Economics Paper 1 Grade 12 Memorandum - NSC Past Papers And Memos September 2020 Preparatory Examinations

Share via Whatsapp Join our WhatsApp Group Join our Telegram GroupMEMORANDUM

SECTION A (COMPULSORY)

QUESTION 1

1.1 MULTIPLE-CHOICE QUESTIONS

1.1.1 B income

1.1.2 A trend line

1.1.3 D central

1.1.4 C three

1.1.5 C employment rate

1.1.6 A economic union

1.1.7 B Accelerated and Shared Growth Initiative for South Africa (AsgiSA)

1.1.8 D production price (8 x 2) (16)

1.2 MATCHING ITEMS

1.2.1 F buying of financial assets such as shares in companies on the stock exchange of another country

1.2.2 I prescribed by the United Nations to compile the gross domestic product figures

1.2.3 A SARB consultation with commercial banks to act in a desirable manner according to prevailing economic conditions

1.2.4 C a trade agreement between a group of emerging markets

1.2.5 H the upper turning point of the business cycle

1.2.6 E government estimates of income and expenditure for a three-year period

1.2.7 D probable number of years a person will live after birth

1.2.8 G controlled by SARB (8 x 1) (8)

1.3 GIVE ONE TERM

1.3.1 Composite indicator

1.3.2 Land restitution

1.3.3 Dumping

1.3.4 Monetary

1.3.5 Closed

1.3.6 Globalisation (6 x 1) (6)

TOTAL SECTION A: 30

SECTION B

Answer TWO of the three questions in this section in the ANSWER BOOK.

QUESTION 2: MACROECONOMICS

2.1

2.1.1 Name any TWO methods of import substitution.

- Tariffs

- Quotas

- Subsidies

- Exchange control

- Physical controls

- Diverting trade (Any 2 x 1) (2)

2.1.2 How can world trade improve through specialisation?

World trade can improve through specialisation if:

- countries specialise in producing the goods for which they have a comparative advantage

- countries specialise in what they are relatively best at producing.

(Accept any other correct relevant response)

(Any 1 x 2) (2)

2.2 DATA RESPONSE

2.2.1 Provide a name for the graph given above.

- Phillips Curve (1)

2.2.2 What is the original natural rate of unemployment in the graph above?

- 14% (1)

2.2.3 Briefly describe the term new economic paradigm

- The new economic paradigm refers to government policies designed to ensure a high rate of economic growth without having supply constraints and price inflation.

(Accept any other correct relevant response) (2)

2.2.4 Explain how the government can use its fiscal policy to speed up the recovery of an economy.

Government can speed up the recovery of the economy by:

- reducing taxes which will give consumers and companies more money to spend on goods and services and for companies to expand their production capacity.

- increasing government spending which will increase aggregate expenditure and demand and thus stimulate economic activity and employment.

- increasing government spending and simultaneously decreasing taxes.

(Accept any other correct relevant response) (Any 1 x 2) (2)

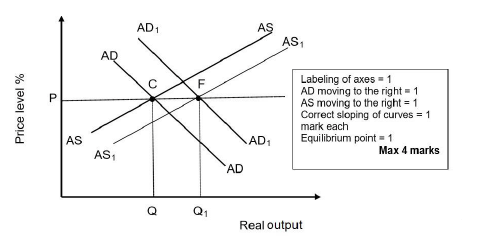

2.2.5 With an aid of a graph, illustrate the effect of demand-side and supply-side policies in smoothing out business cycles.

(4)

2.3 DATA RESPONSE

2.3.1 How much has the terms of trade increased in the last two quarters of 2019?

- 3 Index Points / 3% (1)

2.3.2 What caused an increase in South Africa’s terms of trade in the third quarter of 2019?

- An increase in the Rand price of exports

- A decrease in the Rand price of imports (Any 1 x 1) (1)

2.3.3 Briefly describe the term terms of trade.

- Terms of trade expresses a country’s export prices in terms of its import prices.

(Accept any other relevant correct response) (2)

2.3.4 Explain the effect of an improvement in terms of trade on the economy.

- An improvement in terms of trade, all things being equal, increases economic welfare, although welfare may be lost in the long term.

(Accept any other relevant correct response) (2)

2.3.5 How does current account deficit (negative balance of trade) affect terms of trade?

A negative balance of trade means a country is importing more than it exports.

