ACCOUNTING GRADE 12 MEMORANDUM - NSC PAST PAPERS AND MEMOS JUNE 2016

Share via Whatsapp Join our WhatsApp Group Join our Telegram GroupNATIONAL SENIOR CERTIFICATE

GRADE 12

JUNE 2016

ACCOUNTING

MEMORANDUM

GENERAL RULES:

- Award full marks for the correct final answers. If the answer is incorrect, mark the workings provided.

If a workings figure/amount is shown as a final answer, allocate the working mark. - “Method” marks are denoted by ☑

- In calculations and final totals, at least one part of the workings must be correct to earn the mark.

- In cases where answers of previous questions must be used, check the transfer.

- Ignore brackets on statements, but check the operation before awarding marks.

- Where penalties are applied, the marks for that section cannot be a negative. (foreign items)

- For questions requiring explanations and comments, award part-marks. A good explanation will

normally mention and explain a point. Beware of alternative wording reflecting the same points. This

marking guideline provides some explanations – they are not conclusive. Read the candidates’

responses and give credit for their interpretations. - Where appropriate/acceptable, accept recognisable abbreviations.

- Educators are expected to work through the entire paper and make reasonable adjustments within the

framework of the mark allocation.

QUESTION 1 RECONCILIATIONS

1.1 BANK RECONCILIATION

1.1.1 Calculation of the Bank Account balance

| (Debits): 2 400 + 15 300 + 7 600 = 25 300 ✓ ✓ (Credits) : 9 410 ✓ + (5 000 + 12 400) ✓ + 540 ✓ = 27 350 ☑ One part correct = 2 050 ☑ One part correct Accept alternative arrangements of the amounts. FAVOURABLE ✓/ UNFAVOURABLE : |

(8)

1.1.2

| Provide a reason why cheque No. 882 should not appear as an outstanding cheque. Also state how this transaction must be corrected. REASON: Any reasonable explanation ✓✓ Cheque is more than 6 months old / the cheque is stale / the cheque is no longer valid. RECORDING: The entry must be reversed in the CRJ ✓✓ |

(4)

1.1.3

| Cheque No. 1234 is post-dated. How must this cheque be treated at the end of the financial year? Bank must be debited (increased) ✓✓ Creditors / Accounts payable must be credited (increased) ✓✓4 |

(4)

1.1.4

| List the accounting entries that must be made to take this transaction into account. Any valid explanation ✓✓ This entry must be reversed in the CPJ to take this amount as a loss Bank must be credited Rule of prudence (2) |

| Provide ONE control measure to prevent such incidents in future. Any valid explanation ✓✓ Inspect books regularly /regular and random audits / deposit regularly / Do not keep cash on the premises for too long / request SMS notification of bank transactions.(2) |

1.2

CREDITORS RECONCILIATION ON 30 APRIL 2016

|

1.3.1

| Explain why the balance on the Debtors’ Control account in the general ledger should equal to the total of the Debtors’ List. Any valid explanation ✓✓ The control account is a summary of the individual transactions of debtors from the different journals. The triple-entry principle means that all transactions are recorded in the Debtors ledger as well as the General Ledger. One is a check (or control) of the other. |

(2)

1.3.2

CORRECTION TO DEBTORS LIST

*One part correct to score total mark |

1.3.3

| Explain why you would be concerned about the management of debtors. Quote figures in your answer. Explanation ✓✓ figures quoted ✓✓ Only 20% (14 140/70 700) of the debtors are current and are taking advantage of the 5% discount.(4) |

45

QUESTION 2 INVENTORY VALUATION

2.1 CONCEPTS

| 2.1.1 | First in first out ✓ |

| 2.1.2 | Weighted average ✓ |

| 2.1.3 | Specific identification ✓ |

| 2.1.4 | Perpetual ✓ |

(4)

2.2.1

Calculate the value of the closing stock of tennis balls (8) (8) |

Calculate the cost of sales of tennis balls

|

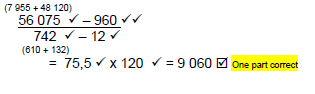

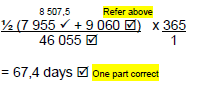

Calculate the stock holding period (in days)

|

2.2.2

| Comment on whether the stock holding period is appropriate or not. |

| Any valid explanation ✓✓ The tennis balls last for more than 2 months (67,4 days) They do not turnover too often Could be a seasonal sport This may be a good period – these are durable goods May take advantage of lower cost prices.(2) |

