ACCOUNTING GRADE 12 MEMORANDUM - NSC EXAMS PAST PAPERS AND MEMOS SEPTEMBER 2019 PREPARATORY EXAMINATIONS

Share via Whatsapp Join our WhatsApp Group Join our Telegram GroupACCOUNTING

GRADE 12

NSC EXAMS PAST PAPERS AND MEMOS SEPTEMBER 2019

PREPARATORY EXAMINATIONS

MARKING PRINCIPLES:

- Penalties for foreign items are applied only if the candidate is not losing marks elsewhere in the question for that item (no foreign item penalty for misplaced items). No double penalty applied.

- Penalties for placement or poor presentation (e.g. details) are applied only if the candidate is earning marks on the figures for that item.

- Full marks for correct answer. If the answer is incorrect, mark the workings provided.

- If a pre-adjustment figure is shown as a final figure, allocate the part-mark for the working for that figure (not the method mark for the answer). Note: if figures are stipulated in memo for components of workings, these do not carry the method mark for final answer as well.

- Unless otherwise indicated, the positive or negative effect of any figure must be considered to award the mark. If no + or – sign or bracket is provided, assume that the figure is positive.

- Where indicated, part-marks may be awarded to differentiate between differing qualities of answers from candidates.

- Where penalties are applied, the marks for that section of the question cannot be a final negative.

- Where method marks are awarded for operation, the marker must inspect the reasonableness of the answer before awarding the mark.

- 'Operation' means 'Check operation'. 'One part correct' means 'Operation and one part correct'. Note: Check operation must be +, –, x or ÷ or per candidates’ response.

- In calculations, do not award marks for workings if numerator & denominator are swapped - this also applies to ratios.

- In awarding method marks, ensure that candidates do not get full marks for any item that is incorrect at least in part. In such cases, do not award the method mark. Indicate by way of ⌧

- Be aware of candidates who provide valid alternatives beyond the marking guideline.

- Codes: f = foreign item; p = placement/presentation.

MEMORANDUM

QUESTION 1: DEBTORS AGE-ANALYSIS AND BANK RECONCILIATION

1.1 DEBTORS AGE-ANALYSIS

1.1.1 Explain how the Debtors’ Age Analysis can assist with the control over debtors. Provide ONE point.

Any ONE valid point. ✔✔ Part marks for partial/incomplete answers.

- Effective method of credit control Helps identify debtors who have not paid within the credit terms granted. Interest can be charged to debtors not adhering to the business’ policy. Legal action can be taken against debtors who do not comply. (2)

1.1.2 Calculate the average debtors’ collection period (in days) for the financial year ended 31 August 2019.

Workings | Answer |

½ (19 800 + 76 200) | 38,9 days/39 days ? |

(5)

- Comment whether the business should be satisfied with this. Any ONE valid point. ✔✔ Part marks for partial/incomplete answers.

- The business cannot be satisfied as debtors are not complying with the 30 days credit terms. (2)

1.1.3 Identify TWO different problems revealed by the Debtors’ Age Analysis. Quote evidence and/or figures. In each case, provide advice to improve the internal control relating to the problem identified.

Problem ✔✔ | Advice on internal control✔✔ | |

Problem 1 | Certain debtors have exceeded their credit limit. | Do not sell on credit to debtors who have exceeded their credit limits |

Problem 2 | Debtors do not abide by the credit terms of 30 days. | Charge interest on overdue accounts |

Or | The business is allowing debtors to exceed credit terms and limits. | Install computer system to track debtors accounts |

(6)

1.2 BANK RECONCILIATION

1.2.1 (4)

(a) | True ✔ |

(b) | False ✔ |

(c) | True ✔ |

(d) | True ✔ |

1.2.2 Calculate the correct totals for the Cash Receipts Journal and the Cash Payments Journal for July 2019. Use the tables provided.

