ECONOMICS PAPER 2 GRADE 12 MEMORANDUM - NSC PAST PAPERS AND MEMOS JUNE 2022

Share via Whatsapp Join our WhatsApp Group Join our Telegram GroupSECTION A (COMPULSORY)

QUESTION 1

1.1 MULTIPLE-CHOICE QUESTIONS

1.1.1 A – perfect ✓✓

1.1.2 C – average ✓✓

1.1.3 D – perfect market ✓✓

1.1.4 C – produce less and ask a higher price ✓✓

1.1.5 A – leadership ✓✓

1.1.6 B – sunk ✓✓

1.1.7 D – price ✓✓

1.1.8 B – electricity ✓ (8 x 2)

(16)

1.2 MATCHING ITEMS

1.2.1 E – Group of producers that operate similarly to a collective monopoly ✓

1.2.2 A – Remain constant irrespective of the level of production ✓

1.2.3 F – Encourages people to buy new products from the same range ✓

1.2.4 H – Reduction in economic welfare caused by a reduction in consumer and producer surplus ✓

1.2.5 B – Interest rate at which the net present value of a project is zero ✓

1.2.6 G – Buyers are charged differently for the same product ✓

1.2.7 C – Smallest individual and independent producing unit ✓

1.2.8 D – Additional benefits that a consumer gets from consuming one more unit of good or service. ✓ (8 x 1)

(8)

1.3 ONE WORD TERM

1.3.1 Long run ✓

1.3.2 Producer subsidy ✓

1.3.3 Production possibilities curve ✓

1.3.4 Profit ✓

1.3.5 Microeconomics ✓

1.3.6 Demand ✓

(6 x 1) (6)

TOTAL SECTION A: 30

SECTION B

Answer any TWO of the three questions from this section in the ANSWER BOOK.

QUESTION 2: MICROECONOMICS

2.1

2.1.1 List any TWO examples of industries that are operating under conditions of perfect competition.

- Stock / security exchange ✓

- Agricultural industries ✓

(Accept any other correct relevant example.) (2 x 1)

(2)

2.1.2 Why does the government sometimes set maximum prices for certain products?

- Governments often set maximum prices with the intention to protect consumers against exploitation. ✓✓ (2)

2.2 DATA RESPONSE

2.2.1 Identify the quantity at which total revenue is maximised.

Quantity 4 ✓ (1)

2.2.2 Which revenue curve represents a demand curve in an imperfect competitive firm?

AR / Average revenue ✓ (1)

2.2.3 Briefly describe the concept marginal revenue.

The extra revenue the seller earns when it produces and sells one more unit of product. ✓✓

(Accept any other correct relevant response.) (2)

2.2.4 Briefly explain the significance of economies of scale.

- When more units of a good or service can be produced on a larger scale, yet with few inputs costs economies of scale are said to be achieved. ✓✓

- As a company grows and production units increase a company will have a better chance to decrease costs. ✓✓

- If a firm is already enjoying economies of scale, it becomes difficult for another firm with higher operating costs to compete with it. ✓✓

(Accept any other correct relevant response.) (Any 1 x 2) (2)

2.2.5 Why is the marginal revenue curve below the average revenue curve?

- To increase the quantity sold, the firm must lower the price, therefore for each extra unit sold revenue earned decreases. ✓✓

It is because of the inverse relationship between price and quantity demanded. ✓✓

(Accept any other correct relevant response.) (2 x 2) (4)

2.3 DATA RESPONSE

2.3.1 What is the number of sellers in a perfectly competitive market?

Large number ✓ (1)

2.3.2 What is a market structure that is dominated by two firms?

Duopoly ✓ (1)

2.3.3 Briefly describe the concept production.

- Production is the creation of goods and services. ✓✓

- Transformation of raw material to finished goods. ✓✓

(Accept any other correct relevant response.) (Any 1 x 2) (2)

2.3.4 How can non-price competition act as a barrier to entry in an oligopoly?

- Non-price competition increases the cost of production and therefore makes it more expensive for new firms to enter the industry. ✓✓

