Economics Paper 1 Memorandum - Grade 12 September 2021 Preparatory Exams

Share via Whatsapp Join our WhatsApp Group Join our Telegram GroupMEMORANDUM

SECTION A (COMPULSORY)

QUESTION 1

1.1 MULTIPLE-CHOICE QUESTIONS

1.1.1 B amplitude

1.1.2 A factor

1.1.3 C ad valorem

1.1.4 B the R depreciated against the $

1.1.5 D fiscal

1.1.6 D Beneficiation

1.1.7 C 3–6%

1.1.8 A World Bank (8 x 2) (16)

1.2 MATCHING ITEMS

1.2.1 F the difference between what a country exports, including gold, and what it imports

1.2.2 C producers and consumers can to buy goods and services from anywhere in the world without the interference of government

1.2.3 H the movement of goods, services and factors of production among the participants in the economy

1.2.4 A embedded in demand and supply side policies

1.2.5 D shows relationship between tax rates and tax revenue

1.2.6 B increase potential for large scale production

1.2.7 E the return of land to those who lost it because of discriminatory laws

1.2.8 G measured by dividing the real GDP by the number of workers employed (8 x 1) (8)

1.3 GIVE ONE TERM

1.3.1 Circular flow

1.3.2 Recession

1.3.3 Nationalisation

1.3.4 Globalisation / International trade

1.3.5 Spatial Development Initiative

1.3.6 Economically Active Population (6 x 1) (6)

TOTAL SECTION A: 30

SECTION B

Answer TWO of the three questions in this section in the ANSWER BOOK.

QUESTION 2: MACROECONOMICS

2.1

2.1.1 Name any TWO problems of public sector provisioning

- Accountability

- Efficiency

- Assessing needs

- Pricing policy

- Parastatals

- Privatisation/Nationalisation (Any 2 x 1) (2)

2.1.2 Why is borrowing not a long-term solution for a fundamental BOP disequilibrium?

- This is because borrowing is unsustainable in the long term and countries will be burdened with high interest rate payments

- Countries with large interest payments are unlikely to spend on their investment

(Accept any other correct relevant response.) (Any 1 x 2) (2)

2.2 DATA RESPONSE

2.2.1 Name ONE example of an injection.

- Investment

- Government spending

- Exports (Any 1 x 1) (1)

2.2.2 Give a formula to calculate aggregate expenditure in an open economy.

- Aggregate expenditure (E) = C +I + G + X – M (1)

2.2.3 Briefly describe the term injection.

- An injection is the introduction of additional money into the economy by investment (I), government (G), and payments for exports (X).

(Accept any other correct relevant response.) (2)

2.2.4 What is the effect on national income if injections are less than withdrawals?

- The national income decreases. (2)

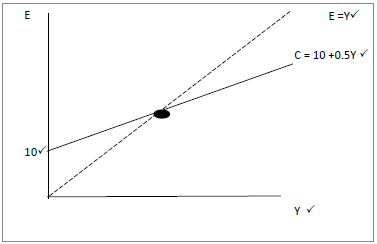

2.2.5 Suppose the expenditure function ( E ) = 10 + 0.5Y. Draw a clearly labelled 45° diagram to show the expenditure function.

Correct positioning and labelling of 45° = 1 mark

Correct labelling of the vertical intercept = 1 mark

Correct drawing and labelling of the expenditure function = 1 mark

Correct labelling of the axis = 1 mark (4)

2.3 DATA RESPONSE

2.3.1 Give an example of a leading indicator.

- Job advertisements / inventory / sales (1)

2.3.2 Indicate the phase of a business cycle that has the highest unemployment rate.

- Depression (1)

2.3.3 Briefly describe the term business cycle

- Business cycle is a successive period of increasing and decreasing economic activity.

