ACCOUNTING GRADE 12 MEMORANDUM - NSC PAST PAPERS AND MEMOS SEPTEMBER 2016

Share via Whatsapp Join our WhatsApp Group Join our Telegram GroupACCOUNTING

GRADE 12

NATIONAL SENIOR CERTIFICATE

MEMORANDUM

SEPTEMBER 2016

MARKING PRINCIPLES:

- Penalties for foreign items are applied only if the candidate is not losing marks elsewhere in the question for that item (no penalty for misplaced item). No double penalty applied.

- Penalties for placement or poor presentation (e.g. details) are applied only if the candidate is earning marks on the figures for that item.

- Full marks for correct answer. If answer incorrect, mark the workings provided.

- If a pre-adjustment figure is shown as a final figure, allocate the part-mark for the working for that figure (not the method mark for the answer).

- Unless otherwise indicated, the positive or negative effect of any figure must be considered to award the mark. If no + or – sign or bracket is provided, assume that the figure is positive.

- Where indicated, part-marks may be awarded to differentiate between differing qualities of answers from candidates.

- This memorandum is not for public distribution, as certain items might imply incorrect treatment. The adjustments made are due to nuances in certain questions.

- Where penalties are applied, the marks for that section of the question cannot be a final negative.

- Where method marks are awarded for operation, the marker must inspect the reasonableness of the answer and at least one part must be correct before awarding the mark.

- In awarding method marks, ensure that candidates do not get full marks for any item that is incorrect at least in part.

- Be aware of candidates who provide valid alternatives beyond the marking guideline.

- Codes: f = foreign item; p = placement/presentation.

QUESTION 1: COST ACCOUNTING

1.1 Match the terms in COLUMN A with an appropriate example/explanation from COLUMN B. Write the letter (A–E) only next to the numbers

(1.1.1– 1.1.5).

1.1.1 C✓

1.1.2 D✓

1.1.3 E✓

1.1.4 A✓

1.1.5 B✓

(5)

1.2 SIDDHI BASKET INC.

1.2.1 Factory Overhead Cost

| Foreman’s salary | 198 000 |

| Depreciation on factory plant and equipment | 86 560 |

| Rent expense ( 107 240 x (5/7)) | 76 600✓✓ |

| Water and electricity (118 520 x 75%) | 88 890✓✓ |

| Insurance (34 845 x (2/3)) | 23 230✓✓ |

| Sundry expenses (22 600 x 65%) | 14 690✓✓ |

| Operation One part correct | 487 970✓ |

(9)

Production Cost Statement on 29 February 2016

| Raw material cost (42 400 ✓ + 745 500 ✓ + 38 500 ✓ – 37 600 ✓) | 788 800 ✓ One part correct |

| Direct labour cost balancing figure | 333 230✓ |

| Prime cost operation (DMC + DLC) | 1 122 030✓ |

| Factory overhead cost Check note above | 487 970✓ |

Total manufacturing cost Operation (less WIP/OB) | 1 610 000✓ |

| Work in process (opening balance) | 27 600✓ |

| Operation (add WIP/CB) | 1 637 600✓ |

| Work in process (closing balance) | (36 800)✓ |

| Total cost of production of finished goods 18 400 x R87 | 1 600 800 ✓ Operation |

(14)

1.3 KUNAL’S SECURITY GATES

1.3.1 Calculate the break-even point (6)

136 800

76 800 + 60 000 ✓✓ = 506,7 (507) units ✓ One part correct

R860 ✓ – (180 + 255 + 155) ✓✓

590 (2 marks)

1.3.2 Compare and comment on the break-even point and the level of production achieved over the last two years. Quote figures. (6)

Comparison of the BEP with the level of production (with figures) ✓✓

Comparison of the 2015 and 2016 (BEP and/or production – with figures) ✓✓

General comment ✓✓

Refer to workings in 1.3.1

The business was not able to break even during the current year (BEP: 507 units / produced 480 units). Ended up making a loss / a lower turnover than last year.

