ECONOMICS PAPER 1 GRADE 12 MEMORANDUM - 2018 JUNE EXAM PAST PAPERS AND MEMOS

Share via Whatsapp Join our WhatsApp Group Join our Telegram GroupECONOMICS PAPER 1

GRADE 12

NATIONAL SENIOR CERTIFICATE

MEMORANDUM

JUNE 2018

SECTION A (COMPULSORY)

QUESTION 1

1.1 MULTIPLE-CHOICE QUESTIONS

1.1.1 D ✓✓ endogenous

1.1.2 B ✓✓ extrapolation

1.1.3 A ✓✓ short term

1.1.4 D ✓✓ a lack of accountability

1.1.5 C ✓✓ exports and imports

1.1.6 C ✓✓ Economies of scale

1.1.7 B ✓✓ Regulation

1.1.8 A ✓✓ Free floating (8 x 2) (16)

1.2 MATCHING ITEMS

1.2.1 D ✓ Prices actually paid by consumers and producers for goods and services plus taxes minus subsidies

1.2.2 E ✓ Caused by changes in net investments by government and businesses

1.2.3 F ✓ Anyone can use these whether they are prepared to pay for them or not

1.2.4 B ✓ Money received without any productive service rendered

1.2.5 C ✓ Deepening of the recession

1.2.6 H ✓ Member countries agree to the removal of all tariffs

1.2.7 A ✓ Public goods

1.2.8 I ✓ National product at constant prices (8 x 1) (8)

1.3 ONE-WORD ITEMS

1.3.1 Real flow ✓

1.3.2 Business cycle ✓

1.3.3 Laffer curve ✓

1.3.4 Direct taxes /direct ✓

1.3.5 Special Drawing Rights ✓

1.3.6 Disinvestment ✓ (6 x 1) (6)

TOTAL SECTION A: 30

SECTION B

Answer TWO of the three questions in this section.

QUESTION 2

2.1 Answer the following questions.

2.1.1 Name TWO characteristics of fiscal policy

- Cyclical ✓

- Goal bound ✓

- Demand biased ✓ (Any 2 x 1) (2)

2.1.2 How can the appreciation of the rand affect exports of goods and services?

- There will be reduction in exports ✓✓

- It makes goods and services more expensive ✓✓

(Accept any other correct relevant response.) (Any 1 x 2) (2)

2.2 DATA RESPONSE

2.2.1 Identify the concept in the above extract

Multiplier/multiplier effect ✓ (1)

2.2.2 What percentage of their income will households spend?

70 percent ✓ (1)

2.2.3 Briefly describe the term multiplier.

Occurs when a small increase in spending produces a larger increase of their income. ✓✓

(Accept any other correct relevant response) (2)

2.2.4 What impact will a tax increase have on the multiplier?

- It means that less money will be available to spend ✓✓

- Contribution of all sectors in the country. The expectation is that the multiplier will decrease and thus the total value of the multiplier will decrease as well. ✓✓

(Accept any other correct relevant answer.) (Any 1 x 2) (2)

2.2.5 Calculate the size of the multiplier. Show ALL calculations

= 1/mps ✓ = 1/1--mpc ✓

OR

= 1/ 0,2 ✓ = 1/1--0,8 ✓

= 5 ✓✓ = 5 ✓✓

MULTIPLIER = 5 ✓✓(award 2 marks for the answer only) (4)

2.3 DATA RESPONSE

2.3.1 Identify the original equilibrium point on the above graph.

At point e ✓ (1)

2.3.2 What happens to the value of the Rand when the demand curves shifts from DD to D1D1?

Depreciate/Decline/Decrease ✓

(Accept any other correct relevant answer.) (1)

2.3.3 Briefly explain floating exchange rate systems.

Is when the forces of supply and demand are used to maintain the exchange rate in equilibrium. ✓✓

(Accept any other correct relevant response.) (1 x 2) (2)