(Accept any other correct relevant response.) (2)

2.3.5 Why do societies allow oligopoly firms to use their market power to make economic profit?

- Oligopoly firms use some of their economic profits to develop new products ✓✓

- Consumers like the choice that results from product proliferation and differentiation ✓✓

- As a result, they would rather pay higher prices than consume identical products ✓✓

(Accept any other correct relevant response.) (Any 2 x 2)

(4)

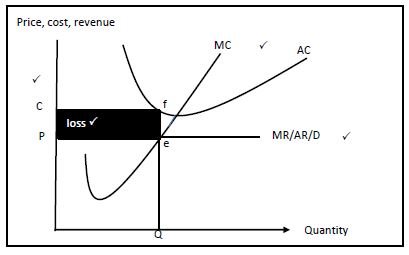

2.4 With the aid of a graph, explain the economic loss of a firm in a perfectly competitive market.

Mark allocation

Revenue curves correctly positioned and labelled = 1

Cost curves correctly positioned and labelled = 1

Economic loss area correctly positioned and labelled = 1

Axis correctly positioned and labelled = 1

Maximum = 4

- Loss is minimised at point ‘e’ where MC=MR, ✓

- The loss minimising output is Q, while price is P and average cost is C ✓

- Average cost is above/greater than average revenue ✓and the firm makes a loss, at area CPef ✓ (Max. 4)

(8)

2.5 Evaluate the economic benefits and drawbacks of an increase in the national minimum wage.

Benefits

- Higher wages increase incomes and are likely to cause higher consumer spending. ✓✓

- An increase will enable people who are the minimum wage earners an opportunity to improve their standard of living /keep up with price

inflation. ✓✓ - Increased wages and spending increases demand and create more jobs.✓✓

- Lower unemployment and higher wages increase tax revenues. ✓✓

- When workers earn higher wages, they rely less on governmental safety net programs ✓✓ (Max. 4)

Drawbacks

- An increase in the minimum wage will increase the wage bill/firms costs/production costs, as they will have to pay their employees more. ✓✓

- Firms will therefore increase their selling price to ensure profitability/

survival. ✓✓ - Increasing the minimum wage can however lead to unemployment and this could increase poverty levels. ✓✓

- In labour-intensive industries, e.g. agriculture/mining where labour is a significant cost factor, an increase in national minimum wage will definitely increase their costs and reduce profitability/competitiveness ✓✓ (Max. 4)

(Accept any other correct relevant response.) (4 + 4) (8)

[40]

QUESTION 3: MICROECONOMICS

3.1

3.1.1 Name the TWO segments of the kinked demand curve.

- elastic ✓

- inelastic ✓ (2 x 1) (2)

3.1.2 Why is collusion not relevant in a perfect market?

- There are many small businesses who act independently. ✓✓

(Accept any other correct relevant response.) (2)

3.2 DATA RESPONSE

3.2.1 What is the formula for cost benefit ratio?

- Total benefit ÷ total cost ✓ (1)

3.2.2 According to the information given above, which project should be chosen?

- Project 2 ✓ (1)

3.2.3 Briefly describe the concept cost-benefit analysis.

- Cost-benefit analysis is a technique for enumerating and evaluating the total social cost and total social benefits associated with an economic project. ✓✓

- An analysis done by the government which weighs the costs and benefits of a project to determine whether it should be carried out. ✓✓

(Accept any other correct relevant response.) (Any 1 x 2) (2)

3.2.4 For what purpose does the government set maximum price?

- The government set a maximum price below the market price to make goods more affordable. ✓✓

- To allow the poor greater access to certain goods and services. ✓✓

- (Accept any other correct relevant response.) (Any 1 x 2)

(2)

3.2.5 Why does the government sometimes carry on with the project even if the private costs are more than the private benefits?

