ECONOMICS PAPER 1 GRADE 12 MEMORANDUM - NSC PAST PAPERS AND MEMOS FEBRUARY/MARCH 2016

Share via Whatsapp Join our WhatsApp Group Join our Telegram GroupNATIONALSENIOR CERTIFICATE

GRADE 12

ECONOMICS P1

FEBRUARY/MARCH 2016

MEMORANDUM

SECTION A (COMPULSORY)

QUESTION 1

1.1 MULTIPLE-CHOICE QUESTIONS

1.1.1 B (per capita national income) ✓✓

1.1.2 A (weather patterns) ✓✓

1.1.3 A (education) ✓✓

1.1.4 C (decline in mineral exports) ✓✓

1.1.5 A (privatisation) ✓✓

1.1.6 C (differences) ✓✓

1.1.7 A (the Industrial Policy Action Plan)✓✓

1.1.8 B (encourage greater investment in training) ✓✓ (8 x 2) (16)

1.2 MATCHING ITEMS

1.2.1 E - the total value of all final goods and services produced within the borders of a country in a given year ✓

1.2.2 G - the upper turning point of the business cycle ✓

1.2.3 A - uses interest rates to influence the level of expenditure ✓

1.2.4 F - the weighting of domestically manufactured outputs ✓

1.2.5 B - gives member countries the opportunity to get financial support from the IMF ✓

1.2.6 I - a trade agreement between a group of emerging markets ✓

1.2.7 C - laws and regulation to enhance manufacturing operations ✓

1.2.8 D - assess the performance of the economy ✓ (8 x 1) (8)

1.3 GIVE THE CONCEPT

1.3.1 Economic development ✓

1.3.2 Import substitution ✓

1.3.3 Revaluation ✓

1.3.4 Trough ✓

1.3.5 Balance of payments (BOP) ✓

1.3.6 Injections ✓ (6 x 1) (6)

TOTAL SECTION A:30

SECTION B

Answer TWO questions from this section in the ANSWER BOOK.

QUESTION 2: MACROECONOMICS

2.1.1 Name TWO instruments of fiscal policy.

- Government spending ✓

- Taxation ✓ (2 x 1)(2)

2.1.2 How can the appreciation of the rand affect the exports of goods and services?

- There will be a reduction in exports

- It makes goods and services more expensive ✓✓ (1 x 2)(2)

2.2 Data Response

2.2.1 What percentage of their income do households spend?

Income equals consumption plus savings. Households will spend 80% of their income ✓✓ (2)

2.2.2 Explain the term multiplier.

It occurs when a small increase in spending produces a larger increase in national income ✓✓ (2)

2.2.3 What impact will a tax increase have on the multiplier?

- Implementation of a tax (VAT) effectively means that less money will be available to spend ✓✓

- The expectation is that the multiplier will decrease and thus the total value the multiplier amount will decrease as well ✓✓(2)

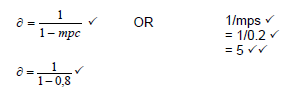

2.2.4 Calculate the size of the multiplier. Show ALL calculations.

Thus the multiplier is 5. ✓✓ (4)

2.3 Data Response

2.3.1 What message is depicted in the cartoon above?

The economy is slowing down/recession ✓✓

(Accept any other relevant explanation) (2)

2.3.2 Give a reason for the current state of the economy.

- Aggregate demand decreases ✓✓

- Bankrupts businesses ✓✓

- World slows down in economic activities ✓✓

- Inflation rate increases ✓✓

(Accept any other relevant answer) (2)

2.3.3 What main economic indicator is used to determine the state of the South African economy?

Real Gross Domestic Product ✓✓ (2)

2.3.4 How can the government speed up the recovery of the economy?

Government has TWO important fiscal policy instruments :

- Taxes ✓

- They can reduce taxes ✓✓

- E.g. Income tax/company tax ✓

- That will give consumers and companies more money to spend on goods and services and for companies to expand their production capacity ✓✓