2.2.3

| Calculate the value of the closing stock of Nexus rackets 2 x 2 640 ✓✓ = 5 280☑ One part correct 4 x 2 800 = 11 200 ✓✓ 3 x 2 750 = 8 250 ✓✓ 11 x 2 900 = 31 900 ✓✓ Total : 56 630 ☑One part correct (10) |

| Calculate the gross profit on Olympus rackets 207 915 ✓ x 50 ✓/150 ✓ = 69 305 ☑One part correct or 207 915 – 138 610 = 69 305 (1 mark) (2 marks) (4) |

35

QUESTION 3 CONCEPTS, AUDIT REPORT AND INCOME STATEMENT

3.1 CONCEPTS

| 3.1.1 | D ✓ |

| 3.1.2 | E ✓ |

| 3.1.3 | B ✓ |

| 3.1.4 | A✓ |

(4)

3.2.1

| Explain the role of the independent auditor. 2 Valid explanation ✓✓ He/she is expected to express an unbiased opinion on the reliability of the financial statements of a company after conducting an audit. |

3.2.2

Did Gunuz Ltd receive an unqualified, qualified or a disclaimer audit (2) |

3.2.3

| The external auditor was not willing to do this. Briefly explain why she feels this way. Valid explanation ✓✓ Professional integrity / reputation of the firm / agreeing to corruption. |

| Provide TWO consequences for the auditor if she agreed to this request. Any TWO valid points ✓✓ ✓✓ May face disciplinary action May lose future contracts May be struck of the roll and will not be able to practice in the future (4) |

3.3 BHEEM LTD

INCOME STATEMENT FOR THE YEAR ENDED 29 FEBRUARY 2016

| Sales 5 207 600 ✓ – 9 800 ✓ – 2 800 ✓ | 5 195 000 ☑* | |

| Cost of sales 3 717 250 ✓ – 1 750 ✓ | (3 715 500) ☑* | |

| 8 | Gross profit Operation (subtracted) | 1 479 500 ☑ |

| Other income | 98 500 ☑* | |

| Rent income 78 600 ✓ – 6 200 ✓✓ | 72 400 ☑* | |

| Commission income | 25 250 ✓ | |

| Provision for bad debts adjustment 3 490 – 2 640 | 850 ✓✓ | |

| 9 | Gross income Operation(GP + OI) | 1 578 000 |

| Operating expenses | (950 000) ☑* | |

| Salaries and wages | 432 900 ✓ | |

| Trading stock deficit 132 650 ✓ + 1 750 ✓ – 131 400 ✓ | 3 000 ☑* | |

| Consumable stores 31 600 ✓ – 4 100 ✓ | 27 500 ✓ | |

| Directors’ fees 329 000 ✓ – 9 400 ✓✓ | 319 600 ☑* | |

| Audit fees 16 160 ✓ + 3 840 ✓ | 20 000 ☑ | |

| Insurance 43 150 ✓ – 1 650 ✓✓ | 41 500 ☑* | |

| Depreciation | 32 700 ✓ | |

| Sundry expenses | 72 800 ✓ | |

| 23 | Operating profit Operation(GI - OE) | 628 000 ☑ |

| Interest income | 22 000 ☑ | |

| Profit before interest expense Operation (OP + Int) | 650 000 ☑ | |

| Interest expense | (24 500) ✓ | |

| Net profit before income tax Operation (-) | 625 500 ☑ | |

| Income tax 30% of NPbT | (187 650) ☑ | |

| 6 | Net profit after income tax Operation (-) | 437 850 ☑ |

*one part correct to score method marks

-1 (max -2) for foreign entries; misplaced items must be marked wrong.

60

QUESTION 4 COMPANIES – CONCEPTS AND BALANCE SHEET

4.1 CONCEPTS

| 4.1.1 | Non-current asset ✓ |

| 4.1.2 | Equity ✓ |

| 4.1.3 | Current asset ✓ |

| 4.1.4 | Non-current liability ✓ |

| 4.1.5 | Current liability ✓ |

(5)

4.2.1 ORDINARY SHARE CAPITAL

| 650 000 | Ordinary shares on 1 May 2015 | 3 992 500 |

| 150 000 | Ordinary shares issued at R6,45 per share | 967 500 ✓✓ |

| (75 000) | Shares repurchased (average share price: R6,20✓✓) | (465 000) ☑* |

| 725 000 * | Ordinary shares on 30 April 2016 | 4 495 000 ☑* |

(7)