2.3.4 What effect does globalisation have on international trade?

- It stimulates international trade ✓✓

- Allows a greater variety of goods and services between countries ✓✓

(Accept any other correct relevant response.) (Any 1 x 2) (2)

2.3.5 How will demand influence foreign exchange?

The demand will influence the foreign exchange by:

- Importing goods ✓✓

- Payment for services from foreign countries ✓✓

- Tourists spending money overseas ✓✓

- Buying shares in another country ✓✓

(Accept any other correct relevant response.) (Any 2 x 2) (4)

2.4 Briefly discuss any TWO arguments in favour of privatisation.

- Privatisation attracts more foreign investors to South Africa. ✓✓ Capital skills, technology and foreign exchange flow into the country. ✓✓

- Privatisation relieves pressure of the budget ✓✓deficits on the budget will decrease. ✓✓

- Promote black economic empowerment. ✓✓Shares in public companies can be made available to black entrepreneurs. ✓✓

- Private enterprises are more efficient than public enterprises. ✓✓ The profit motive in the private sector ensures that firms operate efficiently and at the lowest possible price ✓✓

- SOE’s are bureaucratic, inefficient, unresponsive to consumer needs, poorly managed. ✓✓

- Tax base will be broadened ✓✓ creating more income for government ✓✓

- Privatisation ensures additional funds (income) for government ✓✓ this will help them to maintain and manage state-owned enterprises.

(Any 4 x 2) (8)

2.5 What effect does the term of trade have on the balance on the current account?

The terms of trade compare a country’s export prices with its import prices by means of indexes. ✓✓

The terms of trade decline when:

- A decrease in export prices, less income is erased with the same expenditure. ✓✓

- An increase in import prices, welfare is lost because expenditure on imports is more. ✓✓

- For a surplus balance exports should be encouraged ✓✓ and imports limited. ✓✓

The terms of trade will improve when:

- An increase in export prices, more revenue is earned with the same expenditure. ✓✓

- A decrease in import prices, welfare increases because expenditure on imports is less. ✓✓

- Larger injection into the economy, balance on the current account will improve. ✓✓

(Accept any other correct relevant response.) (Max. 8) (8)

[40]

QUESTION 3

3.1

3.1.1 Name TWO demand reasons for international trade.

- Size of the population ✓

- An increase in wealth ✓

- Preferences and tastes ✓

- Population’s income ✓

- Differences in consumer patterns ✓ (Any 2 x 1) (2)

3.1.2 How important are national account aggregates for the country?

- Determine the wealth of the country ✓✓

- Measure the performance of the country. ✓✓

- Contribution of all the sectors in the country is determined. ✓✓

(Any 1 x 2) (2)

3.2 DATA RESPONSE

3.2.1 What does the above curve represent?

Phillips Curve ✓ (1)

3.2.2 Name the point that represents the natural rate of unemployment.

Point A ✓ (1)

3.2.3 Explain the relationship between inflation and unemployment

- There is an inverse/negative/opposite relationship. ✓✓

- As inflation increases unemployment decreases ✓✓ or as inflation decreases unemployment increases. ✓ (Any 1 x 2) (2)

3.2.4 What measures could be used by the government to reduce unemployment?

- Improved education ✓✓

- Effective training ✓✓

- Fewer legal restrictions on businesses ✓✓

- Fewer restrictions on the immigration of skilled workers ✓✓ (2)

3.2.5 What impact will an increase in commercial banks’ reserve requirements have on the aggregate money supply?

- The aggregate money supply will decrease ✓✓

- There will be a negative impact ✓✓

(Accept any other relevant correct response.) (Any 2 x 2) (4)

3.3 DATA RESPONSE

3.3.1 Identify the trade policy referred to in the cartoon above.

Free trade ✓ (1)

3.3.2 Name ONE reason why the policy is beneficial

- It allows economies of scale to be maximised ✓

- Unit costs reduced ✓

- Consumers are given a choice of what to buy from the world ✓

(Any 1 x 1) (1)