- Government spending ✓

- They can increase spending ✓✓

- E.g. Spending on salaries, infrastructure and creating more job opportunities (EPWP) ✓

- That will increase expenditure which will stimulate economic activity ✓✓

(Accept any other relevant fact) (Any 2 x 2)

2.4 Differentiate between real flows and money flows in the circular flow model.

Real flows

- The flow of goods and services the between the various participants are called real flow ✓✓

This includes: - Factors of production from household to firms ✓✓

- Goods and services from firms to households ✓✓

- Goods and services from the government ✓✓

- Goods and services from the foreign sector to households, businesses and the government (imports) ✓✓

- Goods and services to the foreign sector (exports) ✓✓

Money flows

- The flow of money earned and spent between the various participants ✓✓

This includes: - Payment for factors of production in the form of rent, profit, wages and salaries and interest from firms to households ✓✓

- Payment for goods and services from households to firms ✓✓

- Payment for goods and services from households to the foreign sector ✓✓

- Payment for goods and services by households ✓✓

- Payment of taxes by households and firms to government ✓✓

- Payments for exports by the foreign sector ✓✓

(Accept any other relevant fact) (Any 2 x 4) (8)

2.5 In your opinion how can the Reserve Bank reduce the deficit on the balance of payments?

- Countries experiencing deficits will borrow money from other countries. That is why developing countries have so much foreign debt ✓✓

- In the event of a fundamental disequilibrium, member countries may borrow from the International Monetary Fund (IMF) ✓✓

- Borrowing is nevertheless not a long-term solution for fundamental balance of payments disequilibrium ✓✓

- South Africa will decrease imports by depreciating the currency. Exports will become cheaper for foreign buyers✓✓

- Increasing interest rates will decrease spending, including on imports ✓✓

- Increasing FDI in the country with the higher interest rate ✓✓

- There are domestic regulations that allow central banks to ration foreign exchange ✓✓

- Those who require foreign exchange have to apply to the central bank ✓✓

(Accept any other relevant response) (Any 4 x 2) (8)

[40]

QUESTION 3: ECONOMIC PURSUITS

3.1.1Name TWO indicators related to foreign trade.

- Terms of trade ✓

- Exchange rate ✓ (2 x 1) (2)

3.1.2 What is the effect of increased investment spending on the economy?

- Expansion in infrastructure development ✓✓

- Increased employment, productivity and production ✓✓

- Increased economic growth ✓✓

(Accept any other relevant answer) (1 x 2) (2)

3.2 Data Response

3.2.1 Which year according to the table above indicates the highest life expectancy without HIV?

2014 ✓ (1)

3.2.2 Which institution is responsible for publishing life expectancy trends in South Africa?

Statistics SA/Stats SA✓ (1)

3.2.3Explain the concept life expectancy.

Life expectancy expresses the number of years a new-born infant will live if the prevailing patterns of mortality remained the same throughout his or her life ✓✓(2)

3.2.4 What impact will HIV/Aids have on productivity levels?

- Low productivity ✓✓

- High levels of absenteeism ✓✓

- High loss of working hours ✓✓

(Accept any other relevant answer) (2)

3.2.5 In your opinion, what brought about the improvement in life expectancy from 53,4 to 61,2 years?

- Community awareness campaigns on the illness ✓✓

- Improved medical services ✓✓

- Improved drugs dealing with the illness ✓✓

- More emphasis of the negative effects of the illness on the education front ✓✓

(Accept any other relevant response) (2 x 2) (4)

3.3 Data Response

3.3.1 What does the abbreviation NDP stand for?

National Development Plan ✓✓ (2)

3.3.2 What is meant by an inclusive economy?

Inclusive means having an integrated approach, all aspects of the economy being considered ✓✓ (2)

