ACCOUNTING GRADE 12 QUESTIONS - NSC EXAMS PAST PAPERS AND MEMOS NOVEMBER 2018

Share via Whatsapp Join our WhatsApp Group Join our Telegram GroupACCOUNTING

GRADE 12

NSC EXAMS

PAST PAPERS AND MEMOS

NOVEMBER 2018

INSTRUCTIONS AND INFORMATION

Read the following instructions carefully and follow them precisely.

- Answer ALL the questions.

- A special ANSWER BOOK is provided in which to answer ALL the questions.

- Show ALL workings to achieve part-marks.

- You may use a non-programmable calculator.

- You may use a dark pencil or blue/black ink to answer the questions.

- Where applicable, show ALL calculations to ONE decimal point.

- Write neatly and legibly.

Use the table below as a guide when answering the question paper. Try NOT to deviate from it.

QUESTION 1: 40 marks; 25 minutes | |

Topic: | This integrates: |

Manufacturing | Managerial accounting

Managing resources

|

QUESTION 2: 35 marks; 20 minutes | |

Topic: | This integrates: |

VAT and Creditors Reconciliation | Financial accounting

Managing resources

|

QUESTION 3: 75 marks; 45 minutes | |

Topic: | This integrates: |

Financial Statements and Audit Report | Financial accounting

|

QUESTION 4: 70 marks; 40 minutes | |

Topic: | This integrates: |

Cash Flow Statement and Interpretation | Financial accounting

|

QUESTION 5: 45 marks; 30 minutes | |

Topic: | This integrates: |

Inventory Valuation and Fixed Assets | Managing resources Concepts

|

QUESTION 6: 35 marks; 20 minutes | |

Topic: | This integrates: |

Cash Budgets | Managerial accounting

|

QUESTIONS

QUESTION 1: MANUFACTURING (40 marks; 25 minutes)

1.1 Indicate whether the following statements are TRUE or FALSE. Write only 'true' or 'false' next to the question numbers (1.1.1 to 1.1.3) in the ANSWER BOOK.

1.1.1 Bad debts are an administration cost.

1.1.2 Indirect labour is a factory overhead cost.

1.1.3 Rent expense is a fixed cost. (3)

1.2 KRIGE SHIRTS

The business manufactures shirts. The financial year-end is 31 July 2018.

REQUIRED:

1.2.1 Refer to Information C. Calculate direct labour cost. (9)

1.2.2 Production Cost Statement for the year ended 31 July 2018 (12)

INFORMATION:

-

Work-in-progress stock balance 31 JULY 2018 1 AUGUST 2017 ? R35 570 - Raw materials issued to factory: R528 300

- Direct labour:

Number of factory workers

4

Normal time expected per worker per year

1 960 hours

Normal time rate

R90 per hour

Bonuses to workers: 12% of normal wages

NOTE: One worker worked only 1 680 hours and received a reduced bonus of R12 146.

- Factory overheads were calculated at R360 880 for the year. However,this excludes insurance of R48 750 paid for the period 1 August 2017 to 31 August 2018. Insurance must be allocated to the factory, administration and sales in the ratio 4 : 3 : 2.

- Production for the year: 17 500 shirts at a cost of R95 per shirt

1.3 GEMMA'S MANUFACTURERS

This business manufactures security gates. The financial year-end is 31 August 2018.

REQUIRED:

1.3.1 Calculate the break-even point for the year ended 31 August 2018. (5)

1.3.2 Compare and comment on the break-even point and the production level achieved over the last two years. Quote figures. (6)

1.3.3 Give TWO reasons for the increase in direct material cost. Suggest ONE way to control this cost. (5)

INFORMATION FOR YEAR ENDED 31 AUGUST:

A.

COSTS | 2018 | 2017 | ||

TOTAL AMOUNT | UNIT COST | UNIT COST | ||

Direct materials | Variable | 75 600 | R180 | R148 |

Direct labour | 105 840 | R252 | R244 | |

Selling and distribution | 60 900 | R145 | R136 | |

TOTAL VARIABLE COST | 242 340 | R577 | ||

Factory overheads | Fixed | 67 200 | R160 | R156 |

Administration | 51 660 | R123 | R127 | |

B. Additional information:

2018 | 2017 | |

Total sales | R382 200 | R475 200 |

Selling price per unit | R910 | R880 |

Units produced and sold | 420 units | 540 units |

Break-even point | ? | 435 units |

QUESTION 2: VAT AND CREDITORS' RECONCILIATION (35 marks, 20 minutes)

2.1 VAT

Samson Traders is registered for VAT. The VAT rate is 15%.