- A service is vital to the existence of the community. ✓✓

- When a need for infrastructure is necessary but might not have any benefits in terms of profit, e.g., the building of a community centre or a bridge ✓✓

- Funding of these projects are mainly financed through tax revenue and does not impoverish any individual as such. ✓✓

- This infrastructure adds to the welfare of the community at large and is non-excludable to anyone using it. ✓✓

(Accept any other correct relevant response) (Any 2 x 2) (4)

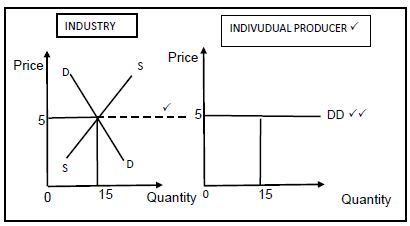

3.3 DATA RESPONSE

3.3.1 Which market structure is represented by the graph above?

Perfect market ✓ (1)

3.3.2 Provide the correct label, (in full), for 3.3.2 in the above-mentioned graph.

Equilibrium point ✓ (1)

3.3.3 Briefly describe the term industry.

Industry is a group of enterprises producing the same kind of products. ✓✓ (2)

3.3.4 Explain the implication of a price-taker.

A price-taker does not determine its own price but takes the price determined by the market and can only change the price if the market changes it. ✓✓

(Accept any other correct relevant response.) (2)

3.3.5 Using the graph above, derive a demand curve of an individual producer. (4)

3.4 Distinguish, without using graphs, between productive and allocative inefficiency.

Productive inefficiency

- The business does not produce at the lowest possible cost. ✓✓

- Resources are not used appropriately to produce the maximum number of goods. ✓✓

- There is room to reduce cost without producing fewer goods or without producing lower quality goods. ✓✓ (Max. 4)

Allocative inefficiency

- When resources are not allocated in the right proportions and the product mix does not meet the consumers' tastes. ✓✓

- Some goods might be oversupplied, while other goods might be under-supplied. ✓✓ (Max. 4)

(Allocate a maximum of 4 marks for mere listing of facts/examples.)

(Accept any other correct relevant response.) (8)

3.5 Examine the consequences of an increase in the demand for a firm’s products in a perfect competitive market.

- An increase in demand for the product will lead to a shortage of the

product ✓which will cause the price to increase ✓ - Firms will increase their production in the short term by employing more labour while making economic profit ✓✓

- Other firms are then attracted to enter the market in the longer term. ✓✓

- Because there are no barriers to entry into the market; they can produce at the same average cost ✓✓

- This will then cause an increase in supply ✓✓

- The price starts to drop and continue to do so until firms are only making a normal profit. ✓✓

(Accept any other correct relevant response.) (Any 4 x 2) (8)

[40]

QUESTION 4: MICROECONOMICS

4.1

4.1.1

Name TWO market structures that sell homogenous products.

- Perfect competition ✓

- Oligopoly ✓ (2 x 1) (2)

4.1.2 What would happen if firms in an oligopolistic market compete in prices?

- It can lead to a price war which will lower profits which might lead to certain firms leaving the market in the long run. ✓✓

(Accept any other correct relevant response.) (1 x 2) (2)

4.2 DATA RESPONSE

4.2.1 Give ONE example of an explicit cost.

- Wages ✓

- Rent ✓

- Material ✓

(Accept any other correct relevant response.) (Any 1 x 1) (1)

4.2.2 Provide a correct economic term for zero profit.

- Normal profit ✓ (1)

4.2.3 Briefly describe the concept implicit costs.

- The opportunity cost to the owners of the firm for using the factors of production they own to produce output. ✓✓

- Implicit costs are those opportunity costs that are not reflected in monetary payments. ✓✓

- It includes the costs of self-owned or self-employed resources, for an economist the use of these resources is not free. ✓✓

(Accept any other correct relevant response.) (Any 1 x 2)

(2)

4.2.4 How is total revenue determined?

- Total revenue is the full amount of total sales of goods and

services. ✓✓ It is calculated by multiplying the total amount of goods and services sold by the price of the goods and services. ✓✓

(2)

4.2.5 Use the information above to calculate economic profit. Show ALL calculations.

- Economic profit = total revenue – (explicit + implicit cost) ✓

= 1 000 – (100 + 75) ✓

= 825 ✓✓

(4)

4.3 DATA RESPONSE

4.3.1 Identify from the extract ONE objective of the Competition policy.

- To regulate the formation of mergers and acquisition ✓ (1)

4.3.2 Give ONE authority/institution of the Competition policy not mentioned in the extract.

- Competition Appeal Court ✓ (1)

4.3.3 Briefly describe the concept competition as used in economics.

- Competition is rivalry among sellers where each seller tries to increase sales, profits and market share by varying the marketing mix of price, product, distribution and promotion. ✓✓

(Accept any correct relevant response.)

