundays and public holidays is twice/double/2 times the daily salary ✔ (Any 2) (2)

3.2.2 Daily records of labour

- Starting time ✔

- Departing time / knock-off time ✔

- Absentees / leave✔

- Reason for absentees ✔

- Work done/productivity ✔

- Any labour related problems with labourer ✔

- Any injuries that happened on the farm at the specific day ✔ (Any 6) (6)

3.3 Description of agricultural business plan

- A document for a certain agricultural enterprise or farm ✔

- Indicating the basic information on production ✔

- And subsequently financial aspects ✔

- As part of an economical viable enterprise ✔

OR

- What you want to do ✔

- How you want to do it ✔

- What you will use to do it ✔

- When you want to do it ✔

- Where you want to do it. ✔ (4)

3.4 Sources of information for market research

- (A source can only be used ONCE)

3.4.1 Sources of primary research

- Interviews ✔

- Questionnaires ✔

- Observing competitors ✔

- Producer organisations ✔ (4)

3.4.2 Sources of secondary research

- Magazines ✔

- Newspapers ✔ (2)

3.5 Balance sheet

3.5.1 Aim of having a Balance sheet

- To determine the financial status/liquidity/viability of a farming business ✔

- At a specific date/time (2)

3.5.2 Calculate net worth using formula

- Net worth = total assets – total liabilities ✔

= R930 000 ✔ – R670 000 ✔

= R260 000 ✔ (4)

3.5.3 Viability and meaning

- The enterprise is viable ✔

AND

- The assets is higher than the liabilities ✔

- It has a positive net worth ✔ (Any 1) (2)

3.6 Income and expenditure

3.6.1 Income and expenditure account

| EXPENDITURE | INCOME | ||||

| DATE | ITEM | AMOUNT(R) | DATE | ITEM | AMOUNT(R) |

| 14/6 | Seed | 680,00✔ | 14/10 | Selling produce | 23 600,00✔ |

| 22/6 | Fertiliser | 2 280,00✔ | 21/10 | Selling produce | 1 050,00✔ |

| 1/7 | Pesticide | 1 200,00✔ | |||

| 22/10 | Transport | 720,00✔ | |||

| 28/10 | Labour | 16 000,00✔ | |||

| TOTAL | 20 880,00✔ | TOTAL | 24 650,00✔ |

Rubric

- 6 correct entries ✔ (6)

- Income total correct calculated ✔(1) CA

- Expenditure total correct calculated ✔(1) CA (8)

3.6.2 Profit or loss (CA from QUESTION 3.6.1)

(If QUESTION 3.6.1 not answered – no marks)

- The farmer made a profit✔

- Profit/loss = income – expenditure

= R 24 650,00 – R20 880,000 ✔

= R 3 770,00✔ (3)

3.7 Difference between a cash flow statement and an income statement

3.7.1 Cash flow statement

- Indicate the movement of funds through (cash flow in and out) the businesses account for a specific period ✔

- Comparing values to the budget for that month ✔ (2)

3.7.2 Income statement

- Is the record of financial transactions ✔

- Indicating the profit or loss for and an enterprise/farm for that period ✔

- Determine the credibility of farming enterprise ✔

- determine income source of enterprise and expenditure made ✔

- Indicate the amount of money spent on items ✔ (Any 3) (3)

3.8 Climate records in decision making process

- Determine the farming enterprise ✔

- Determine corrective measures ✔

- When to plant ✔

- Which adjustments are suitable ✔ (Any 2) (2) [50]

QUESTION 4: HARVESTING, PROCESSING, MANAGEMENT AND AGRITOURISM

4.1 Storage

4.1.1 Effects of moisture and high temperature on stored plant products • Some of the products may start to germinate ✔

- Encourages product to rot ✔

- Moulding may occur ✔

- Breeding of some post-harvest pests ✔

- Deterioration in quality/shelf life/nutritional value ✔ (Any 4) (4)

4.1.2 Methods to minimize damage on stored plant products

- Fumigation ✔

- Increase ventilation with fans/blowers ✔

- Store product in the correct manner according the product ✔

- Packaging of the product before storage ✔

- Prevent wetness ✔

- Take measured control against rodents ✔ (Any 3) (3)

4.2 Identify correct preserving method

4.2.1 Blanching ✔ (1)

4.2.2 Sterilisation ✔ (1)

4.2.3 Radiation ✔ (1)

4.2.4 Pasteurization ✔ (1)

4.2.5 Filtration ✔ (1)

4.3 Legal requirements for people working at a processing plant

- Wear protective clothing ✔

- Provide First Aid kit ✔

- Training (induction) of staff on safety rules applicable in the processing plant ✔

- Training of staff on correct handling/operation of machinery ✔

- Regularly health test for diseases than can be transmitted by food ✔

- Constant consciences on safety practises ✔

- Good hygienic practices ✔ (Any 5) (5)

4.4 Requirements of suitable wrapping material for perishable foods

- Clean ✔

- Strong ✔

- Should seal effectively ✔

- Non-toxic ✔

- Transparent ✔

- Resistant to mechanical and temperature damage ✔ (Any 5) (5)

4.5 Discuss FOUR motivation techniques

- Making them shareholders of the farm business ✔

- They will feel they are part of the business ✔

- Create joint ventures with the workers ✔

- Discuss any work issues that involves changes at labour level

- Involve them in the economic planning of the farm activity ✔

- Understanding economics will help preventing any losses ✔

- Involve them in the physical planning of the farm activity ✔

- Workers feel they are needed and can give some inputs in the planning ✔

- Delegate some responsibilities/Encourage shared supervision ✔

- Good work will pay off in the long run/ worker feel that advance in the working place ✔

(Any 4 + correct description) (8)

- Good work will pay off in the long run/ worker feel that advance in the working place ✔

4.6 Marketing channels

(Each channel can ONLY be used ONCE.) (6)

Informal marketing channels | Formal marketing channels |

|

|

4.7 Reasons to use two different venues to market farm products

- To increase sales volume by selling more produce / To have a bigger market share ✔

- Lower prices at one market can be softened by higher prices at the other market ✔

- If one market sales are lower the other market sales can be higher ✔

- Easier access to the product by consumers in different markets can result in higher sales ✔

- Socio - economic environment can differ, leading to different prices ✔

- Income/profit can be manipulated by manipulating amount sent to each market ✔ (Any 4) (4)

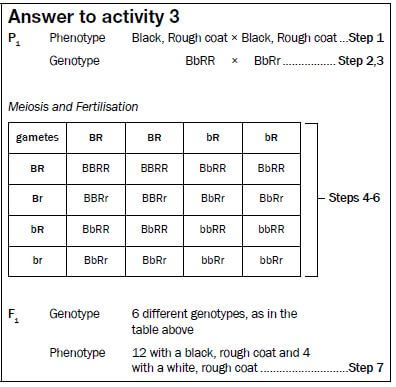

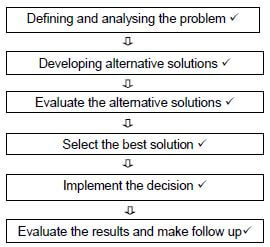

4.8 A flow chart indicating SIX chronological steps of decision making.

Rubric

- Each one at correct place/order ✔

- One mark for the correct version of a flow chart ✔

- For one is out of order, penalise and continue to mark the rest (7)

4.9 Types of Agritourism

- Product routes ✔

- Game farm / farming trips / game farm visits / game watching ✔

- Farm stays ✔

- Eco tourism ✔

- Adventurous activities ✔

- Educational activities ✔

- Leisure activities ✔

- Farm activities ✔ (Any 3) (3) [50]

TOTAL SECTION B: 150

GRAND TOTAL: 200

ACCOUNTING GRADE 12 MEMORANDUM - AMENDED SCE PAST PAPERS AND MEMOS MAY/JUNE 2018

ACCOUNTING

GRADE 12

SCE PAST PAPERS AND MEMOS

JUNE 2018

MARKING PRINCIPLES:

- Unless otherwise stated in the marking guideline, penalties for foreign items are applied only if the candidate is not losing marks elsewhere in the question for that item (no penalty for misplaced item). No double penalty applied.

- Penalties for placement or poor presentation (e.g. details) are applied only if the candidate is earning marks on the figures for that item.

- Full marks for correct answer. If answer incorrect, mark the workings provided.

- If a pre-adjustment figure is shown as a final figure, allocate the part-mark for the working for that figure (not the method mark for the answer). Note: if figures are stipulated in memo for components of workings, these do not carry the method mark for final answer as well.

- Unless otherwise indicated, the positive or negative effect of any figure must be considered to award the mark. If no + or - sign or bracket is provided, assume that the figure is positive.

- Where indicated, part-marks may be awarded to differentiate between differing qualities of answers from candidates.

- This memorandum is not for public distribution, as certain items might imply incorrect treatment. The adjustments made are due to nuances in certain questions.

- Where penalties are applied, the marks for that section of the question cannot be a final negative.

- Operation means 'check operation'. 'One part correct' means operation and one part correct. Note: check operation must be +, -, x, ÷, or per memo.

- 'One part correct' means ‘operation and one part correct’. Where method marks are awarded for one part correct, the marker must inspect the reasonableness of the answer and at least one part must be correct before awarding the mark. If a figure has earned a method-mark, this will be regarded as ‘one part correct’.

- In calculations, do not award marks for workings if numerator and denominator are swapped - this also applies to ratios.

- In awarding method marks, ensure that candidates do not get full marks for any item that is incorrect at least in part. Indicate with a x

- Be aware of candidates who provide valid alternatives beyond the marking guideline.

