ECONOMICS PAPER 1 GRADE 12 MEMORANDUM - NSC PAST PAPERS AND MEMOS JUNE 2016

Share via Whatsapp Join our WhatsApp Group Join our Telegram GroupECONOMICS P1

GRADE 12

JUNE 2016

MEMORANDUM

NATIONAL SENIOR CERTIFICATE

SECTION A (COMPULSORY)

QUESTION 1

1.1 MULTIPLE-CHOICE QUESTIONS

1.1.1 C ✓✓ privatisation

1.1.2 B ✓✓ extrapolation

1.1.3 A ✓✓ short term

1.1.4 C ✓✓ tariffs

1.1.5 C ✓✓ decline in mineral exports

1.1.6 B ✓✓ economic growth

1.1.7 A ✓✓ Prosperity

1.1.8 A ✓✓ BRICS (8 x 2)

(16)

1.2 MATCHING ITEMS

1.2.1 D ✓ caused by changes in the building and construction industry

1.2.2 G ✓ human resource used to maximum capacity

1.2.3 F ✓ removal of unnecessary restrictions by law

1.2.4 B ✓ buying and selling equities / shares

1.2.5 C ✓ the flow of goods and services

1.2.6 H ✓ involves removing barriers to international trade

1.2.7 A ✓public goods

1.2.8 I ✓GDP figures that has taken into account the changes in the level of prices (8 x 1)

(8)

1.3 ONE WORD ITEMS

1.3.1 Import substitution ✓

1.3.2 Taxation/taxes ✓

1.3.3 Balance of payments ✓

1.3.4 Terms of trade ✓

1.3.5 Phillips curve ✓

1.3.6 Leakages✓✓✓(6 x 1)

(6)

TOTAL SECTION A: 30

SECTION B

Answer TWO of the three questions in this section.

QUESTION 2: MACROECONOMICS

2.1

2.1.1 Name an example of a lagging and a coincident indicator.

- Lagging indicators – hours worked in construction / unit labour costs in manufacturing / number of commercial vehicles sold ✓

- Coincident indicators – registered unemployed / real GDP (excluding agriculture) / real retail sales. ✓

(Any relevant responses) (Any 1 + 1) (2)

2.1.2 What effect will corruption have on the efficiency of the government?

- Corruption will cause less profit ✓✓

- Less profit will cause that allocation of resources to different departments to decrease.✓✓

- The government will become less efficient due to services and goods delivery decreasing ✓✓

- Government officials being discouraged. ✓✓ (1 x 2) (2)

2.2 Data Response

2.2.1 Identify the method used in the table above to calculate GVA.

Production method ✓✓ (2)

2.2.2 Classify any activity under the tertiary sector.

- Distribution of goods and services ✓✓

- Transport, storage and communication ✓✓

- Finance, insurance, real estate and business services ✓✓

- Wholesale, retail trade, catering and accommodation ✓✓

(Any 1 x 2) (2)

2.2.3 Calculate the contribution of the secondary sector to the GDP.

R716 620 ✓✓ (2)

2.2.4 Highlight the importance of national account aggregates.

- Determine the wealth of a country ✓✓

- Contribution of all sectors in the country. ✓✓

- Measure the performance of the country. ✓✓

- Indicate economic activity within a country. ✓✓

- Measuring economic growth from one year to the next. ✓✓

(Accept any relevant answer) (Any 2 x 2) (4)

2.3 Data response

2.3.1 Explain the term e-toll.

Tariffs that should be paid to make use of certain roads. ✓✓

(Any relevant answer) (1 x 2) (2)

2.3.2 What does the acronym Sanral stands for?

South Africa’s National Road Agency. ✓✓ (1 x 2) (2)

2.3.3 What negative socio-economic impact can e-toll tariffs have in South Africa?

- Not all people have access to e-tolling. ✓✓

- People pay more on travelling expenses. ✓✓ (Any 1 x 2) (2)