(2)

4.3.4 How does the competition policy save businesses in South Africa?

- By preventing the formation of large businesses that have too much market power ✓✓

- By making it easier for new competing businesses to start up ✓✓

- Saving potential as well as existing businesses ✓✓

(Accept any other correct relevant response.)

(2)

4.3.5 Why is the petrol market in South Africa regarded as an example of an oligopoly?

- There are only a few firms in the South African petrol market and the market/market share is dominated by only a few. ✓✓

- There are significant barriers to starting fuel station/petrol company, e.g., substantial amounts of capital ✓✓

- While there is a lot of information available for the different petrol companies, it remains incomplete. ✓✓

- Petrol, as a product, may be regarded as homogeneous. ✓✓

- The quality of service, different types of fuel and different add-ons e.g., loyalty schemes, supermarkets, access to ATMs makes it more likely to be heterogeneous ✓✓

(Accept any other correct relevant response.) (Any 2 x 2)

(4)

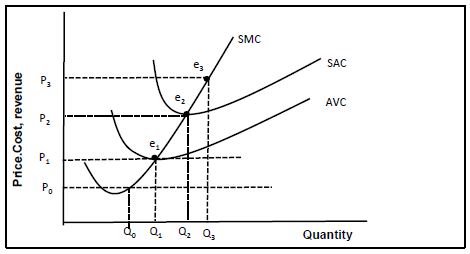

4.4 Use the graph below to explain how the supply curve of a firm in a perfect competitive market is derived.

- At P0 the business will not be covering its variable costs, then it will be better for it to close down ✓✓

- As the market price increases to P1 the horizontal demand curve of the business shifts upwards, at e1 the price P1 is equal to the AVC ✓✓

- At this point the firm can cover its variable costs ✓✓

- Given the slope of the MC curve , each higher demand curve intersect the MC curve at a point that lies to the right of the previous point of intersection, e1 , e2 and e3 ✓✓

- Points e1 , e2 and e3 plot the firm’s supply curve at different prices ✓✓

- In the perfect market, the supply curve is represented by the part of the MC curve that is above the AC curve. ✓✓

(Accept any other correct relevant explanation.)

(8)

4.5 How does collusion negatively impact the economy?

Collusion will impact the economy negatively by:

- reducing competitiveness in the long run by decreasing the GDP and employment ✓✓

- allowing price fixing, market sharing and output control by cartels and price leadership ✓✓

- creating scarcity in order to increase prices while also protecting inefficient suppliers ✓✓

- forcing community, consumers, businesses and even governments to pay higher prices for goods and services ✓✓

- distorting economic markets and slowing down innovation because there is little incentive to spend money on research and development ✓✓

(Accept any other correct relevant response.)

(8)

[40]

TOTAL SECTION B: 80

SECTION C

Answer ONE of the two questions from this section in the ANSWER BOOK.

QUESTION 5: MICROECONOMICS

- Compare and contrast in detail, without graphs, monopolistic competition, and monopoly market structures. (26 marks)

- Why would government support or licence monopolies? (10 marks)

INTRODUCTION

Any market that does not have all characteristics of perfect markets is called an imperfect market. This is also the case with monopolies and monopolistic markets✓✓

(Accept any other relevant low order introduction.)