- Codes: f = foreign item; p = placement/presentation.

MEMORANDUM

QUESTION 1

1.1.1

| CASH RECEIPTS JOURNAL |

CRJ 1 850 CPJ 3 700 | CASH PAYMENTS JOURNAL |

| R510 607 ✔✔ | R488 260 ✔✔ | |

| 4 800 ✔ | 25 000 ✔✔ | |

| 6 250 ✔ | 1 425 one mark + 575 one mark 2000 ✔✔ | |

| 145 ✔ | 230 ✔ | |

| 1850 ✔ | ||

| 3600 ✔✔ | ||

| 521 802 | 520 940 |

Foreign entries -1 (max -1) e.g. 6 950; 12 675; 18 450; 30 975 (from previous recon) And/or other foreign entries incorrectly duplicated in journals and/or reconciliation (mark scored elsewhere)

1.1.2 Calculate the Bank Account balance in the Ledger of Hartfield Suppliers on 30 April 2018.

R30 975 | Signs may be omitted (or brackets may be used), but operation must be appropriate on the answer |

+ 521 802 | ✔see 1.1.1 CRJ total; net effect can be shown |

− 520 940 | ✔ see 1.1.1 CPJ total; net effect can be shown |

31 837 | ✔operation, correct transfers; both CRJ must be +ve and CPJ must be -ve; must include balance b/f (could be more or less than 30 975) |

Accept alternative arrangements for calculations such as ledger account / equation form

1.1.3 Bank Reconciliation Statement on 30 April 2018

| -1 max for presentation of details if marks earned on figures | One column method. Mark signs consistently | Debit | Credit |

| Balance per Bank Statement | 41 537 Cannot be R18 450 | Operation, balancing figure | 41 537 Cannot be R18 450 |

| Credit outstanding deposit | 10 000 | 10 000 | |

| Debit outstanding cheques / items | |||

| No. 613 | (13 400) | 13 400 | |

| No. 652 | (5 650) | 5 650 | |

| EFT - Small | (2 500) | 2 500 | |

| Credit amount wrongly debited | 1 850 | 1 850 | |

| Balance per Bank Account | 31 837 | See 1.1.2 | |

| Balance per Bank Account | See 1.1.2 31 837 | 53 387 | 53 387 |

*Foreign entries -1 (max -1) e.g. 6 950; 12 675; 18 450; 30 975 (from previous recon)

*And/or other foreign entries incorrectly duplicated in journals and/or reconciliation (mark scored elsewhere)

*TWO column method: Assume debit followed by credit column. Mark negative amounts wrong.

1.2 The internal auditor is concerned about the management of cash.

1.2.1 Explain TWO different problems to justify her concern. Quote figures.

Any TWO valid responses: Problem ✔Theft ✔Rolling Figure or date ✔✔

Do not accept incorrect recording of a cheque; alternative terms may be used

Problems: Inspect if two aspects are included in one explanation

- Theft/Fraud/Internal control measures are lacking (R25 000 missing) Accept date in lieu of figures

- Rolling / late depositing of cash: R12 675 received on 10 March and deposited only on 28 April 2018 OR R10 000 was received on 20 April 2018 and is still outstanding

1.2.2 Give advice (TWO points) on how such problems can be avoided in future.

Any two valid responses: ✔✔

- Create a policy for regular, daily depositing

- Request notification from bank for all transactions (sms)

- Division of duties / one person serves as a check on another

- Check promptly to bank statements

- Use a security company to collect cash

- Ask debtors to pay by EFT Accept use EFT

- Background checks / police clearance on staff

1.3Explain TWO benefits of using the electronic funds transfer (EFT) system rather than cheques for direct payments to suppliers.

Any TWO valid responses ✔✔ ✔✔ Part-marks for unclear/incomplete explanations

- Cheaper than cheque payments or debit orders (only data costs)

- No holding period as for cheques before money is available

- Less fraud and theft than with cheques / eliminate risks with lost / stolen / forged / dishonoured cheques / greater security Accept security

- Payees are happy because funds can be transferred more quickly at any time of the day or night (not restricted by banking hours)

- Simplifies bookkeeping and efficiency / saves time / transactions quicker / proof of payment immediate

- Save on bank charges 4

TOTAL MARKS |

35 |

QUESTION 2

2.1 Accept abbreviations

2.1.1 Selling and distribution cost✔

2.1.2 Direct labour cost ✔

2.1.3 Direct/raw materials cost ✔

2.1.4 Administration cost ✔

2.2 TIGHT-FIT MANUFACTURERS

2.2.1

| Calculate: Value of the closing stock of raw materials | |

| Workings | Answer |

2 607 000 ✔ x 3 900 ✔ | 429 000 ✔ |

| Calculate: Value of direct/raw materials issued for production | |

| Workings | Answer |

2 607 000 ✔ - 429 000 ✔ see above | 2 178 000 ✔ Operation, one part correct |

| Calculate: Correct factory overhead costs | |

| Workings | Answer |

| 69 600 one mark - 13 050 two marks 746 670 + 56 550 ✔✔ + 59 280 ✔✔ e.g. 746 670 + 56 550 - 59 280 would be three marks plus the method mark on answer 746 670 - 56 550 - 59 280 would be 0 marks and no method mark on answer | 862 500 ✔ Operation, one part correct |

2.2.2 Production Cost Statement for the year ended 31 March 2018.

Incorrect placement of DMC and FOHC: do not award ticks for details; -1 presentation if WIPS details not given;

Will also lose method marks on Prime cost subtotal; the figures will get method mark even if incorrectly placed

| ✔Direct materials cost see DMC in 2.2.1 | 2 178 000✔ |

| Direct labour cost | 3 522 000✔ |

| Prime cost Must be DMC + DLC | 5 700 000✔ |

| Factory overhead cost see FOHC in 2.2.1 | 862 500✔ |

| Total manufacturing costs Operation one part correct, DMC+DLC+FOHC regardless of placement | 6 562 500✔ |

| Work-in-process at beginning of year | 147 500 |

| *Cost of production of FG: 231 + x = 6518 + 118 or 231 - 118 - 6518 = -x or -118 - 6518 + 231 as long as answer is positive | 6 710 000✔ |

| Work-in-process at end of year Balancing figure; do not accept 231 000 or 118 000 must be subtotal above - COPOFG | (305 000)✔ |

| Cost of production of finished goods operation, one part correct *Could do T-a/c or solve for x (118 000 ✔+ 6 518 000 ✔ - 231 000✔) | 6 405 000✔ |

2.2.3 Give TWO reasons why the business should support local suppliers.

Reasons: Any TWO relevant reasons ✔✔

- No import charges will be paid

- Less transport costs

- Prices more stable / prices not influenced by fluctuations in exchange rates.

- Creates more employment opportunities to people from the country / enhances GDP of the country / helps small or new businesses / improves standard of living

- No delays in the case of emergency orders or returns / more convenient to transport goods

- Money stays in the country / improves exchange rate

- Less crime if employment increases

- Goodwill of the community (Ubuntu) 2

2.3 BREAK-TIME MANUFACTURERS

2.3.1

| Calculate the direct labour cost for the year ended 30 April 2018. | |

| Workings | Answer |

| 331 500 x R7,56 Two marks or nothing on final answer | R2 506 140 ✔✔ |

| Calculate the break-even point for the year ended 30 April 2018. | |

| Workings | Answer |

| R3 102 500 ✔ R28 ✔ - R19,50 ✔ 8,50 two marks | 365 000 units✔ Operation, one part correct Must not be R, c, % etc Units do not have to be stated |

2.3.2 Explain why the owner should be concerned about the break-even point. Quote figures.

Compare BEP with level of production ✔✔ Figures ✔

- The business produced and sold 331 500 units. This is below the break-even point of 365 000 units (33 500 units less) see 2.3.1

- The BEP has increased by 131 000 units (56%) while the number of units produced and sold increased by 37 500 units (13%).

2.3.3 Explain why the owner would NOT be satisfied with the direct labour cost per unit.

Quote figures.

Trend ✔ Figures ✔ Explanation ✔ Do not accept comment on total DLC

- Trend: The increase in the labour cost is R1,96 per unit (R5,60 to R7,56) / 35% increase / DLC per unit went up by 35% while units produced went by 13%

- Explanation: This exceeds the inflation rate / workers have been inefficient / production volume did not increase as much as the DLC per unit

Give ONE solution to this problem.

Any ONE relevant control measure ✔✔ Part marks for unclear / incomplete answer

- Set production targets of production (during normal hours) / time and motion studies.

- Better supervision to ensure workers are on duty during normal working hours/ Set limits on overtime hours and ensure foreman controls this.

- Reconsider conditions of service e.g. minimum normal hours, overtime rate.

- Have plans for disruption due to power cuts, strikes etc.

- Engage in skills training to improve efficiency of workers.

- Use machines more extensively

- Negotiate affordable / reasonable increases (in line with inflation) in salaries/ wages.

TOTAL MARKS |

45 |

QUESTION 3

3.1.1 Calculate the value of the closing stock of bicycles on 31 May 2018.

Workings | Answer | |||||||||||||

Tempo | 8 500 x 4✔ Must multiply by correct cost price | ✔34 000 | ||||||||||||

Cruze | 9 400 x 40✔ Must multiply by correct cost price | ✔ 376 000 | ||||||||||||

Ryder | 7 400 x 57✔✔ Must multiply by correct cost price | ✔ 421 800 | ||||||||||||

Operation, one part correct | ✔ 831 800 | |||||||||||||

OR: Op.Stock Purchases COS Tempo COS Cruze COS Ryder | ||||||||||||||

Calculate the cost of sales for the year ended 31 May 2018.

