FINANCE - MATHEMATICAL LITERACY QUESTIONS AND ANSWERS GRADE 12

Share via Whatsapp Join our WhatsApp Group Join our Telegram GroupActivity 1

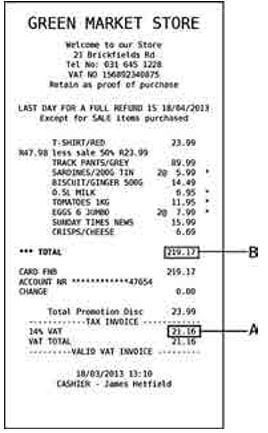

Sakhile goes to his local store and buys some clothes and groceries. He receives the following till slip. Study the slip and answer the questions that follow.

- What item did Sakhile buy on sale, and how much was the discount? (2)

- Can Sakhile return the sale item for refund? Explain your (2)

- How many eggs did Sakhile buy? (1)

- Calculate the total value of the VAT exempt items Sakhile (2)

- Demonstrate how the amount indicated by Letter A was calculated. Show all your (3)

- Demonstrate how the amount indicated by Letter B was calculated. Show all your (5) [15]

Solutions | ||

1. | A red T-shirt, ✓ 50% discount. ✓ | (2) |

2. | No, ✓ full refunds are only available for non-sale items. ✓ | (2) |

3. | 2 packs of 6, so 12 eggs. ✓ | (1) |

4. | 2(R5,99) + R6,95 + R11,95 + 2(R7,99) ✓ = R46,86. ✓ | (2) |

5. | VAT incl. items total R151,15. ✓ 14% VAT ✓ of this = R21,16. ✓ | (3) |

6. | Non-VAT items total R46,86. ✓ VAT incl. ✓ + VAT excl. ✓ + R21,16. ✓ VAT = R219,17. ✓ | (5) |

[15] | ||

Activity 2

|

Jet Stores | |

Edgars Stores | |

CBS stores | |

Ms D T Bears 222 Straight Str Hababa City 1313 | Credit available: R1 550,35 | |||||

Date: 02/06/2011 | ||||||

Statement | Instalment R280.00 | |||||

Date | Ref. no. | Details | Amount | Balance | Total Due R280.00 | |

22/05/11 | Opening balance | 3 450.15 | Due Date | |||

22/05/11 | Cash payment Thank you! | 280.00 | 3 170.15 | Credit limit | ||

23/05/11 | 12 months plan Purchase Jet Menlyn | 55.50 | 3 225.65 | Enquiries | ||

Purchase Jet Menlyn | 120.15 | 3 345.80 | Office Hours | |||

Purchase Jet Menlyn | 500.00 | (a) | ||||

Closing balance | (b) | |||||

Study the account statement above and answer the following questions.

- What is Daisy’s opening balance? (1)

- How much is her credit limit? (1)

- Why is there a due date on the statement? (2)

- Calculate the value of the goods she purchased this month. (2)

- Calculate the values (a) and (b). (2)

- The company charges 33% per annum on late payments. How much will Daisy owe if she does not pay the R280,00 installment until 07/07/2011? (6)

- The closing balance includes VAT. Calculate the original total, excluding VAT. (2)

- Why is the “Credit Available” amount not the same as the “Credit Limit”? (2) [18]

| Solutions | |||

| 1. | R3 450,15. ✓ | (1) | |

| 2. | R5 600,50. ✓ | (1) | |

| 3. | To regulate payment and also add charges if the account is not paid by that date. | (2) | |