*Operation, one part correct

RETAINED INCOME

| Balance (1 May 2015) | 222 900 |

| Net profit after income tax (1 228 000 – 368 400) | 859 600 ✓☑* |

| Share buyback (525 000 – 465 000 ☑) | (60 000) ☑* |

| Ordinary share dividends Operation | (427 500) ☑ |

| Interim dividends (650 000 x 35 cents) | 227 500 ✓☑* |

| Final dividends (800 000 x 25 cents) | 200 000 ✓☑* |

| Balance (30 April 2016) Operation, one part correct | 595 000 ☑ |

(10)

*one part correct

4.2.2 BALANCE SHEET AS AT 30 APRIL 2016

| NON CURRENT ASSETS | 5 022 000 ☑* | |

| 4 042 000 ✓ | |

| 980 000 ☑ | ||

| CURRENT ASSETS | 600 000 ☑* | |

| 326 500 ✓ | |

| 189 900 ✓ | ||

| 11 600 ☑* | ||

| 72 000 ✓ | ||

| 11 | TOTAL ASSETS - Check E + L | 5 622 000 ☑ |

| EQUITY AND LIABILITIES | ||

SHAREHOLDERS EQUITY

| 5 090 000 ☑* | |

| 495 000 ☑ | ||

| 595 000 ☑ | ||

| NON-CURRENT LIABILITIES | 170 320 | |

| 170 320 ☑* | |

| CURRENT LIABILITIES | 361 680 ☑* | |

| 111 680 ✓ | |

| 200 000 ☑ | ||

| 50 000 ☑ | ||

| 12 | TOTAL EQUITY AND LIABILITIES | 5 622 000 ☑* |

*Operation, one part correct

(23)

45

QUESTION 5 CASH FLOW STATEMENT AND INTERPRETATION

5.1 CONCEPTS

| 5.1.1 | Solvency ✓ |

| 5.1.2 | Gearing/risk ✓ |

| 5.1.3 | Liquidity ✓ |

| 5.1.4 | Operating efficiency/profitability ✓ |

(4)

5.2.1 CASH GENERATED FROM OPERATIONS

| Net profit before tax | 456 000 |

| Adjustments for : | |

| Depreciation | 118 140 ✓ |

| Interest expense | 37 600 ✓ |

| 611 740 | |

| Cash effects of changes in working capital | 6 000 ☑* |

| Increase in stock (150 300 – 145 600) | (4 700) ✓☑* |

| Decrease in debtors (102 300 – 75 200) | 27 100 ✓☑* |

| Decrease in creditors (98 900 – 82 500) | (16 400) ✓☑* |

| CASH GENERATED FROM OPERATIONS | 617 740 ☑* |

(10)

*Operation, one part correct

5.2.2

| Income tax paid – 7 300 ✓ + 132 240 ✓ – 3 500 ✓ = 121 440 ☑ one part correct (4) |

| Dividends paid 120 000 ✓ + 132 000✓ = 252 000 ☑ one part correct (3) |

| Fixed assets sold at carrying value 3 541 900 ✓ + 995 000 ✓✓ – 118 140 ✓ – 4 340 060 ✓ = 78 700 ☑ (820 000 + 175 000) (6) |

*one part correct

5.2.3

| CASH EFFECTS OF FINANCING ACTIVITIES | |

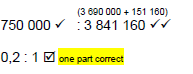

| Proceeds from shares issued 3 690 000 ✓ + 332 500 ✓ – 3 240 000 ✓ | 782 500 ☑* |

| Shares repurchased (50 000 x 6,65 ✓✓) (5,40 + 1,25) | (332 500) ☑* |

| Increase in loan (750 000 – 250 000) | 500 000 ✓✓ |

*one part correct

(9)

5.2.4

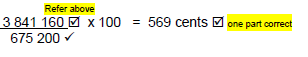

Calculate the debt equity ratio |

Calculate the net asset value per share (3) (3) |

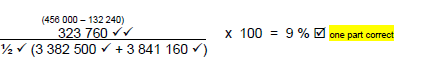

Calculate the return on shareholders’ equity (6) (6) |

5.2.5

| Quote and explain THREE financial indicators (with figures) that suggest that the liquidity of the business has generally improved. Financial indicators (with figures) Trend and comment ✓✓✓ Current ratio improved from 0,9 : 1 to 1,6 : 1 Acid test ratio improved from 0,4 : 1 to 0,9 : 1 Debtors collection period improved from 40 days to 31 days The current ratio may suggest that too much stock is being held The acid test shows that the business is in a better position to pay back short-term debt Debtors are paying at a faster rate which helps the cash flow position Do not accept stock turnover rate |