OR One mark One mark One mark One method mark | ||||||||||||||

| Calculate the gross profit for the year ended 31 May 2018. ✔ ✔see above ✔ operation, one part correct 5 185 420 - 3 354 200 = 1 831 220 OR (66 x 8 500 x 60%) + (220 x 9 400 x 60%) + (98 x 7 400 x 35%) two method marks and one accuracy mark 336 600 + 1 240 800 + 253 820 = 1 831 220 | ||||||||||||||

3.1.2

| Calculate the selling price of a Ryder bicycle. ✔ ✔ Operation, one part correct OR R7 400 x 135/100 = R9 990 OR R7 400 + R2 590 = R9 990 |

| Calculate the average number of Ryder bicycles sold per month. ✔ ✔ ✔ Operation, one part correct 98 ÷ 9 = 10,9 per month |

| Indicate how long it will take Fred to sell the closing stock of the Ryder bicycles. Show calculations. For three marks: 57 units ✔ see 3.1.1 ÷ 10,9 per month ✔ = 5,2 months ✔ OR 57 units X 9 = 5,2 months or approx. 157 days 98 units 1 OR 421 800 see 3.1.1 X 270 = 5,2 months or approx. 157 days 725 200 1 For two marks: 421 800 X 365 = 212,3 days 725 200 1 OR 57 units X 12 = 7 months 98 units 1 |

Give ONE possible reason for the slow sales of Ryder bicycles.

ONE valid reason: ✔✔ Part-marks for unclear / incomplete answer

- The customers do not like the new Ryder model /

- High returns indicate the quality is not good

- This is a new model / Customers not familiar with this model / poor marketing strategy.

Give advice (ONE point) to Fred in this regard.

ONE valid point of advice ✔✔ Part-marks for unclear / incomplete answer

- Look for another model to replace the Ryder model

- Discontinue selling this model as mark-up % is low

- Advertise/promote the positive characteristics of the new model.

3.2.1 Explain why it was NOT a good idea to change to a cheaper supplier of T-shirts. State TWO points.

Any two valid points Explanations ✔ ✔ Figures ✔✔

Possible answers:

- The returns by customers are up from 0 to 40 (do not accept poor quality only)

- Although more units were sold the total gross profit decreased from R43 200 to R29 000 or by R14 200 (32,9%)

- Maintaining the profit mark-up at 50% on cost resulted in a lower selling price (R45 cheaper) made customers doubt the quality.

3.2.2 Celia decided to change the supplier in 2018 and to change the mark-up %. How has this decision affected the business? State TWO points.

Any two valid points Explanations ✔✔ Figures ✔✔

Possible answers:

- Total units sold decreased from 165 to 150 / by 15 units / by 9%

- No returns (zero) in 2018 / returns by customers went down from 5 to 0

- The gross profit increased from R61 600 to R97 500 /by R35 900 / 58,3%)

3.2.3 Make TWO separate suggestions to Celia to improve the profit on pants in 2019.

Any two valid points Explanations ✔✔ Figures ✔✔

Possible answers:

- Advertise more to increase the sales as it went down from 325 to 280

- Increase the selling price (increase mark-up) to be > 910 and < 990

- Find a cheaper supplier as cost price went up from R620 to R650

TOTAL MARKS |

40 |

QUESTION 4

4.1

4.1.1 True ✔

4.1.2 False ✔

4.1.3 True ✔ Accept abbreviations for T or F

4.1.4 False ✔

4.1.5 False ✔

4.2 MODISE LTD

4.2.1RETAINED INCOME Ignore foreign items; presentation -1 max

| Balance at beginning of year | R567 000 |

| Funds used for shares repurchased (250 000 x R0,25) | ✔✔(62 500)* Ignore brackets |

| Net profit after tax (3 400 000 ✔ - 918 000 ✔✔) or 3 400 000 x 73% Operation, one part correct | ✔2 482 000 |

| Ordinary share dividends Operation, one part correct | ✔(2 400 000)* Ignore brackets |

| Interim | ✔672 000 |

| Final (4 800 000 ✔ x 36/100 ✔) or 36 cents or 0,36 (4 550 000 + 250 000) Operation, one part correct | ✔1 728 000 |

| Balance at end of year Operation, one part correct * figures must be subtracted | ✔✔586 500 |

4.2.2 MODISE LTD

BALANCE SHEET ON 28 FEBRUARY 2018

| ASSETS | ||

| Non-current assets Operation, TA - CA | ✔13 386 500 | |

| Fixed assets Operation, balancing figure | ✔12 666 500 | |

| *✔Fixed deposit / Investments / Financial assets (48 000✔ x 12/10✔ x 100/8✔) Operation, one part correct Be aware of alternative methods of calculation | ✔720 000 | (7) |

| Current assets No part marks (2 600 000 x 1,5) | ✔3 900 000 | |

| Inventories (1 015 000 ✔ + 25 000 ✔) | ✔1 040 000 | |

| *✔Trade and other receivables Operation, one part correct (554 000✔ - 33 240✔✔ +19 240✔) | ✔540 000 | |

| *✔ Cash and cash equivalents Operation, balancing figure | ✔2 320 000 | |

| TOTAL ASSETS See total for E + L | ✔17 286 500 | (14) |

| EQUITY AND LIABILITIES | ||

Ordinary shareholders’ equity Operation, one part correct (i.e. RI figure from note): OSC + RI | ✔14 236 500 | |

| Ordinary share capital | ✔13 650 000 | |

| *✔ Retained income See 4.2.1; could be -ve; | ✔586 500 | (3) |

| Non-current liabilities | ✔450 000 | |

| *✔ Loan from director (630 000✔ - 180 000 ✔✔) or 12/42 15 000 x 12 Operation, one part correct | ✔450 000 | (5) |

| Current liabilities | ✔2 600 000 | |

| Trade and other payables operation, balancing figure | #✔ 674 000 | |

| Shareholders for dividends See 4.2.1 | ✔1 728 000 | |

| See 4.2.1 or 3 400 000 x 27% SARS: Income tax (918 000- 900 000 ) one part correct | ✔18 000 | |

| * Loan (current portion) see above | ✔180 000 | |

| TOTAL EQUITY AND LIABILITIES Operation, See OSHE + NCL + CL | ✔17 286 500 | (9) |

Ignore foreign items

*Do not award ticks for details if item incorrectly placed

If incorrect placement, mark workings; -1 in each case

Accept negative amounts for balancing figures based on candidates’ workings

# If evidence of current portion of loan included is in T&OP, award 2 method marks

4.2.3 The directors want to give R500 000 to a local school.

Give TWO reasons why companies take such decisions.

Any TWO valid reasons ✔✔ ✔✔ Part-marks for unclear / incomplete answers

- This forms part of their corporate social investment (CSI) / responsibility (CSR) in accordance with the King Code

- Leads to goodwill from the community (support/positive image/good publicity)

- Creates a safer environment for the school / Contributes to better facilities for learners

- Tax deductible 4

4.3 AUDIT REPORT

4.3.1 Briefly explain the role of an independent auditor.

ONE valid explanation: ✔✔ Part-marks for unclear / incomplete answer

- The independent auditor expresses an opinion on the fair presentation of the financial statements

- Protects the interests of the shareholders/public.

Expected responses for max of 1 mark:

- Checks the books/Internal control/Detects fraud

4.3.2 Did Denga Limited receive a qualified/unqualified/disclaimer of opinion audit report?

Qualified report ✔ May be underlined in answer book

Briefly explain your choice. Mark independent of the decision above

Explanation ✔✔Part-marks for unclear / incomplete answer

Valid responses for two marks:

- The audit opinion expressed an exception whereby it qualified the report regarding the shortcoming/exception in the case of advertising

- Advertising expenses of R500 000 could not be verified.

4.3.3 State THREE possible consequences for the independent auditor if he had NOT mentioned the advertising expense in his report.

Part-marks for unclear answers; but one-word answers acceptable because of ‘State’

Three different consequences ✔✔ ✔✔ ✔✔ DO NOT ACCEPT ‘FIRED’

- Disciplinary hearing (IRBA)

- Arrested (if fraud)

- Deregistered / struck off the roll

- Suspended (during investigation)

- Fined

- Sued by shareholders (held liable) (if they are found to be negligent)

- Lose clients / fired by clients / won’t be hired

- Not trusted / integrity or character would be questioned

TOTAL MARKS |

70 |

QUESTION 5

5.1

5.1.1 C ✔

5.1.2 D ✔

5.1.3 A ✔

5.1.4 B✔

5.2 MALOTRA LTD

5.2.1 Ignore brackets in final answer

| Workings | Answer | |

| (a) | 6 192 350 ✔ - 4 256 350 ✔ | R 1 936 000✔ |

| (b) | 535 250 ✔ + 419 750 ✔ | R 955 000 ✔ |

| (c) | 1 415 000 ✔ - 955 000 ✔ refer (b) OR one mark one mark 800 250 - 340 250 one mark one mark (1 415 000 - 614 750) - (535 250 - 195 000) one mark one mark (1 415 000 - 614 750) + 195 000 - 535 250 | R 460 000 ✔ Operation, one part correct |

| (d) | 905 000 ✔ ✔ (1 500 000 - 595 000) x 20% | R 181 000 ✔ Operation, must be multiplied by 20% |

| (e) | 1 500 000 - 595 000 one mark for both 905 000 ✔ - 181 000 ✔ - 626 000 ✔ refer (d) | R 98 000 ✔ Operation, one part correct |