3.3.3 Briefly explain the term trade liberalisation.

Refers to the abolishment of government intervention in trade flows on both the import and export side. ✓✓ (2)

3.3.4 Explain the dangers of dumping in a country

- Decreases prices below the cost of producing the products ✓✓

- In the long term this may drive out domestic producers ✓✓

- Consumers are likely to lose out as a result of reduction and choice ✓✓

- Exporters charge higher prices ✓✓

(Accept any other correct relevant response.) (Any 1 x 2) (2)

3.3.5 Why should infant industries be protected?

- They find it difficult to compete with well-established competitors. ✓✓

- They take advantage of economies of scale to lower their average cost. ✓✓

- Their average cost is higher than that of their competitors✓✓

- They often reduce their cost through learning by doing ✓✓

(Any 2 x 2) (4)

3.4 Illustrate in the form of a table how Gross Domestic Product @ market prices is calculated using the income method. (NO FIGURES NECESSARY)

| Consumption of employees ✓ Net operating surplus ✓ Consumption of fixed capital ✓ |

| Gross value added @ factor cost ✓ |

| +Other taxes on production --Other subsidies on production ✓ |

| Gross value added @ basic prices ✓ |

| +Other taxes on products] --Other subsidies on products ✓ |

| Gross Domestic Product @ market prices ✓ |

(8)

3.5 How can the South African government avoid public sector failure?

- Goods and services should be provided in the desired quantity and quality ✓✓

- Public goods can be efficiently provided if pareto efficiency is achieved. ✓✓

- Avoid bureaucracy / minimise red tape / rules and procedures should be streamlined to minimise the negative impact on service delivery ✓✓

- Increase training, effective training must be provided for government officials e.g. reskilling in service training. ✓✓

- Improve motivation ✓✓

- Eliminate corruption. ✓✓

(Accept any other correct relevant response.) (Max. 8) (8)

[40]

QUESTION 4

4.1

4.1.1 Name TWO examples of injections.

- Government spending ✓

- Investment ✓

- Exports ✓ (Any 2 x 1) (2)

4.1.2 How are ad valorem duties used to limit imports?

They are charged as a percentage of the value of an item. ✓✓ (1 x 2) (2)

4.2 DATA RESPONSE

4.2.1 Identify an example of a leading economic indicator from the above extract. (1)

Job advertisements ✓

4.2.2 Name the factor that contributed to a fall in the manufacturing sector.

Fewer hours worked in the manufacturing sector. ✓ (1)

4.2.3 Briefly explain the term composite indicator.

- It is a grouping of various indicators of the same type into a single value. ✓✓

- The single figure forms the norm for a country’s economic performance. ✓✓ (Any 1 x 2) (2)

4.2.4 Explain how leading economic indicators are used in forecasting?

- Leading economic indicators change before the economy changes, giving a warning of what we can expect in the future. ✓✓

- They lead the economy indicating changes before the changes happen. ✓✓

- They reach a peak/trough a few months before the business cycle reaches a peak/trough ✓✓

- Examples: share prices, total number of new cars sold etc. ✓

(Any 1 x 2) (2)

4.2.5 How can the government use fiscal policy to stimulate the economy?

- Raising government spending (G) ✓ with borrowed money (budget deficit) ✓ / Aggregate expenditure and demand will increase and employment is likely to increase ✓

- Decreasing taxes ✓ consumers and producers have a larger part of their incomes available to spend on goods and services ✓ or investment ✓/ aggregate expenditure increases ✓and employment increases✓

- Raising government spending and simultaneously decreasing

taxes ✓✓will have a strong effect of increasing government spending ✓ and consumers and producers will have more to spend ✓ or to invest ✓ demand increases substantially ✓ and employment increases. ✓

(Accept any other correct relevant response.) (Any 2 x 2) (4)

4.3 DATA RESPONSE

4.3.1 What is represented in the above cartoon)

Government spending/government expenditure ✓ (1)

4.3.2 Identify the people most affected as a result of increased government spending.

Taxpayers ✓ (1)

