Accounting Paper 2 Questions - Grade 12 June 2021 Exemplars

Share via Whatsapp Join our WhatsApp Group Join our Telegram GroupINSTRUCTIONS AND INFORMATION

Read the following instructions carefully and follow them precisely.

- Answer ALL the questions.

- A special ANSWER BOOK is provided in which to answer ALL the questions.

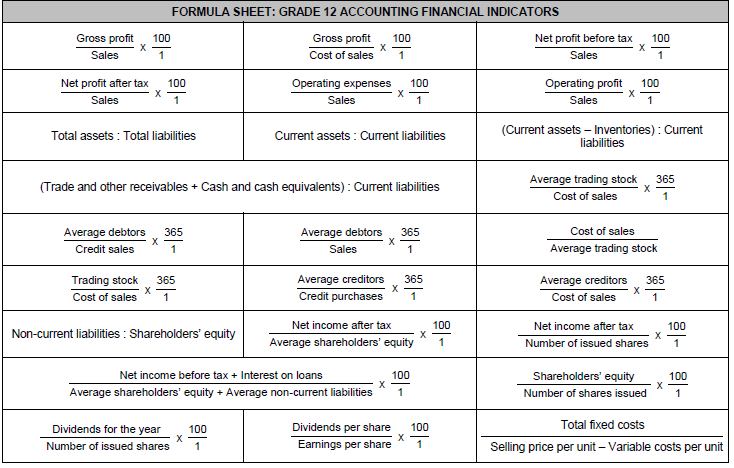

- A FORMULA SHEET for financial indicators is attached to this question paper. You may use it if necessary.

- Show ALL workings to earn part-marks.

- You may use a non-programmable calculator.

- You may use a dark pencil or blue/black ink to answer the questions.

- Where applicable, show all calculations to ONE decimal point.

- Write neatly and legibly.

- Use the information in the table below as a guide when answering the question paper. Try NOT to deviate from it.

QUESTION | TOPIC | MARKS | TIME |

1 | Reconciliation | 32 | 25 |

2 | Inventory Valuation and Fixed Assets | 58 | 45 |

3 | Manufacturing and Cost Accounting | 42 | 35 |

4 | Internal and Financial Control; Ethics | 18 | 15 |

QUESTIONS

QUESTION 1: RECONCILIATIONS AND INTERNAL CONTROL

(32 marks; 25 minutes)

1.1 CONCEPTS

Indicate whether the following statements are TRUE or FALSE. Write only ‘true’ or ‘false’ next to the question numbers (1.1.1–1.1.2) in the ANSWER BOOK.

1.1.1 Debtors forms part of current liabilities of a business.

1.1.2 Trade discount is entered as follows:

Debit Creditors Control and Credit Discount Received (2)

1.2 CREDITORS’ RECONCILIATION

You are provided with information on East Cape Traders. The Creditors’ Control Account and the Creditors’ List were prepared by an inexperienced bookkeeper on 31 May 2020.

The Creditors’ Control Account shows a credit balance of R589 010 and the Creditors’ List shows a total of R585 050.

As internal auditor, you discovered the errors and omissions given below.

REQUIRED:

1.2.1 Record the following errors and omissions in the given table in the ANSWER BOOK and calculate the correct balance and total. (16)

INFORMATION:

Errors and omissions discovered:

- A debit balance of R5 630 of one of the creditors must be transferred to their account in the debtors’ ledger.

- Discount received from a creditor, R590, was erroneously posted to the creditors’ ledger as R950.

- Interest of R645 on an overdue account, was not entered at all.

- An amount of R450 from the Creditors Allowance Journal was posted to the wrong side of the creditors’ account.

- Goods worth R83 500 returned to a creditor was incorrectly entered as a credit purchase.

- A credit invoice for goods purchased, R34 000 has not been entered at all.

- Goods purchased on credit from West Wholesalers for R72 000, was credited to the account of East Wholesalers.

- The column for creditors in the Creditors’ Allowance Journal was under cast by R4 500.

1.3 DEBTORS’ ANALYSIS

REQUIRED:

1.3.1 Give TWO reasons why preparing a Debtors’ age analysis is a useful tool in managing debtors. (4)

1.3.2 Calculate the debtors’ collection period for 2020 and comment on your findings. Keep in mind that the debtors’ collection period for 2019 was calculated at 45 days. Provide figures in your comments.