(Accept any other relevant correct response.) (2)

2.3.4 Explain the Keynesian approach of business cycles

- The Keynesian approach holds the view that markets are inherently unstable and therefore government intervention may be required. The price mechanism fails to co-ordinate demand and supply in markets and this gives rise to upswings and downswings. (2)

2.3.5 How can the South African Reserve Bank prevent the economy from reaching a trough?

The Reserve bank can:

- adjust the interest rate (repo rate) downwards, that will make loans and credit cheaper and stimulate aggregate demand

- decrease cash reserve requirements to make more money available at banks, for loans

- buy securities in the open market to make money available for loans (open market transactions)

- persuade commercial banks to act responsibly

- increase the money supply

(Accept any other correct relevant response) (Any 2 x 2) (4)

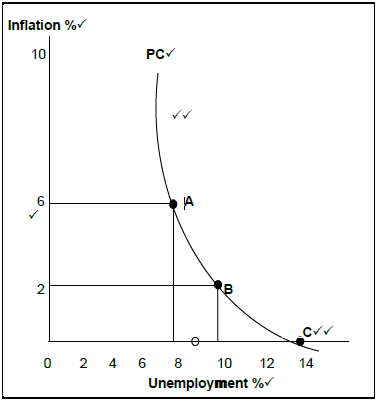

2.4 Draw a fully labelled graph to show the relationship between inflation and unemployment.

Mark allocation:

Correct shape and positioning of PC = 2 marks

Labelling of PC = 1 mark

Correct labelling of axes = 2 marks

Labelling on axis = 1 mark

Identification of natural unemployment rate point = 2 marks (8)

2.5 Assess the limitations of comparative advantage theory for countries involved in international trade.

Comparative advantage theory has been criticised because of the following limitations:

- Transport costs, tariffs and exchange rates may change the relative prices of goods and may distort comparative advantages between the countries / Transport costs may outweigh any comparative advantage

- Increased specialisation may lead to diseconomies of scale

- Governments may restrict trade

- Imperfect competition may lead to prices being different to opportunity cost ratios.

- Comparative advantage theory does not take into account of some of the more dynamic elements determining world trade for example capital, may come outside the scope of the theory.

- Trade gains do not mean that everyone will become better off – workers in uncompetitive industries may struggle to gain employment in new industries.

- It does not take into account complexity of global trade where in the real world, there are multiple goods and countries being traded between countries.

(Accept any other correct relevant response.) (8)

[40]

QUESTION 3: ECONOMIC PURSUITS

3.1

3.1.1 Name any TWO indicators relating to money supply.

- M1

- M2

- M3 (Any 2 x 1) (2)

3.1.2 How does education help in social development?

- As a process of learning and expanding culture, education contributes to the improvement of the human condition through better knowledge, health, living conditions, social equity and productivity.

- It is a central tool for social progress.

(Accept any other correct relevant response) (Any 1 x 2) (2)

3.2 DATA RESPONSE

3.2.1 Give a formula to calculate per capita income.

- GDP/population (1)

3.2.2 Identify the side where longer life expectancy is experienced.

- North

(Accept any other correct relevant response.) (1)

3.2.3 Briefly describe the term North-South divide.

- Refers to the developed countries in the Northern hemisphere and the developing countries in the Southern hemisphere. (Accept any other correct relevant response) (2)

3.2.4 Compare poverty levels of the North and South countries.

- The North has very low levels of poverty and in the South half the population lives below the poverty line.

(Accept any other correct relevant response) (Any 1 x 2) (2)

3.2.5 How do countries in the ‘south’ negatively affect the environment?

Countries in the ‘south’ negatively affect the environment by:

- engaging in methods of production that are not environmentally friendly.

- Not implementing environmental regulations

- focusing on agriculture, which depletes their natural resources such as soil and water

- lacking in water conservation solutions

(Accept any other correct relevant response) (Any 2 x 2) (4)

3.3 DATA RESPONSE

3.3.1 Identify an indicator related to interest rates.

- Repurchase/repo rate (1)

3.3.2 Name the type of exchange rate system used in South Africa.

- Free-floating exchange rate (1)

3.3.3 Briefly describe the term prime rate.

- The prime rate is the interest rate that commercial banks charge their most creditworthy corporate customers.