2.3.4 In your opinion what is the most important cause of public sector failure in South Africa? Motivate your answer

- Corruption ✓✓

- Government does not use resources to produce the right goods at the right volumes. ✓✓

(Accept any relevant answer.) (2 x 2) (4)

2.4 Explain the exogenous causes (monetarism) for business cycles.

- Exogenous variables are independent factors that can influence business cycles and originate outside the economy. ✓✓

- Exogenous factors that influence business cycles are as follows:

- The monetarists believe markets are inherently stable. ✓✓

- Disequilibrium is caused by incorrect use of policies e.g. monetary policy ✓✓

- Weather conditions and market shocks cause upswings and downswings. ✓✓

- Government should not intervene in the market. ✓✓

- Sunspot theory based on the belief that increased solar radiation causes changes in weather conditions. ✓✓

- Technological changes ✓✓ (Any 4 x 2) (8)

2.5 How effective is international trade for South Africa?

- Specialisation increase the standard of living, especially when the area of specialisation is in great demand due to a shortage of supply, e.g. Angola has oil so it can specialise in oil products. ✓✓

- Mozambique has no oil resources and cannot specialise in these resources. ✓✓

- Mass production becomes possible if the domestic demand is added to foreign demand, e.g. manufacturing cellphones. ✓✓

- Efficiency increases when there is competition. Lower prices means that the same income can buy more goods and services. ✓✓

- Globalisation is driven by international trade, e.g. trade in IT products and vehicles (cars and trade) (Any 4 x 2)

(8)

[40]

QUESTION 3: ECONOMIC PURSUITS

3.1

3.1.1 Name TWO examples to promote exports.

- Incentives ✓

- Subsidies ✓ (2 x 1) (2)

3.1.2 What effect will an increase in investment have on the economy?

- Job creation

- Increase in wealth ✓✓

- Higher production levels ✓✓

(Accept any relevant answer) (1 x 2)

(2)

3.2 Data Response

3.2.1 At what point on the graph does equilibrium for exchange originally occur?

- At point e / e at point where DD intersects SS / at a price of R10 and at a quantity of 100. ✓✓

(2)

3.2.2 Give TWO reasons for the shift of the demand curve for dollars from DD to D1 D1.

Reasons

- Increase in the number of South Africans visiting the USA ✓✓

- South Africans buy more American financial assets. ✓✓

- Increases imports from the USA. ✓✓

- Increased exports to South Africa. ✓✓

- Services (shipping, insurance) from the USA. ✓✓

- Payments of instalments on repayments of overseas loans. ✓✓

- Payments of interest and dividend on foreign capital. ✓✓

- Other payments to foreign countries, which take place from time to time. ✓✓

- Foreign countries speculation. ✓✓

(Accept any other country using dollar as a currency) (Any 2 x 2) (4)

3.2.3 What happens to the value of the rand when DD shifts to

D1 D1? Motivate your answer.

Depreciated/Decreased. ✓✓

Motivation

- Increased demand for dollars OR decreased demand for rand. ✓✓

- More rand for dollars. ✓✓

- More expensive to buy dollars. ✓✓

- One dollar costs R12,00 instead of R10,00. ✓✓ (Any 2 x 2)

(4)

3.3 Data Response

3.3.1 What do dotted lines a and b represent?

Amplitude ✓✓ (2)

3.3.2 Define the term real (actual) business cycle.

- Real changes in economic activities over a period of time. ✓✓(2)

3.3.3 What is the importance of the length (T2 T3) of the business cycle?

- The length of the business cycle is the amount of time it takes to move through one complete cycle. ✓✓

- Longer cycles show strength – shorter cycles show weaknesses. ✓✓

- The length in this instance is approximately 3 years and we can predict that the following one will also take approximately 3 years or shorter. ✓✓

(Accept any other relevant response.) (Any 1 x 2)

(2)