The business produced less units this year compared to last year (540 in 2015 / 480 in 2016)

The business was able to break-even last year by 32 (540 – 508) units. (6)

1.3.3 Provide TWO reasons for the increase in direct material cost and suggest ONE way in which Kunal can control this cost. (5)

TWO REASONS:

Any valid reasons ✓✓✓✓

- Increased cost due to inflation / transport costs / scarcity.

- Wastage due to poor workmanship.

- Theft of material due to poor internal controls.

ONE SUGGESTION:

Any valid suggestion related to the reason identified ✓ - Look for cheaper suppliers without compromising quality.

- Negotiate transport and delivery discounts.

- Take advantage of bulk discounts.

- Train and supervise workers to minimise wastage.

- Control stock regularly to identify shortages. (5)

Q1: TOTAL MARKS : 45

QUESTION 2: RECONCILIATIONS

2.1 TRUE OR FALSE: (3)

2.1.1 True ✓

2.1.2 False ✓

2.1.3 True ✓

2.2 Bank Reconciliation

2.2.1 Calculate the correct bank account balance as per the General Ledger.

11 743 – 45 ✓– 132 ✓ + 23 ✓ – 325 ✓– 475 ✓ + 522 ✓ +189 ✓✓=11 500✓ (9)

One part correct

Accept alternative presentations such as columns/ledger account etc.

2.2.2 BANK RECONCILIATION STATEMENT ON 31 JULY 2016

| Debits | Credits | |

| Dr balance as per bank account | 11 500 ✓ Refer 2.2.1 | |

| Dr outstanding cheques: No. 1287 | 675✓ | |

| No. 1299 | 2 010✓ | |

| Cr deposit not yet recorded 28/07/16 | 4 410✓ | |

| Cr amount duplicated on statement | 325✓ | |

| Cr balance as per statement | 9 450✓ Balancing figure | |

| 14 185 | 14 185✓ | |

| - 1 (max -2) for poor presentation (incorrect or no details) | Operation – One part correct |

(7)

2.2.3 Provide ONE reason why the internal auditor expressed concern about Lucky’s job description.

One valid reason ✓✓

- Lucky is the sole person controlling cash (no division of duties).

- This is open to mismanagement and fraud.

- Lucky does not have any supervision and may neglect duties/tasks. (2)

2.2.4 Explain to Lucky why it was necessary to prepare a bank reconciliation statement each month. Provide TWO points.

TWO valid points ✓✓✓✓

To check the business records against the bank records.

To identify outstanding cheques and deposits.

To note and address errors and omissions.

To note stale cheques, bank charges, interest and/or debit orders.

Effective cash management / internal control mechanism. (4)

2.3 Creditor’s Reconciliation

2.3.1

| NO. | CREDITOR’S LEDGER ACCOUNT BALANCE | STATEMENT BALANCE |

| Balance | 87 320 | 95 400 |

| (i) | - 6 500✓ | - 6 500✓ |

| (ii) | + 900✓✓ | |

| (iii) | - 800✓ | |

| (iv) | + 1 250 ✓ | |

| (v) | - 4 000 ✓✓ | |

| (vi) | + 3 530 ✓ | |

| + 2 400 ✓ | ||

| (vii) | - 5 000 ✓ | |

| TOTAL | 84 000 ✓* | 84 000 |

(12)

Marks awarded for correct sign with amount. Accept the use of brackets for negative amounts

*Operation, One part correct for both totals (does not have to be the same total)(12)

2.3.2 As an internal auditor, what advice you offer the owner regarding the purchase of goods through the business accounts? Make reference to a GAAP principle in your explanation.

Any valid explanation ✓✓

Reference to the GAAP principle ✓

- The owner should not use the business accounts for private use.

- Private use is always recorded as drawings.

- The business account will be distorted and not reflect the correct information of the operation of the business.