(2)

MAIN PART

| CHARACTERISTICS | MONOPOLY | MONOPOLISTIC |

| Number of firms in an industry ✓ | A single supplier or firm ✓ e.g. Eskom. ✓ There is no competition, one business in the market controls the supply of the goods and services. ✓✓ | A large number of firms or suppliers ✓e.g. KFC, Nandos and Tagos. ✓ There is an element of competition ✓✓ |

| Nature of the product ✓ | A unique product is produced. ✓ There are no close substitutes ✓✓ The product cannot be easily replaced ✓✓ Consumers have no choice in price and quality of the product ✓✓ | Differentiated products ✓ Products are similar but not identical.✓✓ They are similar in that they satisfy the same need of the consumer. ✓✓ There may be differences in packaging but the product is the same. ✓✓ |

| Freedom to enter and exit the market ✓ | There are barriers to entry ✓ Entry into the market is completely blocked ✓✓ The barriers are caused by patents and other forms of intellectual property rights ✓✓ | Easy entry into the market. ✓ There is complete freedom of entry and exit into the market ✓✓ |

| Slope of the demand curve ✓ | Downward sloping demand curve for the firm ✓ and the same curve for the industry ✓✓ it is also inelastic. ✓✓ | Downward sloping demand curve for the industry, ✓ and elastic ✓✓ |

| Control over price ✓ | The firm is a price-maker ✓ The monopolist is able to influence the market through changing the quantities it supplies to the market ✓✓ | Firms have little control over the price✓ Each business sells at its own price ✓✓ since a single price cannot be determined for the differentiated product ✓✓ |

| Relative market share ✓ | Total market belongs to one firm ✓✓ | Relatively small share of the total market ✓✓ |

| Information ✓ | There is perfect knowledge, information is complete ✓✓ | Information is incomplete ✓✓ |

| (Max. 13) | (Max. 13) |

(Allocate a maximum of 8 marks for mere listing and examples)

(Candidates may not use a table in presenting their responses)

(Accept any other correct relevant response)

(26)

ADDITIONAL PART

Why would government support or license monopolies?

- To protect the intellectual skill and right of the producer. ✓✓

- Some products are very dangerous for many companies producing or providing the service, there needs to be a level of accountability. ✓✓

- To motivate the producer to continue with the skill, grow the company and employ more people ✓✓

- From the economic profits made, government to get more revenue in terms tax. ✓✓

- To be able to monitor the company especially if it provides an essential service like electricity, i.e., price, provision of electricity to all, e.g., in rural areas and the consistency in doing that. ✓✓

(Accept any other relevant and correct higher order explanations.) (Max. 10)

(A maximum of 2 marks will be allocated for a mere listing of facts.)

(10)

CONCLUSION

Both market structures tend to be inefficient because imperfect markets fail to allocate resources efficiently. ✓✓

(Accept any other relevant higher order conclusion.) (Max. 2)

(2)

[40]

QUESTION 6: MICROECONOMICS

- Discuss in detail, without graphs, causes of market failure. (26 marks)

- Evaluate the use of indirect taxation to solve market failure. (10 marks)

INTRODUCTION

Market failure occurs when market forces of demand and supply do not ensure the correct quantity of goods and services are produced to meet demand at the right price. ✓✓

(Accept any other relevant low-order introduction.) (2)

Externalities ✓

- These are known as spill-over effects to third party which is not directly involved in the production process. ✓✓

- As externalities in production and consumption often exist and output is usually based on private costs and benefits, this is a significant cause of market failure.

Negative externalities ✓

- Negative externalities are costs to third parties that are not included in the market price ✓✓e.g. pollution. ✓✓

- The costs of negative externalities such as ill health are not paid by the producers. ✓✓

- Harmful, these goods are often over produced in the economy which is not socially desirable. ✓✓

Positive Externalities ✓

- A positive externality occurs when there is a benefit to a third party from the action or decision of another party. ✓✓e.g., education ✓

- These goods are often under-produced by the market and government steps in to provide for the short-fall. ✓✓

Public goods/Missing markets ✓

- Can only form under certain conditions and when these conditions are absent markets struggle to exist. ✓✓

- Public goods are not provided for by market mechanism because producers cannot withhold the goods for non-payment and since there is often no way of measuring how much a person consumes, there is no basis to establish a market price. ✓✓