4.3.3 Name any reason why the government impose taxes.

- To generate income/revenue ✓✓

- Engage in international trade ✓✓

(Accept any other correct relevant response) (Any 1 x 2) (2)

4.3.4 Briefly explain how people benefit from taxes.

- Provision of social services e.g. grants and pensions ✓✓

- Building houses for the poor ✓✓

- Infrastructure of the country ✓✓e.g. physical ✓or social infrastructure ✓

(Accept any other correct relevant response.) (Any 1 x 2) (2)

4.3.5 How do community goods differ from collective goods?

- Community goods

- Anyone can use these whether they are prepared to pay or not✓✓ e.g. police stations. ✓

- Goods that have non-rivalry and non-excludability, which means that the private sector is not willing to supply them. ✓✓

- Collective goods

- Goods provided for the society as a whole ✓✓ e.g. parks and public utilities. ✓

- Provision of these goods gives rise to the free-rider problem ✓✓

- Goods that are specially characterised when it is possible to exclude free riders by levying fees or tolls. ✓✓

- (Accept any other correct relevant response) (Any 2 x 2) (4)

4.4. Explain direct and portfolio investments in the financial account.

- Direct investments

- Refers to investments in real estate (fixed property). ✓✓

- Obtaining a meaningful share or control of such a business. ✓✓

- e.g. USA’ s takeover of the local chain Massmart was a foreign direct investment. ✓ (Any 2 x 2)

- Portfolio investments

- Refers to the buying of financial assets such as shares in companies on the stock exchange of another country. ✓✓

- These investments are highly liquid and their flow can be reversed at any time. ✓✓

- Portfolio investment money is also known as hot money. ✓✓

(Any 2 x 2) (8)

4.5 Why are state owned enterprises (SOEs) seen as a problem in public sector provisioning?

- The costs of maintaining and managing SOEs are very high ✓✓

- These costs result in higher taxes and larger public debt ✓✓

- Private enterprises are more cost-efficient than public enterprises ✓✓

- SOEs are seen as bureaucratic, inefficient and unresponsive to consumer needs ✓✓

- SOEs do not operate according to the profit motive-they sometimes incur large losses, which must be funded by tax money ✓✓

- SOEs are seen as the exact cause of huge unemployment and a shortage of funds for other developments ✓✓

(Accept any other correct relevant response.) (Max. 8) (8)

[40]

TOTAL SECTION B:80

SECTION C

Answer ONE of the two questions in this section in the ANSWER BOOK.

The answer must be assessed as follows:

| STRUCTURE OF ESSAY | MARK ALLOCATION |

Introduction

| Max. 2 |

| Body Main part: Discuss in detail/In-depth discussion/Examine/Critically discuss/Analyse/Compare/Evaluate/Distinguish/Differentiate/ Explain Additional part: Give own opinion/Critically discuss/Evaluate/ Critically evaluate/Draw a graph and explain/Use the graph given and explain/Complete the given graph/Calculate/Deduce/ Compare/Explain/ Distinguish/ Interpret/Briefly debate/ How/Suggest | Max. 26 Max. 10 |

Conclusion

| Max. 2 |

| TOTAL: | 40 |

QUESTION 5 MACROECONOMICS

The new economic paradigm is embedded in demand-and-supply side policies to influence the economy.

- Discuss in detail the use of monetary and fiscal policies to influence supply in the smoothing of business cycles. (26)

- Explain the effects of demand-side and supply-side policies using a graph (aggregate demand and aggregate supply) (10)

INTRODUCTION

- According to the New Economic Paradigm, it is possible for output to rise over extended periods of time without being hampered by supply constraints and inflationary pressures. ✓✓

- Smoothing of the business cycle is when policy is used to prevent dramatic peaks and troughs. ✓✓

- Consecutive periods of increasing and decreasing economic activities ✓✓

(Accept any other correct relevant introduction.) (Max. 2) (2)

BODY

MAIN PART:

Monetary policies:

When the level of economic activity changes, the SARB can use expansionary or contractionary measures to reduce the fluctuation of such economic activities.