3.3.3 Give a reason why it is important to eliminate poverty and reduce inequality in South Africa.

- Redress ✓✓

- To address the legacy of apartheid ✓✓

- To ensure a better standard of living for all ✓✓

- SA need a broad based participation in economic activities ✓✓

(Accept any other relevant answer) (1 x 2) (2)

3.3.4 What impact does the Expanded Public Works Programme have on your local community?

- Community projects are earmarked ✓✓

- Jobs are created while at the same time, community upliftment taking place ✓✓

- Poverty is alleviated ✓✓

- Providing an income for the unemployed ✓✓

(Accept any other relevant argument) (Any 2 x 2) (4)

3.4 Briefly discuss employment as an economic indicator.

- Data relating to employment is an important indicator that is used to determine the success or state of the economy ✓✓

- It indicates the number of workers employed, as well as the total number of people that are unemployed ✓✓

- If the employment rate is compared with the economically active population, the unemployment rate can be determined ✓✓

- It indicates the productivity of labour in the country ✓✓

- E.g. the productivity rate could be used as a useful tool to justify the income per worker ✓

- It relates to the employment rate in various sectors of the economy ✓✓

- Employment indicators can be used by government to formulate the best policies to decrease unemployment and reduce poverty ✓✓

(Accept any other relevant answer) (Any 4 x 2) (8)

3.5 How will the new demarcated Special Economic Zones (SEZs) benefit regional development in South Africa?

- Expand the manufacturing sector ✓✓

- Create jobs ✓✓

- Produce for the export market ✓✓

- Create additional industrial hubs so that the national industry base will be diversified ✓✓

- Investments in the SEZs are based on Public-Private Partnerships (PPP), where the state provides the infrastructure and the private sector sets up business ✓✓

- Various incentive schemes are offered to attract businesses into the SEZs ✓✓

- Reduced tax benefits ✓✓

(Accept any other relevant answer) (Any 4 x 2) (8)

[40]

QUESTION 4: MACROECONOMICS AND ECONOMIC PURSUITS

4.1.1 Name TWO items in the financial account of the balance of payments.

- Direct investments ✓

- Portfolio investments✓

- Other investments✓

- Derivatives✓✓

- Assets ✓ (Any 2 x 1) (2)

4.1.2 What effect does inflation have on the poor?

The poor becomes poorer/The poor will be able to purchase less goods ✓✓

(Accept any other relevant response) (1 x 2) (2)

4.2 Data Response

4.2.1 Which supply curve indicates a decrease in the supply of dollars?

S2S2 ✓ (1)

4.2.2 What type of exchange rate system is currently used in South Africa?

Free floating exchange rate system ✓(1)

4.2.3 Explain the term exchange rate.

It is the price of one currency in terms of another ✓✓ (2)

4.2.4 State one factor that could have led to an increase in the supply of dollars.

- Increase in the number of US tourists visiting South Africa ✓✓

- Increase in imports from SA to the US ✓✓

(Accept any other relevant answer) (2)

4.2.5 Use the above graph to explain the effect of the increase in the supply of US dollars on the R/US$ exchange rate.

US$ - Depreciates ✓

Reason: The supply of dollars increase SS to S1S1 and the equilibrium point move from E to E1

The price for dollars will be fixed at P1 which is lower ✓✓

R - Appreciates ✓

Reason: The demand for rand increase from DD to D1D1 and the equilibrium point from E to E1

The price of rands will be fixed at P1 which is higher ✓✓(2 x 2) (4)

4.3 Data Response

4.3.1 What does the abbreviation MTEF stands for?

Medium Term Expenditure Framework ✓✓ (2)

4.3.2 What is the international benchmark for budget deficits as an percentage of the GDP?

3% ✓✓ (2)

4.3.3 Calculate the budget deficit as a percentage of the GDP (A).

A : 3,0% ✓✓ (2)

4.3.4 In your opinion what can the government do to reduce the budget deficit?

- Government can increase its revenue ✓✓, e.g. increasing taxes/improve on efficiency/more productive labour force ✓