Cash receipts journal |

one part correct | Cash payments journal |

127 670 | 68 900 | |

1 800 ✔✔ | 1 300 ✔✔ | |

12 340 ✔✔ | 920 ✔✔ | |

| 600 ✔✔ | ||

| 50 000 ✔✔ | ||

| 141 810 ✔✔✔ | 121 720 ✔✔✔ |

(14)

1.2.3 Bank reconciliation statement on 31 July 2019. (10)

Debit | Credit | |

Balance as per bank statement | 44 040 ✔✔ | |

Outstanding deposit | 18 000 ✔✔ | |

Outstanding cheques: 897 #balancing figure: 905 | 8 700 ✔ | |

20 500 | ||

908 | 3 100 ✔ | |

Balance as per bank account | 29 740* | |

Both totals must be the same | 62 040 | 62 040 |

# Note: Do not award method mark for balancing figure if R15 000 appears in any column.

1.2.4 Explain how cheque No. 908 should be treated when preparing the financial statements on 31 July 2019, the end of the financial year.

- Increase bank ✔ and increase creditors ✔

Do not accept: Dr bank and Cr Creditors control is for ledger account not financial statement 2

1.2.5 Identify the GAAP principle applied by the bookkeeper.

- Principle of prudence ✔

Provide TWO suggestions on how a similar problem in future can be prevented.

Any TWO valid suggestions ✔✔ ✔✔ Part marks for partial/incomplete answers

Division of duties (partial answer)

- Encourage EFT payments by customers/debtors.

- All cash received must be deposited daily (deposit slips must tally with receipts issued).

- Daily checks to see that deposits are made.

- Request notification (SMS) from bank for all transactions. (5)

TOTAL MARKS : 50

QUESTION 2: INVENTORY VALUATION

2.1 Calculate the following on 28 February 2019:

2.1.1 Value of closing stock (10)

Workings | Answer |

4 191 500 four marks | 1 111 000? |

10 2.1.2 Gross profit for the year ended. (5 )

Workings | Answer |

see 2.1.1 see 2.1.1 | 369 800 ? |

2.2.1 Calculate the stock value on 28 February 2019 using the FIFO method. (7)

Workings | Answer |

200 – 7 | 1 202 731? |

2.2.2 Explain the effect on gross profit if the FIFO method is used.

Any valid point ✔✔

- A larger closing stock will result in a smaller cost of sales and hence a greater (an increased) gross profit.

- The gross profit will be more compared to when weighted average method is used. (2)

2.2.3 As an internal auditor, explain the benefits of using the FIFO method to the owner and the accountant. State TWO points.

Any TWO valid points ✔✔ ✔✔ part marks for short/incomplete statements

- Stock shown at recent prices, realistic

- Reflect a higher gross profit

- Easy to apply

- No manipulation of profits (4)

2.3 Ching Lee feels that she was not able to achieve her targeted mark up % for 2019.

Do (or perform) a calculation to confirm whether she is correct. (3)

Workings | Answer |

See 2.1.2 | 12% |

Provide TWO suggestions that can be implemented in order to improve profitability.

Any TWO valid suggestions ✔✔ ✔✔

- Give less trade discounts

- Support local suppliers

- Supervise sales to ensure correct prices are applied

- Consider after-sales services such as maintenance, repairs and installations (4)

TOTAL MARKS : 35

QUESTION 3: MANUFACTURING

3.1.1 DIRECT LABOUR COST (6)

Workings | Answer |

Normal wage (50 x 800 x 12) = 480 000 ✔? | 646 800 ? |

FACTORY OVERHEAD COST (10)