(6)

5.2.6

| Should the shareholders be satisfied with their returns and earnings? Explain. Quote TWO financial indicators (with figures) in your answer. Yes/No ✓ Financial indicators (with figures) ✓✓ Valid explanation ✓✓ ROSHE has decreased from 11,5% to 9% (5.2.4) Dividends has also decreased from 46 cents to 40 cents per share although EPS increased from 48 cents to 55 cents per share It is possible that the directors may convince shareholders that a lower dividend pay-out is to improve the business in the long run. The EPS suggest that the business is improving so it is possible that better returns will accrue in the future. Also, ROSHE is a better return than that of alternative investments. |

(5)

5.2.7

| Were the directors justified in acquiring the additional loan? Explain. Make reference to TWO financial indicators (with figures). Yes/No ✓ Financial indicators (with figures) ✓✓ Valid explanation ✓✓ Debt equity of 0,2 : 1 from 0,1 : 1 shows that the business is lowly geared, and it can afford to borrow additional funds. The ROTCE however, decreased from 13% to 10,2%, revealing that the company is not making effective use of the additional funds to increase profitability (negatively geared) Unless the directors have concrete plans to use the money to improve the business, increasing the loan is not a good idea as it now costs more than it generates (interest rate being 12%) |

(5)

65

QUESTION 6 VAT AND FIXED ASSETS

6.1 TRUE AND FALSE.

| 6.1.1 False ✓ 6.1.2 False ✓ 6.1.3 True ✓ |

(3)

6.2 VAT CALCULATION

6.2.1

| Calculate the amount that is either due to SARS or receivable from SARS for the two-month period ended 30 April 2016. 589 + 14 280 – 553 – 112 – 34 020 + 490 + 406 + 98 = (9 822) ✓ ✓✓ ✓ ✓ ✓✓ ✓ ✓ ✓ one part correct Accept alternative presentations such as signs reversed, input and output VAT calculations and VAT control account RECEIVABLE / PAYABLE : Payable ✓ |

(12)

6.2.2

| What advice would you offer Joe regarding this proposal? Explain. ADVICE ✓ Joe should not do this. He should record the sales at the lower mark-up and declare the VAT received. He should maintain good business practice at all time REASON ✓✓ This is not ethical as he is a VAT vendor and will be defrauding SARS It is also illegal and if caught he will be punished in terms of the law. No documents will also mean understating the sales revenue. |

(3)

6.3.1

GENERAL LEDGER OF CHUMLEE STORES ASSET DISPOSAL ACCOUNT

| 2015 Dec | 1 | Equipment 435 000 + 126 000 – 468 000 | 93 000 ✓☑* | 2015 Dec | 1 | Accumulated depreciation 54 800 ✓+ 5 730 ✓✓ | 60 530 | |||

| Debtors control ✓ | 25 000 ✓ | |||||||||

| Loss on sale of asset ✓ | 7 470 ☑# | |||||||||

| 93 000 | 93 000 | |||||||||

*One part correct

#balancing figure

(10)

6.3.2

| WORKINGS | ANSWER | |

| (a) | 1 380 000 – 930 000 | 450 000 ✓✓ |

| (b) | 234 000 ✓ / 3 ✓✓ Or 520 000 x 15% | 78 000 ☑ one part correct |

| (c) | 93 000 ☑ – 60 530 ☑ Refer asset disposal account (6.3.1) | 32 470 ☑ one part correct |

| (d) | Sold : 5 730 ☑ (6.3.1) New : 126 000 x 20% x 2/12 = 4 200 ✓✓ Old : (435 000 – 93 000) – (212 280 – 54 800) 342 000 ✓✓ 157 480 ✓✓ 184 520 x 20% = 36 904 ☑ one part correct | 5 730 4 200 36 904 = 46 834 ☑ one part correct |

6.3.3

| Provide TWO possible reasons why the business decided to dispose of the old office equipment. Any TWO reasons ✓✓ ✓✓ Upgrading to improve efficiency Keeping up with technology Improving the image of the business Demands of the business environment – keeping up to competitors |

(4)

50

TOTAL: 300

(4)

(4) (4)

(4)