MATHEMATICAL LITERACY PAPER 1 GRADE 12 QUESTIONS - NSC PAST PAPERS AND MEMOS NOVEMBER 2021

Share via Whatsapp Join our WhatsApp Group Join our Telegram GroupMATHEMATICAL LITERACY PAPER 1

GRADE 12

NSC EXAMINATIONS

NOVEMBER 2021

QUESTION 1

1.1 TABLE 1 below shows the fuel price in US dollars) in six African countries on 05/06/2019 and 01/03/2021 with the exchange rate per currency on 01/03/2021.

TABLE 1: FUEL PRICE (IN US DOLLARS) IN SIX AFRICAN COUNTRIES

| COUNTRY | FUEL PRICE IN US$ | CURRENT DOLLAR EXCHANGE RATE/CURRENCY ON 01/03/2021 | |

| 05/06/2019 | 01/03/2021 | ||

| South Africa | 1,04 | 1,061 | R15,36 |

| Angola | 0,47 | 0,254 | 626,41 Angolan Kwanzas |

| Zimbabwe | 0.80 | 1,258 | $1,258 |

| Namibia | 10.88 | 0,796 | 15,36 Namibian dollars |

| Swaziland | 0.86 | 0.87 | 15,35 Swazi emalangeni |

| Botswana | 0,84 | 0,732 | 11,14 Botswana pulas |

Use TABLE 1 to answer the questions that follow.

1.1.1 Calculate the fuel price increase for Zimbabwe from 05/06/2019 to 01/03/2021.

1.1.2 Write down the current exchange rate of the Botswana pula to the US dollar in the following format:

1 Botswana pula = ... US dollars

1.1.3 Identify the countries which showed a decrease in the fuel price from 05/06/2019 to 01/03/2021.

1.1.4 Arrange, in descending order, the fuel price in US$ for 01/03/21.

(23)

1.1.5 The probability of randomly selecting a country that is not South Africa

Write this probability in decimal form rounded to THREE decimal places.(2)

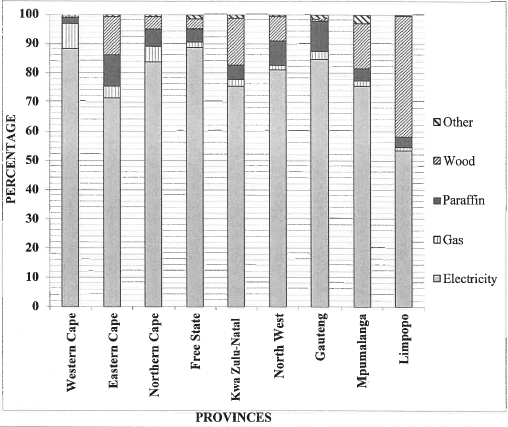

1.2 The graph below indicates the energy sources used for cooking in different provinces.

DIFFERENT ENERGY SOURCES USED FOR COOKING Use the graph above to answer the questions that follow.

Use the graph above to answer the questions that follow.

1.2.1 Identify the source of energy that is mostly used for cooking,

1.2.2 Name the province that uses the most wood for cooking.

1.2.3 The price of paraffin fluctuates. On 3 February 2021 the price was 764,59 c/e.

- Write down (in rand) the cost of ONE litre of paraffin.

- Determine, to the nearest rand, the cost of 12,5 l of paraffin.

1.2.4 Name another form of energy that could be used for cooking which could fall under the 'Other' category.

1.3 The following questions were taken from a company's information sheet:

- How many hours per day do you spend reading?

- How many books have you read in the last 16 weeks?

- How many books have you bought in the last 3 months?

- Were the books you bought hard copies or soft copies?

- Do you believe that we should pay 15% VAT on book prices?

Study the information above and answer the questions that follow

1.3.1 Identify the data collection instrument that was used to collect the above information.

1.3.2 Name the next step in the data cycle after the instrument has been completed and collected.

1.3.3 State whether the choices given for question D represent categorical or numerical data.

1.3.4 Write the acronym VAT in full.

1.3.5 Give an example of a business that will find the above data useful

QUESTION 2

2.1 Mrs Smith would like to buy a car but does not have the full cash amount. She downloaded TWO payment options for TWO different cars as shown in TABLE 2 below.