4. | Purchases = R55,50 + R120,15 + R500,00 ✓ = R675,65. ✓ | (2) | |

5. | (a) R3 845,80. ✓ (b) R3 845,80. ✓ | (2) | |

6. | (33/100 × R280,00) ÷ 12 = R7,70. ✓✓ | ||

She will owe R3 845,80 ✓ – R280 ✓ + R7,70 ✓ | (6) | ||

= R3 573,50. ✓ | |||

7. VAT (excl.) Price = R3 845,80 ✓ ÷ 1,14 = R3 373,51. ✓ | (2) | ||

8. It shows that she still owes the company ✓, although they gave power of R5 600,50. ✓ | her buying | (2) | |

[18] | |||

Activity 3

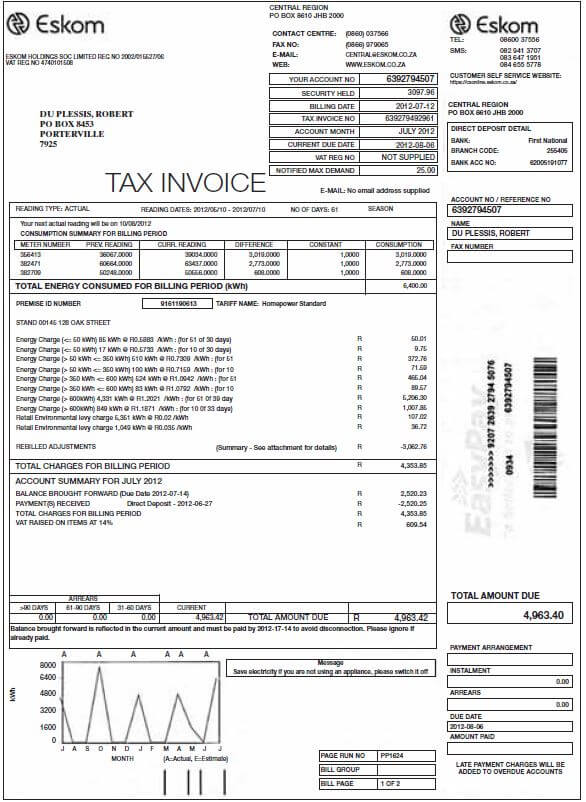

Study the Eskom bill below and answer the questions that follow.

Mr du Plessis gets the account for his electricity consumption over 2 months (see above bill). He has three electricity meters on his property for two small houses and a flat on the premises and they are billed together.

-

- What is the total amount due? (1)

- What does “billing period” mean and how long is it in this case? (4)

- When did Mr du Plessis last pay his electricity account and how much did he pay? (2)

- Why is the amount for “Payment(s) Received” negative (–R2 520,25)? (3)

- What do you think “Balance brought forward” means? (3)

- The consumption levels for the first two meters listed (meter numbers 356413 and 382471) are fairly similar, both close to 3 000 kWh. The consumption level for the third meter (number 382709) is much lower.

- Why do you think this might be so? (2)

- Give examples of factors that might increase a household’s electricity consumption. (2)

- The graph in the bottom left corner of the invoice shows the meter readings for Mr du Plessis’ electricity consumption over the previous 12 months.

- What do you think the letters under the horizontal axis mean?

Is there anything unusual about their order? (2) - What does the spiky shape of the graph indicate? Give a possible reason for why the consumption (in kWh) is high for some months and at zero for others. (3)

- Can you see a pattern between the high points (spikes) on the graph and the number of months that has passed? What does this pattern suggest about how often Mr du Plessis’ metre is read? (3) [25]

- What do you think the letters under the horizontal axis mean?

Solutions

-

- R4 963,42 ✓

- The billing period is a specific number of days ✓ covered by the invoice. The standard billing period is one month. ✓ In this case it is 61 days ✓, so this invoice includes electricity consumption for the 61 days before the billing date. ✓ (4)

- His last payment was on 2012-06-27, for R2 520,25. ✓✓ (2)

- The amount is negative to indicate that R2 520,25 ✓ was subtracted from what Mr du Plessis owed. (This payment is called a credit ✓ – it is money being paid into the account). ✓ (3)

“Balance brought forward” is the amount of money from the previous ✓ invoice that must be paid, or is still outstanding. In this invoice, the amount still outstanding was due to be paid by 2012-07-14 ✓, and Mr du Plessis paid it in full on 2012-06-27. ✓ (3)

- If the third meter is for the small flat on the property, for example, then the consumption will be lower ✓ because there will be fewer ✓ lights and plugs.(2)

- One major factor that affects how much electricity people use is the weather. In winter, ✓ for example, people use more ✓ lighting (because it gets dark ✓ earlier), heaters, electrical blankets, and appliances like tumble driers. (any 2) (2)

-

- The letters under the graph stand for the months of the year. They are not in the usual order (J (January), F (February), M, A, etc.) ✓ but are arranged in the order of the last months starting 12 months ago and ending with the most recent month (J (July), A (August) ✓, S (September) to J (June)).