Business entity principle (3)

Q2: TOTAL MARKS : 40

QUESTION 3: FIXED ASSETS AND COMPANIES – FINANCIAL STATEMENTS

3.1.1 GENERAL LEDGER OF MICAILA LTD

ASSET DISPOSAL ACCOUNT (N12)

| 2015 Dec | 31 | Equipment | 66 200 ✓* | 2015 Dec | 31 | Accumulated Depreciation on Equipment (43 225✓ + 8 275 ✓) | 51 500 ✓ One part correct |

| Profit on sale of assets | 300 ✓ Balancing figure | Bank | 15 000 ✓* | ||||

| 66 500 | 66 500 | ||||||

| *Amount and details must be correct | |||||||

(6)

3.1.2 Calculate the total depreciation on equipment

966 200 – 66 200 = 900 000 ✓ x 15% = 135 000 ✓

66 200 x 15% x 10/12 = 8 275 ✓✓

Total: 135 000 + 8 275 = 143 275 ✓ One part correct (5)

3.1.3 Calculate the carrying value of equipment

(66 200 – 51 500) refer 3.1.2

Equipment: 966 200 ✓– 549 600 ✓– 14 700 ✓ – 143 275 ✓

= 258 625 ✓ One part correct

Accept alternative presentation for information, including the note format. (5)

3.2 Income Statement for the year ended 29 February 2016

| Sales | 3 402 000 |

| Cost of sales (2 250 000 ✓✓ + 30 000 ✓✓) | (2280000)✓ |

| Gross profit | 1122000✓ |

| Other income | 164950 |

| Rent income (98 523 ✓+ 9 523 ✓✓) | 108046✓ |

| Commission income (60 281 ✓ – 5 577 ✓) | 54704✓ |

| Profit on sale of asset | 300✓ |

| Provision for bad debts adjustment | 1900✓✓ |

| Gross income | 1286950✓ |

| Operating expenses | (1057005) |

| Audit fees | 27500 |

| Sundry expenses | 76120 |

| Municipal fees | 215800 |

| Salaries and wages | 235820✓ |

| Directors fees (316 100 ✓ + 10 900 ✓✓) | 327000✓ |

| Discount allowed (6 330 ✓– 180 ✓✓) | 6150✓ |

| Consumable stores (24 770 ✓ – 1 970 ✓) | 22800✓ |

| Trading stock deficit | 2540✓ |

| Depreciation refer 3.1.2 | 143275✓ |

| Operating profit | 229945✓ |

| Interest income (220 000 x 8,5% x 9/12) | 14025✓✓ |

| Profit before interest expense | 243970 |

| Interest expense (1 064 000 – 975 400) | (88600)✓✓ |

| Net profit before income tax | 155370 |

| Income tax | (46770)✓ |

| Net profit after tax | 108600✓ |

(38)

-1 for foreign items (max -2)

All method marks: Operation, one part correct / * must be subtracted

3.3 TRADE AND OTHER RECEIVABLES

| Debtors control (280 200 + 3 600 ✓ + 1 200 ✓) | 285 000✓ |

| Provision for bad debts (2,5% of debtors control) | (7 125)✓ |

| Net trade debtors (this step is not necessary) | 277 875 |

| Accrued Income (9 523 + 4 675) 1 mark each, refer 3.2 for amounts | 14 198✓ |

| SARS : Income tax | 3 570✓ |

| Operation, one part correct | 295 643✓ |

(8)

3.4 Extract: CURRENT ASSETS section of the Balance Sheet

| CURRENT ASSETS operation, one part correct | 741 225 ✓ |

| Inventories (415 400 – 2 540) + 1 970 | 414 830✓✓ |

| Trade and other receivables check 3.3 | 295 643✓ |

| Cash and cash equivalents ( 34 172 ✓ – 3 420 ✓✓) | 30 752✓ |

(8)