TABLE 2: PAYMENT OPTIONS FOR TWO DIFFERENT CARS

| ITEM | FORD FIGO | VW POLO |

| Retail price/Cash price(including VAT) | R215 100 | R220 300 |

| Deposit | 5% | 0% |

| Monthly instalment | R2 999,00 | R3 345,00 |

| Residual value | 30% | R116 759 |

| Monthly admin fee (not included in monthly instalment) | R69,00 | 2,08% of the monthly instalment |

| Term agreement | 72 months | 48 months |

| VAT | 15% | 15% |

Use TABLE 2 above to answer the questions that follow.

2.1.1 State what type of payment option is shown in TABLE 2.

2.1.2 Calculate the deposit amount for the Ford Figo.

2.1.3 Write down in simplified form) the ratio of the term agreement of the Ford Figo to theVW Polo.

2.1.4 Which ONE of the two vehicles will be more cost effective in terms of monthly budget?

2.1.5 Calculate the total cost of the VW Polo if the monthly instalment remained the same throughout the contract period, except for the final payment You may use the following formula: Total cost -Total value of monthly instalments + admin fees + residual value

2.1.6 Mrs Smith invested R60 000 at a bank for two years with compound interest. In the first year she received an interest rate of 4,3% per annum while in the second year the interest rate was 5,1% per annum. Mrs Smith stated that she would have enough money at the end of the second year to pay the residual value of the Ford Figo. Verify, showing ALL calculations, whether her statement is CORRECT. (8)

2.2 ANNEXURE A Shows an invoice of the cellphone contracts taken out by Mr Fortune.

Use ANNEXURE A to answer the questions that follow.

2.2.1 State the number of cellphone contracts shown on this invoice.

2.2.2 Name the cellphone contract which shows the most expensive device.

2.2.3 Show how the VAT amount of R142,95 was calculated.

2.2.4 Calculate the missing value A.

2.2.5 State, in words, the probability of randomly selecting a cellphone contract that is not from ABC.

QUESTION 3

3.1 South Africa is in the middle of a potentially wet season as heavy rainfalls continue to fall over large parts of the country, thus improving the country's water situation

TABLE 3 shows the full storage capacity and dam levels as a percentage of the full storage capacity in different provinces in South Africa on 5 April 2021. The damlevel readings are taken on the same day each week.

TABLE 3: DAM LEVELS IN DIFFERENT PROVINCES ON 5 APRIL 2021

| PROVINCE | NET FSC (MILLION m3) | THIS WEEK(%) | LAST WEEK(%) | LAST YEAR(%) |

| Eastern Cape | 1823 | 55 | D | 56 |

| Free State | 15657 | 100 | 99 | 77 |

| Gauteng | 128 | 100 | 101 | 101 |

| KwaZulu-Natal | 4784 | 73 | 73 | 61 |

| Limpopo | 1480 | 88 | 88 | 70 |

| Mpumalanga | 2539 | 89 | 89 | 75 |

| North West | 867 | 82 | 82 | 71 |

| Northern Cape | 147 | 102 | 105 | 95 |

| Western Cape | 1866 | 52 | D | 40 |

Net FSC (million mb) = net full storage capacity in million cubic metres

Use TABLE 3 to answer the questions that follow.

3.1.1 Determine the date on which the reading of the dam level was taken last week.

3.1.2 Write down, in words, the actual value of the net FSC for Gauteng,

3.1.3 Identify the province with the third lowest dam level percentage for last year.

3.1.4 Determine which province had the highest percentage increase in dam levels from last year to this week.

3.1.5 Calculate the missing value D if the mean percentage storage capacity for last week was 83%.

3.1.6 Determine, as a fraction, the probability of randomly selecting a province with dam levels exceeding 100%, for both this week and last week.

3.1.7 Calculate (in m3) the actual net FSC of Free State for last week.

3.2 In an average middle-class household in South Africa a 10-minute shower costs almost R13 (or R1,30/min) if you have a normal 15 litre/min shower head. By changing to a low-flow shower head and reducing shower time to 6 minutes, you can reduce this to R4,20 per shower (or 70c/min).