- The large spikes indicate when the meter reading for consumption was high ✓, and the flat segments of the graph indicate that it was at 0kWh ✓. It is unlikely that Mr du Plessis used no electricity in the months when the meter reading was zero – it is more likely that the meter was not read at

all (for example, if no one was home when the meter reader arrived) in those ✓ months, and so consumption was entered into the system as being 0kWh. (3) - Initially, the peaks in the graph occur once every three months ✓ (July, October, January, April). Then the graph changes and there are non-zero readings for April and May ✓, no reading for June and again a reading for July ✓. So, from July 2011 to April 2012, the meter was read once every 3 months. Then it was read for 2 consecutive months (April and May), and then again two months later. (3) [25]

Activity 4

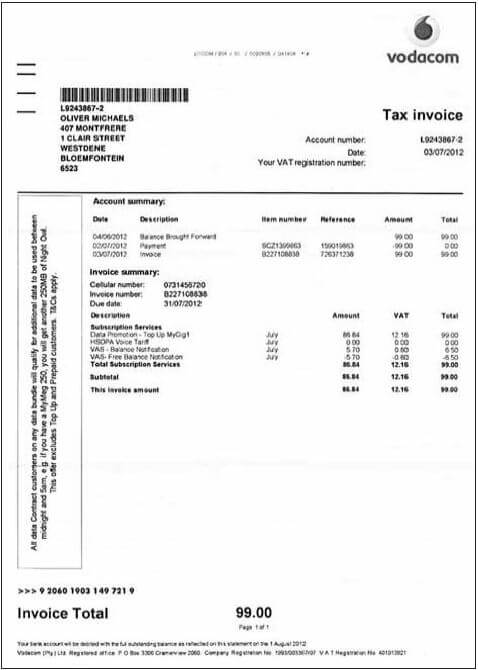

Oliver receives the cell phone bill on the previous page.

- What is the balance brought forward from the previous invoice? (1)

- On what date was the payment of this balance made? (1)

- When is the payment for the current outstanding amount due? (1)

- What subscription service does Oliver get for free? (1)

- What subscription does Oliver get a full refund for? (1)

- What is the billing period for this invoice? (1)

- Oliver wants to query the last payment he made. List four things he could use as a reference number. (4)

- Oliver wants to check that the VAT calculated on the total amount due is correct. Show how he can do this. Show all your calculations. (3) [13]

Solutions | |

1. R99,00 ✓ | (1) |

2. 02/07/2012 ✓ | (1) |

3. 31/07/2012 ✓ | (1) |

4. HSDPA Voice Tariff ✓ | (1) |

5. VAS Balance Notification✓ | (1) |

6. The month of July 2012✓ | (1) |

7. His cell phone number ✓, his account number ✓, the invoice number ✓ and the payment ✓ reference number. | (4) |

8. Total without VAT = R86,84. ✓ 14% of this = R86,84 ✓ ´ 14 ÷ 100 = R12,157 ≈ R12,16 ✓ | (3) |

| [13] |

Activity 5

Consider the previous activity, where Douglas planned to travel to Durban. He eventually decided to travel to Durban using bus Option 1. He kept all the receipts and till slips so that he could write a statement to see how much money he actually spent. Read the summary below of Douglas’s bus trip.

When Douglas arrives at the bus station to buy the ticket, he finds that the advertised price does not include VAT, and he needs to add 14% to the cost. To add to his problems, the bus breaks down and Douglas needs to find a place to stay the night in Knysna. He finds a backpackers’ lodge that costs R200 a night for a shared room. He also needs to rent a locker for R20 to keep his luggage safe. Apart from three meals on the bus, he needs to buy an extra supper and breakfast, which cost him R30 each.

- Fill in a table like the one used for his budget, to show his actual expenses and the running total of expenses.

Expense description

Amount

Running total of expenses

- What is the amount of money he ends up with as spending money in Durban?

Remember: he had R2 500 to begin with.

Solutions

-

Expense description

Amount

Running total of expenses

Bus Fare

R1 200 + R168 VAT

R1 368

Meals on Bus

R90

R1 458

Backpacker’s accommodation

R200

R1 658

Locker

R20

R1 678

Meals

R30 × 2 = R60

R1 738

- He has saved R2 000 and received R500 from his parents.