Discuss TWO points of advice which you can offer to the credit manager. (10)

INFORMATION:

Extract from the financial statements on year end:

29 February 2020 | 28 February 2019 | |

Total sales | 816 240 | 1 211 000 |

| 367 920 | 525 600 |

| 448 320 | 685 400 |

Cost of sales | 396 940 | 538 220 |

Trade debtors (net) | 104 190 | 68 540 |

[32]

QUESTION 2: INVENTORY; FIXED ASSETS

(58 marks; 45 minutes)

2.1 MATCHING CONCEPTS

Choose a description in COLUMN B that matches the term in COLUMN A. Write only the letters (A–D) next to the question numbers (2.1.1–2.1.4) in the ANSWER BOOK.

COLUMN A | COLUMN B | ||

2.1.1 | Specific identification method | A | Cost price minus accumulated depreciation |

2.1.2 | Weighted average method | B | Stock valuation method used for similar goods of low value |

2.1.3 | Carrying value | C | Stock valuation method used for expensive and diverse goods |

2.1.4 | FIFO | D | Stock system whereby the oldest stock is sold first |

(4 x 1) (4)

2.2 INVENTORY

You are provided with information on Champions Traders. They sell rugby jerseys and rugby balls. They use the periodic stock system.

REQUIRED:

2.2.1 Calculate the value of closing stock for rugby jerseys. (4)

2.2.2 Calculate the cost of sales for rugby jerseys. (5)

2.2.3 Calculate the mark-up percentage on rugby jerseys. (4)

2.2.4 How many months will it take to sell the rugby jerseys on hand on 31 May 2020? (4)

2.2.5 Calculate the value of closing stock for rugby balls. (8)

2.2.6 Calculate the number of rugby balls missing on 31 May 2020. (5)

INFORMATION:

A The stock valuation system used:

- for rugby jerseys is First-In-First-Out (FIFO).

- for rugby balls is the weighted average system.

B Stock values:

Rugby jerseys | Rugby balls | |||||

Number of units | Price per unit | Total value | Number of units | Price per unit | Total value | |

01/06/19 | 1 200 | R440 | R528 000 | 300 | R150 | R45 000 |

31/05/20 | 1 000 | ? | ? | 120 | ? | ? |

C Purchases during the year:

Rugby jerseys | Rugby balls | |||||

Number of units | Price per unit | Total value | Number of units | Price per unit | Total value | |

20/09/19 | 800 | R460 | R368 000 | 1 500 | R150 | R225 000 |

20/12/19 | 1 000 | R490 | R490 000 | 3 000 | R180 | R540 000 |

20/03/20 | 1 000 | R500 | R500 000 | 2 000 | R190 | R380 000 |

2 800 | R1 358 000 | 6 500 | R1 145 000 | |||

D Stock returned: (Faulty stock has to be returned within 5 days of purchase.)

- 12 rugby jerseys returned on 24 March 2020.

- 15 rugby balls returned on 23 December 2019.

E

- Delivery fees for rugby jerseys are included in the price charged by suppliers.

- Carriages paid on rugby balls, amounts to R61 140.

F Sales during the year:

- Rugby jerseys: 3 000 units to the value of R2 271 200.

- Rugby balls: 6 660 units to the value of R2 669 040.

2.3 FIXED ASSETS

The information below is taken from Praven Traders on 30 April 2020, end of the financial year.

REQUIRED:

2.3.1 Calculate the cost of the additional garage that was built. (1)

2.3.2 Calculate the balance of the Accumulated Depreciation on Equipment account on 30 April 2020. (You don’t need to show the account.) (5)

2.3.3 Complete the Accumulated Depreciation on Vehicles account. The account must be balanced on 30 April 2020. (10)

2.3.4 Complete the Asset Disposal account. (8)

INFORMATION:

A Balances:

| 30 April 2020 | 30 April 2019 | |

| Land and Buildings | 2 266 000 | 1 966 000 |

| Vehicles | 520 000 | 720 000 |

| Equipment | 1 440 000 | 1 440 000 |

| Accumulated depreciation on Vehicles | ? | 192 000 |

| Accumulated depreciation on Equipment | ? | 1 320 000 |

B. Additional information:

- During the year an additional garage was built to accommodate the bigger delivery vehicle that was purchased.

- At the beginning of the year Praven Traders only had one vehicle. On 31 January 2020 this vehicle was traded in for R460 000, on a new delivery vehicle from Blitz Motors.

- Vehicles are depreciated on the diminishing balance method at 20% p.a.

- Equipment are depreciated by 20% per year on cost.

[58]

QUESTION 3: MANUFACTURING AND COST ACCOUNTING

(42 marks; 35 minutes)

3.1 CONCEPTS

Indicate whether the following statements are TRUE of FALSE. Write only ‘true’ or ‘false’ next to the question numbers (3.1.1–3.1.2) in the ANSWER BOOK.