3.3.4 What can government do to ensure that high inflation does not occur during peaks of business cycles?

- Government can increase taxes. ✓✓

- Government expenditure can be reduced. ✓✓

- Monetary policy instruments e.g. increased interest rates, inflation targeting. ✓✓

(Accept any other relevant responses related to fiscal and monetary policy.) (Any 2 x 2)

(4)

3.4 Argue in favour of import substitution.

- More local businesses can be established / diversification. ✓✓

- It is often argued that the industrial base of the economy need to be strengthened and expanded and this will make them less dependent on foreign countries and give them more control over their economies. ✓✓

- A natural starting point therefore to substitute imports because there are certainties that the domestic market exists for those products. ✓✓

- A greater variety of businesses can exist or continue to exist. ✓✓

- Trade – developing countries rely on their natural resources as a base for their economic growth and development. ✓✓

- Increased employment – the establishment of new industries demands more employment and improve the standard of living of the people. ✓✓

- More choice / greater variety of goods produced. ✓✓

- Speedy economic development and growth. ✓✓

- Correction of balance of payments (BOP) problems.

(Accept any other relevant response) (Any 4 x 2)

(8)

3.5 How are interest rates and taxation influenced in the contractionary and expansionary situations?

| MONETARY POLICY | EXPANSIONARY | CONTRACTIONARY |

| Interest rates | Decrease interest rates ✓✓ | Increase interest rates ✓✓ |

| When interest rates lowered – more credit ✓✓ | When interest rates increases – less credit ✓✓ | |

| More credit increase money in circulation ✓✓ | Less credit decrease money in circulation ✓✓ | |

| (Any 2 x 2) (4) | ||

| FISCAL POLICY | EXPANSIONARY | CONTRACTIONARY |

| Taxation | Decrease taxes so that disposable income and aggregate demand can increase ✓✓ | Increase taxes so that disposable income and aggregate demand can decrease. ✓✓ |

| (Any 2 x 2) (4) |

[40]

QUESTION 4: MACROECONOMICS AND ECONOMIC PURSUITS

4.1

4.1.1 Name TWO models that are used to explain economics.

- Diagrams ✓

- Graphs ✓

- Tables ✓(Any 2 x 1)

(2)

4.1.2 What effect will a weak rand have on foreign trade?

- Exports will increase ✓✓

- Imports will decrease ✓✓

(Accept any other relevant answer) (Any 1 x 2)

(2)

4.2 Data response

4.2.1 What does the abbreviation MTEF stands for?

Medium Term Expenditure Framework ✓✓ (2)

4.2.2 The deficit on the budget should NOT exceed which percentage of GDP?

3% ✓✓ (2)

4.2.3 Calculate the budget deficit as a percentage of GDP (A)

A: -0,3%.✓✓ (2)

4.2.4 In your opinion what can the government do to reduce the budget deficit?

- Government can increase revenue, e.g. increasing taxes ✓✓

- Improve efficiency / more productive labour force. ✓✓

- Government can reduce public sector expenditure, e.g. stricter financial procedures / control. ✓✓

- Appointment of competent employees / training of employees. ✓✓

(Accept any other relevant fact) (Any 2 x 2)

(4)

4.3 Data response

4.3.1 Name TWO items in the financial account of the balance of payments. (2)

- Direct investment ✓

- Portfolio investment ✓

- Other investment ✓

- Derivatives ✓

- Assets ✓ (Any 2 x 1)

(2)

4.3.2 Which institution gives guidelines in the compilation of the balance of payments?

International Monetary Fund (IMF) ✓✓ (2)

4.3.3 According to the BPM6 how many accounts does the balance of payments have?

Three accounts ✓✓ (2)

4.3.4 Briefly explain how disequilibrium in the balance of payments can be corrected using borrowing and lending.

- Countries with surpluses often lend money to countries with deficits while countries with deficits often borrow. ✓✓

- In the event of a fundamental disequilibrium, member countries may borrow from the International Monetary Fund (IMF). ✓✓