Therefore:

- more currency will be leaving a country resulting in an increase in the demand of foreign exchange and lower demand.

- this will likely cause depreciation of the currency making exports cheaper and imports expensive.

- this would be a deterioration in terms of trade.

(Accept any other relevant correct response) (Any 2 x 2) (4)

2.4 Discuss the reasons for export promotion.

- The country achieves significant export-led economic growth.

- Export promotion enlarges the production capacity of the country.

- Greater employment is possible as production is stimulated. / /More workers will be employed due to the increased production.

- Exporting has the effect of reducing prices due to larger volumes of goods being produced.

(Accept any other relevant correct response) (Any 4 x 2) (8)

2.5 Analyse the benefits of deregulation for households.

Deregulation benefits households by:

- increasing competition which allows greater choices for consumers.

- enabling prices to drop as an increased number of firms enter the market, for example in markets such as airlines and telecommunication.

- improving efficiency through increased competition by reducing ‘red tape’ and bureaucracy when governments make the most decisions.

- improving innovation of products being offered

- leading to increased labour participation rates especially of women.

- encouraging inward investment in the labour market by creating job opportunities.

(Accept any other correct relevant response) (8)

[40]

QUESTION 3: ECONOMIC PURSUITS

3.1

3.1.1 Name any TWO international organisations that require members to standardise their indicators

- International Monetary Fund (IMF)

- World Bank

- United Nations (UN) (Any 2 x 1) (2)

3.1.2 How do countries in the North divide contribute to the destruction of the environment?

Countries in the North contribute to the destruction of the environment by:

- causing pollution through mass production of goods and services.

- causing climate change by being involved in high levels of industrial activities.

- exhausting natural resources due to over industrialisation.

- deforestation due to over industrialisation.

(Accept any other correct relevant response)

(Any 1 x 2) (2)

3.2 DATA RESPONSE

3.2.1 Name an economic indicator used to measure economic growth.

- Real GDP (1)

3.2.2 What is the term used to describe countries with low economic growth?

- Developing countries

(Accept any other correct relevant response) (1)

3.2.3 Briefly describe the term economic growth.

- Economic growth is an increase in the production capacity of a country/ it is an increase in the real GDP.

(Accept any other correct relevant response) (2)

3.2.4 How does economic growth lead to economic development?

Sustained economic growth can lead to economic development when:

- more goods and services produced leads to creation of job opportunities providing a flow of income for people.

- increased per capita GDP gives households greater financial resources to save

- it leads to a reduction of income and wealth inequality and the standard of living improves.

(Accept any other correct relevant response) (Any 1 x 2) (2)

3.2.5 What can South African policy makers do to improve the country’s economic standing?

They can improve the country’s economic standing by:

- maintaining macro economic stability by ensuring a strong political leadership and skilful economic steermanship.

- tackling rising public debt by returning to the basic principles of fiscal discipline and sound budgetary planning.

- dealing with inefficient state–owned enterprises, like ensuring security of electricity supply to boost business confidence.

- strengthening collaborative efforts between the public and private sectors.

(Accept any other correct relevant response) (Any 2 x 2) (4)

3.3 DATA RESPONSE

3.3.1 Identify the demand-side policy in promoting growth and development from the extract above.

- Fiscal policy (1)

3.3.2 Give an example of wealth tax.

- Capital gains tax

- Estate duties

- Transfer duties

- Donation tax

(Accept any other correct relevant response) (1)

3.3.3 Briefly describe the term progressive tax system.

- It is a system of taxation where higher-income earners are taxed at higher rates than lower-income earners. (Accept any other correct relevant response) (2)

3.3.4 Explain the contribution of taxes to social development.

- Taxes are used to finance social development.

- The poor benefit more than those with higher incomes

(Accept any other relevant correct response) (Any 1 x 2) (2)

3.3.5 How can the government through its budgetary processes redistribute income and wealth?

The government can:

- use the budget to change the distribution of the incomes by increasing expenditure targeted at low income groups. / by re-prioritising expenditure to low income groups so that they benefit more than they presently do.

- increase the level of taxation on the wealthy and use the proceeds for more effective targeting of expenditure

- use the economic tools at its disposal by increasing the incomes of low-income groups

- for example, increasing levels of employment

- providing better support to the unemployed,

- raising the level of wages.