(Accept any other correct relevant response.) (2)

3.3.4 Why is it important for the government to assess the performance of the economy ?

- To be able to make informed decisions for planning purposes and compiling policies to improve the economy

(Accept any other relevant correct response.) (2)

3.3.5 How can an increase in repo rate affect consumption expenditure?

- Higher interest rates mean that consumers do not have as much disposable income and must cut back on spending.

- As interest rates rise, bond prices fall.

- The longer the maturity of the bond, the more it will fluctuate in relation to interest rates.

(Accept any other correct relevant response.) (Any 2 x 2) (4)

3.4 Discuss tariffs and quotas as methods of import substitution.

Tariffs

- Customs duties or import duties are taxes on imported goods.

- They can be ad valorem (based on the value) or specific to certain goods.

- Prices of imported goods increase for domestic consumers, and they tend to shift demand from imports to domestic products (goods) (Any 2 x 2)

Quotas

- Limits are put on the supply of goods and services.

- Supply is reduced and prices rise.

- Foreign enterprises benefit if demand for their products remains high.

(Accept any other correct relevant response) (Any 2 x 2) (8)

3.5 How can the Expanded Public Work Programmes be used to reduce the unemployment rate?

EPWP can be used by:

- Investing on (labour-intensive) infrastructural development while creating job opportunities.

- Provision of skills that can help the communities to become employable.

- Giving ordinary citizens the opportunity to establish their own business using skills acquired from the programme.

- Providing workers with a combination of work experience and training.

- Improving the lives of South Africans by building and maintaining community assets and providing services to communities.

(Accept any other correct relevant response.) (8)

[40]

QUESTION 4: MACROECONOMICS AND ECONOMIC PURSUITS

4.1

4.1.1 Name any TWO incentives used by the SA government to improve industrial development.

- Small Businesses Support Program

- SEDA Technology Program (STP)

- Skills Support Program (SSP)

- Critical Infrastructure Facilities

- Custom-free incentives

- Foreign investment incentives

- Strategic Investment Program

- Services to Business Processes (Any 2 x1) (2)

4.1.2 How can a country improve the terms of trade?

It can improve the terms of trade by:

- raising the quality of exports so that they match those of other competitors in the international market.

- increasing the price of exports and decreasing the price of imports.

(Accept any other correct relevant response) (Any 1 x 2) (2)

4.2 DATA RESPONSE

4.2.1 Give ONE example of taxes on products.

- VAT

- Taxes on imports

- Taxes on exports

(Accept any other correct relevant response.) (1)

4.2.2 Identify the method used to calculate Gross Domestic Product

- Income method (1)

4.2.3 Briefly describe the term consumption of fixed capital.

- Is the depreciation in the value of fixed assets that occurs during the production process.

(Accept any other correct relevant response.) (2)

4.2.4 Determine the value of A above.

- R4 523 581

(Accept any other correct relevant response.) (2)

4.2.5 Why does the government provide subsidies on products?

- To make certain products more affordable e.g. brown bread

- To increase production

- To increase exports

(Accept any other correct relevant response.) (Any 2 x 2) (4)

4.3 DATA RESPONSE

4.3.1 Give any other example of a basic service.

- Refuse removal

- Eletricity

- Sanitation

(Accept any other correct relevant response.) (Any 1 x 1) (1)

4.3.2 Indicate the percentage of South African households who do not have access to improved water sources.

- 11,8% (1)

4.3.3 Briefly describe the term social indicator.

- Measures that economists use to evaluate the performance of a country in terms of the social well-being of its citizens.

(Accept any other correct relevant response) (Any 1 x 2) (2)

4.3.4 What measures can be used to ensure sufficient water supplies in South Africa?

- Educate to change consumption and lifestyles

- Invent new water conservation technologies

- Recycle wastewater

- Improve irrigation and agricultural practices

- Appropriately price water.