- Borrowing is nevertheless not a long-term solution for fundamental balance of payments disequilibrium. ✓✓ (2 x 2)

(4)

4.4 Explain the new economic paradigm.

- Refers to government policies designed to ensure high economic growth, without having supply constraints and price inflation. ✓✓

- Theories by the Monetarists and Keynesians extrememists and only true under specific circumstances. ✓✓

- Under the real circumstances, government pursues economic growth irrespective of inherently stable or unstable markets. ✓✓

- Therefore government are not extreme but transparent and follow pragmatic policies. ✓✓

- The root of the new economic paradigm is embedded in the prevention of unstable conditions that will lead to contractions. ✓✓

- According to the new economic paradigm it is possible for output to rise over extended periods of time without being hampered by supply constraints and inflationary pressures. ✓✓

- Embedded in demand- side and supply-side policies. ✓✓

(Any relevant answer) (Any 4 x 2)

(8)

4.5 How is the economy negatively affected by the public sector failure?

Allocation of

- When the government fails, an optimal allocation of resources is not achieved and consequently resources are wasted. ✓✓

Economic instability ✓

- Government failure can lead to macro-economic instability. Government is unable to use fiscal policy effectively. ✓✓

Distribution of income ✓

- If government fails to use the tax system effectively then there will be an unfair distribution of income in the economy. ✓✓

Social instability ✓

- When the public sector fails to deliver the required social services to the poor, the economy can be destabilised. ✓✓

Social stability ✓

- The public sector is supposed to ensure social stability by providing services such as sanitation, protection, roads and cash grants to the poor. If it fails, the lives of people are destabilised and their human rights compromised. (4 x 2)

(8)

[40]

TOTAL SECTION B: 80

SECTION C

Answer ONE of the TWO questions in this section.

| STRUCTURE OF ESSAY | MARK ALLOCATION |

| Introduction | Max. 2 |

| Body Main part: Discuss in detail/In-depth discussion/Examine/Critically discuss/Analyse/Compare/Evaluate/Distinguish/ Differentiate/ Explain/Assess/Debate Additional part: Give own opinion/Critically discuss/Evaluate/ Critically evaluate/Draw a graph and explain/Use the graph given and explain/Complete the given graph/Calculate/Deduce/Compare/ Explain/ Distinguish/Interpret/Briefly debate/How?/Suggest |

Max. 26 Max. 10 |

Conclusion

| Max. 2 |

| TOTAL: | 40 |

QUESTION 5: MACROECONOMICS

Economists present the economy as a simplified circular flow model to show how the different participants interact with each other.

- Discuss in detail, without the use of a graph, the interaction of all participants in an open economy circular flow model. (26)

- Draw and explain the multiplier process by using a fully labelled graph. (10)

INTRODUCTION

The circular flow model of an economy is a simplification showing how the economy works and the relationship between income and spending in the economy as a whole. ✓✓

It is different to a closed economy because it includes foreign trade. ✓✓

(Accept any other suitable introduction.) (Max. 2) (2)

BODY

MAIN PART:

- There is a flow of money and goods and services between the household sector and the business sector. ✓

- Households earn income in the form of wages and salaries by selling their factors of production. ✓✓

- Businesses use the factors of production to produce goods and services on which the household sector spending money. ✓✓

- Thus the business will receive an income in return from the households for goods and services. ✓✓

- There is a flow of money and goods and services between the household sector and the state. ✓

- Household sector provides the state with labour and receive an income. ✓✓

- The state provides the households with public goods and services and receives taxes as income in return ✓✓

- (e.g.) parks, hospitals which was paid by taxes pay earns an income for the state. ✓

- There is a flow of money and goods and services between the business sector and the state. ✓

- The business sector provides the state with goods and services for which the state pays. ✓✓

- The state provides the business sector with public goods and services for which they pay taxes. ✓✓