(Accept any other correct relevant response) (Any 2 x 2) (4)

3.4 Briefly discuss capital formation and free advisory services as supply side approach in promoting growth and development in South Africa.

Capital formation

- Capital formation must increase

- Depreciation of capital goods used by businesses is designed to encourage investment.

- Government, through the Department of Trade and Industry, provides capital and loans to SMMEs and bigger businesses.

- These serve as incentives to promote efficiency. (Any 2 x 2)

Free advisory services

- Free advisory services must be made available so that business efficiency improves.

- There are various government institutions that provide free advisory services – Council for Scientific and Industrial Research (CSIR)

- Examples include the development of export markets, weather forecasts and preventing and curing animal diseases (Any 2 x 2)

3.5 Critically discuss how the Broad-based Black Economic Empowerment has benefited the South African economy

BBBEE has benefitted the economy by:

- empowering indigenous people through gender equality and more opportunities for representation at all levels of management.

- spreading of financial wealth – there has been an increase in economic power through shareholding capacity of big companies.

- increasing the standard of living – those who got empowered are enjoying a much higher standard of living.

BBBEE has not benefitted the South African economy because:

- only a small number of the community benefitted due to corruption and nepotism.

- unemployment is still high and many have no access to capital.

- many South Africans are still living below the poverty line – the Gini coefficient has worsened.

(Accept any other correct relevant response) (8)

QUESTION 4: MACROECONOMICS AND ECONOMIC PURSUITS

4.1

4.1.1 Name TWO problems of public sector provisioning

- Lack of accountability

- Inefficiency

- Problem in assessing needs

- Pricing policy

- Parastatals

- Privatisation/nationalisation (Any 2 x 1) (2)

4.1.2 Why is it important to assess the performance of an economy?

- To help the government to develop appropriate policies to promote economic growth and development.

(Accept any other correct relevant response) (Any 1 x 2) (2)

4.2 DATA RESPONSE

4.2.1 Name a monetary instrument used to achieve price stability.

- Interest rates (1)

4.2.2 What is the inflation target range set by the South African Reserve Bank?

- 3–6 % (1)

4.2.3 Briefly describe the term repurchase rate (Repo rate).

- Repurchase rate is the rate at which the central bank of a country lends money to commercial banks.

(Accept any other correct relevant response) (2)

4.2.4 Explain the reason why the government pursues price stability as a macroeconomic objective.

- The government pursues price stability because stable prices lead to better results in terms of job creation and economic growth.

(Accept any other correct relevant response) (2)

4.2.5 How does the South African Reserve Bank maintain price stability?

The South African Reserve Bank maintains price stability by:

- setting and maintaining inflation targeting range of 3–6%.

- controlling the amount of money in circulation by changing interest rates.

(Accept any other correct relevant response) (Any 2 x 2) (4)

4.3 DATA RESPONSE

4.3.1 What type of workers are often employed through the Expanded Public Works Programme?

- Unskilled workers (1)

4.3.2 How is the NDP funded?

- By taxes (1)

4.3.3 Briefly describe the term economic development.

- It implies an increase in the capacity of the population to produce more goods and services.

- The process by which the standard of living improves.

(Accept any other correct relevant response) (Any 1 x 2) (2)

4.3.4 Explain how the development of human resources can be used as an approach to alleviate poverty.

- By providing skills and training, job opportunities can be attained, hence reducing poverty.

- By acquiring education and training, citizens have a better chance to become active participants in the job industry which earn them income.

(Accept any other correct relevant response) (1 x 2) (2)

4.3.5 How can the NDP increase the employment rate in South Africa?

NDP can increase the employment rate by:

- expanding economic opportunities.

- investing in infrastructure.

- private investment in the economy.

- creating entrepreneurship opportunities.

(Accept any other correct relevant response) (Any 2 x 2) (4)

4.4 Briefly discuss poverty and trade as challenges of globalisation (North/South divide).

Poverty

- There is a growing gap between the rich and poor, particularly in Africa.

- Developed countries have low poverty levels and countries in the South divide (developing) have high levels of poverty.

- The inequalities in poverty levels still continue. (Any 2 x 2)

Trade

- Rich countries continue to subsidise production of their agricultural goods.

- These countries make it hard for developing countries to compete while insisting that developing countries eliminate their tariffs on manufactured goods.