Monetary policy is more effective when dampening an overheated economy that has inflation rising.

- An expansionary monetary policy is implemented when the economy is in recession in order to stimulate economic activities. ✓✓

- Interest rates can be reduced to encourage spending. ✓✓

- Inflation can be curbed by reducing money supply and availability of credit. ✓✓

- To dampen the demand at the peak the government will be able to reduce money supply by increasing interest rates. ✓✓

- Selling government bonds and securities and reduce the supply of money in circulation. ✓✓

- Increase the cash reserve requirements to manipulate money creation activities of banks. ✓✓

- Persuade banks to decrease lending and to devaluate the exchange rate. ✓✓

Fiscal policy:

When the level of economic activity changes, the minister of Finance can use expansionary and contractionary measures to reduce fluctuation of such economic activities. ✓✓

- An expansionary fiscal policy can be implemented when the economy is in recession in order to stimulate economic activities. ✓✓

- An increase in government expenditure will increase aggregate demand.

- This will lead to higher income and higher expenditure.✓✓

- Increase in government expenditure serves as an injection into the economy as production will increase, more factors of production will be employed.✓✓

- Taxes can be reduced, which will lead to an increase in disposable income. ✓✓

- This serves as an injection into the economy and eventually aggregate demand will increase.✓✓

- When the economy grows too fast, government can reduce its spending and increase taxes. ✓✓

- This will lead to a decrease in aggregate demand, which will reduce production as fewer goods and services will be needed. ✓✓

Supply-side policies – governments can arrange things in the economy in a way that is cooperative to changes in demand.

- Reduction in costs ✓

- Greater output supplies at any given price level ✓✓ and output expands with prices stable ✓✓

- Government measures that can reduce costs ✓

- Infrastructural services like communication, transport and energy costs ✓✓

- Administrative costs like inspections and regulations – add to overall . costs ✓✓

- Cash incentives e.g. subsidies ✓✓ and payment to exporters ✓✓

- Measures to improve efficiency of inputs ✓

- Tax rates – high rates of personal tax are disincentives. ✓✓ usually achieved with incentive schemes and measures such as tax rates ✓✓

- Capital consumption, human resources development and free advisory services ✓✓

- Improving efficiency of markets ✓✓

- Measures to improve efficiency include deregulation, competition and levelling the economic playing field. ✓✓

(Max. 26 marks)

(Listing max. 4 marks)

ADDITIONAL PART

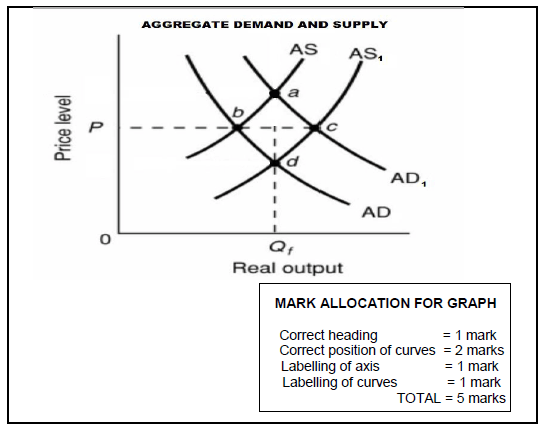

Explain the effect of demand-side and supply-side policies using a graph (aggregate demand and aggregate supply).