- Develop energy efficient desalination plants.

- Improve distribution infrastructure.

(Accept any other correct relevant response.) (Any 1 x 2) (2)

4.3.5 How successful has the South African government been in rendering services as a social indicator?

Successes:

- The National Electricity Regulator reports that 85,4% of households in South Africa had access to electricity in 2013. The figure in 2010 was 83,5%

- Some 66% of households in South Africa had access to refuse removal by local authorities once a week

- 89% of South Africans had access to clean water in 2013

- In South Africa, free basic water comprises 6 000 litres per household per month

- 77,9% of households in South Africa in 2013 had access to functioning basic sanitation

- This includes flush toilets, chemical toilets and pit toilets with ventilation pipes

Failures:

- Currently, the country is challenged by illegal electricity connections and power-cuts

- Municipalities are failing in their endeavour to collect refuse as expected

- There are still areas in South Africa with bucket toilets without proper ventilation systems

- Some areas in the country are facing serious water challenges, whereby people and animals have access to the same contaminated water resources

(Accept any other correct and relevant response) (Any 2 x 2) (4)

4.4 Briefly discuss prevention of dumping and protection of natural resources as arguments in favour of protectionism

Prevention of dumping

- Some countries sell their surplus goods in a foreign country at lower prices than it cost them to produce the goods.

- Local producers cannot compete, and their factories may close.

- In the long term, constant undercutting of local prices will force the domestic industry out of business and allow the foreign business to establish itself as a monopoly

- These foreign monopolies will soon increase prices and exploit consumers (2 x 2)

Protection of natural resources

- Free trade can easily exhaust natural resources.

- Therefore protection is needed to protect local industries and indigenous knowledge systems so that they can survive.

- The South African government has taken steps to protect Rooibos tea as natural resource and safeguard indigenous knowledge that allows the hoodia plant to be used for medicinal purposes.

(Accept any othe correct relevant response) (2 x 2) (8)

4.5 How can the Reserve Bank effectively reduce the deficit on the balance of payments?

The deficit can be reduced by:

- Encouraging the country if experiencing deficits to borrow money from other countries

- Borrowing: a country is nevertheless not having a long-term solution for fundamental balance of payments disequilibrium

- Borrowing from the International Monetary Fund (IMF) in the event of fundamental disequilibrium, as a member country

- Increasing interest rates will decrease spending, including on imports

- Using supply side policies to improve the competitiveness of domestic industry and exports

- For example if the government pursued a policy of privatization and deregulation, it may help to increase the efficiency of the economy because of the profit movite in the private sector.

(Accept any othe correct relevant response) (8)

[40]

SECTION C

QUESTION 5: MACROECONOMICS

- Discuss in detail the reason(s) for public sector failure (26 marks)

- How can inefficiencies contributing to public sector failure be solved? (10 marks)

INTRODUCTION

- Public sector failure occurs when the government fails to manage the economy and the resources under its control optimally. / Public sector failure can be regarded as a failure of government to achieve its objectives.

(Accept any other correct relevant introduction.) (2)

MAIN PART

Management failure

- Ignorance, e.g. implementing conflicting policies or wrong policies,

- Incompetence, that is, lack of skill or ability to do a task properly. This may be due to improper qualifications, lack of training, experience and an attitude of apathy

- This may lead to wrong decisions and low productivity

- Corruption: i.e. exploiting of a person’s position for personal gain. Taking bribes, committing fraud, nepotism, behaving dishonestly and committing discrimination.

- Allowing rent-seeking which is behaviour that improves the welfare of somenone at the expense of the welfare of others.

Apathy

- Successful public production relies on long-term accountability.

- It is not always easy to hold the public sector accountable because of the huge workforce of the various departments

- Poor accountability can lead to inefficiencies such as corruption, poor service delivery.

- People employed by the state do not always serve the interests of the public

- They seek to maximise their salaries, status and power and are not required to produce a profit and loss statement

- They are budget driven

- Poor accountability is the result of low motivation, poor training, lack of competence.