R2 500 - R1 738 = R762 to spend in Durban

Activity 6

Look at the family budget for the month of December 2013, for the Philander family. There are two adults and two school children in the family.

Item | Expenditure | Expenditure | Income |

Fixed | Variable | ||

Mrs Philander’s salary | R9 500 | ||

Mr Philander’s salary | 1. | ||

Additional income | 2. | ||

Bond repayment | 3. | ||

Food | 4. | ||

Edgars clothing account | 5. | ||

School fees | 6. | ||

Transport | 7. | ||

Entertainment | 8. | ||

Savings | 9. | ||

Car repayment | R1 300 | ||

Municipality rates | 10. | ||

Electricity | R200 | 11. | |

Vodacom contract cost | R700 | ||

Total | ? | ? | ? |

Surplus or deficit? |

Complete the above family budget by using the following information.

- Mr Philander’s income: He works 20 days per month at a rate of R500 per (1)

- Additional income: Mr Philander owns additional property which he rents out to people at a fixed charge of R2 500 per (1)

- The monthly bond repayments are fixed at R5 550 per (1)

- The average amount spent on food each month comes to R2 500. Mrs Philander believes that this should be increased by 10% due to recent food price (1)

- Mr Philander pays Edgars an amount of R800 per month. However, since he bought his children their school uniforms on account, he estimates that this amount will increase by a further 12%. (1)

- The school fees are R1 200 per child per (1)

- Transport costs are as follows: For the children, taxi fare per child = R5,00 per trip to school and another R5,00 each for the trip home. There are 20 school days in a month. Mr Philander first drives his wife to work and then goes to work himself. In the evenings he picks her up and they drive home again. They both work 20 days per month. Mr Philander has noticed that his car uses an average of 4 litres of petrol per day each time he does this.

On the other 10 days of the month, his car uses an average of 3 litres per day. The cost of petrol is R10,50 per litre. Calculate the total amount that should be budgeted for transport. (5) - The amount budgeted for entertainment is estimated at 5% of the combined income of Mr and Mrs (2)

- Savings are currently 5% of Mrs Philander’s (2)

- The amount budgeted for municipal rates is 5% of the total income earned by the Philander (5)

- The fixed component of the electricity account is currently R200 per month. The variable component is calculated as follows: the average amount of electricity consumed by the Philander household is 550 kilowatt hours per month at a rate of R0,50 per kilowatt hour. (4)

- Is the Philander family within budget? Explain your (5) [29]

Solutions

- 20 ´ R500 = R10 000 ✓

- R2 500 ✓

- R5 500 ✓

- R2 500 + R250 = R2 750 ✓

- R800 + R96 = R896 ✓

- R1 200 ´ 2 = R2 400 ✓

- Taxi fare: R10 per day ´ 2 children ´ 20 days ✓ =R400. ✓

Petrol: (20 × 4 litres ×R10,50) ✓ + (10 × 3 litres × R10,50) ✓ = R1 555 ✓ - Total salaries = R19 ✓ 5% of this is R975. ✓

- 5% of R9 500 ✓ = R475. ✓

- Total income = salaries ✓ + additional income ✓ = R19 500 + R2 500 ✓

= R22 000. ✓ 5% of this is R1 100. ✓ - 550 × R 0,50 ✓ = R275; ✓ monthly is R275 ✓ + R200 = R475. ✓

- The total for fixed expenses is R12 621 ✓. The total for variable expenses is R5 755 ✓. So, the total for all expenses is R18 376. The total income for the household is R22 000, so yes – they are within budget ✓, because their income is greater than their total ✓ expenditure and they have a surplus of money. ✓

Activity 7

Below is an incomplete bank statement for Koketso’s savings account at the end of March.