EXPLANATION

- The above graph shows that aggregate supply and demand are in equilibrium at point b ✓✓

- If aggregate demand is stimulated, it moves to AD1 and aggregate supply responds and relocates at AS1, ✓✓ a larger output becomes available without any increases ✓✓

- Supply is fixed in the short term ✓✓ if aggregate demand increases and aggregate supply does not respond. The point of intersection is F. ✓✓

- Real production increases, but so do prices ✓✓

- The solution is to create conditions that ensure that supply is more flexible ✓✓

- This is done with the use of supply-side measures. ✓✓ (Max. 5 marks)

(10)

CONCLUSION

- Monetary and fiscal instruments must be used by policy makers to prevent an unstable economy. ✓✓

- Fluctuations must be monitored through indicators that are available. ✓✓

(Accept any other correct relevant conclusion.) (Max. 2)

[40]

QUESTION 6: MACRO ECONOMICS

South Africa’s international trade policy consists of export promotion and import substitution.

- Discuss export promotion as part of South Africa’s international trade policy under the following headings:

- Methods (8)

- Reasons (8)

- Disadvantages (10) (26 marks)

- How can countries use lending and borrowing to correct the deficit and surpluses on the balance of payments? (10 marks)

[40]

INTRODUCTION

- Incentives or mechanisms to encourage domestic manufactures to increase the exports of goods and services to foreign countries. ✓✓

(Accept any other correct relevant introduction) (Max. 2) (2)

BODY

MAIN PART

Methods of export promotion

- Incentives ✓

- The government supplies information on export markets in order to stimulate exports ✓✓

- Research on new markets, export credit etc. ✓✓

- Subsidies ✓

- These include direct and indirect subsidies ✓✓

- Direct subsidies: Cash payments to exporters ✓✓

- Indirect subsidies: Refunds on import tariffs and general tax rebates ✓✓

- Trade neutrality: ✓

- Subsidies equal in size to import duties are paid. ✓✓

- Neutrality can be achieved through trade liberalisation. ✓✓ (Max. 8)

- Incentives ✓

- Reasons for export promotion:

- Export markets are much bigger than local markets. ✓✓

- Prices will be reduced ✓✓

- The country achieves significant export-led economic growth ✓✓

- It leads to lower prices ✓✓

- Larger production units will create more job opportunities ✓✓

(Max. 8)

Disadvantages of export promotion - The real cost of production is hidden ✓

- The product may never be able to compete in the open markets.✓✓

- It reduces the total costs by subsidies and incentives. ✓✓

- The real cost of production is hidden by the subsidies. ✓✓

- Increased tariffs and quotas✓

- Powerful overseas enterprises can afford to offer similar products at lower prices. ✓✓

- Overseas countries may bring in tariffs and quotas when similar goods are sold locally below their cost of production. ✓✓

- Compared to their production, the subsidised businesses’ domestic market may be so small that it will destroy the businesses who receive the subsidy. ✓✓

- Lack of competition ✓

- Total potential trade is lowered with subsidies rather than without subsidies ✓✓

- Incentives and subsidies reduce prices and force competitors who may be able to create sustainable and profitable businesses out of the

market ✓✓ - Protection is thus necessary to prevent local wage levels from falling or even prevent local businesses from closing down due to becoming unprofitable. ✓✓

- Protection of labour-intensive industries ✓

- Export promotion results in the protection of labour-intensive industries by developed countries. ✓✓

- Developed countries maintain high levels of effective protection for their industries that produce labour-intensive goods in which developing countries have or can achieve comparative advantage. ✓✓(Max. 10)

(Listing max. 7 marks)

ADDITIONAL PART

How can countries use lending and borrowing to correct the deficits and surpluses in the balance of payments?

Countries can use lending and borrowing when:

- Those countries with surpluses lend money to countries with deficits. ✓✓

- Countries with deficits often borrow. ✓✓

- This is why some developing countries have so much foreign debt. ✓✓

- In the event of a fundamental disequilibrium, member countries may borrow from the International Monetary Fund (IMF). ✓✓

- Borrowing is nevertheless not a long-term solution for fundamental balance of payments disequilibrium. ✓✓

(Accept any other correct relevant response.) (Max. 10)

CONCLUSION

Internationally, open economies with an export base have much better economic growth than closed economies. ✓✓

(Accept any other higher order conclusion.) (Max. 2)

[40]

TOTAL SECTION C: 40

GRAND TOTAL: 150