- Government can reduce public sector expenditure ✓✓, e.g. stricter financial procedures/control/appointment of competent employees/training of employees✓

(Accept any other relevant fact) (4)

4.4 Explain how the amplitude and trend line can be used in the forecasting of business cycles.

Amplitude:

The power of the underlying forces – for example interest rates, exports or consumer spending ✓✓

- A large amplitude during upswing demonstrates strong underlying forces ✓✓

- The duration of a cycle with a large amplitude is usually longer than one with a smaller amplitude ✓✓

The extend of change – the larger the amplitude the more extreme the changes that may occur ✓✓

- For example during an upswing unemployment may decrease from 20% to 10% (a decrease of 50%) inflation may increase from 3% to 6% (by 100%) or a surplus on the current account (of the balance of payments) can change from surplus to a deficit ✓✓

Trend line:

- The trend line that rises gradually will be positively sloped in the long run, the rising line indicates a growing economy ✓✓

- The trend indicates the general direction in which indexes that were used in the business cycle move ✓✓

- The trend will change when the time series data change their behaviour patterns of the past ✓✓

- However some forces have to be overcome for that to happen e.g. Resistance points and Channels ✓✓

(Accept any other relevant facts) (Any 2 x 4) (8)

4.5 How can taxation be used to stimulate employment in South Africa?

Individual Income Tax

- Lower taxes effectively increases the disposable income of people✓✓

- This could lead to an increase in the demand for goods and services ✓✓

- Businesses (suppliers) will have to increase their production to compensate for the increased demand ✓✓

- This could lead to job creation ✓✓

Company Tax:

- Lower company tax increase investment possibilities to expand the business ✓✓

- This will create the opportunity to employ more people ✓✓

Taxes on imports:

- Import/custom duties reduce imports ✓✓

- Stimulate local production and create more jobs ✓✓

(Accept any other relevant facts) (Any 4 x 2) (8)

[40]

TOTAL SECTION B: 80

SECTION C

QUESTION 5: MACROECONOMICS

To be internationally competitive, a country needs to have suitable trade policies in place. They have to grow their industries if they want to increase the standard of living.

- Discuss, in detail, the arguments in favour of protectionism. (26 marks)

- In your opinion, how can the government use subsidies to ensure that local industries are protected against unfair competition from abroad? (10 marks)

INTRODUCTION

Protectionism refers to a deliberate policy on the part of the government to erect trade barriers, such as tariffs and quotas, in order to protect domestic industries against international competition. ✓✓

(Accept any other relevant definition) (Max. 2)

BODY

MAIN PART

Arguments in favour of Protectionism:

- Raising revenue for the government✓

- Import tariffs raise revenue for the government ✓✓

- In smaller countries the tax base is often small due to low incomes of individuals and businesses ✓✓

- Low incomes do not provide much in the form of income taxes ✓✓ and therefore custom duties on imports is a significant source of income or revenue ✓✓

- Protecting the whole industrial base ✓

- Maintaining domestic employment ✓✓

- Countries with high unemployment are continuously pressured to stimulate employment creation and therefore resort to protectionism in order to stimulate industrialisation ✓✓

- It is thought that using protectionism the country's citizens will would purchase more domestic products and raise domestic employment ✓✓

- These measures on domestic employment creation at the expense of other countries, led to such measures as 'beggar-my-neighbour' policies ✓✓

- Applying import policies is likely to reduce other countries ability to buy country's exports and may provoke retaliation ✓✓

- Protecting workers ✓

- It is argued that imports from other countries with relatively low wages represent unfair competition ✓✓ and threaten the standard of living of the more highly paid workers of the local industries ✓✓

- Local industries would therefore, be unable to compete because of higher wages pushing up the price levels of goods ✓✓

- Protection is thus necessary to prevent local wage levels from falling ✓✓ or even to prevent local businesses from closing down due to becoming unprofitable ✓✓