Date | Transaction | Payment | Deposit | Balance |

27/02/2013 | OPENING BALANCE | 2 304,85 | ||

01/03/2013 | INTEREST ON CREDIT BALANCE | 13,95 | ||

01/03/2013 | CHEQUE (SALARY) | 2 100,00 | ||

01/03/2013 | ATM CASH | 400,00 | ||

05/03/2013 | ATM CASH | 800,00 | ||

10/03/2013 | ATM DEPOSIT | 600,00 | ||

22/03/2013 | SPENDLESS DEBIT CARD PURCHASE | 235,95 |

- How can you tell the difference between the debits and the credits in this statement? (2)

- Copy Koketso’s statement and complete the balance column asa running total. (6)

- What is Koketso’s balance on the 22nd of March? (1)

- Koketso aims to keep a minimum balance of R2 500 in his account to earn interest. Is he succeeding? (1) [10]

Solutions

- As payments (debits) ✓ and deposits (credits) ✓ respectively.

-

Date

Transaction

Payment

Deposit

Balance

27/02/2013

OPENING BAL

2 304,85

1/03/2013

INTEREST ON CREDIT BALANCE

13,95

2 318,80

1/03/2013

CHEQUE (SALARY)

2 100,00

4 418,80

1/03/2013

ATM CASH

400,00

4 018,80

5/03/2013

ATM CASH

800,00

3 218,80

10/03/2013

ATM DEPOSIT

600,00

3 818,80

22/3/2013

SPENDLESS DEBIT CARD PURCHASE

235,95

3 582,85

- R3 582,85 ✓

- He has succeeded since the beginning of March. ✓

Activity 8

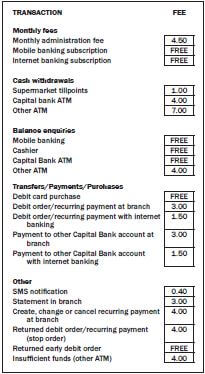

Mia has recently opened a Global account at Capital Bank. She is concerned about her monthly bank charges. Use the provided brochure and list of her account activities for the month of April to answer the questions below.

Date | Activities | Amounts |

01 April 2013 | Balance of previous month carried forward | R210,25 |

01 April 2013 | Old Mutual Policy x74534: Debit order returned: insufficient funds* | R254,39 |

01 April 2013 | Balance enquiry (mobile) | R0,00 |

02 April 2013 | Davidsons Textiles: Salary deposit* | R450,00 |

02 April 2013 | Shoprite Purchases: debit card* | R847,21 |

02 April 2013 | Shoprite: Cash withdrawal* | R250,00 |

07 April 2013 | Old Mutual Policy x74534: Branch Payment | R254,39 |

15 April 2013 | Edgars: Purchases: Debit card* | R149,59 |

20 April 2013 | Capital Bank ATM Withdrawal: * | R200,00 |

23 April 2013 | Shoprite: municipal account payment* | R639,00 |

28 April 2013 | FNB ATM withdrawal* | R500,00 |

29 April 2013 | Balance statement at the branch | R3,00 |

30 April 2013 | Monthly admission fee | R4,50 |

*denotes SMS notification for April

- How many withdrawals did Mia make during this month? (1)

- Calculate the amount of money that was spent on monthly shopping (1)

- Use the relevant resources to calculate the amount of bank fees that Mia will pay for April. (9)

- Suggest how Mia can further reduce her banking (3) [14]

Solutions

- Three. ✓ (1)

- R847,21 + R149,59 = R996,80 ✓ (1)

- Returned debit order R4,00 ✓. Cash withdrawal at Shoprite: R1,00 ✓. Old Mutual debit order payment at branch: R3,00 ✓. Capital Bank ATM withdrawal: R4,00 ✓. FNB ATM withdrawal: R7,00 ✓. Balance statement in branch: R3,00 ✓. Monthly admin fee: R4,50 ✓. 8 SMS notifications: R3,20 ✓. Total: R29,70 ✓. (9)

- She could do away with SMS notifications ✓, only draw cash at till points ✓ and make sure that her debit (3) orders ✓ don’t get returned. [14]

Activity 9

You found the following advertisement in a local newspaper. Answer the questions below.

- Does the advertisement indicate the percentage of interest that will be charged if the TV is not paid for in cash? (1)

- What will the balance be once the deposit has been paid? (4)

- Will the interest be charged on the full purchase price or on the balance? (1)

- How much will the instalment be per month? (1)

- How much will you have to pay for the TV in total? Use the formula:

Total to be paid = Deposit + (Instalment x number of instalments) (6) - How much interest (in Rands) will you have paid once you have completed paying off the TV? Use the formula:

Interest = Total paid – cash price. (3) - What simple interest rate per annum will you be paying on the outstanding balance? (4) [20]

REMEMBER:

- You calculate the interest rate on the money that you owe after you pay the deposit.

