MATHEMATICAL LITERACY PAPER 2 GRADE 12 QUESTIONS - NSC EXAMS PAST PAPERS AND MEMOS MAY/JUNE 2021

Share via Whatsapp Join our WhatsApp Group Join our Telegram GroupMATHEMATICAL LITERACY PAPER 2

GRADE 12

NATIONAL SENIOR CERTIFICATE EXAMINATIONS

MAY/JUNE 2021

INSTRUCTIONS AND INFORMATION

- This question paper consists of FOUR questions. Answer ALL the questions.

- Use the ANNEXURES in the ADDENDUM to answer the following questions:

ANNEXURE A for QUESTION 2.1

ANNEXURE B for QUESTION 3.2

ANNEXURE C for QUESTION 4.2 - Number the answers correctly according to the numbering system used in this question paper.

- Start EACH question on a NEW page.

- You may use an approved calculator (non-programmable and non-graphical), unless stated otherwise.

- Show ALL calculations clearly.

- Round off ALL final answers appropriately according to the given context, unless stated otherwise.

- Indicate units of measurement, where applicable.

- Maps and diagrams are NOT drawn to scale, unless stated otherwise.

- Write neatly and legibly.

QUESTION 1

1.1 Aggie and 14 friends started a stokvel in order to buy groceries. The grocery items bought will be shared equally among all the members of the stokvel. Aggie sourced prices from two wholesalers, A and B, for the items they intend buying.

TABLE 1 below shows the comparison of the prices, excluding VAT, of items she needs to buy. (Some values have been omitted.)

TABLE 1: PRICES OF ITEMS AT WHOLESALERS FOR JANUARY 2020

| ITEM DESCRIPTION (packaging detail) | QUANTITY (as per packaging detail) | WHOLESALER A | WHOLESALER B |

| TOTAL AMOUNT | TOTAL AMOUNT | ||

| Cake flour (12,5 kg) | 15 | R1 274,85 | R1 334,25 |

| Maize meal (5 kg) | 30 | R689,70 | R659,70 |

| Rama 125 g (48 in a packet) | 15 | R4 154,85 | R3 899,85 |

| # Rice (10 kg) | 15 | R1 679,85 | R1 814,85 |

| # Canned fish (12 cans x 400 g) | 10 | R1 559,50 | R1 699,00 |

| # Long-life milk (6-pack of 1 f) | 15 | R1 049,85 | R1 154,85 |

| Spice (10 x 50 g) | 15 | R1 499,85 | R1 439,85 |

| VAT (15%) | ... | R1 100,05 | |

| Total including VAT | ... | R13 102,40 |

NOTE: # — means items that are VAT exempted

1l = 1 kg

Use the information and TABLE 1 above to answer the questions that follow.

1.1.1 Write down how many cans of fish each member of the stokvel will receive. (3)

1.1.2 Aggie stated that she could load all these items onto her half-ton bakkie without overloading it.

Verify, showing ALL calculations, whether her statement is valid. (7)

1.1.3 Determine, showing ALL calculations, which wholesaler (A or B) will be cheaper if she buys all the items (including VAT) from one wholesaler. (7)

1.1.4 The food inflation rate was 5,17% in January 2021 and is estimated to be 5,3% in January 2022.

Calculate the total amount for 5 kg of maize meal from Wholesaler B at the end of January 2022. (5)

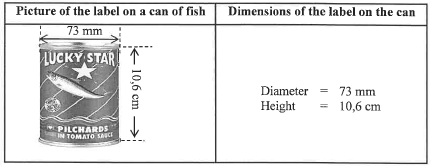

1.2 Below is a picture of a cylindrically shaped 400 g can of fish. The can is fully covered by a label with dimensions as shown in the picture.

You may use the following formulae:

Circumference of a circle = diameter x 3,142

Surface area of the label around the can = circumference x height

Use the information above to answer questions that follow.

1.2.1

- Calculate (in cm2) the surface area of the label around the can. (4)

- Determine the total length of a label if an overlap of 0,6 cm is needed for it to be glued around a can. (2)

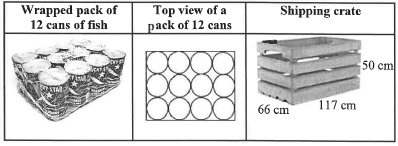

1.2.2 Some of the cans of fish are imported by ship. The cans of fish are wrapped in packs of 12.

Dimensions of a pack of 12 cans:

- Length: 29,2 cm

- Width: 21,9 cm

- Height: 10,8 cm

The mass of an empty can is 40 g.

The mass of a fully packed shipping crate with cans of fish is 280 kg.

The inner dimensions of a shipping crate are 117 cm by 66 cm by 50 cm. Packs of cans are placed lengthwise (length to length) in the shipping crates.