- Markets measuring how much a person consumes, there is no basis for establishing a market price for lightning, flood control, storm water drainage and lighthouses. ✓✓

- Collective goods: these are goods and services such as parks, beaches and beach facilities, streets, pavements, roads, bridges, public transport, sewerages systems, waste removals, water reticulation and refuse removals. ✓✓

- Community goods: these are goods such as defence, police services, prison services, streetlights: these are goods and services such as parks, beaches and beach facilities, streets, pavements, roads, bridges, public transport, sewerages systems, waste removals, water reticulation and refuse removals. ✓✓

Merit goods and demerit goods: ✓✓

- Merit goods: Some goods are highly desirable for the general welfare of the people of the country and are often not highly rated by the market. ✓✓

- If people have to pay market prices for them, relatively little would be consumed. ✓✓

- Demerit goods: Items such as cigarettes, alcohol and non-prescriptive drugs are examples of demerit goods. ✓

- In a free market economy, these goods are over-consumed. ✓✓

- Government can ban their consumption or reduce it by means of taxation such as excise duties ✓✓and by providing information about their harmful side effects. ✓✓

Imperfect competition ✓

- In market economies, competition is often impaired by power. ✓✓

- Power often lies to a greater extent with producers than with consumers. ✓✓

- Most businesses operate under conditions of imperfect competition that allow producers to restrict output, increase prices and produce where price exceeds marginal cost. ✓✓

Lack of information ✓

- Consumers, workers and entrepreneurs do not always have the necessary information at their disposal to make rational decisions. ✓✓

- Consumers: Although advances in technology increase the amount of information to which people have access, they obviously do not have perfect information. ✓✓

- Workers: They may be unaware of job opportunities outside their current employment. ✓✓

- Entrepreneurs: They may lack information about the costs, availability and productivity of some factors of production, and may be operating on the basis of incorrect information. ✓✓

Immobility of the factors of production ✓

- Most markets do not adjust rapidly to changes in supply and demand. ✓✓

- Labour: may take time to move into new occupations and geographically to meet the changes in consumer demand. ✓✓

- Physical capital: Factory buildings and infrastructure such as telephone lines, bridges, rail links and airports are not moveable at will. ✓✓

- This capital last for many years but cannot be moved to fit change in demand. ✓✓

- Technological applications change production methods: Technology used in the production may change such as the use of robots rather than labour in mines. ✓

- It takes time for most industries to adapt – with greater technologicalchanges ✓✓

- Workers need to be flexible, upskilled and be able to change employment, as well as work patterns. ✓✓

Imperfect distribution of income and wealth: ✓

- The most important shortcoming of market systems is that it is neutral in the issue of income distribution. ✓✓

- If the initial distribution is unequal, the final distribution will be too. ✓✓

- For this reason, it is often argued that the market fails. ✓✓

(Accept any other correct relevant response.) (Max. 26)

(26)

ADDITIONAL PART

Indirect taxation is the imposition of a tax on goods and services rather than on income or profits (i.e., direct taxation). ✓✓

Indirect taxes are associated with market failure to ‘internalise the externalities’ of consumption or production. ✓✓

Positive

- They are used to raise revenue for government to provide public and merit goods and to redistribute income. ✓✓

- Governments use indirect taxes to reduce sales of goods that are harmful and have consumption externalities such as tobacco and alcohol, that is demerit goods. ✓✓

- Revenue raised can be used to redistribute income through the welfare state, or provide infrastructure ✓✓

Negative

- Indirect taxes can also lead to unintended consequences that produce more inefficient outcomes, for example, a tax on cigarettes may see consumers switch to smoking illegal and more harmful substitute

- Consumers may also try to avoid a tax, which results in a rise in black markets that require extra policing (e.g., cigarette smuggling).

(Accept any other correct relevant response)

(10)

CONCLUSION

- The government is trying to safeguard the interests of the community and improve the efficiency in markets but there is still more to be done ✓✓

(Accept any relevant high order conclusion.)

(2)

[40]

TOTAL SECTION C: 40

GRAND TOTAL: 150