5.2.2 Calculate the net profit after income tax on 28 February 2018.

| Workings | Answer |

| 286 200 ✔ x 70/30 ✔ or 954 000 one mark - 286 200 one mark | R667 800 ✔ |

5.2.3

| Calculate the dividends paid. | |

| Workings | Answer |

| 176 000 ✔ + 332 000 ✔ - 132 000 ✔ Kan T-rek doen 200 000 two marks OR: -176 000 - 332 000 + 132 000 | R376 000 ✔* Operation, one part correct |

| Calculate the funds used to repurchase shares. | |

| Workings | Answer |

| 6 512 000 ÷ 880 000 120 000 ✔ x (7,40 ✔✔ + 0,60 ✔) Could do T-a/c R8,00 three marks OR: One mark One mark One mark One mark (120 000 x 7,40) + (120 000 x 0,60) 888 000 72 000 | R960 000 ✔* Operation, one part correct 888 000 or 72 000 as final answer = only two marks |

| Calculate the proceeds from shares issued. | |

| Workings | Answer |

| 120 000 x 7,40 (ASP above) 6 512 000 ✔ + 888 000 ✔✔ - 5 760 000 ✔ Could do T-a/c OR: 5 760 000 - 6 512 000 - 888 000 | R1 640 000✔ Operation, one part correct |

*Brackets not needed as it is a calculation, not a CFS

5.2.4

| Net change in cash and cash equivalents | 146 000 ✔ Operation, from bottom up |

| Cash and cash equivalents (opening balance) | (109 600) ✔✔ Must be in brackets |

| Cash and cash equivalents (closing balance) | 36 400 |

5.2.5

| Calculate the acid-test ratio. | |

| Workings | Answer |

| 665 600 two marks 1 136 700 ✔ - 471 100✔ : 512 000 ✔ | 1,3 : 1 ✔ Operation, one part correct (x :1) |

| Calculate the debt-equity ratio. | |

| Workings | Answer |

| 1 500 000 ✔ : 6 843 300 ✔ Accept 0,22 : 1 | 0,2 : 1 ✔ Operation, one part correct (x :1) |

| Calculate the return on shareholders' equity. | |

| Workings | Answer |

| See 5.2.2 667 800 ✔ x 100 ½ ✔ (6 843 300 ✔ + 5 826 500 ✔) 6 334 900 three marks 12 669 800 two marks | 10,5%✔ Operation, one part correct; must be shown as % |

5.2.6 The directors decided to increase the loan during the current financial year. Explain whether this was a good decision or not. Quote TWO financial indicators (with figures).

✔ Debt/equity ratio is 0,2:1 ✔ (see 5.2.5) / 0,1:1 / from 0,1:1 to 0,2:1

✔ Return of capital employed is 14,6% / 16,4% ✔

Do not accept any other financial indicators

Explanation must contain reasons Part-marks for unclear /incomplete explanation

Response for two marks:

There is positive gearing (ROTCE exceeds interest rate on loans) and it is low risk (not making extensive use of borrowed capital). ✔✔

Response for one mark:

- This is a good decision because of positive gearing

- This is a good decision because it is still low risk

5.2.7 Comment on the price paid for the shares repurchased on 1 January 2018.

Quote TWO financial indicators (with figures).

Must compare NAV and market price to repurchase price (not average share price price)

The company paid a *higher price for the share R8,00✔ than the ✔ NAV of ✔ 778 cents and the ✔market price of ✔ 780 cents. see 5.2.3

*This might be higher/lower/equal if error is made in calculation in 5.2.3.

5.2.8 Thandi Nene owns 416 000 shares in the company. When the directors decided to issue a further 200 000 shares during October 2017, she decided not to buy more shares and rather spend her funds on an overseas holiday.

Explain why you feel Thandi has made the wrong decision. Quote relevant figures or calculations to support your opinion.

Calculations: If workings correct, but answer not a %, award marks but -1 in each case for no %

- % shareholding before the share issue 416 000 / 800 000 = 52% ✔✔

- % shareholding after the share issue 416 000 / 1 000 000 = 41,6%✔✔

- % shareholding after repurchase 416 000 / 880 000 = 47,3%

Explanation:

Explanation (must mention or imply majority shareholding i.e. 50% + 1 share) ✔✔

Thandi was the majority shareholder before the issue of the additional shares. As she did not increase her number of shares, she is no longer the majority shareholder. (Even after the repurchase of 120 000 shares she remains with less than 50% of the shares).

Response for two marks:

She has lost out on earning a maximum of R80 000 of dividends on the extra shares she could have bought / she has lost out on extra capital growth or extra returns of the shares.

Note: 200 000 x 40 cents = R80 000 dividends extra could have been earned

(She would have had to pay 200 000 x R8,20 = R1,64m)

TOTAL MARKS |

70 |

QUESTION 6

6.1.1 The main purpose of a Cash Budget is to … ✔✔

Part-marks for incomplete / unclear response

- Project / estimate the expected bank balance at end of budget period.

- Project / estimate / monitor / control expected cash received and paid over budget period.

6.1.2 The main purpose of a Projected Income Statement is … ✔✔

Part-marks for incomplete / unclear response

- Project / estimate the expected net profit for the budgeted period.

- Project / estimate / monitor / control expected income and expenses for budget period.

6.2.1 Debtors' Collection Schedule:

| CREDIT SALES | MAY 2018 | JUNE 2018 | |

| March 2018 | 252 000 | 22 680 | |

| April 2018 | 288 000 | 172 800 | 25 920 ✔ |

| May 2018 | 180 000 ✔✔ | 51 300 | 108 000 ✔✔ 60% of credit sales |

| June 2018 | 216 000 | 61 560 | |

| Cash from debtors | 246 780 | 195 480 ✔✔ Operation, one part correct | |

6.2.2

Determine the discount allowed for May 2018.

|

| Determine the bad debts written off in June 2018. ✔ ✔ ✔ Operation one part correct 1% x 252 000 = 2 520 |

6.3

| Calculate the cash sales for May 2018. | |

| Workings | Answer |

| 300 000 x 40% OR 300 000 - 180 000 | No part marks 120 000 ✔✔ |

| Calculate the payment to creditors in June 2018. | |

| Workings | Answer |

| 300 000 ✔ x 100/150 ✔ x 80/100 ✔ 200 000 two marks | 160 000✔ Operation, one part correct |

| Calculate the salaries for May 2018. | |

| Workings | Answer |

| ✔ ✔ ✔ ✔ 14 500 + 11 600 (2 x 14 500) + (4 x 26 100) 29 000 104 400 OR (6 x 14 500) + (4 x 11 600) 87 000 two marks 46 400 two marks | 133 400 ✔ Operation, one part correct |

6.4.1 Tony is not concerned about the overspending in advertising. Explain why this is so.

Quote figures to support your answer.

Candidates must indicate the positive effect of advertising on sales ✔✔

Provide appropriate figures ✔ ✔ one mark each

Expected response for 4 marks:

- Advertising increased by R3 000 but Sales increased by R96 000.

OR - Advertising increased by 37,5% while Sales increased by 20% on bigger base.

6.4.2 State ONE consequence of not paying the amount due to creditors in April 2018.

Any ONE valid consequence ✔✔ Part-marks for incomplete / unclear response

- Credit to the business will be stopped by the creditors.

- The credit ratings of business will decrease / could be blacklisted / report to credit bureau

- Business will be charged interest for slow payment.

- Legal action can be taken by the creditors

6.4.3 State TWO points in favour of appointing Gentex Cleaning Services.

Any two valid responses ✔✔ ✔✔ Figures not required but may be provided as part of an explanation

Part-marks for incomplete / unclear response

- Outsourced cleaning could cost less than budgeted/actual for wages and cleaning materials

- Easier to budget (fixed contract amount)

- Expertise / professionalism / specialisation of the cleaning company

- No interruption or extra costs due to workers on sick leave etc.

- No storage space needed for cleaning materials

- Leads to reduction in administration costs

- VAT input can be claimed from SARS

- The cleaners can be rotated between different clients if necessary

Explain ONE point that Tony should consider before making this decision.

Any valid response ✔✔ Part-marks for incomplete / unclear response

- Whether it will make the current employees redundant / retrench or reassign the existing cleaners (consider the ethics of this)

- Reliability of the new cleaning company

- Honesty of the workers of the outsourced business

- Negative image of outsourcing to the company

- Whether outsourcing conflicts with their social responsibility programmes

- Instructions to cleaners have to be given through the cleaning firm’s managers

- Terms of the contract regarding fee increases

Response for one mark:

- VAT charged on outsourced cleaning services 6

TOTAL MARKS |

40 |

ACCOUNTING GRADE 12 QUESTIONS - AMENDED SCE PAST PAPERS AND MEMOS MAY/JUNE 20182018

ACCOUNTING

GRADE 12

SCE PAST PAPERS AND MEMOS

JUNE 2018

INSTRUCTIONS AND INFORMATION

Read the following instructions carefully and follow them precisely.

- Answer ALL the questions.

- A special ANSWER BOOK is provided in which to answer ALL the questions.

- Show ALL workings to achieve part-marks.

- You may use a non-programmable calculator.

- You may use a dark pencil or blue/black ink to answer the questions.

- Where applicable, show ALL calculations to ONE decimal point.

- Write neatly and legibly.

- Use the information in the table below as a guide when answering the question paper. Try NOT to deviate from it.