Solutions

- No. ✓

- Balance = Cash price ✓ – Deposit ✓ = R15 600 - R1 560 ✓ = R14 040. ✓

- It will be charged on the account balance. ✓

- R356,24. ✓

- Total Payable = Deposit + (Instalment amount ´ number of instalments)

= R1 560 ✓ + [R356,24 ✓ × (12 × 5)] ✓ = R1 560 ✓ + R21 374,40 ✓

= R22 934,40. ✓ - Interest = total paid – cash price

= R22 934,40 ✓ - R15 600 ✓ = R7 334,40 ✓ - R7 334,40 ✓ ÷ R14 040 ✓ × 100% = 52,24% ✓ over 5 years, which is 10,45% ✓ p.a.

Activity 10

Mosima wants to buy an LCD TV and saw it advertised at R25 000. She does not have enough money to pay cash for the TV, so she has the option of either taking a loan from a microlender or paying by means of an instalment sale (hire purchase) agreement.

Suppose Mosima borrows R25 000 from a microlender to pay for the TV. The amount she has to repay every month depends on the length of time she takes to repay the loan. The table below shows the different options she can choose from.

Number of monthly instalments | |||||

12 | 18 | 24 | 36 | 42 | |

Loan amount | R25 000 | R25 000 | R25 000 | R25 000 | R25 000 |

Initiation Fee | R1 140 | R1 140 | R1 140 | R1 140 | R1 140 |

Monthly Admin. Fee | R57 | R57 | R57 | R57 | R57 |

Monthly Instalment | R2 283 | R1 875 | R1 562,50 | R1 145,83 | A |

Total Amount paid by the end of loan period | R29 220 | R35 916 | R40 008 | R44 441 | R48 534,06 |

NOTE:

- An initiation fee is the amount charged by the microlender to process the loan application and is payable when the loan has been

- A monthly instalment is the amount paid

- A monthly administration fee is an additional cost that is added to the monthly

- The total amount to be repaid = Initiation fee + [no. of instalments (monthly instalment + admin fee)].

QUESTIONS

- Use the formula to calculate the missing value (2)

- Suppose Mosima chose to repay the loan over 42 months. How much will the loan cost her in total? (1)

- If she buys the TV at R25 000 by means of an instalment sale agreement, she must first pay a 10% deposit, and then pay off the balance owing in equal instalments over 24 months at 33% per annum simple interest. Calculate the amount she has to pay for the (1)

- Calculate the amount she is required to pay for her equal monthly Use the formula:

(balance owing × interest × no. of years) ÷ 24. (2) - Calculate the total cost of the TV if she used this method of payment. (3)

- Mosima decides that she wants to pay for the TV over a period of 24 Why? (1) [10]

Solutions

- R48 534,06 - R1 140 = R47 394,06 over 42 months. ✓

Divide by 42 and subtract R57 to get A = R1 071,43. ✓ - R48 534,06 ✓

- R2 500 ✓

- (R22 500 × 0,33 × 2) ÷ 24 ✓ = R618,75 ✓

- R2 500 ✓ + (24 × R618,75) ✓ = R17 350. ✓

- It costs less in total. ✓

Activity 11

- A bar of soap currently costs R8,51 in 2014. The expected inflation rate for 2015 will be 6,3%. What will the price of the soap be in 2015? (2)

- The price of a dress is R1 300,95 in What was the price of the dress in 2013, if the inflation rate for 2013 was 6,5%? (4)

- A set of chairs increases in price from R17 355,75 to R19 943,99. Calculate the inflation rate for this period

Inflation rate = current price - previous price × 100%

previous price (3) - In November 2009 Statistics SA announced that the annual inflation rate was 5,8%.

- Determine the price of a bicycle in November 2008 if it cost R1 586,95 in November 2009. (4)

- Calculate the projected cost of a loaf of bread in November 2014 if it cost R5,45 in November 2008. Assume that the annual inflation rate remained at 5,8% over the given You may use the formula

A = P(1 + i)n (2)

where

A = the projected cost

P = current cost.

i = the annual inflation rate.

n = number of years.