Indirect Material | 128 000 |

Indirect labour | 135 340 |

Water and electricity (4/7 X 77 000) | 44 000 ✔✔ |

Insurance | 48 500 ✔ |

Rent (288 000 x 15/24) | 180 000 ✔✔ |

Sundry expense (84 000 x 75%) | 63 000 ✔✔ |

Depreciation on factory equipment | 18 900 ✔ |

617 740 ?*✔ one part correct |

3.1.2 PRODUCTION COST STATEMENT FOR THE YEAR ENDED 28 FEBRUARY 2019 (10)

Direct materials cost | 1 427 000 ?* |

Labour Cost see 3.1.1 | 646 800 ? |

Prime Cost operation | 2 073 800 ? |

Factory Overhead Cost see 3.1.1 | 617 740 ? |

Total cost of production operation | 2 691 540 ? |

Work in process at the beginning of the year | 79 000 |

| 2 770 540 | |

Work in process at the end of the year operation, it should be subtracted | (80 350) ? |

Cost of production of finished goods | 2 690 190 |

3.2.1 Identify ONE variable cost that is not well controlled in each department. Quote figures. In each case, provide a solution for the problem identified.

Mark sections independently (8)

Suitcases | Laptop bags | |

Cost identified ✔✔ | Direct labour cost ✔ | Direct material cost ✔ |

Figures ✔✔ ✔✔ | Increased from R130 to R150 ✔✔ by R20 or 15,4% | Increased from R40 to R54 ✔✔ Increased by R14 or 35% |

Solution ✔ ✔ | Train workers to be more efficient/work less overtime/control working hours ✔ | Secure cheaper supplier/improve security over material/supervise use to minimise wastage/recycle ✔ |

3.2.2 CALCULATION OF BREAK-EVEN POINT (4)

Workings |

3 500 000 ✔ |

3.2.3 Explain whether the business should be satisfied with the production of suitcases. Quote figures.

- The business will not be satisfied, ✔ did not break-even by 663 units.

- Produced 19 000 units; Break-even point was 19 663 units.

- The business is making a loss on 663 units ✔✔

OR - Production dropped compared to last year by 6 000 units whilst break even point increased by 432 units.3

3.2.4 JP wants to adjust the selling price of ONE of the products. What advice would you offer? Provide a valid reason for your suggestion, quoting relevant figures.

Product and explanation ✔✔ figure ✔

- Consider decreasing the price of suitcases to increase sales.

- The competitor has maintained his selling price, and has possibly attracted many customers.

- The increased selling and distribution costs was not effective to increase sales.

- A reduced price will attract more customers which will require production to increase.

- THREE-mark option: (if figure provided)

- Increase the price of laptop bags to be just below the price of the competitor

- The competitor charges R265. (4)

TOTAL MARKS : 45

QUESTION 4: FINANCIAL STATEMENTS

4.1 (5)

4.1.1 | C ✔ |

4.1.2 | E ✔ |

4.1.3 | A ✔ |

4.1.4 | B ✔ |

4.1.5 | D ✔ |

4.2.1 RETAINED INCOME NOTE (12)

Balance at the beginning of the year | 468 000 ✔ |

Net profit after tax (1 085 500 x 70%) | 759 920 ✔✔ |

Re-purchase of shares (50 000 ✔x 55c ✔✔) | (27 500) ? * |

| Ordinary share dividends | (460 000) |

| 240 000 ✔ ?* |

| 220 000 ✔ ?* |

| Balance at the end of the year | 740 420 ?* |

| *one part correct 12 |

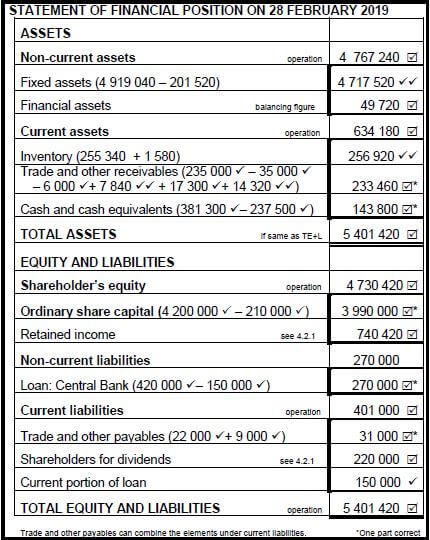

4.2.2  [35]

[35]

4.2.3 At the annual general meeting, the board of directors proposed the following TWO programmes:

Explain why the directors included these proposals in their directors’ report. Provide TWO points.