QUESTION 1: 35 marks; 20 minutes | |

Topic: | This question integrates: |

Bank Reconciliation and Control | Financial accounting

Managing resources

|

QUESTION 2: 45 marks; 30 minutes | |

Topic: | This question integrates: |

Manufacturing | Managerial accounting

Managing resources

|

QUESTION 3: 40 marks; 25 minutes | |

Topic: | This question integrates: |

Inventory Valuation | Managing resources

|

QUESTION 4: 70 marks; 40 minutes | |

Topic: | This question integrates: |

Balance Sheet and Audit Report | Financial accounting

Managing resources

|

QUESTION 5: 70 marks; 40 minutes | |

Topic: | This question integrates: |

Fixed Assets, Cash Flow and Interpretation | Financial accounting

Interpretation of financial information

|

QUESTION 6: 40 marks; 25 minutes | |

Topic: | This question integrates: |

Budgeting | Managerial accounting

Managing resources

|

QUESTIONS

QUESTION 1: BANK RECONCILIATION AND CONTROL (35 marks; 20 minutes)

The following information relates to Hartfield Suppliers for April 2018.

REQUIRED:

1.1 Bank reconciliation:

1.1.1 Show the entries that must be recorded in the Cash Journals by completing the table in the ANSWER BOOK. (14)

1.1.2 Calculate the Bank Account balance in the Ledger of Hartfield Suppliers on 30 April 2018. (3)

1.1.3 Prepare the Bank Reconciliation Statement on 30 April 2018. (8)

1.2 The internal auditor is concerned about the management of cash.

1.2.1 Explain TWO different problems to justify her concern. Quote figures. (4)

1.2.2 Give advice (TWO points) on how such problems can be avoided in future. (2)

1.3 Explain TWO benefits of using the electronic funds transfer (EFT) system rather than cheques for direct payments to suppliers.(4)

INFORMATION:

A. Extract from the Bank Reconciliation Statement on 31 March 2018:

Favourable balance as per Bank Statement | R18 450 | |

Outstanding deposits: | Dated 10 March 2018 | 12 675 |

Dated 25 March 2018 | 25 000 | |

Outstanding cheques: | 502 (dated 19 October 2017) | 4 800 |

613 (dated 24 April 2018) | 13 400 | |

614 (dated 26 April 2018) | 6 950 | |

Favourable balance as per Ledger Account | 30 975 | |

NOTE:

- The outstanding deposit of R12 675 appeared on the Bank Statement on 28 April 2018.

- The outstanding deposit of R25 000 did not appear on the Bank Statement for April 2018. An investigation revealed that this money was never been deposited. The cashier employed in March has left the country and cannot be traced.

- Cheque 614, R6 950, was presented for payment.

B. Provisional totals in the Cash Journals on 30 April 2018 before receiving the Bank Statement:

- Cash Receipts Journal, R510 607

- Cash Payments Journal, R488 260

C. Entry in the April 2018 Cash Receipts Journal, not in the April 2018 Bank Statement:

DOCUMENTS | DATE | DETAILS | BANK |

Deposit slip 998 | 20 | Sales | R10 000 |

D. Entries in the April 2018 Cash Payment Journal, not in the April 2018 Bank Statement:

DOCUMENTS | DATE | DETAILS | BANK |

Cheque 652 (dated 24 June 2018) | 25 | MM Suppliers | R5 650 |

S Small (*EFT) | 30 | Drawings | R2 500 |

*EFT: electronic funds transfer/direct payment

E. Information on the April 2018 Bank Statement, which did not appear in the April 2018 Cash Journals:

DATE | DETAILS | DEBIT | CREDIT |

10 | M Mamba (*EFT by tenant) | 6 250 | |

17 | Cash deposit fees | 575 | |

18 | Interest | 145 | |

21 | Unpaid cheque: Apple | 230 | |

24 | Service fees | 1 425 | |

28 | Debit order (Kruger Insurers) | 1 850 | |

28 | Debit order (Kruger Insurers) | 1 850 |

NOTE:

- The unpaid cheque was received from debtor A Apple to settle his account of R250.

- The debit order for the monthly insurance appeared on the Bank Statement twice. The bank will rectify this on the Bank Statement for next month.

F. Information in the April 2018 Bank Statement that does not agree with the Cash Payments Journal for April 2018:

| Cheque 633, recorded as R2 630 in the Cash Payment Journal, appears correctly on the Bank Statement as follows: | R6 230 |

G. The Bank Statement on 30 April 2018 reflected a balance of R?.

QUESTION 2: MANUFACTURING (45 marks; 30 minutes)

2.1 Choose ONE cost account for each of the following descriptions. Write only the cost accounts next to the question numbers (2.1.1 to 2.1.4) in the ANSWER BOOK.

| direct labour cost; direct/raw materials cost; factory overheads cost; administration cost; selling and distribution cost |

2.1.1 Bad debts written off during the financial year

2.1.2 Pension fund contributions paid on behalf of the workers in the production process

2.1.3 Transport costs paid for raw materials purchased

2.1.4 Depreciation on office equipment (4 x 1) (4)

2.2 TIGHT-FIT MANUFACTURERS

The information relates to Tight-Fit Manufacturers, a business that manufactures denim jeans, for the financial year ended 31 March 2018.

REQUIRED:

2.2.1 Calculate:

- The value of the closing stock of raw materials of fabric using the weighted-average method (4)

- The value of direct/raw materials issued for production (3)

- The correct factory overhead costs (6)

2.2.2 Complete the Production Cost Statement on 31 March 2018. (12)

2.2.3 The business purchases raw materials from an overseas supplier,although there are numerous local suppliers. Give TWO reasons why the business should support local suppliers. (2)

INFORMATION:

A.Stock balances on 31 March:

2018 | 2017 | |

Work-in-process | ? | R147 500 |

Finished goods | R118 000 | R231 000 |

B. Raw materials (fabric):

Raw materials, consisting of metres of fabric, are issued by the storeroom to the factory.

Storeroom stock records:

METRES | TOTAL AMOUNT R | |

Stock on 1 April 2017 | 5 000 | 535 000 |

Purchases: | 18 700 | 2 072 000 |

July 2017 | 6 200 | 620 000 |

October 2017 | 4 800 | 528 000 |

January 2018 | 7 700 | 924 000 |

Total available for production | 23 700 | 2 607 000 |

Stock on 31 March 2018 | 3 900 | ? |

C. Figures provided by the bookkeeper on 31 March 2018:

Wages of factory workers (direct labour) | R3 522 000 |

Factory overhead cost (see Information D below) | R746 670 |

Administration cost | R655 700 |

Selling and distribution cost | R413 900 |

D. Adjustments must be made to factory overhead cost in respect of the following:

- Insurance of factory plant and equipment paid was R69 600 and incorrectly debited to the Administration Cost Account. Included in this is a new annual premium of R17 400 paid on 1 January 2018.

- Rent is allocated according to the floor space. However, the bookkeeper correctly allocated only R14 820 to the administration section.

FACTORY | ADMINISTRATION OFFICE | TOTAL FLOOR AREA |

520 m2 | 130 m2 | 650 m2 |

E. Details from the Income Statement for the year ended 31 March 2018:

Sales | R9 747 000 |

Cost of sales | 6 518 000 |

Gross profit | 3 229 000 |

2.3 BREAK-TIME MANUFACTURERS

Break-Time Manufacturers is a manufacturing business that produces lunch boxes for school children.

REQUIRED:

2.3.1 Calculate the following for the year ended 30 April 2018:

- Direct labour cost (2)

- Break-even point (4)

2.3.2 Explain why the owner should be concerned about the break-even point. Quote figures. (3)

2.3.3 The owner is concerned about the direct labour cost.

- Explain why the owner would NOT be satisfied with the direct labour cost per unit. Quote figures. (3)

Give ONE solution to this problem. (2)

INFORMATION ON 30 APRIL:

2018 | 2017 | |||

TOTAL COST | PER UNIT | TOTAL COST | PER UNIT | |

Direct labour cost | ? | R7,56 | R1 646 400 | R5,60 |

Total fixed costs | R3 102 500 | R9,36 | R1 989 000 | R6,77 |

Total variable costs | R6 464 250 | R19,50 | R4 704 000 | R16,00 |

Selling price per unit | R28,00 | R24,50 | ||

Number of units produced and sold | 331 500 units | 294 000 units | ||

Break-even point | ? | 234 000 units | ||

QUESTION 3: INVENTORY VALUATION (40 marks; 25 minutes)

3.1SPEEDY CYCLES

You are provided with information for the year ended 31 May 2018. The owner is Fred Fakude. The business sells different models of bicycles. Fred uses the periodic inventory system and the specific identification method to value stock.

REQUIRED:

3.1.1 Calculate:

- Value of the closing stock of bicycles on 31 May 2018 (8)

- Cost of sales for the year ended 31 May 2018 (4)

- Gross profit for the year ended 31 May 2018 (3)

3.1.2 Fred is satisfied that he is selling approximately 18 Cruze bicycles per month. However, he is concerned that the new Ryder model, despite its lower selling price, is not selling as quickly as the Cruze model.