- There is a flow of goods (imports) to the business from the foreign sector which the business pay for ✓

- This will be regarded as expenditure for the business. ✓✓

- There is also a flow of goods from the business to the foreign sector (exports) ✓✓

- This will be income for the business. ✓

- The financial markets consists of banks, insurance companies and pension funds. ✓

- They act as a link between households and firms who have surplus money and others in the economy who require funds.✓✓

- The money that households and firms provide to the financial sector is known as savings. ✓✓

- The spending on capital equipment by firms is regarded as investment. ✓

(Accept any relevant response) (Max. 26)

ADDITIONAL PART

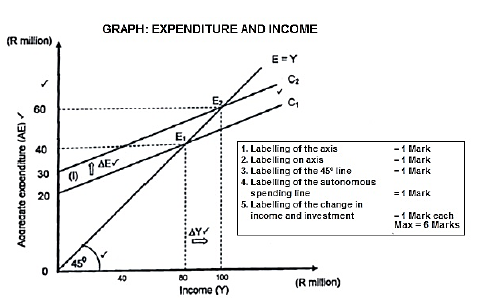

Draw and explain the multiplier process by using a fully labelled graph.

EXPLAINATION

- A change in investment of R10 m , will result in a change in income of R20 m ✓✓

- The income increase by more than a proportionate change in investment ✓✓

OR - An increase in investment causes the expenditure function to shift upwards from C1to C2 so that C1 is parallel to C2 ✓✓

- The effect of an increase in investment is that the total expenditure will increase from R20 m to R30 m. ✓✓

- In other words the increase in investment results in an increase in expenditure and an equilibrium level of income and output ✓✓

- The increase in the value of the output (Y) is greater than the increase in the expenditure (E) ✓✓

(Explanation MUST comply with the figures supplied in the graphical presentation) (Max. 4)

(2)

CONCLUSION

- The circular flow ensures continued interdependence and coordination of the economic activities in the economy. ✓✓

(Accept any other relevant response) (Max. 2)

[40]

QUESTION 6: MACRO ECONOMICS

To be internationally competitive, a country needs to have suitable trade policies in place. They have to grow their industries if they want to increase the standard of living.

- Discuss, in detail, the arguments in favour of protectionism. (26)

- In your opinion, how can the government use subsidies to ensure that local industries are protected against unfair competition from abroad. (10)

INTRODUCTION

Protectionism refers to a deliberate policy in the part of the government to erect trade barriers, such as tariffs and quotas, in order to protect domestic industries against international competition. ✓✓

(Accept any other relevant definition.) (Max. 2)

(2)

BODY

MAIN PART

Arguments in favour of Protectionism.

- Raising revenue for the government ✓

- Import tariffs raise revenue for the government ✓✓

- In smaller countries the tax base is often small due to low incomes of individuals and businesses ✓✓

- Low incomes do not provide much in the form of income taxes and therefore custom duties on imports is a significant source of income or revenue. ✓✓

- Protecting the whole industrial base ✓

- Maintaining domestic employment. ✓✓

- Countries with high unemployment are continuously pressured to stimulate employment. ✓✓

- Creation and therefore resort to protectionism in order to stimulate industrialisation. ✓✓

- It is thought that using protectionism the country’s citizens will purchase more domestic products and raise domestic

employment. ✓✓ - These measures on domestic employment creation at the expense of other countries led to such measures as ‘beggar-my-neighbour’ policies. ✓✓

- Applying import policies is likely to reduce other countries ability to buy country’s exports and may provoke retaliation. ✓✓

- Protecting workers ✓

- It is argued that imports from other countries with relatively low wages represent unfair competition and threaten the standard of living of the more highly paid workers of the local industries. ✓✓

- Local industries would therefore, be unable to compete because of higher wages pushing up the price levels of goods. ✓✓

- Protection is thus necessary to prevent local wage levels from falling or even prevent local businesses from closing down due to becoming unprofitable. ✓✓