REQUIRED:

2.1.1 Calculate the figures indicated by (a) to (d) in the table below. (10)

2.1.2 You are the internal auditor. The sole owner, Samson, used a business cheque to buy a new car for R460 000 including VAT.

This car is kept at home for his wife's use. Samson says the vehicle must be recorded as a business asset and R60 000 must be recorded as a VAT input in the business' books.

Explain what you would say to Samson. Provide TWO points. (4)

INFORMATION:

EXCLUDING VAT | VAT AMOUNT | INCLUDING VAT | |

Sales returns | 960 | (a) | 1 104 |

Purchase of stock | 52 600 | (b) | |

Discount received | (c) | 720 | |

Cash sales | (d) | 112 470* |

* This includes zero-rated goods that should have been sold for R5 500. The bookkeeper has incorrectly included VAT of R825 on these goods. This must be corrected.

2.2 CREDITORS' RECONCILIATION

Claire Traders buys goods on credit from Mariti Suppliers.

REQUIRED:

2.2.1 Use the table provided to indicate changes to the:

- Creditors' Ledger Account in the books of Claire Traders

- Creditors' Reconciliation Statement on 31 July 2018 (13)

2.2.2 The internal auditor insists that direct payments (EFTs) must be used to pay suppliers. Explain:

- ONE reason to support his decision (2)

- ONE internal procedure to ensure control over this system (2)

2.2.3 Refer to Invoice 301. It was discovered that the store manager, Vernon, had signed a fictitious order form and took the goods for himself when they arrived. Besides dismissing Vernon, provide:

- ONE suggestion for action to be taken against him

- ONE suggestion to prevent this problem in future (4)

INFORMATION:

A. Creditors' Ledger of Claire Traders

MARITI SUPPLIERS (CL5)

DEBIT | CREDIT | BALANCE | ||||

2018 July | 1 | Balance | b/d | 67 500 | ||

10 | Invoice 209 | 81 000 | ||||

EFT | 33 750 | |||||

17 | Debit Note 674 | 8 640 | ||||

Invoice 282 | 40 950 | |||||

Invoice 301 | 25 000 | |||||

21 | Invoice 360 | 50 250 | ||||

24 | Debit Note 995 | 8 100 | ||||

27 | Journal Voucher 570 | 5 400 | ||||

31 | Cheque and discount | 77 190 | 147 820 | |||

B. Statement of account from Mariti Suppliers

MARITI SUPPLIERS | |||||

DEBIT | CREDIT | BALANCE | |||

2018 July | 1 | Balance | 67 500 | ||

10 | Invoice 209 | 81 000 | |||

Receipt 695 | 33 750 | ||||

17 | Credit Note 741 | 6 840 | |||

Invoice 301 | 25 000 | ||||

21 | Invoice 360 | 20 250 | |||

24 | Credit Note 811 | 8 100 | 145 060 | ||

C. Differences noted:

- The incorrect entry for Debit Note 674 in the Creditor's Ledger Account of Mariti Suppliers relates to the correct Credit Note 741 on the statement.

- Invoice 282 was incorrectly reflected in the account of Mariti Suppliers in the Creditors' Ledger. The goods were purchased from Genesis Suppliers.

- Invoice 360 was incorrectly recorded on the statement from Mariti Suppliers.

- Mariti Suppliers also purchased goods on credit from Claire Traders. Claire Traders has transferred a debit balance from the Debtors' Ledger (Journal Voucher 570). Mariti Suppliers will offset this on the next statement.

- The transaction on 24 July 2018 is for merchandise returned to Mariti Suppliers.

- The statement reflects transactions up to 25 July 2018.