- Calculate the selling price of a Ryder bicycle. (3)

- Calculate the average number of Ryder bicycles sold per month. (3)

- Indicate how long it will take Fred to sell the closing stock of the Ryder bicycles. Show calculations. (3)

- Give ONE possible reason for the slow sales of Ryder bicycles, and give advice (ONE point) to Fred in this regard. (4)

INFORMATION:

A. Three different models of bicycles were sold during the 2018 financial year.

MODEL | MARK- UP | UNITS SOLD | SALES | OTHER INFORMATION |

Tempo | 60% | 66 | R897 600 | This model is no longer produced. |

Cruze | 60% | 220 | R3 308 800 | |

Ryder | 35% | 98 | R979 020 | This model was introduced on 1 Sep. 2017. |

TOTAL SALES | R5 185 420 | |||

B. Opening stock:

DATE | MODEL | UNITS | COST PRICE PER UNIT | TOTAL |

1 Jun. 2017 | Tempo | 70 | R8 500 | R595 000 |

Cruze | 0 |

C. Purchases and returns:

DATE | MODEL | UNITS | COST PRICE PER UNIT | TOTAL |

PURCHASES: | ||||

1 Jun. 2017 | Cruze | 260 | R9 400 | R2 444 000 |

1 Sep. 2017 | Ryder | 200 | R7 400 | R1 480 000 |

RETURNS: | ||||

Feb. 2018 | Ryder | 45 | R7 400 | (R333 000) |

Net purchases | R3 591 000 | |||

3.2 MANAGEMENT OF INVENTORIES: CELIA'S CLOTHING

Celia Mtolo owns a small clothing business. You are provided with information for the year ended 28 February 2018. The business sells T-shirts, jackets and pants.

Celia took certain decisions at the beginning of the 2018 financial year.

REQUIRED:

Quote relevant figures for ALL the questions below.

3.2.1 T-shirts:

Explain why it was NOT a good idea to change to a cheaper supplier of T-shirts. State TWO points. (4)

3.2.2 Jackets:

Celia decided to change the supplier in 2018 and to change the mark-up %. How has this decision affected the business? State TWO points. (4)

3.2.3 Pants:

Celia reduced the selling price of pants significantly in the 2018 financial year in response to a new competitor who sells similar pants at R990.

Based on the information below, make TWO separate suggestions to Celia to improve the profit on pants in 2019. (4)

INFORMATION:

T-SHIRTS | JACKETS | PANTS | ||||

2018 | 2017 | 2018 | 2017 | 2018 | 2017 | |

Gross units sold | 1 200 | 1 080 | 150 | 165 | 280 | 325 |

Returns by customers | 40 | 0 | 0 | 5 | 15 | 15 |

Selling price | R75 | R120 | R1 650 | R1 085 | R910 | R1 054 |

Cost price | R50 | R80 | R1 000 | R700 | R650 | R620 |

Mark-up % | 50% | 50% | 65% | 55% | 40% | 70% |

Gross profit | R29 000 | R43 200 | R97 500 | R61 600 | R68 900 | R134 540 |

QUESTION 4: BALANCE SHEET AND AUDIT REPORT (70 marks; 40 minutes)

4.1 CONCEPTS

Indicate whether the following statements are TRUE or FALSE. Write only 'true' or 'false' next to the question numbers (4.1.1 to 4.1.5) in the ANSWER BOOK

4.1.1 A fixed deposit maturing within the next 12 months will be shown as cash and cash equivalent in the Balance Sheet.

4.1.2 Earnings per share are calculated using the net profit before tax.

4.1.3 Net current assets are also referred to as net working capital.

4.1.4 Provision for bad debts is a liability.

4.1.5 Total capital employed consists only of ordinary shareholders' capital and retained income. (5 x 1) (5)

4.2 MODISE LTD

The information below relates to Modise Ltd. The financial year ended on 28 February 2018.

REQUIRED:

4.2.1 Prepare the Retained Income Note to the Balance Sheet on 28 February 2018. (12)

4.2.2 Complete the Balance Sheet on 28 February 2018. Show ALL workings. (38)

4.2.3 The directors want to give R500 000 to a local school. Give TWO reasons why companies take such decisions. (4)

INFORMATION:

A. Extract of balances on 28 February 2018:

R | |

Ordinary share capital | 13 650 000 |

Retained income (1 March 2017) | 567 000 |

Fixed assets at carrying value | ? |

Fixed deposit: Peoples Bank | ? |

Loan from director | 630 000 |

Debtors' control | 554 000 |

Provision for bad debts (1 March 2017) | 31 300 |

Bank (favourable) | ? |

Trading stock | 1 015 000 |

Consumable stores on hand | 25 000 |

Creditors' control | ? |

Expenses prepaid | 19 240 |

SARS: Income tax (provisional tax payments) | 900 000 |

B Share capital:

- The authorised share capital of Modise Ltd is 6 500 000 ordinary shares.

- On 20 February 2018, 250 000 shares were repurchased at 25 cents above the average share price. This has been recorded.

- On 28 February 2018, the ordinary share capital comprised 4 550 000 ordinary shares.

C. Dividends:

- Interim dividends of R672 000 were paid on 28 August 2017.

- A final dividend of 36 cents per share was declared on 28 February 2018. All shares (including the shares repurchased on 20 February 2018) qualify for final dividends.

D. Net profit before tax:

- After taking all relevant information into account, the net profit before tax was accurately calculated to be R3 400 000.

- Income tax at 27% of the net profit must be taken into account.

E. Fixed deposit:

- The interest on the fixed deposit was R48 000. The fixed deposit was invested on 1 May 2017 at 8% p.a.

F. Loan from director:

- The interest-free loan was received on 1 September 2015.

- This loan is to be repaid over six years in equal monthly instalments. The first repayment was made on 30 September 2015. All payments have been made to date.

G. Provision for bad debts:

- The provision for bad debts must be adjusted to 6% of the outstanding debtors.

H. The current ratio calculated after all adjustments was 1,5 : 1.

4.3 AUDIT REPORT

You are provided with an extract from the audit report of the independent auditors of Denga Limited.

REQUIRED:

4.3.1 Briefly explain the role of an independent auditor. (2)

4.3.2 Did Denga Limited receive a qualified/unqualified/disclaimer of opinion audit report? Briefly explain your choice. (3)

4.3.3 State THREE possible consequences for the independent auditor if he had NOT mentioned the advertising expense in his report. (6)

INFORMATION:

EXTRACT FROM THE REPORT OF THE INDEPENDENT AUDITORS Independent Auditors' Responsibility Basis for … Opinion … Audit Opinion Khan & Kruger |

QUESTION 5: FIXED ASSETS, CASH FLOW AND INTERPRETATION (70 marks; 40 minutes)

5.1 Choose a description in COLUMN B that matches the user of financial statements in COLUMN A. Write only the letters (A to D) next to the question numbers (5.1.1 to 5.1.4) in the ANSWER BOOK.

| COLUMN A | COLUMN B |

| 5.1.1 Trade unions 5.1.2 SARS 5.1.3 Shareholders 5.1.4 Directors | A want to be assured that their investment in the company is used wisely (4 x 1) (4) |

5.2 MALOTRA LTD

You are provided with information relating to Malotra Ltd for the financial year ended 28 February 2018. The company is registered with an authorised share capital of 1 200 000 ordinary shares.

REQUIRED:

5.2.1 Refer to Information A.

Calculate the missing amounts denoted by (a) to (d) on the Fixed Asset Note. (16)

5.2.2 Calculate the net profit after income tax on 28 February 2018. (3)

5.2.3 Calculate the following for the Cash Flow Statement:

- Dividends paid (4)

- Funds used to repurchase shares (5)

- Proceeds from shares issued (5)

5.2.4 Complete the section for Cash and Cash Equivalents in the Cash Flow Statement. (4)

5.2.5 Calculate the following financial indicators on 28 February 2018:

- Acid-test ratio (4)

- Debt-equity ratio (3)

- Return on average shareholders' equity (5)

5.2.6 The directors decided to increase the loan during the current financial year. Explain whether this was a good decision or not. Quote TWO financial indicators (with figures). (6)

5.2.7 Comment on the price paid for the shares repurchased on 1 January 2018. Quote TWO financial indicators (with figures). (5)

5.2.8 Thandi Nene owns 416 000 shares in the company. When the directors decided to issue a further 200 000 shares during October 2017, she decided not to buy more shares and rather spend her funds on an overseas holiday.

Explain why you feel Thandi has made the wrong decision. Quote relevant figures or calculations to support your opinion. (6)

INFORMATION:

A. Incomplete Fixed Asset Note:

LAND AND BUILDINGS | VEHICLES | EQUIPMENT | |

Carrying value (1 Mar. 2017) | 4 256 350 | 535 250 | |

Cost | (b) | 1 500 000 | |

Accumulated depreciation | (419 750) | (595 000) | |

Movements: | |||

Additions | (a) | (c) | 0 |

Disposals | 0 | (e) | |

Depreciation | (195 000) | (d) | |

Carrying value (28 Feb. 2018) | 6 192 350 | 626 000 | |

| Cost | 1 415 000 | ||

| Accumulated depreciation |

- An extension to the storeroom and improvements to the buildings were completed during the financial year.

- A new vehicle was purchased on 1 June 2017.

- Old equipment was scrapped at carrying value on 28 February 2018.

- Depreciation policy: Vehicles: 15% on cost

Equipment: 20% on carrying value

B. Income tax:

- Income tax at 30% of the net income amounts to R286 200.

C. Dividends:

- Interim dividends were paid on 31 August 2017.

- Final dividends were declared on 28 February 2018.

- Only shareholders in the share register qualified for dividends.

- Dividends paid and declared for the current financial year: R332 000

D. Ordinary Share Capital:

800 000 | Ordinary shares on 1 March 2017 | R5 760 000 |

200 000 | Shares issued on 1 October 2017 | ? |

(120 000) | Shares repurchased on 1 January 2018 | ? |

880 000 | Ordinary shares on 28 February 2018 | R6 512 000 |

NOTE: Shares were repurchased at 60 cents above the average share price.