Solutions

- Current cost = R8,51 × 106,3% ✓ = R9,05 ✓ OR

R8,51 ✓ + (R8,51 × 6,3 ÷ 100) = R8,51 + R0,54 = R9,05 ✓ - Inflation Value = R1 300,95 × 6,5 ÷ 106,5 ✓ = R79,40 ✓

Previous price = R1 300,95 ✓ – R79,40

= R1 221,55 ✓

OR

R1 300,95 ✓ ÷ 1,065 ✓✓ = R1 221,55 ✓

3. Inflation rate = (R19 943,99 – R17 355,75) ✓ ÷ R17 355,75 ✓ × 100

= R2 588,24 ÷ R17 355,75 × 100% = 14,91% ✓ - a) Price of bicycle ✓ × 105,8% = R1 586,95 ✓

Price of bicycle = R1 586,95 ✓ ÷ 105,8% = R1 586,95 ÷ 1,058 = R1 499,95 ✓ (4)

b) A = P (1 + i)n

A = 5,45 (1 + 0,058)6 ✓

= R7,64 ✓

Activity 12

Study the payslip below and answer the questions.

FASHION DIVA | |||

NAME: Lucinda Adams | Payslip nr. 009 | Pay date: 25 August 2013 | |

ADDRESS: 4 Arcade Ave Kriel | BANK DETAILS: ASBA bank Cheque account 19056634486 | ||

INCOME | DEDUCTIONS | ||

Basic salary: | R15 780 | PAYE/TAX | R2 865,83 |

Overtime: | (a) | Medical Aid: | R1 420 |

(38 hrs @ R85 p/h | UIF | (b) | |

(1% of basic salary) | |||

Pension fund ( of the amount paid to medical aid fund) | (c) | ||

Total income: (d) | Total deductions: (e) | ||

Net pay (Income – Deductions): (f) | |||

- Calculate the missing values in order to complete the (6)

- Lucinda sees that R2 865,83 was deducted from her salary for PAYE (also known as personal tax). Use the table and example below to show that the amount was calculated correctly.(8)

INCOME TAX FOR INDIVIDUALS for the tax year 2011/2012

TAXABLE YEARLY INCOME (R)

RATE OF TAX (R)

0 – 160 000

18% of each R1

160 001 – 250 000

28 800 + 25% of taxable income above R160 000

250 001 – 364 000

51 300 + 30% of taxable income above R250 000

364 001 – 484 000

81 100 + 35% of taxable income above R346 000

484 001 – 617 000

128 400 + 38% of taxable income above R484 000

617 001 and above

178 940 + 40% of taxable income above R617 000

TAX REBATES:

Primary rebates – R11 440

Secondary Rebates (persons 65–75 years) – R6 390

Tertiary Rebates (persons 75 years and older) – R2 130TAX THRESHOLD:

Below age 65 years – R63 550

Age above 65 years to below 75 – R99 056

Age above 75 years and older – R110 889EXAMPLE

R556 444 (yearly salary)

R128 400 + 38% of amount above R484 000 (R556 444 – R484 000)

= R128 400 + 38% × R72 444

= R155 928,72 – R11 440

= R144 488,72 (yearly tax)

∴R12 040,73 (monthly tax) - Lucinda wants to buy a coat from Fashion The coat costs R749 including VAT. As she is an employee of the shop, the owner gives her a discount by not charging her VAT (14%) on the coat. Calculate the amount she would have to pay. (2) [16]

Solutions

- a) R3 230 ✓

b) R157,80 ✓

c) R1 065 ✓

d) R19 010 ✓

e) R5 508,63 ✓

f) R13 501,37 ✓ - R19 010 × 12 = R228 120 ✓

Therefore = R28 800 ✓ + (25% × [R228 120 ✓ – R160 000])

= R28 800 + (25% × R68 120)

= R45 830 ✓

Less rebate = R45 830 – R11 440 = R34 390 ✓

R34 390 ÷ 12 ✓

= R2 865,83 ✓ - R749, 00 ÷ 1,14 = R657,02 ✓✓