Q3: TOTAL MARKS : 70

QUESTION 4: FINANCIAL STATEMENTS, CASH FLOW AND INTERPRETATION

4.1 SHARE CAPITAL

Authorised share capital

1 200 000 ordinary shares

Issued share capital

| 820 000 | Ordinary shares (1 July 2015) | 7 134 000 |

| 180 000 | Shares issued at R9,20 each Operation | 1 656 000✓ |

| (75 000) ✓ | Shares repurchased One part correct; in brackets (average share price R8,79 each ✓✓) | (659 250)✓ |

| 925 000 ✓ | Ordinary shares (30 June 2016) Operation | 8 130 750 ✓ |

4.2 CASH FLOW STATEMENT FOR THE YEAR ENDED 30 JUNE 2016

| CASH EFFECTS OF OPERATING ACTIVITIES | |

| Cash generated from operations | |

| Interest paid | (675 000) |

| Income tax paid – 15 500 ✓ + 656 100 ✓– 34 600 ✓ * | (606 000) ✓# |

| Dividends paid 369 000 ✓ + 795 400✓✓ * | (1 164 400)✓# |

| CASH EFFECTS OF INVESTING ACTIVITIES | |

| Fixed assets purchased | (856 450) |

| Proceeds from disposal of fixed assets - 11 935 460 ✓ + 856 450 ✓ + 12 363 550 ✓ ‒ 1 256 340 ✓ * | 28 200✓ |

| Increase in fixed deposit | 330 000 |

| CASH EFFECTS OF FINANCING ACTIVITIES | (231 500)✓ |

| Proceeds from shares issued | 1 656 000 ✓ |

| Funds used to re-purchase shares (75 000 x 9,30) | (697 500)✓# |

| Decrease in loan (5 300 000 – 4 110 000) | (1 190 000)✓# |

| NET CHANGE IN CASH AND CASH EQUIVALENTS | 442 670 ✓ |

| Cash and cash equivalents (1 July 2015) | (48 370) ✓✓ |

| Cash and cash equivalents (30 June 2016) | 394 300 |

(22)

* Accept alternative arrangement for calculations, such as signs reversed or the use of ledger accounts

# To earn the method marks, check operation, one part correct and outflow must be clearly indicated by brackets.

4.3

4.3.1 Calculate the percentage operating profit on total sales.

2 810 000 ✓ x 100 = 19% ✓ One part correct; must be % (3)

14 784 000 ✓

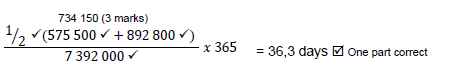

4.3.2 Calculate the average debtors collection period (in days) (5)

(5)

4.3.3 Calculate the net asset value per share

9 339 010 ✓ x 100 cents

925 000 ✓✓

= 1 009,6 cents ✓ One part correct

Also accept 1 010 cents (4)

4.3.4 Calculate the debt/equity ratio.

4 110 000 ✓ : 9 339 010 ✓

= 0,4 : 1 ✓ One part correct (x : 1) (3)

4.4 Comment on the liquidity of the business. Quote THREE financial indicators (with figures) in your explanation.

Financial indicators and figures ✓✓✓✓✓✓

Valid comment ✓✓

Any three of:

Current ratio: 1,1 : 1 to 1,8 : 1

Acid test ratio: 0,5 : 1 to 1,1 : 1

Debtors collection period: 42 days to 36,3 days (check 4.3.2)

General comment:

The liquidity has generally improved. The business is able to pay short term debts with current assets.

Improvement in collections from debtors – still not reached the desired 30 days.

(Do not accept creditors’ payment period as an option.) (8)

4.5 Some shareholders feel that the company paid back too much of the loan. What would you say to them? Make reference to TWO financial indicators with relevant figures to motivate your response.

Financial indicators and figures ✓✓✓✓

Valid comment ✓✓

Relevant financial indicators:

Debt/equity: improved from 0,7 : 1 to 0,4 : 1 (check 4.3.4)

ROTCE: improved from 17% to 21,3 %

Interest rate on loans: 11%

The company is lowly geared (not making extensive use of borrowed funds).