(Accept any other correct relevant response)

(Any 2 x 2) (8)

4.5 Why should developing countries ensure survival of labour-intensive industries in a global economy?

Survival of labour-intensive industries should be ensured to:

- protect jobs and wage levels by limiting unfair competition which may force local industries to reduce production and cut the factors of production.

- reduce wages or salaries in order to remain competitive in the international market.

- reduce high levels of poverty and unemployment which is of critical importance to protect jobs.

- protect those labour intensive industries that cannot compete with

- well-established foreign competitors.

- protect strategic industries e.g. the mining industry needed for long-term sustainability.

(Accept any other correct relevant response)

(Any 4 x 2) (8)

[40]

SECTION C

QUESTION 5: MACROECONOMICS

- Discuss in detail the markets within the four-sector model

- Evaluate the contribution/role of firms in growing the economy

INTRODUCTION

- Markets coordinate economic activities and in the process prices are determined for goods and services.

(Accept any other correct relevant introduction) (2)

MAIN PART

Factor market

- Households are the owners of factors of production.

- They sell the factors of production on the factor markets and are paid rent for land, wages for labour, interest fo capital and profit for entrepreneurship.

- The factor market also includes the labour, property and financial markets.

Financial markets

- These markets are not directly involved in the production of goods and services, they are a link between households, firms and other participants,

- e.g. insurance companies, banks etc.

- The financial market serves those who wish to save and those who wish to borrow.

Money market

- It is where short term loans and very short term funds are saved and borrowed by consumers and business enterprises.

- Banks operate in the money market.

- The SARB is the key institution in the money market.

- Bank debentures, treasury bills, government bonds are traded.

Capital market

- In the capital market long term funds are borrowed and saved by consumers and business enterprises.

- JSE is the key institution in this market.

- Shares are traded and mortgage bonds.

Foreign exchange market

- In the RSA these transactions take place in our banks.

- Businesses buy foreign currency to pay for imported goods and services.

- The SA Rand is traded freely in these markets.

- E.g when a person buys travellers cheques to travel abroad.

- The most important foreign exchange markets are in London, New York and Tokyo.

Goods/product market

- These are markets for consumer goods and services – goods are defined as any tangible items such as food , clothing and cars that satisfy some human wants and needs.

- Buying and selling of goods that are produced in markets.

- E.g durable consumer goods – furniture

- Semi-durable consumer goods – tyres

- Non-durable consumer goods – beverages

- Services are intangible items such as hairdressing, insurance

- Capital goods market is for trading of buildings and machinery. (26)

ADDITIONAL PART

POSITIVE ROLE

- Firms employ different factors of production which includes employing workers (labour) to produce goods and services.

- By employing labour, firms pay wages creating a flow of income to households, which is spent by households on goods produced by different firms.

- Firms develop new products and services to try to respond to consumer preferences and tastes.

- For example, in response to increased demand for coffee, firms have opened new stores to cater for the new demand/ they can also involve offering new services such as home delivery by supermarkets.

- Firms invest in capital and new technology to improve productivity in the economy and ultimately higher living standards.

- Firms provide goods and services for the consumer which has enabled greater specialisation in the economy.

- For example, labour saving devices such as washing machines, vacuum cleaners, childcare have saved time for ‘household chores’ enabling women to enter the labour force in greater number.

- Firms pay taxes which contribute to social welfare the government pays to its citizens to ensure economic development.

NEGATIVE ROLE

- Production by firms may lead to negative externalities of production, e.g. pollution and loss of natural resources.

- Firms with monopoly power can charge excessive prices and cause an inefficient allocation of resources.

- Firms which are publicly owned and supplying essential services may struggle to increase profits which can lead to regular bail-outs from the state.

Max (10)

CONCLUSION

- Markets are critically important institutions in our economic system, because they regulate supply and demand and safeguard stable prices and confidence amongst business people.

(Accept any other relevant higher order conclusion.) (2)

QUESTION 6: ECONOMIC PURSUITS

- Discuss in detail the social indicators. (26)

- How successful has the South African government been in promoting economic development through the use of these social indicators? (10)

INTRODUCTION

- Social indicators are numerical measures that describe the well-being of individuals or communities used by economists.

(Accept any correct relevant introduction) (2)

MAIN PART

Demographics

- These deal with statistical data relating to the population such as size, race, age, sex, income, language and education.

- Government and businesses must know the size of the country’s population to be able to provide for its infrastructure and businesses to know the availability of labour and size of markets.