TWO valid points ✔✔ ✔✔

- Companies are expected to contribute to the communities that support them (corporate social responsibilities)

- The King Code prescribes that companies concentrate on the triple bottom line and not just profits. They are expected to put back into the community as well as the environment.

- Positive publicity will improve their image and their support. (4)

Provide a different benefit of each of the programmes proposed, to the company.

TWO points each ✔✔ ✔✔

Programme 1 |

|

Programme 2 |

|

TOTAL MARKS : 60

QUESTION 5: CASH FLOW AND INTERPRETATION

5.1.1 CASH GENERATED FROM OPERATIONS (15)

Net profit before tax | 1 230 000 ✔ |

Adjustments in respect of: | |

Depreciation | 950 000 |

Interest expense | 144 150 ✔ |

Operating profit before changes in working capital operation | 2 324 150 ? |

Changes in working capital operation | 59 400 ? |

| Decrease in inventory (1 044 700 – 903 900) | 140 800 |

Increase in debtors | (137 200) ?* |

889 000 two marks | 55 800 ?* |

| Cash generated from operations operation | 2 383 550 ? |

| The figure and the brackets (or no brackets) must be correct to earn the mark in the money column. | *one part correct |

5.1.2 (10)

| CASH FLOWS FROM INVESTING ACTIVITIES operation | (1 853 900) ? |

Purchase of fixed assets | (2 491 400) ? |

| Proceeds of sale on non-current assets | 225 000 ✔✔ |

| Decrease in investments (712 500 – 300 00) | 412 500 ✔✔ |

5.1.3 (7)

| CASH FLOWS FROM FINANCING ACTIVITIES operation | 988 000 ? |

| Proceeds from the issue of shares | 520 000 ✔ |

Repurchase of shares | (854 000) ?* |

Proceeds from long-term borrowings | 1 322 000 ✔ |

5.1.4

| NET CHANGE IN CASH AND CASH EQUIVALENTS operation | 131 000 |

Cash and cash equivalents – beginning of year | (61 000) |

| Cash and cash equivalents – end of year | 70 000 ✔ |

5.2 Calculate the following financial indicators for 2019:

- Acid test ratio

327 150 two marks

1 231 050 ✔ – 903 900 ✔ : 944 800 ✔

0,35 : 1 one part correct accept 0,4 : 1 (4) - Debt-equity ratio

3 345 800 two marks

1 622 000 ✔: 1 932 000 ✔ + 1 413 800 ✔

0;48 :1 one part correct accept 0,5:1 (4) - Net asset value per share

3 345 800 two marks

1 932 000 + 1 413 800 x 100 = 363,67 or 364 cent one part correct (4)

920 000 - Percentage return on total capital employed:

1 230 000 + 144 150 x 100 = 32,6 one part correct (8)

½ (4 967 800 + 3 456 000 )

4 211 900 five marks

5.3 It was a good decision for the directors to increase the loan. Explain by quoting TWO financial indicators with figures to support the director’s decision.

Financial indicator ✔ ✔ and Figure ✔ ✔ Explanation ✔ ✔

- The debt-equity ratio increases from 0,1 : 1 to 0,5 : 1.

- The return on total capital increase from 21,2% to 32,6% (see 5.2)

Explanation

- Although the business is making greater use of loans than last year as reflected by the increase in the debt/equity ratio, ROTCE is much higher than the interest rate (cost of the loan).

- Debt-equity ratio is lowly geared and the return on capital employed is 32,6% and is much higher than the 15% interest on loan. Positively geared. (6)

5.4 One of the shareholders want to sell their shares at 550 cents per share. Explain why the business should not repurchased these shares. Quote TWO financial indicators (with figures) to support your opinion.