E. Information extracted from the Financial Statements on 28 February:

2018 R | 2017 R | |

Fixed deposit: Sisi Bank | 100 000 | 240 000 |

Loan: Mihla Bank | 1 500 000 | 600 000 |

Current assets (including inventories) | 1 136 700 | 1 246 400 |

Inventories | 471 100 | 717 550 |

Current liabilities | 512 000 | 755 500 |

Cash and cash equivalents | 36 400 | 2 400 |

Bank overdraft | 0 | 112 000 |

Shareholders' equity | 6 843 300 | 5 826 500 |

Shareholders for dividends | 132 000 | 176 000 |

F. Financial indicators on 28 February:

2018 | 2017 | |

Current ratio | 2,2 : 1 | 1,6 : 1 |

Acid-test ratio | ? | 0,7 : 1 |

Debt-equity ratio | ? | 0,1 : 1 |

Earnings per share | 77 cents | 87 cents |

Dividends per share | 40 cents | 80 cents |

Return on average equity (ROSHE) | ? | 11,9% |

Return on capital employed (ROTCE) | 14,6% | 16,4% |

Net asset value | 778 cents | 728 cents |

Interest rate on loans | 12% | 11% |

Market value of shares on JSE | *780 cents | 725 cents |

*NOTE: This value was unchanged over the past three months.

QUESTION 6: BUDGETING (40 marks; 25 minutes)

You are provided with information relating to Magic Traders. The business is owned by Tony Salotte.

REQUIRED:

6.1 Complete the following statements:

6.1.1 The main purpose of a Cash Budget is to … (2)

6.1.2 The main purpose of a Projected Income Statement is to … (2)

6.2 Debtors' Collection Schedule and Projected Income Statement:

6.2.1 Complete the Debtors' Collection Schedule for June 2018. (7)

6.2.2 Determine the following amounts that will appear in the Projected Income Statement:

- Discount allowed for May 2018 (3)

- Bad debts written off in June 2018 (3)

6.3 Calculate the following:

- Cash sales for May 2018 (2)

- Payment to creditors in June 2018 (4)

- Salaries for May 2018 (5)

6.4 Tony compared the budgeted figures to the actual figures for April 2018.

BUDGETED | ACTUAL | |

Sales | R480 000 | R576 000 |

Advertising | R8 000 | R11 000 |

Wages of cleaners | R9 000 | R12 500 |

Cleaning materials | R1 200 | R2 700 |

Payment to creditors | R224 000 | R0 |

6.4.1 Tony is not concerned about the overspending in advertising. Explain why this is so. Quote figures to support your answer. (4)

6.4.2 State ONE consequence of not paying the amount due to creditors in April 2018. (2)

6.4.3 Refer to the figures above and to Information F. State TWO points in favour of appointing Gentex Cleaning Services. Also explain ONE point that Tony should consider before making this decision. (6)

INFORMATION:

A. Total sales:

ACTUAL | BUDGETED | |

March 2018 | R420 000 | |

April 2018 | R480 000 | |

May 2018 | R300 000 | |

June 2018 | R360 000 |

B. Cash sales amount to 40% of the total sales.

C. Debtors are expected to pay as follows:

- 30% in the month of sales. They receive a 5% settlement discount.

- 60% in the month following the sales month

- 9% in two months after the sales month

- 1% is written off as bad debts in the third month after sales

D.Purchases and payment to creditors:

- The business maintains a fixed-stock base level.

- Goods are sold at a mark-up of 50% on cost.

- 80% of all merchandise purchased is on credit.

- Creditors are paid in full in the month following the purchase month.

E. Salaries:

- Total salaries are R101 500 for April 2018.

- There are 7 employees who earn the same monthly salary.

- 1 employee will resign and leave on 30 April 2018.

- 4 employees will each receive a bonus of 80% of their salaries in May 2018.

F. The business pays wages to two cleaners, one of whom has been on sick leave in April and a substitute had to be employed. Tony is concerned that too much money is wasted on cleaning. He thinks that he should contract Gentex Cleaning Services to take over the cleaning process entirely. They will charge R8 000 per month.

TOTAL: 300

HUMAN IMPACT ON THE ENVIRONMENT- LIFE SCIENCES QUESTIONS AND ANSWERS

Activity 1

Questions

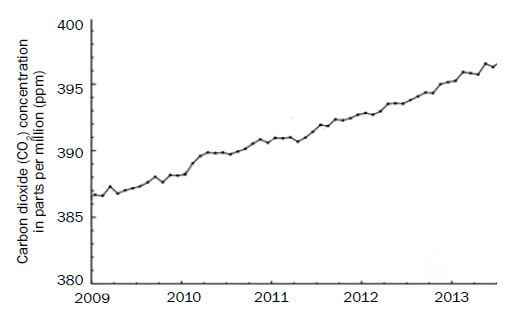

1. Figure 11.1 below shows the averages of carbon dioxide concentration in the atmosphere since January 2009, as measured at the Mauna Loa Observatory in Hawaii.

Figure 11.1: Average carbon dioxide concentration in the atmosphere since January 2009, at Mauna in Hawaii

1.1 Describe how deforestation could lead to an increase in the carbon dioxide concentration in the atmosphere. (2)

1.2 Mention ONE human activity that might have led to the increase in carbon dioxide concentration as seen in the graph. (1)

1.3 What was the carbon dioxide concentration in the atmosphere in July 2012? (2)

1.4 What is the dependent variable in this investigation? (1)

1.5 Explain how the excess carbon dioxide in the atmosphere could lead to climate change. (4)

1.6 Mention ONE way in which humans can reduce the amount of carbon dioxide released into the atmosphere. (1) [11]

Answers to activity 1

1.

1.1 Cutting down of trees decreases the amount of carbon dioxide✔ taken up by the plants during photosynthesis✔ (2)

1.2 Burning of fossil fuels✔ (1)

1.3 393,5✔ ppm✔ (2)

1.4 Carbon dioxide concentration in ppm✔ (1)

Answers to activity 1 (continued)

1.5

- Carbon dioxide is a greenhouse gas✔

- which absorbs long wave radiation emitted from the Earth✔

- and prevents it from escaping back into the atmosphere✔.

- An increase in the concentration of carbon dioxide leads to an increase in the greenhouse effect✔,

- which may result in global warming✔. (any 4)

1.6

- Drive less✔/use public transport, walking, bicycle more

- Reduce the need for heating by insulating walls✔

- Building energy efficient homes✔

- Use alternative energy sources✔ (solar and wind)

- Reforestation✔to act as carbon reservoir

- Reuse and recycle✔ (any 1) [11]

Activity 2

Questions

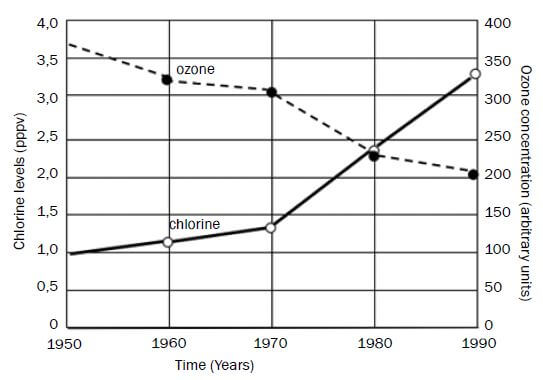

1. An investigation to measure the ozone concentration and the chlorine levels has been done in Antarctica since 1950 and the results are shown in the graph below:

1.1 Give a caption for the graph. (2)

1.2 What is the relationship between the levels of chlorine and the concentration of ozone? (2)

1.3 Name the dependent variable(s) in the investigation. (2)

1.4 In which 10-year period was the ozone depletion the greatest? (1)

1.5 In 1987 the Montreal Protocol was signed to lay down targets to reduce the use of CFCs by countries. Give TWO reasons why, despite a reduction in the use of CFCs, there was still a decline in the ozone layer. (2)

1.6 Name ONE item that humans were using which contained CFCs. (1)

1.7 Explain why the ozone layer is important for humans. (2) [12]

Answers to activity 2

1.

1.1 Changes in the levels of chlorine and ozone concentration✔ from 1950 to 1990✔ (2)

1.2 An increase in the level of chlorine ✔leads to a decrease in the ozone concentration✔ (2)

1.3

- Chlorine levels✔

- Ozone concentration✔ (2)

1.4 Between 1970 and 1980✔ (1)

1.5

- CFCs might persist for a long time in the atmosphere✔

- Other countries might have taken longer to implement the protocol✔

- Households were still using existing items with CFCs✔ (any)(2)

1.6

- Aerosols✔

- Refrigerators✔

- Food packaging✔ (any)(1)

1.7 The ozone layer provides protection against ultraviolet rays✔, thus reducing the chances of getting skin cancer✔ (2) [12]

Activity 3

Questions

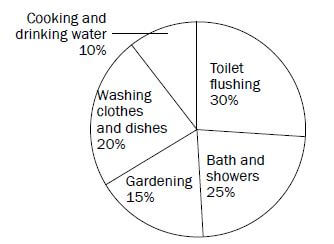

1. A group of learners conducted an investigation to determine the average amount of water used by a household for different purposes. They collected data on water-use from 5 families in their neighbourhood. The results are shown below.