It is also positively geared (ROTCE is higher than interest rate).

It was not necessary for the company to pay large portions of the loan as long as it is generating a better return on investment than the cost of borrowing (interest). (6)

4.6 Comment on the dividend policy of the business and explain the effect of this on the business. Quote TWO financial indicators in your answer.

Financial indicators and figures ✓✓✓✓

Valid comment ✓✓

The company paid out 100% of earnings in 2015 (EPS 164 cents and DPS was 164 cents).

The directors decided to not retain any funds from the net profit.

In 2016, the directors retained 17% of the earnings (or paid out 83%). They distributed 150 cents (DPS) of the 180 cents (EPS). Although the EPS increased from 2015, the directors paid a lower dividend this year. (This adjustment to the dividend policy would have been explained in the directors’ report.) There may have been plans for expansions or growth of the company. (6)

4.7 A shareholder complained about the issue price of the new shares on 1 April 2016. Why do you think she complained? Quote TWO financial indicators with figures in your explanation.

Financial indicators and figures ✓✓✓✓

Valid comment ✓✓

Relevant financial indicators :

NAV: 992 cents in 2015 – 1 010 cents in 2016

Market price of shares: 1 000 cents in 2015 – 1 100 in 2016

- The company is showing growth in share value.

- New shares were issued (920 cents) at below the NAV and market price.

- The new shareholders benefitted from the low price they paid.

- The company lost out on an opportunity to generate additional funds from the issue of these shares.

- The directors’ intentions may be questioned.

- The shareholder is justified in complaining – this must be raised at the AGM. (6)

Q4: TOTAL MARKS: 70

QUESTION 5: INVENTORY VALUATION, VAT AND PROBLEM SOLVING

5.1 INVENTORY VALUATION

5.1.1 Calculate the following for the financial year ended 31 August 2016:

Calculate the value of the closing stock

(5 x 150) (10 x 140)

30 550 ✓+ 156 050 ✓ – 750 ✓ – 1 400 ✓

200 ✓ + 1 005 ✓ – 15 ✓

= 184 450 = 155 (weighted average)

1 190

155 ✓ x 160 ✓

= 24 800 ✓ One part correct (10)

Calculate the cost of sales

184 450 – 24 800 ✓ = 159 650 ✓ one part correct (2)

Above

Calculate the gross profit

993 x 220 = 218 460 (sales)

218 460 ✓✓ – 159 650 ✓ = 58 810 ✓ one part correct (4)

Above

5.1.2 Piet has experienced problems with stock theft and has installed a security camera. Despite this, he is sure that calculators were stolen.

Calculate the number of units missing.

(200 + 1 005 – 5 – 10) = 1 190 ✓ – 993 ✓– 160 ✓= 37 units ✓ (4)

Refer 5.1.1 one part correct

Provide another option that Piet can use to solve this problem.

Any valid option/suggestion ✓✓

Do random physical stock counting.

Have security checkpoints at exits.

Insert security disks/chips on products to be cleared at the tills. (2)

5.1.3 The stock holding period for calculators was accurately calculated to be 64 days. Comment on whether this is appropriate for this product.

One valid point ✓✓

- Calculators are durable items that could be stocked for a long time.

- It would be more appropriate to have extra stock during exam time and at the beginning of the school year when sales would be more than other times.

- Technological changes may cause some calculators to become outdated. It is something to take note of when buying stock.(2)

5.2 VALUE ADDED TAX (VAT)

Insert amounts only. Details not required.

| VAT CONTROL | |

| 17 472✓✓ | 4 778 |

| 448✓ | 25 844✓ |

| 2 212✓ | 210✓ |

| 490✓ | |

| 2 310✓ | |

| 20 132 | 33 632 |

Fill in amount in the correct space.

| Receivable | |

| Payable | 13 500 ✓✓ |

(10)

Method mark for amount; mark for correct column as per workings.