Financial indicator ✔ ✔ and Figure ✔ ✔

- The NAV of 363,7 or 364 (see 5.2) is less than the 550 cents

- Market value of 380 cents is lower than the 550 cents

- This shareholder would not even be able to sell these shares on the JSE.

- Although there is an upward trend in the MP and the NAV, it is still not good practice to pay an amount that is way above the share price. (4)

5.5 Identify TWO major decisions taken by the directors, as evident from the Cash Flow Statement. Quote figures. Explain how these decisions would benefit the business in future.

Decision ✔ ✔ Figures ✔ ✔ Benefit ✔✔ ✔✔ (8)

Decision | Benefit |

Fixed assets were bought for R2 491 400. see 5.1.2 | These could generate profits in future if they are well used and maintained. |

Loan was increased by R1 322 000. see 5.1.3 | The still low risk can attract potential investors. |

New shares were issued. Cash increase by R520 000. | This increased the capital, therefore no need to go back into overdraft. |

Shares were re-purchased, R854 000 was spent. see 5.1.3 | This would raise the NAV, EPS + DPS because the numbers of shares are lower. |

Fixed assets were sold for R225 000. | Got rid of unused or high maintenance assets. The money could be used better elsewhere. |

5.6 Calculate the amount of dividends she obtained this year.

- 20 000 x 0,33 = R6 600 ✔ ✔ (2)

Explain to her why you think the directors changed the dividend pay-out policy this year. Quote figures.

Explanation ✔ ✔ figures ✔

- The company paid out 89,3% of EPS last year as they had no/little plans for improvement in the business.

- They decided to retain 58,8% of the EPS this year as they have plans to expand the business which will in turn result in greater profits in the long run.

- They want to use funds from operations to improve the business rather than increase the loan or issue new shares.

- Their plans would have been explained in the directors’ report so that shareholders would buy into the proposals. (3)

TOTAL MARKS : 80

QUESTION 6: CASH BUDGET

6.1 Provide ONE point why is it a good idea to compare actual figures against budgeted figures.

Any ONE valid response ✔✔

- To reflect on whether your projected receipts and payments have been realistic or well controlled.

- To improve future projections.

- To determine variances between projections and actual amounts.

- To be able to control receipts and payments on a monthly basis. (2)

6.2 Identify TWO items that were incorrectly entered in the Cash Budget.

- Depreciation ✔

- Vehicle bought on credit ✔ 2

6.3 Complete the debtors Collection Schedule for July 2019 (7)

Months | Credit sales | Collections: July 2019 |

May | 180 000 | ✔✔ 32 400 |

June | ✔252 000 | 126 000 |

July | 288 000 | ✔✔✔ 84 240 |

| operation | 242 640 |

6.4.1 Percentage increase in salary and wages with effect from July 2019. (3)

Workings | Answer |

16 200 ✔ X 100 | 12% ? |

6.4.2 Missing figures, (i) and (ii) in the extract of the Cash Budget. (8)

Workings | Answer |

(i) 420 000 x 100/160 x 30/100 | 78 750 |

(ii) 480 000 ✔ x 100/160 x 70/100 | 210 000 |

6.5 Explain what you would mention to shareholders about each of the following items at the end of July 2019.

In each case advise what effect these items will have on the company.

Any valid responses

Explanation one mark per item ✔ ✔ Advice one mark per item ✔ ✔ (4)

EXPLANATION | ADVICE |

Audit fees: | Change of auditors/ audited twice will eliminate fraud and assure shareholders that their investment is protected against any fraudulent activities. Improve the internal audit. |

Advertising: | Consider the implications of not advertising. It is important to advertise in order to attract customers and possibly improve sales. |

6.6 Shareholders are thinking of purchasing the business premises rather than renting it.

Explain ONE major advantage and ONE major disadvantage of this option. (4)

Advantage ✔✔ |

Disadvantage ✔✔ |

TOTAL MARKS: 30

TOTAL: 300