Purpose for which water is used | Average amount of water used (%) |

Toilet flushing | 30 |

Baths and showers | 25 |

Gardening | 15 |

Washing clothes and dishes | 20 |

Cooking and drinking water | 10 |

1.1 Identify the:

a) Dependent variable (1)

b) Independent variable (1)

1.2 State TWO ways in which the reliability of the results can be improved. (2)

1.3 Draw a pie-chart to represent the data in the table. Show all calculations. (7)

1.4 Describe ONE advantage of making the results of the survey available to the various households that participated. (2) [13]

Answers to activity 3

1.1

a) Average amount of water used✔ (1)

b) Purpose for which water is used✔ (1)

1.2

- Repeat the investigation✔

- Select the households randomly✔

- Increase the number of households involved in the investigation✔ (any 2)

1.3 Calculations for proportions of slices in the pie-chart

Purpose for which water was used | Working | Proportion (degrees) |

Toilet flushing | 30 | 108 |

Baths and showers | 25 | 90 |

Gardening | 15 | 54 |

Washing clothes and dishes | 20 | 72 |

Cooking and drinking water | 10 | 36 |

Average amount of water used by a household for different purposes

(7)

1.4 Owners can identify the areas of greatest water use✔ to allow them to then develop strategies to reduce water use in that area✔ (2) [13]

Activity 4

Questions

1. Describe how alien plants may reduce both the availability and quality of water. (4)

2. Describe how poor farming practices may reduce both the availability and quality of water. (4) [8]

Answers to activity 4

-

- Alien invasive plants may use water excessively✔ and thus reduce the amount of water available for the natural vegetation✔ of an area (2)

- Alien invasive water plants block the waterways, reducing light to other aquatic plants✔. These plants eventually die and decompose✔. Bacteria that decompose these plants eventually deplete the oxygen supply in the water✔. (any) (2)

-

- Over-grazing leads to soil erosion✔. On land that is eroded, water runs off rapidly rather than soaking into the ground✔, and is thus wasted. (2)

- The use of fertilizers and pesticides may pollute nearby dams, ponds and rivers✔ thus reducing the quality of water available✔ (2) [8]

Activity 5

Questions

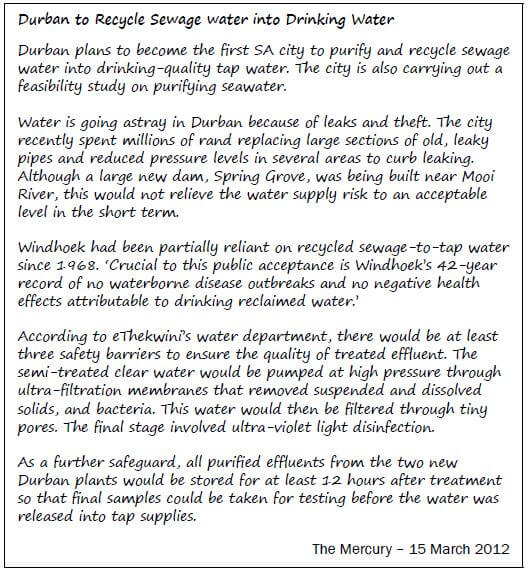

1. Read the article below entitled ‘Durban to Recycle Sewage water into Drinking Water’.

1.1 List FIVE different strategies referred to in the article intended to increase the availability of clean drinking water. (5)

1.2 Describe THREE arguments used in the article to convince the reader about the safety of recycled sewage water. (6)

1.3 List THREE processes that will be used to ensure that the recycled sewage water will be fit for human consumption. (3) [14]

Answers to activity 5

1.1

- Recycling sewage water✔

- Purifying sea water✔

- Replacing old, leaky pipes✔

- Reducing water pressure✔

- Building new dams✔ (5)

1.2

- No outbreak of water-borne diseases✔ in Windhoek for 42 years✔

- 3 safety barriers✔ to ensure the quality✔ of treated effluent

- Stored for at least 12 hours✔ allowing sufficient time for repeated testing✔ (6)

1.3

- Pumped at high pressure through ultra-filtration membranes✔ to remove suspended and dissolved solids and bacteria

- Filtration through tiny pores✔

- Ultra-violet disinfection✔ (3) [14]

Activity 6

Questions

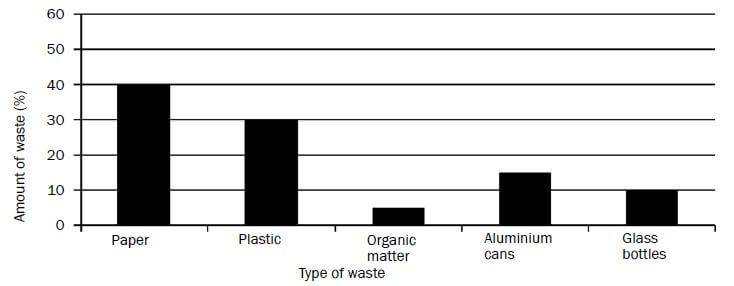

1. Study the table below and answer the questions that follow.

Country/Region | Total (kg) | Developed/ Developing Regions | Food loss and waste per person per year | |

At the production and retail stages (kg) | By consumers (kg) | |||

Europe | 280 | Developed | 190 | 90 |

North America and Oceania | 295 | Developed | 185 | 110 |

Industrialized Asia | 240 | Developed | 160 | 80 |

Sub-Saharan Africa | 160 | Developing | 155 | 5 |

North Africa, West and Central Asia | 215 | Developing | 180 | 35 |

South and Southeast Asia | 125 | Developing | 110 | 15 |

Latin America | 225 | Developing | 200 | 25 |

Adapted from CUP Biology: Jones and Jones, 2010

1.1 For Sub-Saharan Africa, calculate the food wastage by consumers as a percentage of the total food waste. (3)

1.2 Suggest a reason for this low percentage calculated in QUESTION 1.1 above. (2)

1.3 Explain the differences in the pattern of food wastage in developed and developing regions. (4)

1.4 State TWO possible ways of preventing the high levels of food waste that are found in the developed countries. (2) [11]

2. The following questions relate to the factors that threaten food security in a country.

2.1 Give ONE reason why there has been an increase in the demand for food over the years. (1)

2.2 State one way in which the use of each of the following helps to increase food productivity:

a) Pesticides (1)

b) Fertilizers (1)

2.3 Describe how the use of pesticides could destroy food chains. (2)

2.4 Explain why GMOs may be considered a threat to food security. (3) [8]

Answers to activity 6

1.

1.1 Food Wastage in Sub-Saharan Africa

5/160✔ × 100✔ = 3.1%✔ (3)

1.2 Access to food is scarce and the food that is available is either provided by international aid agencies or subsistence farming✔. Very little food is bought and even less is bought from supermarkets.✔ There is no food left over to waste.✔ (any 2)

1.3 In developed regions: buy food from markets, shops and supermarkets, often in excess of their requirements and will throw unused food away.✔ The markets, shops and

supermarkets will also throw away unsold food.✔

In developing regions: people will depend more on small, local sources of food,✔ have less food security and will not have food in excess of their needs.✔ (4)

1.4 Possible ways to reduce food waste include:

- Prevention - prevent consumers from throwing away food or stop them from producing/buying more food than they need✔

- Plan what you need before you shop and reduce impulse and spontaneous buying✔

- Understand how to store and preserve food✔

- Ensure that unused food is used in some way - e.g. give to the poor, animal feed, compost heaps.✔

- Education✔ (any 2) [11]

2. 2.1 There has been a rapid increase in the human population✔ (1)

2.2

a) Pesticides kill the pests which destroy the crops✔ (1)

b) Fertilizers increase nutrient content in the soil✔ (1)

2.3 Secondary consumers e.g. birds can eat the pests with the poison✔, which can kill the birds3 thereby decreasing the population size of birds✔

OR

The pest can become extinct✔, and the population size of the secondary consumer feeding on the pest will also decrease✔ (any 1 × 2) (2)

2.4

- Loss of flora and fauna biodiversity by inbreeding of GMOs✔

- Entire species could be wiped out✔ if exposed to diseases✔ (no variation in the population)/GMOs will have no resistance to the diseases (3) [8]

Activity 7

Questions

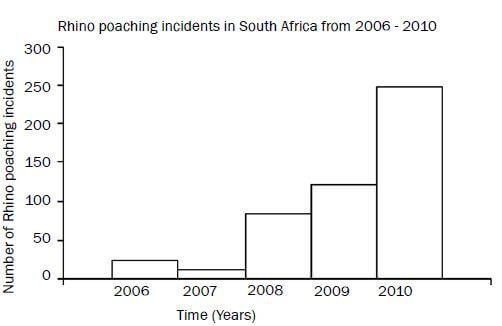

1. Study the following table showing a summary of the rhino poaching incidents in South Africa from 2006 - 2010.

Province | 2006 | 2007 | 2008 | 2009 | 2010 | Total |

Kruger National Park (part of Limpopo) | 17 | 10 | 36 | 50 | 109 | 222 |

Gauteng | 0 | 0 | 0 | 7 | 15 | 22 |

Limpopo | 0 | 0 | 23 | 16 | 37 | 76 |

Mpumalanga | 2 | 3 | 2 | 6 | 12 | 25 |

North West | 0 | 0 | 7 | 10 | 44 | 61 |

Eastern Cape | 0 | 0 | 1 | 3 | 2 | 6 |

Free State | 0 | 0 | 0 | 2 | 3 | 5 |

KwaZulu-Natal | 5 | 0 | 14 | 28 | 23 | 70 |

Northern Cape | 0 | 0 | 0 | 0 | 2 | 2 |

Total Illegally hunted | 24 | 13 | 83 | 122 | 247 | 489 |

1.1 How many rhinos were illegally hunted in 2009? (1)

1.2 Suggest THREE ways in which the poaching of rhinos can be stopped. (3)

1.3 Describe the general trend observed in the table. (2)

1.4 By what percentage did the poaching of rhino incidents increase in North West from 2008 to 2010? Show all working. (3)

1.5 Use the data in the table and draw a bar graph to show the number of rhinos poached each year from 2006 to 2010 in South Africa. (7) [16]

2. Read the following passage on Rooibos (Aspalanthus linearis) and answer the questions that follow.