QUESTION 3: FINANCIAL STATEMENTS AND AUDIT REPORT (75 marks; 45 minutes)

3.1 Indicate where EACH of the following items would be placed in the financial statements by choosing a term from the list below. Write only the answer next to the question numbers (3.1.1 to 3.1.4) in the ANSWER BOOK.

| non-current assets; current assets; equity; operating expenses; operating income |

3.1.1 Trade and other receivables

3.1.2 Adjustments of provision for bad debts (decrease)

3.1.3 Fixed deposit maturing in three years' time

3.1.4 Trading stock deficit (4)

3.2 TEMBISO LTD

You are provided with information for the financial year ended 28 February 2018.

REQUIRED:

Complete the following for the year ended 28 February 2018:

3.2.1 Income Statement (Statement of Comprehensive Income) (28)

3.2.2 Notes to the Balance Sheet (Statement of Financial Position) for:

- Ordinary share capital (7)

- Retained income (7)

3.2.3 Equity and Liabilities section of the Balance Sheet (16)

INFORMATION:

A. Balances/Totals on 28 February:

2018 | 2017 | |

Ordinary share capital | 8 816 000 | 6 976 000 |

Retained income | 384 600 | 376 600 |

Loan: LSO Bank | ? | 1 725 500 |

Trade creditors | 414 120 | |

SARS: Income tax (provisional payments) | 341 800 | |

Sales | ? | |

Cost of sales | 4 856 000 | |

Total operating income | 879 440 | |

Salaries and wages | 501 200 | |

Audit fees | 65 400 | |

Rent expense | 79 240 | |

Directors' fees | 497 800 | |

Sundry expenses | 91 680 | |

Interest on fixed deposit | ? | |

Interest on loan | 242 500 |

B. Adjustments and additional information:

- Sale of goods:

The company maintains a mark-up of 40% on cost. Note that old goods costing R96 000 (included in cost of sales) were sold at 10% below cost price. - Audit fees:

75% of the annual fees have been paid. - Directors' fees:

The company has three directors who earn the same fee. One director was paid two months in advance. - Rental:

A storeroom was rented from 1 June 2017 at R11 200 per month. Rent increased by 7,5% on 1 December 2017. Provide for outstanding rent. - Loan: LSO Bank

- Fixed monthly repayments, including interest, are R31 600.

- Capitalised interest amounted to R242 500 for the year ended 28 February 2018.

- Interest for the next financial year is expected to be R162 000.

- Part of the loan will be repaid within the next financial year.

- Income tax for 2018:

- R31 300 is still due to SARS.

- The correct net profit after tax is R959 400.

- Share capital and dividends:

Authorised share capital: 1 600 000 ordinary shares

1 March 2017 | 80% of the shares were in issue. |

1 May 2017 | 300 000 shares were repurchased at R465 000 above the average share price. |

31 August 2017 | Interim dividends paid: 30 cents per share. |

31 October 2017 | Additional shares were issued. |

28 February 2018 | Final dividends were declared. |

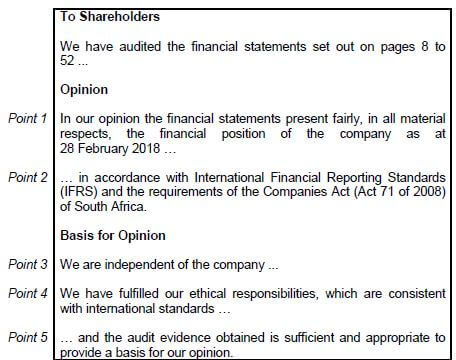

3.3 AUDIT REPORT

Extracts from the audit report of Tembiso Ltd are provided.

INFORMATION:

REQUIRED:

3.3.1 Refer to points 1 to 3.

Why did the auditors mention these points? Give ONE explanation for EACH point. (5)

3.3.2 Refer to points 4 and 5.

Explain TWO examples of:

- Ethical responsibilities

- Audit evidence (8) [75]

QUESTION 4: CASH FLOW STATEMENT AND INTERPRETATION (70 marks; 40 minutes)

You are provided with information about Vooma Limited for the past two financial years ended 30 June. The company is situated in KZN and trades in racing bikes.

REQUIRED:

NOTE: Provide figures or financial indicators (ratios or percentages) and comparisons with the previous year to support comments or explanations.