5.3 PROBLEM SOLVING:

| PROBLEM IDENTIFIED (with figures) Identifying problem ✓ Quoting figures ✓ | ADVICE OR SOLUTION One valid point ✓ | |

| SMART STREET | High stock of bags (80 opening and 82 closing ) They still received 120 units although they had stock on hand. OR Missing bags – (8) 80 + 120 – 110 = 90 should be on hand | Provide stock according to sales figures/demand. Transfer stock to other stall – shows better sales. OR Stock control should be done daily. Control where stock is displayed. |

| JAMES STREET | Bags sell well but money is missing R45 x 130 = R5 850 – 5 500 (R350 short) OR Caps not a good seller – high closing stock / only 70 sold. | Do daily reconciliations with assistant – cash control OR Monitor sales to order appropriately. Transfer caps to other stall Reconsider mark-up to increase sales Suggest commission for increased sales. Advertise caps to increase sales. |

(6)

Q5: TOTAL MARKS: 40

QUESTION 6: BUDGETING

6.1.1 Explain why bad debts expense does not appear in a cash budget.

Any valid explanation ✓✓

Bad debts is a non-cash expense. It does not involve a flow of cash.(2)

6.1.2 Explain why a cash budget is an effective internal control mechanism. Provide ONE reason

Any valid reason ✓✓

- It helps to plan receipts and payments.

- It highlights payments (expenses) that are not well controlled.

- It helps to ensure that cash is available for essential payments. (2)

6.2 ALGOA LTD

6.2.1

| MONTHS | CREDIT SALES | SEPTEMBER | OCTOBER | NOVEMBER |

| July | 108 000 | 12 960 | ||

| August | 104 400 | 46 980 | 12 528 | |

| September | 93 000 | 37 200 | 41 850 | 11 160✓✓ |

| October | 102 000 | 40 800 | 45 900✓✓ | |

| November | 111 600 | 44 640✓✓ | ||

| Total collection from debtors | 95 178 | 101 700 ✓ |

(7)

6.2.2

| Calculations | Answer | |

| (a) | 16 985 x (100/107,5) | 15 800 ✓✓ |

| (b) | 116 250 x 20% | 23 250 ✓✓ |

| (c) | 106 250✓ x 80% ✓ = 85 000 x 95% 21 250 x 80/20 = 85 000 | 80 750 ✓ one part correct |

| (d) | 8160 x 100 = 12% ✓✓ 74 400 x 12% 68000 ✓ | 8928✓ one part correct |

| (e) | 513000 = 95000 ✓+ 515 000 ✓ = 610 000 x 0,15 5,40 | 91500✓ one part correct |

(13)

6.2.3

Calculate:

- The amount of the loan that will be paid back on 1 November 2016.

2 000 x 12/0,1 = 240 000 ✓

1 750 x 12/0,1 = 210 000 ✓

30 000 was repaid ✓ one part correct (3) - The total cost of the new vehicle purchased on 31 July 2016.

4 750 x 48 = 228 000 ✓✓ + 40 000 ✓ = 268 000 ✓ One part correct (4)

6.2.4 A young shareholder is of the opinion that the company should not spend money on staff training – they should employ trained personnel.

Explain why the company spends money on staff training? Give ONE point.

A valid explanation ✓✓

- The company must be able to show that they are committed to the growth and development of the society that supports its venture (the triple bottom line).

- Giving back to society.

- Involvement in economic growth.

- CSR and the King code requires companies to invest in their communities. (2)

What can the business do to ensure that trained personnel remain in the employ of the business? Give ONE point.

A valid explanation ✓✓

- Ensure that market related salaries are paid.

- Make workers feel valued and appreciated.

- Sign contracts to remain with business for a specified period.

- Get employees to participate in profit sharing options. (2)

Q6: TOTAL MARKS : 35

TOTAL: 300