Aggie stated that an empty shipping crate has a mass of less than 20 kg.

Verify, with calculations, if her statement is valid. (9)

[37]

QUESTION 2

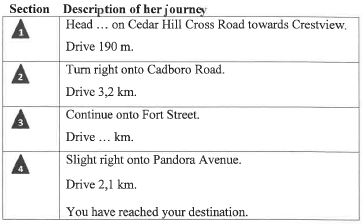

2.1 Tumi received a bursary to study at the University of Victoria in Canada.

She travelled from the University of Victoria to Victoria Downtown.

ANNEXURE A shows the map and two routes she could have used to travel on.

A summary of the route via Cadboro Road and Pandora Avenue [12 min. (6,8 km)] she used (with some information missing) is listed below.

SUMMARY OF THE ROUTE

Use ANNEXURE A and the information above to answer the questions that follow.

2.1.1 In which general direction did she head from Cedar Hill Cross Road towards Crestview? (2)

2.1.2 Determine the distance that she travelled on Fort Street. (3)

2.1.3 Name the road she travelled on after crossing Flower Street. (2)

2.1.4 Calculate (in km/h) the average speed she travelled.

You may use the formula:

Distance = Speed x Time (4)

2.1.5 On another day, Tumi travelled from the University of Victoria to Victoria

Downtown via Shelburne at an average speed of 36,5 km/h.

Calculate (in metres) the difference between the distances of the two routes. (3)

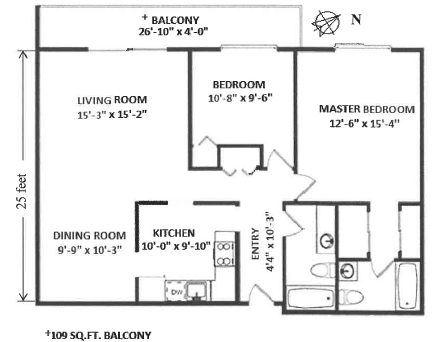

2.2 Tumi rented a 1 045 square feet apartment while she was studying.

Below is a layout plan of the apartment. The dimensions are given in feet and inches.

LAYOUT PLAN OF TUMI'S APARTMENT

NOTE: 1 foot = 12 inches 10'-3" = 10 feet 3 inches

1 inch = 25,4 mm

Use the information above to answer the questions that follow.

2.2.1 Verify, showing ALL calculations, whether the balcony with dimensions 26 feet 10 inches by 4 feet is greater or less than 109 square feet.

You may use the formula:

Area of a rectangle = length x width (6)

2.2.2 The southwest-facing wall, excluding the balcony, is 25 feet.

Measure this distance on the layout plan to determine the scale in the form 1 cm : ... feet. (3)

2.2.3 Tumi's monthly rent for her apartment is C$2 188,71 (C$ is Canadian dollar).

Calculate the rental rate per square feet. (3)

2.3 A rental price ratio is used to calculate whether it is cheaper to rent or buy a property.

This ratio is calculated as follows:

Rental price ratio = Average property price

Average annual rent

This ratio is generally classified into three categories:

- Low (15 and below): better to buy than to rent

- Moderate (15,1 to 20): usually better to rent than to buy

- High (20,1 and above): definitely better to rent than to buy

Use the above information to answer the questions that follow.

2.3.1 The average house price is C$300 000 and the price to rent is C$6 000 per quarter.

Advise Tumi, showing ALL calculations, whether she should rent or buy a property. (4)

2.3.2 The following are rental price ratios of selected North American cities:

2,11 3,62 4,24 4,24 4,68 5,62 5,87

6,44 6,52 7,20 7,59 7,64 7,64 7,69

8,32 8,41 8,72 9,11 11,08 13,85 15,26

The following are rental price ratios of selected South Asian cities:

16,68 12,00 42,80 12,55 7,00 10,82

8,55 13,56 7,07 29,86 27,71 6,84

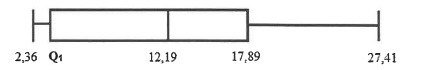

The rental price ratios of selected cities in Africa are illustrated in the box and whisker plot below.

Use the above information to answer the questions that follow.

- Determine, in simplified fractional form, the probability of randomly selecting a South Asian city classified as high.

- Determine the value of Qi (the 1st quartile) if the interquartile range (IQR) for Africa is 14,25.