4.1 Calculate the following for 2018:

4.1.1 % operating expenses on sales (2)

4.1.2 Acid-test ratio (4)

4.1.3 % return on shareholders' equity (4)

4.2 Calculate the following figures that will appear in the 2018 Cash Flow Statement:

4.2.1 Change in investments (2)

4.2.2 Income tax paid (4)

4.2.3 Fixed assets sold (at carrying value) (5)

4.3 Cash flow and financing activities:

4.3.1 Explain why the directors are satisfied with the improvement in cash and cash equivalents since 1 July 2016. (3)

4.3.2 Decisions and gearing in 2018:

- Identify THREE decisions that the directors made to pay for land and buildings. (6)

- Explain how these decisions affected:

- Capital employed

- Financial gearing (Quote TWO indicators.) (6)

4.3.3 From the Cash Flow Statement identify ONE decision made by the directors in 2017 that they did NOT make in 2018, besides the points mentioned above. Give a possible reason for the decision in 2017. (3)

4.4 Dividends, returns and shareholding for the 2018 financial year:

- On 1 July 2017 there were 800 000 shares in issue.

- On 31 December 2017 interim dividends were paid.

- On 1 January 2018, 200 000 shares were issued to existing shareholders.

- On 30 June 2018 final dividends of 75 cents per share were declared on all shares, but have not yet been paid.

4.4.1 Calculate for the 2018 financial year:

- Total interim dividends paid (3)

- Interim dividends per share (3)

4.4.2 Calculate total dividends earned by Dudu Mkhize for the 2018 financial year. Her shareholding is: (5)

SHARES PURCHASED | PURCHASE PRICE | |

31 August 2016 | 380 000 shares | R7,00 |

1 January 2018 | 110 000 shares | R20,00 |

TOTAL | 490 000 shares |

4.4.3 On 1 January 2018 each shareholder was offered two shares for every five shares owned. Dudu did not buy enough shares to become the majority shareholder. Calculate the minimum number of additional shares that Dudu should have bought. (3)

4.5 The directors decided to buy land and buildings in two other provinces in 2018 to solve the problem of low sales that they had previously had in KZN.

4.5.1 Explain:

- Why it was necessary to purchase properties in other provinces instead of in KZN (2)

- Whether the decision to purchase these properties had the desired effect on sales (3)

- Another strategy they used to solve the problem of low sales (3)

4.5.2 The CEO, Ben Palo, wants to communicate other good news to the shareholders at the AGM. Give advice on what he should say about the following topics:

- Earnings per share (3)

- % return earned (3)

- Share price on the JSE (3)

INFORMATION FOR THE YEAR ENDED 30 JUNE:

A. FIGURES IDENTIFIED FROM INCOME STATEMENT:

Sales | R13 182 000 | R7 740 000 |

Number of bikes sold | 1 750 bikes | 900 bikes |

Mark-up % | 58% | 72% |

Cost of sales | 8 330 000 | 4 500 000 |

Gross profit | 4 852 000 | 3 240 000 |

Operating expenses | 1 900 000 | 1 500 000 |

Depreciation | 412 000 | 275 000 |

Income tax | 819 000 | 444 000 |

Net profit after tax | 1 911 000 | 1 036 000 |

B. EXTRACT FROM BALANCE SHEET ON 30 JUNE

| 2018 | 2017 | |

Fixed assets (carrying value) | R12 154 000 | R8 031 000 |

Investments | 625 000 | 600 000 |

Current assets | 2 427 000 | 2 090 000 |

Inventories | 1 652 000 | 1 250 000 |

Trade and other receivables | 365 000 | 820 000 |

SARS: Income tax | 0 | 15 000 |

Cash and cash equivalents | 410 000 | 5 000 |

Shareholders' equity | 12 112 000 | 7 191 000 |

Non-current liabilities (Loan) | 1 850 000 | 2 600 000 |

Current liabilities | 1 244 000 | 930 000 |

Trade and other payables | 420 000 | 515 000 |

Shareholders for dividends | 750 000 | 280 000 |

SARS: Income tax | 74 000 | 0 |

Bank overdraft | 0 | 135 000 |

C. CASH FLOW STATEMENT:

| 2018 | 2017 | |

| Cash flows from operating activities | R1 850 000 | R1 046 000 |

Cash generated from operations | 3 322 000 | 1 989 000 |

Interest paid | ? | (260 000) |

Dividends paid | (520 000) | (254 000) |

Income tax paid | ? | (429 000) |

| Cash flows from investing activities | (4 560 000) | (167 000) |

Purchases of land and buildings | (4 840 000) | 0 |

Sale of fixed assets | ? | 383 000 |

Change in investments | ? | (550 000) |

| Cash flows from financing activities | 3 250 000 | (400 000) |

Share capital issued | 4 000 000 | 0 |

Shares repurchased | 0 | (1 000 000) |

Change in non-current liabilities | (750 000) | 600 000 |

Cash and cash equivalents: Net change | 540 000 | 479 000 |

Opening balance | (130 000) | (609 000) |

Closing balance | 410 000 | (130 000) |

D. FINANCIAL INDICATORS:

| 2018 | 2017 | |

Mark-up % achieved | 58% | 72% |

Operating expenses on sales | ? | 19,4% |

Debt-equity ratio | 0,2 : 1 | 0,4 : 1 |

Acid-test ratio | ? | 0,9 : 1 |

Return on shareholders' equity | ? | 14,4% |

Return on capital employed | 20,8% | 17,8% |

Earnings per share | 208 cents | 130 cents |

Dividends per share | ? | 70 cents |

Dividend pay-out rate | 50% | 54% |

Net asset value per share | 1 211 cents | 899 cents |

Market price on stock exchange | 2 800 cents | 2 100 cents |

Interest on loans | 12% | 12% |

QUESTION 5: INVENTORY VALUATION AND FIXED ASSETS

(45 marks; 30 minutes)

5.1 Choose a method in COLUMN B that matches the description in COLUMN A. Write only the letters (A–E) next to the question numbers (5.1.1 to 5.1.4) in the ANSWER BOOK.

COLUMN A | COLUMN B |

5.1.1 Assumes that stock is sold in date order as purchased. |

(4 x 1) (4) |

(See QUESTION 5.2 on the next page.)

5.2 PACKER'S SUITCASE SHOP

Charles Packer sells travel suitcases. The year-end is 30 June 2018.

REQUIRED:

5.2.1 Calculate the value of the closing stock on 30 June 2018 using the first-in-first-out (FIFO) method. (5)

5.2.2 Charles suspects that suitcases have been stolen. Provide a calculation to support his concern. (5)

5.2.3 Charles is concerned about the volume of stock on hand.

- Calculate for how long his closing stock is expected to last. (6)

- State ONE problem with keeping too much stock on hand and

ONE problem with keeping insufficient stock on hand. (4)

INFORMATION:

- Stock balances:

UNITS | UNIT PRICE | TOTAL | |

Opening stock | 420 | R2 175 | R913 500 |

Closing stock | 496 | ? |

- Purchases, returns and carriage:

UNITS | UNIT PRICE | TOTAL | |

Purchases | 3 155 | R8 460 850 | |

September 2017 | 850 | R2 250 | R1 912 500 |

December | 980 | R2 670 | R2 616 600 |

March 2018 | 875 | R2 930 | R2 563 750 |

June* (see returns) | 450 | R3 040 | R1 368 000 |

Returns* (from June purchases) | 25 | R3 040 | R76 000 |

- Sales: 3 050 travel suitcases were sold at R4 200 each.

5.3 MINDEW LIMITED

The financial year-end is 31 May 2018.

REQUIRED:

5.3.1 Calculate the missing figures indicated by (i) to (v) in the table below. (17)

5.3.2 Explain how the internal auditor should check that movable fixed assets were not stolen. (2)

5.3.3 Land and buildings were bought five years ago for R6 m. Property prices have increased by 20% since then. The directors want to increase the value of this asset and reflect a profit of R1 200 000 in the financial statements.

As an independent auditor, what advice would you give? Provide ONE point. (2)

INFORMATION FOR YEAR-END 31 MAY 2018:

A.