Lack of motivation

- Frontline workers rarely receive incentives for successful service delivery.

- There is little stipulation for service quality or quantity.

- No measurement of effectiveness or productivity and few rewards and penalties for it.

- There are not enough systems in place to evaluate the services that government employees give

- The provider only monitors inputs and compliance with processes and procedures

- This leads to limited services that are poor quality and expensive and government departments that are inefficient and ineffective.

Bureaucracy (official rules and procedures)

- Bureaucracy makes policies: take long to implement or it is not implemented successfully.

- Officials may focus on correct procedures and rules and are indifferent to the quantity (e.g. the number of patients attended to) and quality of the service (e.g. explaining the use of the medicine) Some may be insensitive to the needs of their clients.

- Because of self interest, bureaucrats can manipulate policies to benefit themselves at the expense of the people

Politicians

- Politicians tend to promote policies and spend money on projects as long as they get votes in return.

- These policies might involve an inefficient allocation of resources.

- Politicians can also serve their own interests through corruption, personal and hidden agendas and suspicious motives

Structural weaknesses

- Objectives are not met.

- For example, full employment and houses for all are not realisitic and attainable objectives

- Some objectives may work against each other and cause the government not to reach their macroeconomic objectives

- e.g. government redistributes income and wealth too aggressively, economic growth and development could suffer in the long term

Special interest groups

- Groups such as labour unions and business groups can also cause government failure.

- Trade unions can influence the government to pass certain laws to favour their members

- Business groups can, for example, influence the government to provide them with profitable contracts and favourable regulations.

- They can also influence the government to distribute resources so that they can benefit at the expense of the country.

How can inefficiencies contributing to public sector failure be solved?

- Taxpayer’s money can be used to ensure optimal allocation of resources e.g. subsidise students tuition fees on merit

- Protection of industries of strategic importance e.g. the textile industry that are labour intensive

- Monitor spending of government funds on social services budget related to avoid nepotism and corruption

- Put structures and policies in place to take care of the environment directly e.g. increase the number of security staff to prevent animals e.g. rhinos to become extinct

- Take care of the environment indirectly through programmes to make the communities aware of the state of the environment e.g. more environmental programmes on TV and grass root level

- Human rights must be honoured to ensure cooperation at all levels of government

- Reducing bureaucracy by investing in modern systems, such as IT systems

(Accept solutions that relate to bureaucracy, incompetence or corruption) (10)

CONCLUSION

- The South African Government’s latest growth plan, the Economic Reconstrcution and Recovery Plan (ERRP) of 2020, has seen few short-term goals achieved with progress that has been mainly diagnostic e.g establishment of committees, funds and increased state employment.

(Accept any other relevant higher order conclusion.) (2)

[40]

QUESTION 6: ECONOMIC PURSUITS

- Discuss in detail South Africa's initiatives in regional development. (26 marks)

- Evaluate the success of South Africa's regional development policies in terms of international benchmarking. (10 marks)

INTRODUCTION

Regional development refers to policies which are aimed at increasing the economic livelihood of specific areas or regions.

(Accept any correct relevant introduction.)

MAIN PART

Special economic zones (sez’s)

- These are geographical areas of a country set aside for specifically targeted economic activities

- These activities are supported through special arrangement that may include laws and support systems that promote industrial development

- They are meant to expand the manufacturing sector

- Create additional industrial hubs so that the national industry base will be regionally diversified

- These areas may enjoy incentives such as tax relief and support systems to promote industrial development

- There are plans to reduce tax to 15% as an incentive to attract new industries

- The aim of creating SEZ is to attract :

- only new business

- business which are developing a new product line

- business which are expanding their volume

- The DTI has indicated that the existing IDZs where special tax incentives do not apply, would be graduated into SEZs

- It creates a basis for a broader range of industrial parks and provide economic infrastructure to promote employment