Population growth

- South Africa’s population was estimated at 58,78 million in 2019.

- Growth is slowing down.

Life expectancy

- This expresses the number of years a newborn infant will live if the prevailing patterns of mortality remained the same throughout his or her life.

- Life expectancy at birth was estimated at 61,5 years for males and 67,7 years for females in 2019.

- Assurance companies are interested in life expectancy as unexpected reductions reduce the number of years policy holders can pay premiums.

Nutrition and health

- The standard of living of the population is related to the quality of nutrition and health.

Nutrition

- Nutrition is an important indicator for the well-being of infants and young children.

- Child nutrition ─ Malnutrition is expressed in two ways – weight for age (under weight) and height for age (dwarfism).

- The proportion of underweight children is the most important indicator of malnutrition.

- Overweight children : there is an association between obesity of children and other diseases.

Health

- Infant mortality: The number of children that will die before one year of age is one way of measuring the health of a population.

- Under-five mortality: the number of children that will die before the age of 5 years.

- Health expenditure: the amount of health expenditure as a percentage of GDP.

- Access to safe drinking water: the percentage of a population that has reasonable access to safe drinking water.

- Access to sanitation facilities: the percentage of a population with at least adequate sanitation facilities that can prevent human, animal and insect contact.

Housing and urbanisation

Housing

- A significant proportion of South Africans are poor and cannot afford to buy residential property.

- The government facilitates home ownership by means of a subsidy system and loans from the private sector.

- More than 3 million subsidised houses have been handed over to households since 1994.

Urbanisation

- Urbanisation is the increase in the population numbers of cities and towns

- The level of urbanisation is one of the indicators of a country’s social development.

- Urbanisation is an important social indicator because it points out to governments and developers that land has to be provided for a variety of purposes and services.

- It is measured by:

- Natural growth of the urban population

- Migration

- Establishment of new towns

- South Africa is experiencing a trend of rapid urbanisation

Education

- People’s standard of living is directly related to their level of education.

- Five or six years of schooling is a critical threshold for the achievement of sustainable literacy and numeracy skills.

- A society of literate and skilled citizens has more chances of development at economic and social levels.

- Education can reduce poverty and social injustice by providing the underpriviledged with resources and opportunities for upward social mobility and social inclusion

- Public expenditure percentage – shows the percentage of public expenditure that is directed towards education.

- It measures public sector input but excludes private expenditure.

- Secondary enrolment percentage – shows the percentage of designated age group attending secondary education.

- It is considered a prerequisite for entry into employment for the semi-skilled

Services

- A number of services are vital to enhance people’s lifestyle and level of economic and social development.

Electricity

- A large percentage of South African households have access to electricity.

Refusal disposal

- Some households in South Africa have access to refuse removal by local authorities once a week.

Water supply

- The average number of households who have access to an improved water source has increased in South Africa since 1994.

- An improved source refers to an adequate amount of water from sources such as household connections, taps inside the yard, public taps etc

- Reasonable access is defined as the availability of 20 litres per person per day from a source within at least one kilometre of the dwelling.

Sanitation

- More households in South Africa have access to functioning sanitation.

- This includes flush toilets, chemical toilets and pit toilets with ventilation pipes.

- All other types of sanitation are defined as substandard

ADDITIONAL PART

The South African government has been successful in the following ways:

- It has provided free health services of quality at the provincial hospitals and clinics.

- The government has developed more major road infrastructure leading into economic hubs to accommodate more traffic

- The government extended school feeding schemes to more primary schools in the country where major unemployment is experienced in communities

- Improved the provision of clean water to communities, especially when droughts are experienced

- Increased free housing services and grants to the needy.

The South African government has not been successful in the following ways:

- There is still poor school infrastructure, poor learning conditions and a lack of learning materials in most schools in the country.

- Most public hospitals experience a shortage of resources in medicine and equipment

- Strike actions by municipal workers hamper delivery of services to the citizens

- Escalating corruption in the public sector hampers attempts by the government to provide for the welfare of the population.

- Overall poor service delivery is still rife in the country.

(Accept any other correct relevant response)

(Max 10)

CONCLUSION

- Social indicators can serve as a focal point in directing government expenditure on issues that will guarantee social development and quality lifestyle.

(Accept any other relevant higher order conclusion) Max (2)

TOTAL SECTION C: 40

GRAND TOTAL: 150