- Competition from low-wage countries may also reflect the fact that those countries have a comparative advantage in low-skilled labour-intensive industries ✓✓

- Diversifying the industrial base ✓

- Overtime counties need to develop diversified industries to prevent over-specialisation ✓✓

- A country relying too heavily on the export of one or a few products is very vulnerable ✓✓

- If a developing country's employment and income is dependent on only one or two industries, there is the risk that world fluctuations in prices and demand and supply-side problems could result in significant fluctuations in domestic economic activity ✓✓

- Import restrictions may be imposed on a range of products in order to ensure that a number or domestic industries develop ✓✓

- Develop strategic industries ✓

- Some industries such as the iron-ore and steel, agriculture, (basic foodstuffs, such as maize), energy (fuels) and electronics (communication) among others, are regarded as strategic industries ✓✓ Developing countries a may feel that they need to develop these industries in order to become self-sufficient ✓✓

Protecting specific industries

- Some industries such as the iron-ore and steel, agriculture, (basic foodstuffs, such as maize), energy (fuels) and electronics (communication) among others, are regarded as strategic industries ✓✓ Developing countries a may feel that they need to develop these industries in order to become self-sufficient ✓✓

- Dumping ✓

- Foreign industries may engage in dumping because government subsidies permit them to sell at very low prices ✓✓or because they are seeking to raise profits through price discrimination ✓✓

- The reason for selling products at lower prices may be to dispose of accumulate stocks of the goods ✓✓ and as a result consumers in the importing country stand to benefit ✓✓however, their long term objective may be to drive out domestic producers and gain control of the market ✓✓ and consumers are likely to lose out in the reduction in choice ✓✓ and higher prices that the exporters will be able to charge ✓✓

- Infant industries ✓

- Usually newly established and find it difficult to survive due to their average costs being higher than that of their well-established foreign competitors ✓✓ however, if they are given protection in their early years they may be able to grow and thereby take advantage ✓✓ lower their average costs and become competitive ✓✓ and at this point protection can be removed ✓✓

- Declining industries/sunset industries ✓

- Structural changes in the demand and supply of a good may severely hit an industry ✓✓ such industries should be permitted to go out of business gradually ✓✓ declining industries are likely to be industries that no longer have a comparative advantage ✓✓ and however, if they go out of business quickly there may be a sudden and large increase in unemployment ✓✓

- Protection may enable an industry to decline gradually thereby allowing time for resources including labour to move to other industries ✓✓

- Protecting domestic standards ✓✓ domestic regulations of food safety ✓✓ human rights ✓✓ and environmental standards have been increasingly acting as trade restrictions ✓✓ (Max. 26)

(Accept any other relevant fact)

ADDITIONAL PART

In your opinion, how can the government use subsidies to ensure that local industries are protected against unfair competition from abroad?

South Africa promotes exports through subsidies.

Direct subsidies: Strict screening measures should be put in place when companies apply for financial assistance ✓✓ Government expenditure can provide direct financial support to domestic producers for their exports ✓✓ e.g.

- Cash grants offered to South African exhibitors to exhibit their products at exhibitions overseas. explore new markets ✓

- Foreign trade missions to explore new markets Imposition of tariffs on imports

- Funds for the formation of formal export councils ✓

- Subsidies for training or employing personnel ✓

- Funds for the export market research ✓

- Product registration and foreign patent registrations ✓

Indirect subsidies: Government can refund companies certain taxes to promote exports ✓✓ These types of indirect subsidies are: - General tax rebates (Part of the cost of production can be subtracted from the tax that has been paid) ✓

- Tax concessions on profits earned from exports or on capital invested to produce export goods ✓

- Refunds on import tariffs in the manufacturing process of exported goods, companies often use – custom duties are paid on these goods and the government refunds them ✓ (Max 10)

(Allocate a max of 2 marks for examples)

CONCLUSION

Most countries agree that protectionism is harmful to the economy if not well managed. My opinion is that protectionism in certain areas of importance is needed especially where young industries come into existence ✓✓(Accept any other relevant higher order conclusion (Max 2)

[40]

QUESTION 6: ECONOMIC PURSUITS

Internationally, the main instruments on which growth and development policies are based are called demand and supply-side approaches. The supply-side approach focuses more on microeconomic goals.