Corridors

- Corridors in South Africa are spatial areas that offer specific advantages to mining, manufacturing and other businesses

- The advantages also include the presence of existing infrastructure and the specialisation of products or services

- These corridors are development areas within South Africa and are the development priorities of all development agencies

- The DTI provides help in support of the development corridors

- The Maputo Corridor, that starts in Gauteng and extends through Mpumalanga to the Maputo port, offers opportunity to the transport industry or the Phalaborwa subcorridor in the Limpopo Province offers opportunities for mining and related activities (8)

Spatial development initiatives (SDI’s)

- This is an area with high levels of unemployment and poverty that has been identified by the government for a co-ordinated effort to develop the economic potential of the area

- The area chosen for an SDI must be under-developed and have the potential for sustainable growth

- The development focuses on high level support in areas where socio-economic conditions need concentrated government assistance

- These initiatives help to spread economic activities equally in the country

- All investment is based on public-private partnerships

- It is a government strategy of investment that involves the department of trade and industry (DTI) and transport (DoT)

- It focuses on government attention across national, provincial and local government levels to ensure that investment are fast-tracked and that the maximum synergy between the various types of investments

- These projects are expected to create new jobs well into the future

- The success of these projects relies on a strong move towards international competitiveness, regional cooperation and a more diversified ownership

base

(Accept any other correct relevant response.)

Industrial Development Zones

- This is a purpose built industrial estate, physically enclosed and linked to an international port or airport with duty free incentives

- It was designed to encourage international competitiveness in SA’s manufacturing sector

- IDZ’s fall outside domestic customs zones and therefore able to import items free of customs and trade restrictions, add value, and then exports their

goods - They are designed to attract new investment in export-driven industries. Thus encouraging exports, economic growth and employment

- IDZs are the responsibility of provincial and local government

- Businesses develop around the IDZs (banking, personnel, insurance, auditing, IT, communication, accommodation, catering, shopping, transport)

- IDZs strengthen and stimulate economies in their immediate environments

- Each IDZ offers direct links to an international port or airport, world-class infrastructure, a zero rate VAT on supplies from South African sources, government incentive schemes, reduced taxation for some products, access to latest information

(Accept any other correct relevant response.)

(Allocate a maximum of 8 marks for the mere listing of facts/examples)

(Max. 26)

ADDITIONAL PART

Evaluate the international success of South Africa’s regional development policies in terms of the benchmark criteria

SA has been successful in its Regional Development Policies as:

- interventions in industries are based on sound economic research and analysis which lead to growth-formulation of NIPF on which the IPAP 2018/2019– 2020/2021 are based.

- provision of subsidies and incentives enabled substantial progress and growth in the upgrading of value-adding and labour intensive manufacturing sectors - Black Business Supplier Development Programme, Foreign Investment Grant, SEDA Technology programme etc

- great success was achieved in combating customs fraud, and targeting illegal imports and products of inferior quality through import restrictions by Customs Control Act, the Customs Duty Act, the International Trade Administrations Act and the Counterfeit Goods Act.

- an alignment of trade policy with industrial policy took place through the Department of Trade and Industry (DTI) as one of its objectives.

- it resulted in South African industries being more competitive in the global market.

SA has been unsuccessful in its Regional Development policies as:

- industries have closed down due to the withdrawal of financial support by the government.

- there are no traces of good governance due to corruption and nepotism, e.g. State capture.

- lack of accountability and transparency as a result programmes are not correctly monitored and evaluated.

- policies are only implemented for a short term goal (no sustainability), e.g. programme like EPWP for human resources and protection policies for natural resources.

- No integration as development is still centralised in towns and cities

- There is still a wide gap between development of urban and rural areas in terms of infrastructure.

(Accept any other correct relevant response.)

CONCLUSION

The South African government has entered into several agreements and projects that support development in Southern Africa for the benefit of South Africa. (Accept any other relevant higher order conclusion) Max. (2) (2)

[40]

TOTAL SECTION C: 40

GRAND TOTAL: 150