- Competition from low wages countries may also reflect the fact that those countries have a comparative advantage in low skilled labour intensive industries. ✓✓

- Diversifying the industrial base ✓

- Overtime countries need to develop diversified industries to prevent over specialisation. ✓✓

- A country relying too heavily on the export of one or a few products is very vulnerable. ✓✓

- If a developing country’s employment and income is dependent on only one or two industries, there is a risk that world fluctuations in prices and demand and supply-side problems could result in significant fluctuations in domestic economic activity. ✓✓

- Import restrictions may be imposed on a range of products in order to ensure that a number of domestic industries develop. ✓✓

- Develop strategic industries ✓

- Some industries such as the iron ore and steel, agriculture, (basic foodstuffs such as maize) energy (fuels) and electronics (communication) among other, are regarded as strategicindustries. ✓

- Developing countries may feel that they need to develop these industries in order to become self-sufficient. ✓✓

- Protecting specific industries.

Dumping✓- Foreign industries may engage in dumping because government subsidies permit them to sell at very low prices ✓✓or because they are seeking to raise profits through price discrimination. ✓✓

- The reason for selling products at lower prices may be to dispose accumulated stock of goods and as a result consumers in the importing countries benefit, ✓✓

- however, their long term objective may be to drive out domestic producers and gain control of the market ✓✓and

- consumers are likely to lose out in the reduction in choice and higher prices that exporters will be able to charge ✓✓

- Infant industries ✓

- Usually newly established industries find it difficult to survive due to their average costs being higher than that of their well-established foreign competitors. ✓✓

- However, if they are given protection in their early years they may be able to grow and thereby take advantage, ✓✓

- by lowering their average costs and become competitive and at this point protection can be removed. ✓✓

- Declining industries/sunset industries ✓

- Structural changes in the demand and supply of a good may severely hit an industry ✓✓

- Such Industries should be permitted to go out of business gradually✓✓

- Declining industries are likely to be industries that no longer have a comparative advantage ✓✓

- However, if they go out of business quickly there may be a sudden and large increase in unemployment. ✓✓

- Protection may enable an industry to decline gradually thereby allowing time for resources including labour to move to other industries. ✓✓

- Protecting domestic standards, domestic regulations of food safety, human rights and environmental standards have been increasingly acting as trade restrictions. ✓✓

(Accept any relevant fact) (Max. 26)

ADDITIONAL PART

In your opinion, how can the government use subsidies to ensure that local industries are protected against unfair competition from abroad.

South Africa promotes exports through subsidies. ✓

Direct subsidies: Strict screening measures should be put in place when companies apply for financial assistance. Government expenditure can provide direct financial support to domestic producers for their exports.✓✓ E.g.

- Cash grants offered to South African exhibitors to exhibit their products at exhibitions overseas, and explore new markets. ✓✓

- Foreign trade missions to explore new markets and imposition of tariffs on imports ✓✓

- Funds for the formation of export councils. ✓✓

- Subsidies for training or employing personnel.✓✓

- Funds for the export market research ✓✓

- Product registration and foreign patent registrations. ✓✓

Indirect subsidies: Government can refund companies certain taxes to promote exports. ✓✓

These types of indirect subsidies are: - General tax rebates (part of the costs of production can be subtracted from the tax that has been paid.) ✓✓

- Tax concessions on profits earned from exports or on capital invested to produce export goods. ✓✓

- Refunds on import tariffs in the manufacturing process of exported goods, companies often use – customs duties are paid on these goods and the government refunds them ✓✓

(Allocate a max of 2 marks for examples) (Max. 10)

CONCLUSION

Most countries agree that protectionism is harmful to the economy if not well managed. In certain areas of importance protectionism is needed especially where young industries come into existence. ✓✓

(Accept any other relevant conclusion) (Max. 2)

[40]

TOTAL SECTION C: 40

GRAND TOTAL: 150