- Examine, in detail (without using a graph), the supply-side approach in terms of South Africa's efforts to promote economic growth and development.

(26 marks) - In your opinion, have the RDP and GEAR been successful as growth and development policies? (10 marks)

INTRODUCTION

- Anything that can influence the supply of goods or resources is a supply-side measure

- Supply-side policies focus on supply and its microeconomic components, such as competition and potential output. ✓✓

(Accept any other relevant introduction) (Max. 2)

BODY

MAIN PART

The supply-side explanations are based on the monetarist approach ✓✓ and maintain that government intervention in the economy is only necessary if it improves the smooth operations of markets ✓✓ supply in the economy is fairly fixed particularly in the short term ✓✓ because for the economy to produce more, more workers are needed/more machines need to be built and installed/more electricity needs to be produced/and better roads need to be provided. ✓✓

The South African approach

The South African government uses the supply-side approach complementing or in addition to a demand-side approach ✓✓ Its objective of growth and development ✓✓ higher levels of employment and equity distribution (equity) are embedded in the budget. ✓✓ The Medium Term Expenditure Framework (MTEF) was created to give certainty to the trend ✓✓ and emphasise the real magnitude of the expenditure ✓✓ the aim is to shift the supply curve in the above figure to the right – important focus of growth and development is government's industrial development policy and maintenance ✓✓ upgrading and creation of new infrastructure ✓✓ supply-side policies are also designed to create an environment where businesses and markets can function optimally ✓✓

The effectiveness and efficiency of markets ✓ If businesses accomplish their aims, (profitability and growth), the business is effective ✓✓ In South Africa, government imposes aims on markets by laws, which they are forced to follow ✓✓ and they become effective when they meet these aims together with their own aims which are in fact merged with their own ✓✓

- Effectiveness ✓ Government demands that markets function in a manner that ensures that more black people are absorbed into the mainstream economy because they were previously deliberately disadvantaged ✓✓Two Acts were promulgated to enforce preference for black workers and the businesses of black people✓✓

- The Employment Equity Act ✓ The Act prohibits discrimination and requires that the workforce reflects the racial and gender profile of the population at large ✓✓ enterprises have to file an employment equity plan with the Department of Labour, and inspectors from the department visit business sites to ensure compliance ✓✓

- Broad-Based Black Economic Empowerment Act ✓ The Act provides the legal basis for the transformation of the South African economy ✓✓ it requires redress so that the number of black people who won, manage and control businesses in the country can increase significantly and income inequalities can be decreased substantially ✓✓

- Efficiency ✓ Pareto efficiency means that given the constraints of the effectiveness parameters, it is not possible to change the allocation of resources in such a way that someone is made better off without making someone else worse off ✓✓ it includes productive and allocative efficiency ✓✓

- Competition ✓ Competition in the markets was increased in three ways: by establishing new businesses (small businesses) ✓✓ recruiting Foreign Direct Investment (FDI) ✓✓ and the reduction or removal of import restrictions that hampered competition from abroad ✓✓ in addition the competition regulator network was created to enforce competitive practices among domestic businesses ✓✓ The Competition Act (1998) is aimed at anti-competition practices eliminating the abuse of dominant positions and strengthening merger controls ✓✓ the Act provides for the operation of the Competition Commission, a Competition Tribunal and a Competition Appeal Court and in spite of all these, the Global Competition Index shows that South Africa's competitiveness is slipping by ✓✓