The graph on ANNEXURE B shows more detailed information on water and energy use per shower for a normal shower head and a low-flow shower head.

| GLOSSARY | SKETCH OF LOW-FLOW SHOWER HEAD | PICTURE OF A NORMAL SHOWER HEAD |

| A low-flow shower head reduces the rate of water flow. |  |  |

Use ANNEXURE B and the above information to answer the questions that follow.

3.2.1 A four-minute shower uses 1,7 kWh of energy. A ten-minute shower uses 4,3 kWh of energy.

Calculate the percentage increase in kWh of energy used when taking a 4-minute shower compared to taking a 10-minute shower.

You may use the following formula:

Percentage increase = kWh used for 10 min-kWh used for 4 min x 100%

kWh used for 4 min

3.2.2 Give ONE possible reason why you would advise someone to use a low-flow shower head rather than a normal shower head.

3.2.3 Calculate the range of the number of litres of water used during a 2-minute shower and an 8-minute shower using a normal shower head.

QUESTION 4

4.1 Bobby lives in India and wants to start his own take-away business. His speciality is chicken biryani. All his ingredients will be bought in bulk.

Bobby intends selling a plate of chicken biryani for eighty rupees (Rs80).

TABLE 4 shows the estimated cost of ingredients used to make 8 plates of chicken biryani.

TABLE 4: ESTIMATED COST (IN Rs) OF INGREDIENTS

USED TO MAKE 8 PLATES OF BIRYANI

| PRODUCT | COST( IN Rs) |

| 1 kg chicken | 200 |

| 1 kg basmati rice | 120 |

| Masala powder | 10 |

| Other ingredients | 62 |

Each plate of biryani will be packed in a disposable food container that costs Rs2,43 each.

| GLOSSARY | PICTURE OF A PLATE OF BIRYANI |

| Biryani is a mixed rice dish made with spices, rice and meat |  |

Use TABLE 4 and the information above to answer the questions that follow.

4.1.1 Determine (in Rs) the price of 520 g of chicken,

4.1.2 Calculate the total cost to make and package a plate of chicken biryani. (5)

4.1.3 Bobby claims that he can make more than 50% profit on one plate of chicken biryani.

Verify, by showing ALL calculations, if his claim is valid.

4.1.4 The exchange rate between South African rands and Indian rupees on 3 March 2021 is given in TABLE 5 below:

TABLE 5: EXCHANGE RATE

| SOUTH AFRICAN RAND (ZAR) | INDIAN RUPEES (Rs) |

| 1 | 4,8346707 |

| 0,206839 | 1 |

Determine (in ZAR) the price of masala powder.

4.2 Bobby got the idea of selling biryani from his niece Janet who has her own takeaway business in South Africa.

Janet's variable cost to make one plate of chicken biryani is R13,00. Her fixed cost amounts to R600.

Use the information above to answer the questions that follow.

4.2.1 Janet uses the equation below to calculate her total cost:

Total cost-R600,00 + 13 p, where p = number of plates.

Use the equation to determine the number of plates sold if the total cost was R1 380,00

4.2.2 TABLE 6 below shows Janet's total cost and income from selling different numbers of plates of biryani.

TABLE 6: INCOME AND COST OF SELLING DIFFERENT NUMBERS OF PLATES OF BIRYANI

| NUMBER OF PLATES | 0 | 10 | 30 | 50 | 70 | 90 | 100 |

| INCOME (R) | 0 | 250 | 750 | 1250 | 1750 | 2250 | 2500 |

| COST (R) | 600 | 730 | 990 | 1250 | 1510 | 1770 | 1900 |

The income graph has already been drawn on the attached ANSWER SHEET

Use TABLE 6 and the same grid on the ANSWER SHEET to draw another line graph representing the cost of different numbers of plates of biryani.

4.2.3 Determine the minimum number of plates of biryani that Janet must sell before she starts making a profit.

4.3 Tourism in India is important for the country's economy and it is growing rapidly.

The Travel and Tourism Competitiveness Report 2019 has ranked India 34th out of 140 countries overall,

ANNEXURE C indicates the number of tourist arrivals in India as well as the countries of origin of these tourist arrivals.