- Comment on the possibility of owning a property in these areas by comparing the minimum, maximum and median values for North America and Africa. (5)

[41]

QUESTION 3

3.1 TABLE 2 shows data for South African assessed taxpayers for the 2018 tax year.

TABLE 2: TAXPAYERS BY INCOME GROUP AS ASSESSED FOR 2018

| Taxable income group | Taxpayers | Taxable income | Tax assessed | |||

| Number | % | Amount (R million) | % | Amount (R million) | % | |

| Less than R1 | 127 428 | 2,6% | -16302 | -1% | 2 | 0,0% |

| R1 to R70 000 | 400 133 | 8,1% | 15 030 | 0,9% | 16 | 0,0% |

| R70 001 to R350 000 | 2 856 043 | 58,1% | 577196 | 34,8% | 59961 | 16,8% |

| R350 001 to R500 000 | 717 157 | 14,6% | 297012 | 17,9% | 55464 | 15,6% |

| More than R500 000 | 816268 | 16,6% | 783526 | 47,3% | 240756 | 67,6% |

| Total | 4917029 | C | 356 199 | |||

Use the above data to answer the questions that follow.

3.1.1 Calculate missing value C. (2)

3.1.2 Determine, to THREE decimal places, the probability of randomly choosing an assessed taxpayer if South Africa's population was

57,73 million in 2018. (4)

3.1.3 Calculate, in rand, the mean monthly taxable income per taxpayer in the R70 001 to R350 000 taxable income group. (5)

3.1.4 In the table, the percentage for tax assessed is 0,0% for the taxable income group R1 to R70 000.

Explain, showing calculations, how this percentage was obtained. (4)

3.2 Emily earns a monthly gross salary of R26 904,22. She pays 7,5% of her gross salary towards her pension fund. In South Africa, taxable income is gross income minus payments towards a pension fund.

3.2.1 Calculate Emily's annual taxable income. (4)

3.2.2 The VAT rate in March 2018 was 14%. This rate was increased to 15% in April 2018.

Emily bought an item, including VAT, for R172,50 in April 2018.

Calculate the March 2018 price of this item, including VAT. (4)

3.2.3 ANNEXURE B shows the distribution of assessed taxpayers and income tax per province represented by arrows.

Use ANNEXURE B to answer the questions that follow.

- Arrange the provinces in descending order of tax assessed. (4)

- Give a reason why all these arrows have different lengths. (2)

- Emily stated that when comparing the lengths of the arrows of the North West and Free State, they varied proportionally according to the tax-assessed percentage.

Verify whether her statement is valid. (3)

[32]

QUESTION 4

4.1 The South African taxi association, Transaction Capital, published its results for the current state of the South African minibus taxi industry for the year ended September 2019. A summary of the results are as follows:

- 250 000 minibus taxis are currently doing business in South Africa.

- The net worth of the minibus taxi industry is R50 billion a year.

- Minibus taxis are responsible for 15 million commuter trips daily.

- Minibus taxis travel 19 billion kilometres a year.

Transaction Capital is interested in entering the European market.

Below are two exchange rates quoted at different times of the day:

Exchange Rate A: 1 euro = 15,97 ZAR

Exchange Rate B: 1 euro = 15,966728 ZAR

Use the information above to answer the questions that follow.

4.1.1 It is given that there is one bus for every 13,2 minibus taxis on the road.

Determine, to the nearest thousand, the number of buses needed to replace the minibus taxis. (3)

4.1.2 Transaction Capital plans to present a business model to a group of European businessmen.

- Calculate (in euros) the difference in net worth of the minibus taxi industry using exchange rates A and B. (6)

- Justify which exchange rate (A or B) they should use when doing the presentation to their European clients. (3)

4.1.3 The ratio of the number of daily commuter trips is given as follows:

train : bus : minibus taxi is 4 : 5 : 75

Calculate the number of commuters who do NOT use a minibus taxi daily. (4)

4.1.4 The average distance between the moon and Earth is 384 402 km.

A minibus taxi owner stated that the distance travelled by minibus taxis in one year is more than 24 000 trips to the moon and back.

Verify, showing ALL calculations, whether the statement is valid. (5)

4.2 Transaction Capital is listed on the Johannesburg Securities Exchange (JSE).

(A securities exchange is a place where investors buy and sell the shares of a company in a regulated and legitimate space.)

ANNEXURE C shows the share price of Transaction Capital for the period 9 January 2015 to 3 January 2020.

(Shares are units of ownership interest in a company or financial asset that provide for an equal distribution of profits.)

Use ANNEXURE C and the information above to answer the questions that follow.

4.2.1 Write down the total number of days covered by the period shown in ANNEXURE C.

4.2.2 Determine (in cents) the value of a share on 9 January 2015 if it was R12,68 less than the amount shown on 3 January 2020.

4.2.3 Verify, showing calculations, whether the following statements are CORRECT:

- Transaction Capital's share price went down by 3,51% for the day ending 3 January 2020.

- At the beginning of each year 80% of the time, share prices went down.

4.2.4 Calculate (in rand) the profit a person will make if he/she bought 5 000 shares at the 52-week lowest price and sold them when the price was at its highest. (5)

[40]

TOTAL: 150