- Deregulation ✓ Private sector causes imbalances that inhibit the free operation of markets have been revised and some were even abolished in the mid-1990s ✓✓ government maintains it is committed to improving the ease of doing business in the country ✓✓ exchange control measures were occasionally relaxed ✓✓

- Business efficiency ✓ Some measures serve as incentives to increase efficiency ✓✓ while others assist in establishing and improving efficiency ✓✓ the end result is greater profitability✓✓

- Taxes✓ the corporate income tax rate is 28% ✓✓ small business pay a lower rate as long as their income is less than the SARS income tax threshold ✓✓ individual income tax starts at 18% and increases slightly as determined by SARS on tax review yearly ✓✓ the effect of tax bracket creeping on personal income tax has been attended to in almost every budget with adjustments to income tax brackets ✓✓ the increase for the individuals was 33% ✓✓ VAT remained the same fixed at 14% ✓✓ the level of taxation in South Africa are reasonable compared to developed countries ✓✓ however, as a developing country, lower tax rates would be helpful to promote economic growth ✓✓

- Capital formation ✓ Depreciation of capital goods used by businesses is designed to encourage investment ✓✓ e.g. new machinery may be depreciated over four years at 40% in the first year/and computers and electronic equipment over three years ✓ government through the DTI and the IDC also promote capital and loans to SMMEs and bigger business ✓✓ and this serve as an incentive to promote business efficiency ✓✓

- Human resources ✓ education receives proportionally a bigger slice of the budget expenditure ✓✓ Sector Education and Training Authorities (SETAs) have to facilitate post-school, work-related training ✓✓ the labour relations Act that came into operation in 1998, promotes economic development, social justice, and peaceful labour relations in the promotion of efficiency ✓✓

- Free advisory services ✓ the development of export markets/managing and running SMMEs/agricultural production/weather forecasts/and prevention and curing of animal diseases ✓

- Cost of doing business ✓ In South Africa government controls most physical infrastructure components ✓✓ the availability and cost of infrastructure services play an important role in the financial viability and profitability of businesses ✓✓

- Transport costs ✓ transport options in air, road, rail and sea are available ✓✓ government controls air and sea transport in South Africa. ✓✓government has committed to improving the efficiency and reliability of its rail transport services and to make it more affordable ✓✓

- Communication costs ✓ communication options are in cable, signal and mail ✓ government controls cable( land or fixed lines) and mail communication services cable communication services in South Africa is one of the most expensive in the world but reasonably efficient ✓ high costs make IT services for businesses and individuals expensive and inhibits global competitiveness ✓✓

- Energy costs ✓ electricity and liquid fuels are the main sources of energy in South Africa ✓✓ Eskom is the only supplier (monopoly) ✓ government regulates the prices for petrol and paraffin ✓✓ the prices for imported crude oil are linked to international market prices, which are high ✓ high liquid energy prices undermine the efficiency of the economy ✓✓ (Max. 26)

ADDITIONAL PART

In your opinion, have the RDP and GEAR been successful as growth and development policies?

Positive response:

- The introduction of the RDP programme shot the economy from negative four per cent (-4%) to about 3% ✓✓

- The housing infrastructure of the majority of the people started to improve ✓✓

- More electrification of the rural communities was put in place ✓✓

- The RDP programme became the original route map for economic growth and development of the country ✓✓

- The GEAR policy improved the economy from a 3% point growth to 6% ✓✓

- The resultant growth in the economy trickled down to more social welfare of the communities ✓✓

- The trade deficit of the country decreased ✓✓

Negative response:

- Unemployment rate kept on going up ✓✓

- Poverty and service delivery were never improved ✓✓

(Accept any other relevant facts) (Max. 10)

CONCLUSION

Policy mix application can best help the government trade off strategies in dealing with the economy ✓✓

(Accept any other relevant higher order conclusion) (Max. 2)

[40]

TOTAL SECTION C: 40

GRAND TOTAL: 150