FIXED ASSETS | LAND AND BUILDINGS | COMPUTERS EQUIPMENT | VEHICLES | |

Carrying value: Begin | 6 000 000 | 13 000 | 1 027 500 | 1 300 000 |

Cost | 6 000 000 | 108 000 | 1 250 000 | 2 100 000 |

Accumulated depreciation | - | (95 000) | (222 500) | (800 000) |

Movements |

|

| ||

Additions | (i) | 0 | 172 500 | 0 |

Disposals | 0 | 0 | 0 | (iv) |

Depreciation | 0 | (ii) | (iii) | (256 000) |

Carrying value: End | ||||

Cost | ||||

| Accumulated depreciation | (v) |

B. Land and buildings:

Grant Construction was paid R882 000 for building new offices (R610 000) and repairing windows (R272 000).

C. Computers:

- The three computers were all bought on the same day at R36 000 each.

- Depreciation is 33⅓% on cost.

- These computers are expected to last another two years.

D. Equipment:

- Additional equipment was purchased on 1 February 2018.

- Depreciation is 10% p.a. on cost.

E. Vehicles:

- Depreciation is 20% p.a. on carrying value.

- A vehicle was sold for cash at carrying value on 31 December 2017. The Fixed Assets Register reflected the following:

Cost | R176 000 |

Accumulated depreciation (1 June 2017) | R128 000 |

QUESTION 6: CASH BUDGETS (35 marks; 20 minutes)

Donald May owns Breezy Traders that sell air-conditioner units. The budget period ends on 31 October 2018.

REQUIRED:

6.1 Complete the Debtors' Collection Schedule for October 2018. (7)

6.2 Calculate the amounts indicated by (i) to (iii) in the extract from the Cash Budget. (9)

6.3 Calculate the % increase in salaries of sales assistants for October 2018. Explain whether they should be satisfied with this increase. (5)

6.4 Refer to Information E.

A new competitor moved into the area during September 2018. Donald was not aware of the competitor and did not take any action during September.

6.4.1 Explain the effect of the new competitor on any TWO items in the budget for September. Provide figures. (4)

6.4.2 Identify TWO changes Donald implemented in October in response to the new competitor. Quote figures. Give ONE reason for EACH change. (6)

6.4.3 Explain why Donald feels that his decisions were successful. Provide TWO points (with figures). (4)

INFORMATION:

A. Cash sales comprise 60% of total sales. Mark-up is 75% on cost.

B. Debtors pay as follows:

- 20% in the month of sales and receive 5% discount

- 55% in the month following the month of sales

- 22% two months after the month of sales

C. Stock sold is replaced in the month of sales. 50% of purchases are on credit. Creditors are paid in the month following the month of purchases.

D. Extract from Cash Budget

SEPTEMBER | OCTOBER | |

RECEIPTS | ||

Cash sales | (i) | 630 000 |

Cash from debtors | 369 340 | ? |

Rent income* | 25 600 | (ii) |

PAYMENTS | ||

Payments to creditors | 276 000 | (iii) |

Salaries: Manager | 32 400 | 40 500 |

Salaries: Sales assistants | 92 400 | 102 102 |

*NOTE: Rent income will increase by 9% in October 2018.

E. BUDGETED AND ACTUAL FIGURES FOR SEPTEMBER AND OCTOBER

SEPTEMBER | OCTOBER | |||

BUDGETED | ACTUAL | BUDGETED | ACTUAL | |

Units to sell/sold | 240 | 200 | 250 | 300 |

Selling price per unit | R4 200 | R4 200 | R4 200 | R4 200 |

Cash sales | ? | 336 000 | 630 000 | 378 000 |

Credit sales | 403 200 | 504 000 | 420 000 | 882 000 |

Total sales | 1 008 000 | 840 000 | 1 050 000 | 1 260 000 |

Cash purchases | ? | ? | 300 000 | 252 000 |

Advertising | 10 000 | 10 000 | 10 000 | 10 000 |

Delivery expenses | 80 000 | 67 200 | 80 000 | 138 240 |

Commission on sales | 30 240 | 25 200 | 31 520 | 46 080 |

Cash surplus/deficit | 63 000 | 22 500 | 86 500 | (12 700) |

Cash: Beginning | 98 000 | 98 000 | 161 000 | 120 500 |

| Cash: End | 161 000 | 120 500 | 247 500 | 107 800 |

TOTAL: 300