3.1.1 Fixed costs do not change when the number of units produced changes.

3.1.2 Primary costs consist of direct labour plus indirect labour. (2)

3.2 PRODUCTION COST STATEMENT

You are provided with information on Kyle’s Creations, the manufacturers of sports bags.

REQUIRED:

3.2.1 Complete the note for Factory overhead costs. (12)

3.2.2 Complete the Production cost statement on 29 February 2020. (16)

INFORMATION:

A Balances:

28 February 2019 | 29 February 2020 | ||

Raw material | 115 800 | 69 000 | |

Work-in-process | 218 400 | 120 600 | |

Indirect material | 8 400 | 13 200 | |

B Transactions during the year:

Raw materials purchased | 1 445 400 |

Raw materials returned | 46 200 |

Carriage on raw materials | 57 600 |

Production wages | 1 072 400 |

Pension contributions | 47 520 |

Salary: Factory foreman (contributions included) | 288 000 |

Advertisements | 117 776 |

Electricity | 78 408 |

Indirect material for factory use purchased | 59 400 |

Factory maintenance | 81 000 |

Rent expense | 216 000 |

Depreciation | 97 500 |

C Additional information:

- UIF payments for the year need to be added.

- Overtime needs to be taken into account: 6 workers worked a total of 270 hours each at a rate of R40 per hour.

- 75% of electricity expense is allocated to the factory.

- Rent are allocated as 2 : 1 : 1 to the factory, sales and administrative offices.

- 80% of depreciation is allocated to the factory.

3.3 COST ACCOUNTING

You are provided with information from the records of Nail Art, the producers of nail polish products on 30 April 2020.

REQUIRED:

3.3.1 Calculate the break-even point for 2020. (6)

3.3.2 Calculate the units produced during 2020 (All products were sold). (2)

3.3.3 Should Mickey, the owner, be concerned about the level of production for Nail Art? Give TWO reasons, with supporting figures, to motivate your answer. (4)

INFORMATION:

Total cost | Unit cost | |

Direct labour | 1 981 800 | 18,00 |

Direct material | 2 422 200 | 22,00 |

Selling and distribution cost | 770 700 | 7,00 |

Factory overhead cost | 2 193 510 | |

Administration cost | 990 000 | |

30 April 2020 | 30 April 2019 | |

Selling price per unit | 80,00 | 60,00 |

Units produced and sold | ? | 92 000 |

Break-even point | ? | 102 000 |

[42]

QUESTION 4: FINANCIAL AND INTERNAL CONTROL (18 marks; 15 minutes)

4.1 CONCEPTS

Choose the correct word from those given in brackets. Write only the chosen word next to the question numbers (4.1.1–4.1.2) in the ANSWER BOOK.

4.1.1 The audit report is compiled by the (internal/external) auditors.

4.1.2 Audit reports are directed to (shareholders/directors) of the company. (2)

4.2 FINANCIAL CONTROL

You are provided with information from the records of Knights Sports Ltd.

REQUIRED:

4.2.1 What kind of audit report did Knights Sports Ltd receive for the financial year ended 31 May 2020? Give ONE reason for your answer. (2)

4.2.2 Why does the Companies Act in South Africa require public companies to be audited? (2)

4.2.3 The directors feel that the audit fees charged by the external auditors are excessive. Explain how better internal control will have a positive

effect on fees charged by the external auditors. (2)

INFORMATION:

EXTRACT FROM THE AUDIT REPORT OF KNIGHTS SPORTS LTD In our opinion, the financial statements fairly present the financial position of the company in all material aspects on 31 May 2020. The results of operations and cash flow for the year ended are in accordance with International Financial Reporting Standards and in the manner required by the Companies Act in South Africa. LM Williams & Associates |

4.3 INTERNAL CONTROL

The internal auditor warned the chief executive officer (CEO) that it might create problems for the company should he insist to add his private vehicle expenses as part of Sundry expenses in the company’s Income statement.

REQUIRED:

4.3.1 To which GAAP principle was the internal auditor referring to when he expressed his concern about this matter? (2)

4.3.2 Give TWO consequences for the company should the CEO ignore the internal auditors’ advice. (4)

4.3.3 At the annual general meeting (AGM), the directors suggested that the company should sponsor a childcare facility in the local community, by donating goods and cash to this facility. Give TWO reasons why companies would get involved in these kinds of activities. (4)

[18]

TOTAL: 150