Use ANNEXURE C to answer the questions that follow.

4.3.1 Write down, as a decimal, the probability of selecting a tourist that comes from 'Other countries.

4.3.2 State the trend in the number of tourist arrivals in India from 2015 to 2019. (2)

4.3.3 For 2019 the total number of tourist arrivals in India was 10,93 million

Bobby states that more than 4 500 000 tourists who visited India in 2019 came from Bangladesh.

Verify, showing ALL calculations, whether his statement is CORRECT. (4)

4.3.4 The pie chart shows the total percentage of tourist arrivals in India for 2019 as 99,8%.

Give a valid reason why this value is not 100%.

QUESTION 5

5.1 Marius, who is 64 years old, earned an annual taxable income of R551 762,00 for the 2019/20 tax year. During the 2019/20 tax year Marius was not a member of any medical fund.

TABLE 7 below shows the tax table for the 2019/20 tax year.

TABLE 7: TAX RATES FOR 2019/20 TAX YEAR (1 Mar. 2019 to 28 Feb. 2020)

| TAX BRACKET | TAXABLE INCOME (R) | RATES OF TAX (R) |

| 1 | 1-195 850 | 18% of taxable income |

| 2 | 195 851-305 850 | 35 253 +26% of taxable income above 195 850 |

| 3 | 305 851-423 300 | 63 853 +31% of taxable income above 305 850 |

| 4 | 423 301-555 600 | 100 263 + 36% of taxable income above 423 300 |

| 5 | 555 601-708 | 310 147 891 +39% of taxable income above 555 600 |

| 6 | 708 311-1 500 00 | 207 448 + 41% of taxable income above 708 310 |

| 7 | 1 500 001 and above | 532 041 +45% of taxable income above 1 500 00 |

TABLE 8 below shows the tax rebates and medical credits for the 2019/20 tax year.

TABLE 8: TAX REBATES AND MEDICAL AID CREDITS FOR THE 2019/20 TAX YEAR

| TAX REBATE | |

| Primary | R14 220 |

| Secondary (65 and older) | R7 794 |

| Tertiary (75 and older) | R2 601 |

| MEDICAL CREDITS PER MONTH FOR MEDICAL FUND MEMBERS | |

| Main member | R310 |

| First dependent | R310 |

| Each additional dependent | R209 |

Use TABLE 7 and TABLE 8 above to answer the questions that follow

5.1.1 Identify which tax bracket Marius falls in, based on his taxable income.

5.1.2 Calculate the amount of tax Marius must pay for the 2019/20 tax year.

5.1.3 Marius stated that if he had been one year older, he would have saved more than R600 monthly on taxes paid during the 2019/20 tax year. Verify, showing ALL calculations whether his statement is CORRECT.

5.1.4 Marius is considering joining a medical fund. He plans to include his wife and two grandchildren.

Determine the total monthly medical credits he would qualify for if he joined a medical fund.

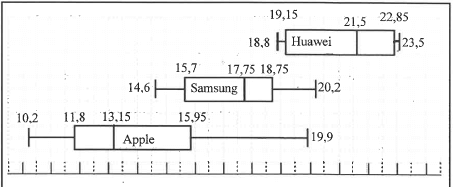

5.2 Marius wants to buy a new laptop. He studied the available data for the three most popular brands of laptops sold in South Africa.

The box and whisker plots below show in percentages) the spread of the market share of the Samsung, Apple and Huawei laptop brands from the fourth quarter in 2019 to the third quarter in 2020.

BOX-AND-WHISKER PLOTS SHOWING MARKET SHARE OF THREE LAPTOP BRANDS MARKET SHARES IN PERCENTAGES

MARKET SHARES IN PERCENTAGES

Use the box and whisker plots above to answer the questions that follow.

5.2.1

- Write down the name of the most popular laptop brand.

- Hence, write down the 50th percentile of the brand identified in QUESTION 5.2.1(a).

5.2.2 Calculate the interquartile range (IQR) of the Samsung brand.

5.2.3 A data analyst claims that 75% of the dataset of Apple was less than 16%.

Explain whether or not his statement is valid.

TOTAL: 150